Parametric flood insurance is a game-changer for those living in flood-prone areas. This innovative approach to insurance coverage is based on actual flood events, providing policyholders with a more accurate and efficient way to receive compensation.

By using parametric flood insurance, policyholders can receive payouts based on the severity of the flood, rather than the traditional damage-based approach. This means faster payouts and more accurate compensation.

The parametric model is built on real-time data, allowing for quicker response times and more precise calculations. This is a significant improvement over traditional flood insurance, which often leaves policyholders waiting for weeks or even months for reimbursement.

See what others are reading: Workers Compensation Insurance Policies

Understanding Risks

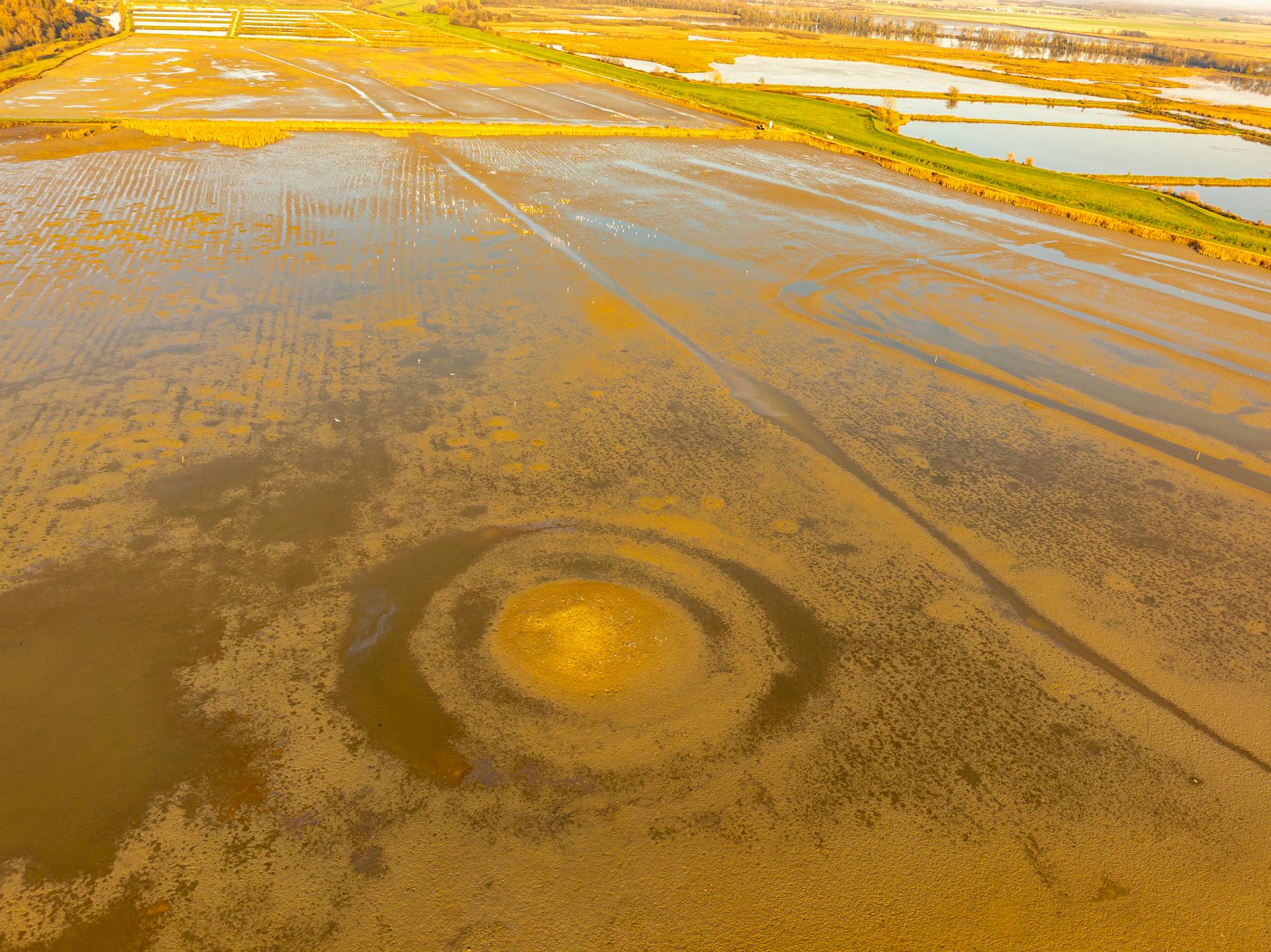

Flood is the most frequently occurring natural disaster globally, resulting from heavy rainfall, rapid snowmelt, or storm surges in coastal areas.

Flooding has caused massive property damages and disrupts access for customers and workers, leading to additional costs. This can impact businesses' continuous operations over several weeks and even months, affecting their stock and supplies.

Global economic losses from flooding reached $85 billion in 2023, with a significant portion uninsured.

Check this out: Does Renters Insurance Cover Basement Flooding

Addressing Risk

Floods are the most frequently occurring natural disaster globally, resulting from heavy rainfall, rapid snowmelt, or storm surges in coastal areas.

Flooding can cause massive property damages, disrupt access for customers and workers, and lead to additional costs for businesses.

Global economic losses from flooding reached $85 billion in 2023, with a significant portion uninsured.

The protection gap for industries in flood-prone regions is substantial, with capacity continuing to shrink due to rising losses.

Flooding can impact businesses for weeks or even months, affecting their operations, stock, and supplies.

Descartes' parametric flood insurance provides fresh capacity to corporate and public sector clients, as well as local SMEs and communities vulnerable to flooding.

