As a savvy investor, it's essential to stay up-to-date on Polymet's stock performance. Polymet's stock quote has consistently reflected the company's growth prospects in the copper-nickel space.

Polymet's market performance has been influenced by the increasing demand for copper and nickel. The company's flagship NorthMet project has the potential to become one of the largest copper-nickel mines in the country.

Polymet's stock price has experienced significant fluctuations in recent years, largely due to the project's permitting process. The company has been working to address environmental concerns and secure necessary permits.

Polymet's stock quote has also been impacted by the company's efforts to reduce costs and improve project economics. By streamlining operations and optimizing production, Polymet aims to increase its competitiveness in the market.

Glencore Acquisition

Glencore sealed a deal to buy the remaining PolyMet shares for $2.11 per share.

PolyMet Mining Corp. shares surged 144% to $1.92 after the company announced Glencore's non-binding proposal.

For more insights, see: Glencore Stock Symbol

Glencore acquired the approximately 17.82% of PolyMet's issued and outstanding common shares that it did not already own.

The acquisition was completed under a statutory plan of arrangement under Part 9, Division 5 of the Business Corporations Act (British Columbia).

The Supreme Court of British Columbia granted the final order in connection with the arrangement, allowing Glencore to proceed with the acquisition.

PolyMet has now been acquired by Glencore, marking the end of the company's independence.

Stock Performance

PolyMet stock has seen its fair share of ups and downs. The current share price is CA$2.86, which is a significant drop from its 52 Week High of CA$4.20.

Looking at the past year, PolyMet's stock price has decreased by 30.58%. This is a notable decline, especially when compared to the Canadian Metals and Mining industry, which returned 27.8% over the same period.

Here's a quick snapshot of PolyMet's stock performance over the past year:

As you can see, PolyMet's stock has underperformed both the Canadian Metals and Mining industry and the Canadian Market over the past year.

Price History & Performance

The price history of PolyMet Mining is a story of ups and downs. The current share price is CA$2.86, with a 52-week high of CA$4.20 and a low of CA$1.00.

PolyMet Mining's stock price has been relatively stable in the short term, with a 1-month change of 0% and a 3-month change of 2.51%. However, over the past year, the stock price has declined by 30.58%.

Here's a breakdown of PolyMet Mining's price history and performance:

Beta, a measure of volatility, is 0.81, indicating that PolyMet Mining's stock price is less volatile than the overall market. The 1-year change in the stock price is -30.58%, which is significantly lower than the 27.8% return of the Canadian Metals and Mining industry over the same period.

You might like: Wallbridge Mining Stock Quote

Return

The return on investment is a crucial aspect of stock performance. PolyMet Mining's (POM) 7-day return was -1.4%, which is slightly better than the Canadian Metals and Mining industry's return of -1.8%.

Recommended read: Aris Mining Stock Symbol

POM's 1-year return, however, is a different story. It underperformed both the Canadian Metals and Mining industry and the Canadian Market, with returns of -30.6%, -9.7%, and -0.8% respectively.

Here's a comparison of POM's return with its industry and market peers over the past year:

The data shows that POM's return is significantly lower than both its industry and market peers, indicating a potential underperformance.

Frequently Asked Questions

What happened to my PolyMet stock?

PolyMet stock is no longer listed on major exchanges due to Glencore's acquisition and the company's decision to delist its shares. You may want to check the status of your shares and consider selling or holding them according to your investment strategy

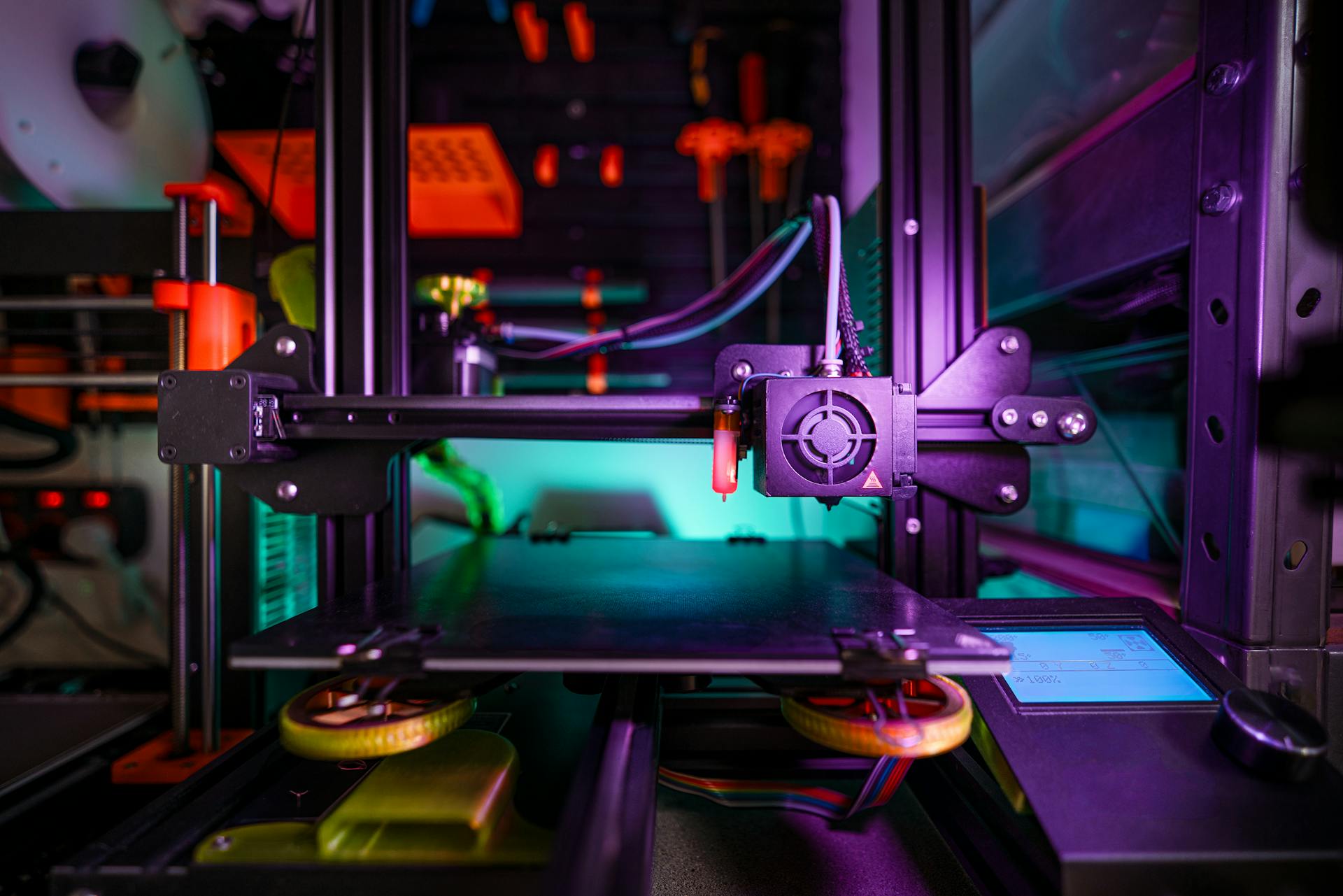

Featured Images: pexels.com