Printing equipment financing can be a game-changer for small businesses looking to upgrade their operations. Many small businesses can't afford to pay cash upfront for new equipment, which can be a major roadblock to growth.

According to a recent study, 70% of small businesses rely on financing options to purchase new equipment, including printing equipment. This statistic highlights the importance of exploring financing options for small businesses.

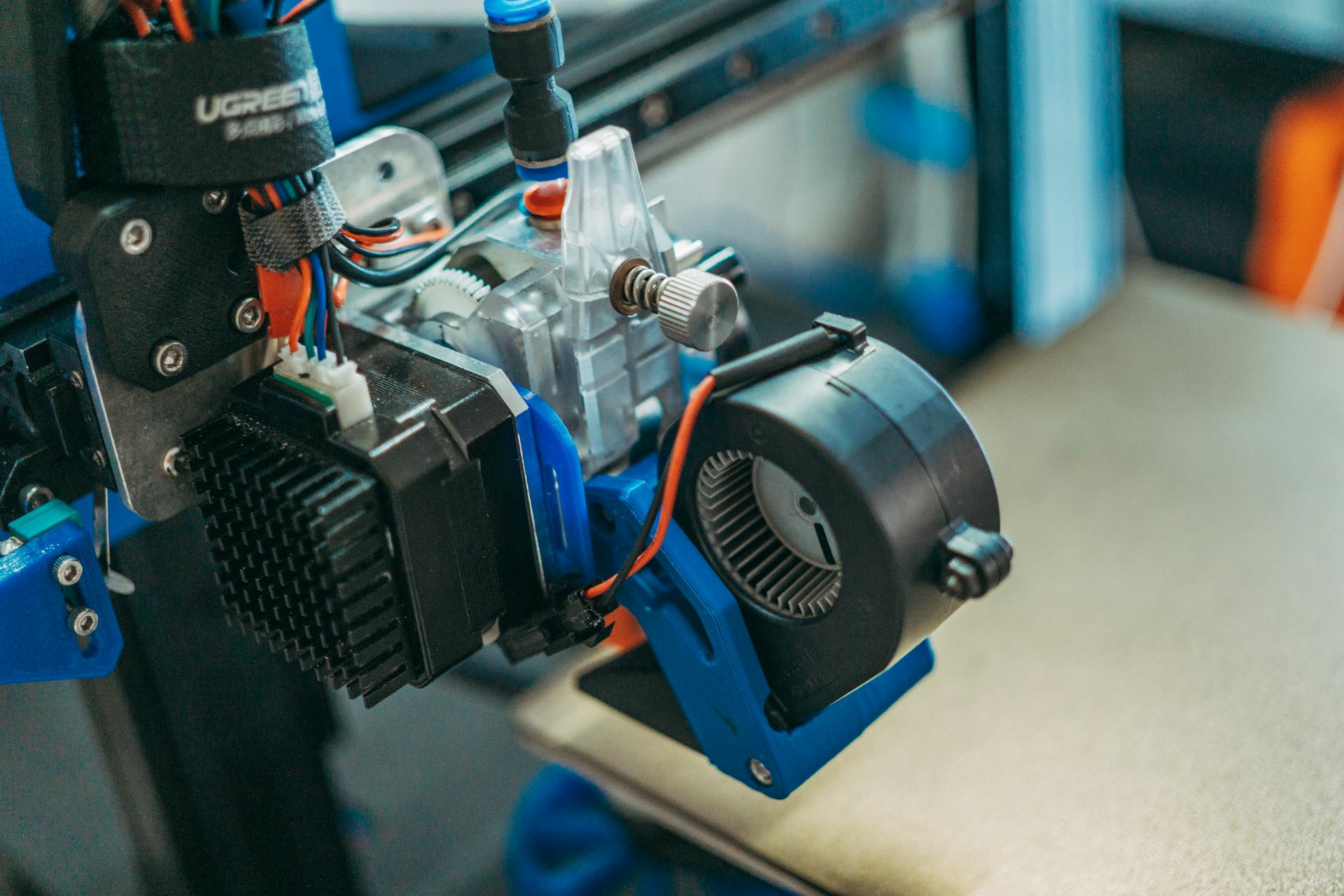

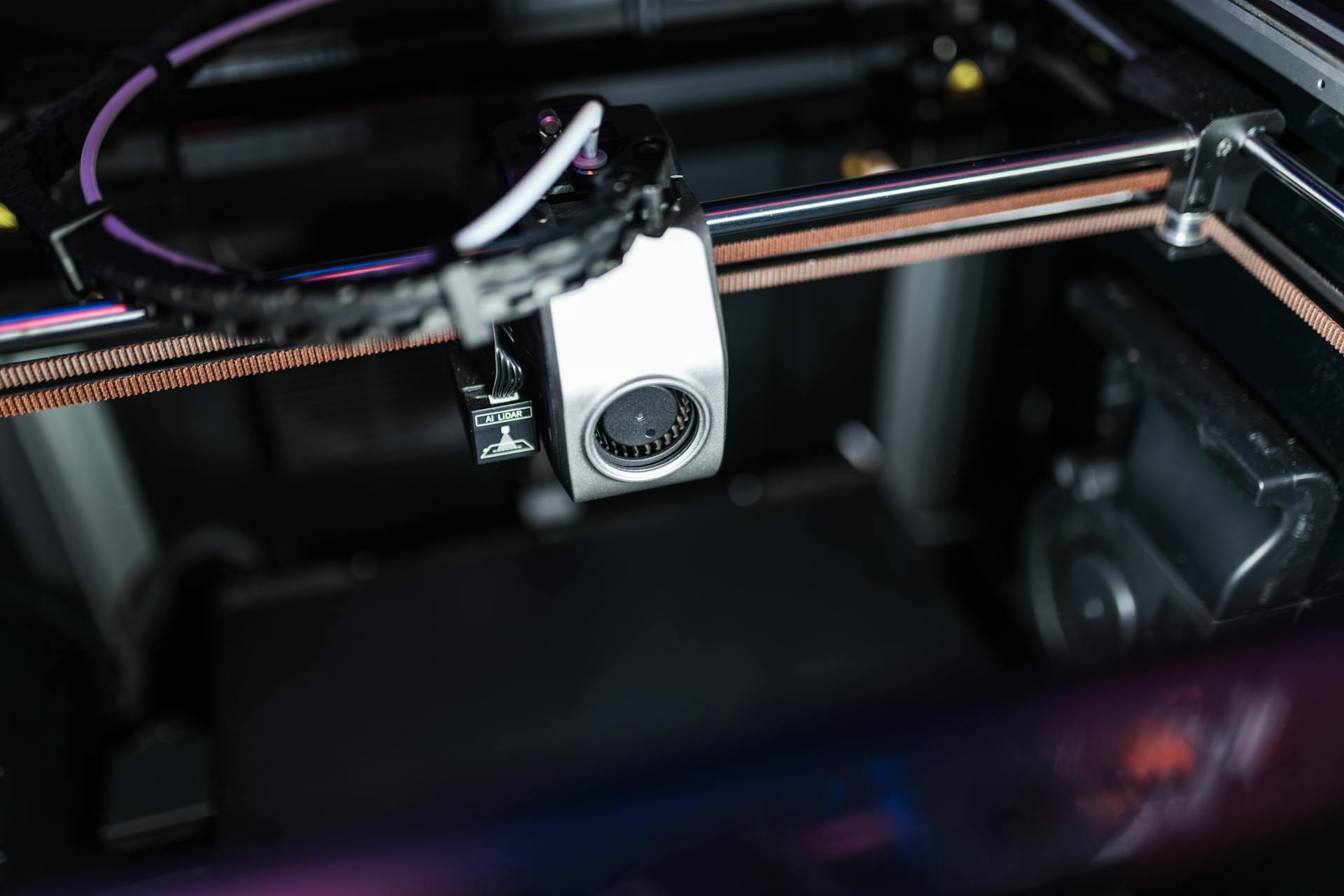

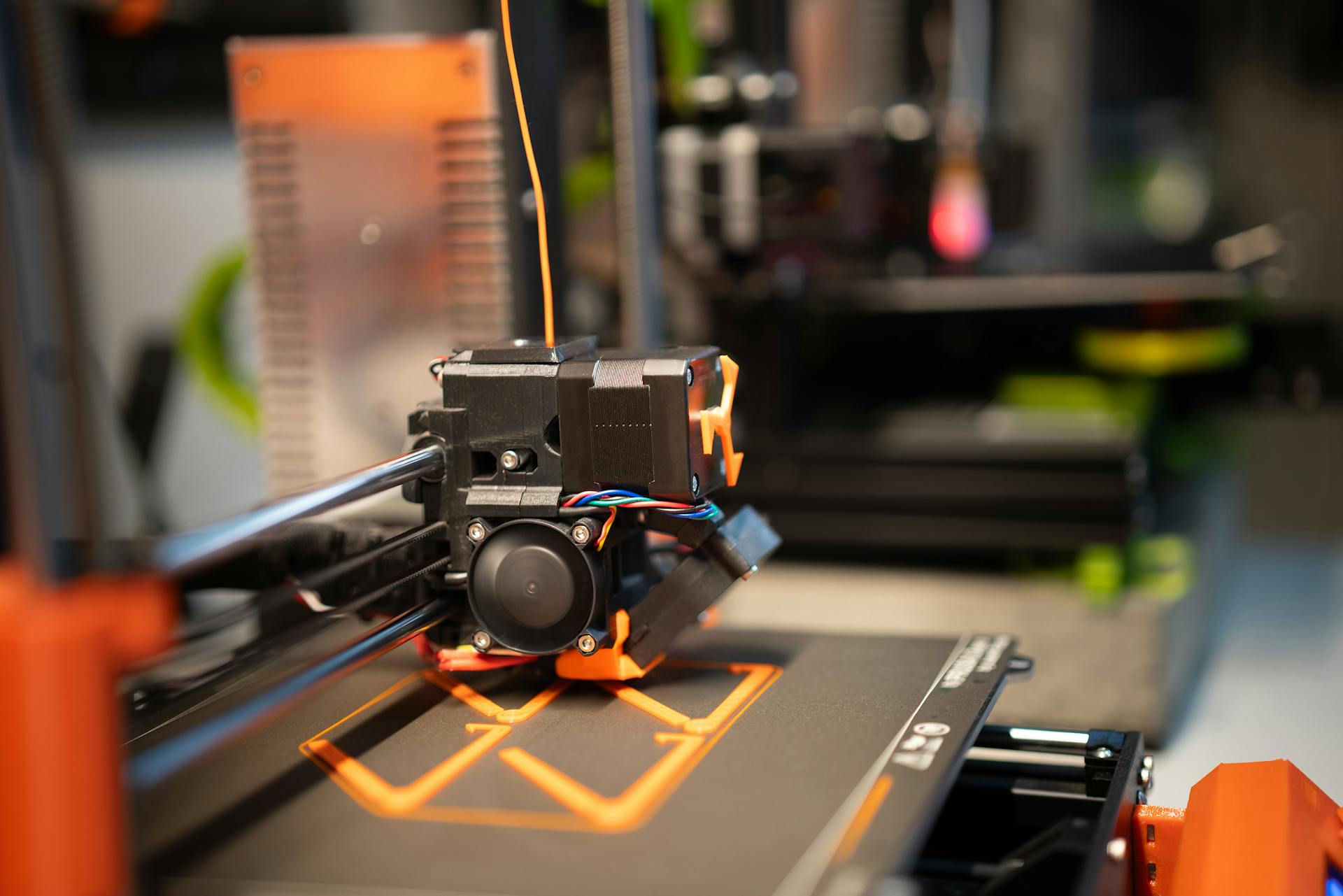

Investing in new printing equipment can boost productivity and efficiency, allowing businesses to take on more clients and increase revenue. A well-maintained printer can produce up to 100 pages per minute, significantly reducing print times and increasing overall output.

By financing printing equipment, small businesses can conserve cash flow and allocate resources to other areas of the business, such as marketing or hiring new staff. This can lead to significant long-term benefits for the business.

Why Lease?

