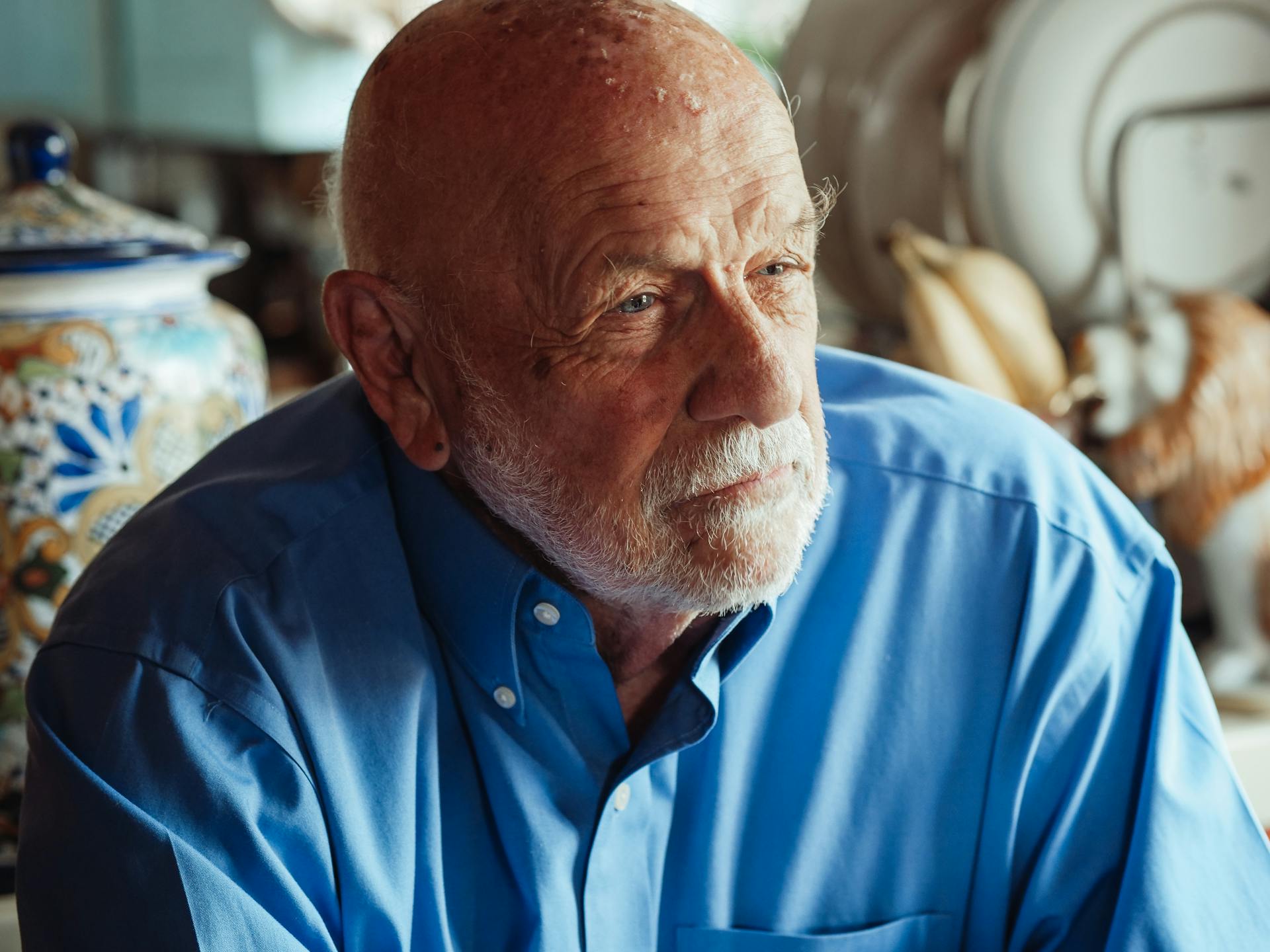

Richard Driehaus was a renowned American investment manager and philanthropist. He was the founder of Driehaus Capital Management.

Driehaus was a pioneer in the field of value investing, which involves identifying undervalued companies with strong fundamentals. He believed in buying low and selling high, and his investment approach was guided by a set of principles that emphasized patience and discipline.

Driehaus's investment philosophy was rooted in the ideas of Benjamin Graham, a prominent value investor who is often referred to as the "father of value investing." Graham's approach emphasized the importance of fundamental analysis and a long-term perspective.

Suggestion: Benjamin Graham Value Investing

Philosophy and Trading Strategy

Richard Driehaus has spent 43 years in the market, and his philosophy remains unwavering. He believes the U.S. market is going through a painful consolidation phase that may be nearing an end.

Having a core philosophy is essential, according to Richard Driehaus. He emphasizes the importance of good design, which doesn't cost but pays.

Additional reading: The Little Book That Still Beats the Market Joel Greenblatt

A good design can make a significant difference in trading. Richard Driehaus advises to focus on having a solid core philosophy.

Richard Driehaus has witnessed numerous market cycles in his career. He believes that a large move on significant news will usually continue in that direction.

When news breaks, it's essential to understand the market's reaction. Richard Driehaus suggests that stocks will often continue to move in the direction of the news.

Worth a look: Scion S Capital Meaning Michael Burry

Legacy

Richard Driehaus was a renowned American investment manager, philanthropist, and art collector. He is best known for being the founder of Driehaus Capital Management.

He was born in 1942 in Chicago, Illinois. Richard Driehaus graduated from Marquette University in 1964.

Driehaus was a pioneer in the field of value investing, which focuses on finding undervalued companies with strong fundamentals. He believed in a long-term approach to investing.

Driehaus was a highly successful investor, with his fund returning over 20% per year from 1994 to 2006. His investment approach was centered around identifying companies with strong balance sheets and competitive advantages.

Richard Driehaus was also a dedicated philanthropist, donating millions of dollars to various causes throughout his life. He was particularly passionate about education and the arts.

Worth a look: Economic and Investment Principles Ray Dalio

Frequently Asked Questions

What did Richard Driehaus die from?

Richard Driehaus died from a cerebral hemorrhage. This led to his passing at home the night before his funeral.

Sources

- https://savingplaces.org/driehaus-preservation-awards

- https://www.morningstar.ca/ca/news/184985/richard-h-driehaus.aspx

- https://www.quantifiedstrategies.com/richard-driehaus/

- https://www.classicist.org/articles/in-memory-of-richard-driehaus/

- https://www.theamericanconservative.com/in-memoriam-richard-driehaus/

Featured Images: pexels.com