Leasing your printing equipment can be a game-changer for your business. It allows you to access the technology you need without a huge lump sum upfront.

You can get started quickly with leasing, which is perfect for entrepreneurs who don't want to miss out on opportunities due to delayed starts. Most leasing companies, like Clicklease, provide a seamless and convenient process that makes it easy to get started, with approvals given within minutes.

Leasing is more affordable than buying equipment outright, with no hefty down payment required. This means you can choose the lease terms that best suit your budget and focus on other aspects of your business.

Leasing frees up your cash flow, allowing you to focus on inventory, production, marketing, and satisfying your customers. This is because you won't need to worry about a burdensome investment for new equipment.

Here are some key benefits of leasing your printing equipment:

- Quick start-up: Leasing allows you to begin operations as soon as possible.

- More affordable: No hefty down payment required, with flexible lease terms.

- Improved cash flow: Focus on other aspects of your business, not equipment costs.

- Convenient financing: Companies like Clicklease provide a seamless process with quick approvals.

Understanding the Process

Familiarizing yourself with the process of printing equipment financing is crucial to make an informed decision. You can apply online and receive a determination in less than four minutes with no documents needed and no threat of a hard credit pull.

Clicklease offers a quick and seamless approval process. This makes it easy to get started with your business quickly. You can select the term that fits your budget, and eDocs are available immediately.

Financing Options

Financing options for printing equipment can be a game-changer for businesses. Rates start at 3.25% with terms ranging from 24 to 72 months, allowing you to tailor your repayment to your specific needs.

You can choose from monthly, quarterly, annually, semi-annually, or seasonal payment due dates, giving you flexibility in managing your cash flow. Typically, loans are approved within 2-4 hours, and funding occurs within 1-2 business days.

No down payment is required, and soft costs such as freight, installation, and tax are covered for both new and used equipment. This can be a huge relief for businesses with limited working capital.

Here are some key benefits of financing your printing equipment:

- No down payment required

- Soft costs covered for new and used equipment

- Flexible payment due dates (monthly, quarterly, annually, semi-annually, or seasonally)

- Typical loan approval within 2-4 hours and funding within 1-2 business days

With financing options like these, you can get the equipment you need without tying up valuable cash. This can help your business improve cash flow and discover potential tax advantages.

Business Growth

Assessing your business reality is key to making informed decisions about printing equipment financing. You need to know what you want to achieve and whether the equipment will pay for itself.

To increase productivity or expand your product offerings, you'll want to consider the expected revenue from the new equipment. If it's more than your monthly payment, you're on the right track. This is a crucial step in making the most of your investment.

You can access funding quickly, with some providers offering payment options in as fast as 24 hours. This can be a lifesaver if you need to upgrade equipment to serve your customers better.

You can borrow up to $500,000 without needing to provide financials, or up to $10 million with financials. This gives you a good amount of flexibility when it comes to financing your printing equipment.

Leasing or loan options are available, and some providers offer flexible term lengths and repayment options to meet your business' specific needs. This can help ensure you have an extraordinary financing experience.

Applying for financing is usually free and won't impact your credit. This makes it a low-risk option to explore.

Embroidery and Capital

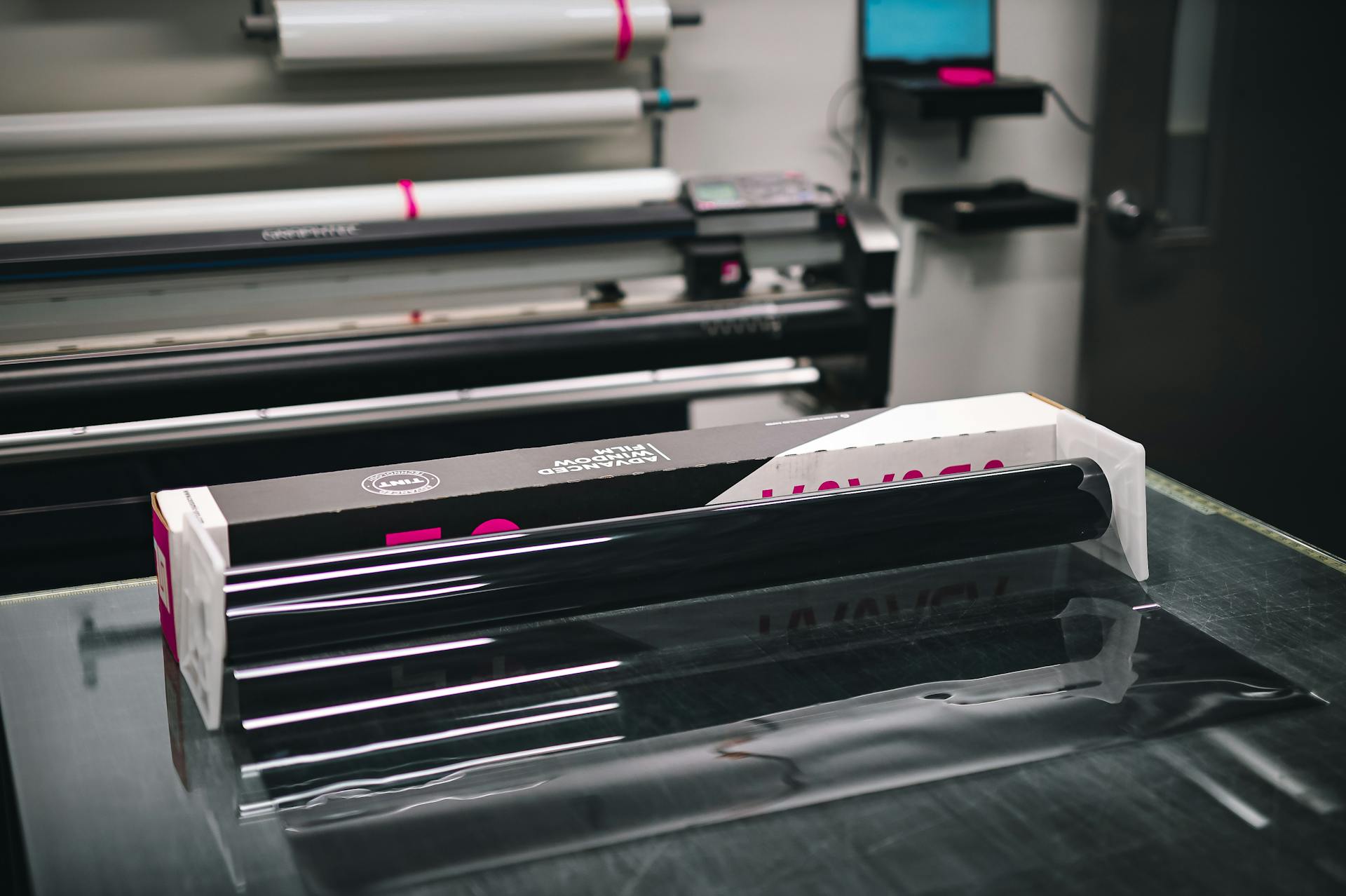

Embroidery and screen printing businesses require a lot of equipment to operate. This can include commercial embroidery machines and software, as well as screen printing presses and dryers.

We can help finance this equipment through our team at The Funding Booth, which offers financing options with several features and benefits to business owners.

Our financing options can provide the funds you need to cover expenses like inventory and marketing. This can be a huge relief for business owners who are struggling to keep up with costs.

You can also get working capital loans, lines of credit, and cash advances through our team. This can give you the funds you need to cover payroll, inventory, marketing, and more.

We encourage you to apply online now to get started. One of our Funding Specialists will be in touch with you shortly to discuss your needs and options.

Funding and Pricing

You can get started with printing equipment financing without putting any money down, thanks to deferred payment options.

With some providers, you can defer your first payment for up to 90 days. This allows you to get started immediately and pay off your loan with the profits from your new equipment.

Some financing options offer flexible term lengths and repayment options to meet your business' specific needs.

Pricing

Pricing can be a major hurdle for small businesses, especially when it comes to investing in essential equipment like printers.

Securing the right financing is crucial to expanding your business, and Direct Capital can help with a range of financing options.

Printing equipment loans, financing, and leasing are all viable options that can eliminate or significantly reduce maintenance and supply costs.

Leasing printing equipment can also provide potential tax benefits.

Get Business Funding Today

You can get business funding today with minimal requirements to get approved.

The Funding Booth offers equipment financing and working capital loans to businesses in a wide range of industries, including embroidery and screen printing.

With no upfront costs, you can get started immediately and pay off your loan with the profits from your new equipment.

You can get funding in as little as 24 hours, and Crestmont Capital offers flexible term lengths and repayment options to meet your business' specific needs.

You can apply online today and get in touch with a Funding Specialist to discuss your needs and options.

Crestmont Capital can finance everything from technology and furniture to motor vehicles and machinery, while also covering consumables, installation and other costs associated with leasing new and used equipment.

You can access up to $500,000 with a simple application, or up to $10 million with financials, and choose from loan or lease options.

The Funding Booth can help you get the financing you need to grow your business, and you can start or expand your business in the embroidery or screen printing industry with their help.

FlexPro Onsite Partnership Program

With FlexPro Onsite Partnership Program, you have full control and flexibility in your printing equipment financing. You can upgrade to the latest technology at any time, purchase at any time, or simply end the agreement and return the equipment.

All your printing needs are covered with one vendor, offering a wide range of products including cloud storage, PCs, plotters, copiers, scanners, smart boards, corporate projectors, and displays, as well as desktop printers.

Real-Time support and supplies monitoring are included with FlexPro, keeping your entire fleet running smoothly with notifications sent to our support team or yours for any issues or errors.

Supplies monitoring also tracks your supplies levels, notifying our supplies ordering department when it's time to restock.

Eligibility and Application

Applying for printing equipment financing and leasing is a straightforward process that requires minimal paperwork. All you need is one-page application and information about the equipment you're purchasing.

To get started, you'll need to provide some basic documents, including a driver's license, a voided business check, and a completed application. You'll also need an equipment quote to complete the application process.

Here are the specific documents you'll need to provide:

- Driver's License

- Voided Business Check

- Completed Application

- Equipment Quote

Qualifying for printing equipment financing and leasing is relatively easy, as nearly every business can qualify. The approved interest rate and loan amount will depend on the type of equipment, your business's financials, and credit history.

How to Apply

Applying for screen print equipment financing or leasing is a straightforward process. All Crestmont Capital needs is a one-page application and some basic information about the equipment you're purchasing.

You'll need to provide a driver's license, a voided business check, and a completed application. This is it – no need to dig up a lot of extra documents.

The equipment quote is also required, so be sure to have that handy. This will help Crestmont Capital understand the specifics of the equipment you're looking to finance or lease.

To make the process even smoother, here are the specific documents you'll need to gather:

- Driver's License

- Voided Business Check

- Completed Application

- Equipment Quote

Who Qualifies?

Nearly every business can qualify for equipment financing loans and leases.

At Crestmont Capital, the approved interest rate and how much your business qualifies depend on the type of equipment, your business's financials, and credit history.

The equipment acts as collateral, making screen print equipment financing & leasing a great decision even if your business or personal credit score isn't perfect.

In fact, Crestmont Capital's underwriters are just as concerned with the equipment as with your borrowing history, and the equipment alone can be enough to get your business qualified for funding.

Frequently Asked Questions

What credit score do you need for equipment financing?

To qualify for equipment financing, you typically need a credit score of 620-650. With a score in this range, you can still secure financing, but may not get the lowest rates available.

What are typical terms for equipment financing?

Typical equipment financing terms include a fixed interest rate, loan terms between 1-5 years, and down payments ranging from 10-20% of the loan amount. Understanding these terms can help you make an informed decision about your equipment financing options.

How hard is it to get equipment financing?

Equipment financing is relatively easy to obtain, even for startups, with moderate credit and a sufficient down payment. Qualifying for an equipment loan is a straightforward process.

What are typical equipment financing rates?

Typical equipment financing rates range from 7% to 20% APR, with better credit scores often resulting in lower rates. This can save you hundreds or thousands of dollars on your equipment costs.

Sources

Featured Images: pexels.com