This type of insurance offers coverage against direct and indirect losses, utilizing a combination of historical flood data and advanced risk modeling capabilities.

Flooding is a costly and complex issue, but with the right insurance solutions, businesses can better manage and mitigate its risks.

For another approach, see: Hurricane Insurance vs Flood Insurance

Causes and Impact of Urbanization on Risks

Urbanization has a significant impact on flood risks. The rapid growth of cities has led to a disproportionately concentrated population, resulting in increased water impermeability into the ground.

This impermeability is a major contributor to the increased number of disasters and worsened damage caused by floods. Insurers still face challenges in addressing this issue.

Floods can arise from geographical or natural circumstances, such as precipitation, melting snow and ice, and tsunamis from typhoons and earthquakes. However, urbanization has exacerbated these risks.

The UK, Australia, and North America are particularly vulnerable to flood risks, with corporates in these countries struggling to find adequate coverage.

US Risk Projections

A new analysis projects changes in flood risk between 2020 and 2050 by zooming in on every neighborhood across the U.S.

Flood risk is projected to rise fastest in certain areas, but the exact locations aren't specified in the analysis.

The US is experiencing changes in flood risk, and understanding these changes is crucial for communities to prepare and adapt.

Suggestion: Insurance Risk Analysis

Some neighborhoods will face increased flood risk due to rising sea levels and heavy rainfall events.

The analysis helps identify areas that need attention and resources to mitigate the effects of flooding.

Flood risk is projected to rise in the US, and it's essential for communities to be aware of these changes to take proactive measures.

Our Risk Approach

Our Risk Approach is designed to help you understand and mitigate risks in a precise and accurate way.

We use a parametric approach to flood risk, which combines river monitoring data, rainfall data, and IoT to assess and measure flood risk in near real-time.

This approach is particularly important for industries exposed to flood risk, such as retail, manufacturing, hospitality, and infrastructure.

Impacted by large-scale climatic phenomena and subject to climate change, estimating flood risk can be challenging.

Descartes' flood products are designed to address these challenges, providing accurate modeling that helps clients understand their unique risks better.

Our products can be easily integrated into a client's insurance program or captive, and cater to both domestic and international exposures across the globe.

Recommended read: Parametric Insurance Data

Insurance Approach

The insurance industry is facing a major challenge as 1.81 billion people are directly exposed to 1-in-100-year floods, which is 23% of the world population.

Traditional insurance models are under pressure due to climate change, which has disrupted historical weather patterns globally.

The situation in Florida is particularly concerning, where many people have found it difficult and expensive to obtain coverage.

Parametric flood insurance offers a transparent solution to the problem of hedging against extreme weather events.

A fresh viewpoint: Weather Commodity Trader

Insurance Features

Parametric flood insurance is a solution to better protect governments, corporates, and communities from flood hazards.

Parametric insurance products are modeled and customized to the specific flood risk a client is exposed to.

Clients are provided with insurance products that are directly linked to pre-agreed thresholds such as river water levels, amount of rainfall, and wind speed.

These pre-agreed thresholds trigger pay-outs when they are reached or exceeded.

This approach gives companies in the blind spot instant resilience to flood damage.

Explore further: Insurance Cover on Business - Merchant Services

Industry Trends

The insurance industry is facing a major challenge due to climate change. 1.81 billion people worldwide are directly exposed to 1-in-100-year floods.

Traditional insurance models are struggling to keep up with the changing weather patterns, making it difficult and expensive for people in areas like Florida to obtain coverage.

Parametric flood insurance offers a transparent solution to this problem, allowing people to hedge against extreme weather events in a more straightforward way.

Additional reading: Weather Insurance

Revolutionizing Modern Insurance

Traditional insurance models are being pushed to their limits due to climate change, which has disrupted historical weather patterns worldwide.

1.81 billion people, or 23% of the world population, are directly exposed to 1-in-100-year floods, according to an article in Nature Communications.

The insurance industry is facing a tough challenge in providing adequate coverage, as seen in Florida where many people have found it difficult and expensive to obtain coverage.

Parametric flood insurance offers a transparent solution to the problem of hedging against extreme weather events.

At Arbol, they're committed to providing user-centric and transparent parametric weather insurance products that serve a global audience.

Their goal is to bring first-class weather risk management solutions to agents working in regions overlooked by conventional insurers.

Arbol's offerings are built on a foundation of unalterable, open, and decentralized climate data, ensuring a transparent lens to the insurance process.

By utilizing publicly verifiable data via an automated smart contract, Arbol supports a streamlined process that benefits both investors and policyholders.

Crossing the Pond

Most flooding occurs in what's considered a non-flood zone every day in the United States, and so the risk is pervasive.

The US has the largest insurance market in the world, making it a prime location for FloodFlash to expand its business.

As CEO of North America, Hara is leading FloodFlash's expansion, bringing his expertise in insurtech and insurance experience to the table.

FloodFlash had already proven its parametric flood insurance business model and scaled rapidly in the UK before deciding to launch in the US.

The company chose to start in five states to focus its efforts and address the flood protection gap through incremental steps.

Consider reading: Slave Insurance in the United States

Agent Benefits

As an agent, you're likely always on the lookout for ways to improve your offerings and provide better value to your clients. One way to do this is by incorporating parametric flood insurance into your portfolio.

Predefined triggers allow parametric flood insurance to operate based on specific conditions like rainfall intensity or water levels. This means that payouts are triggered automatically when certain thresholds are met, eliminating the need for manual intervention.

By using parametric flood insurance, you can save on overhead expenses by reducing the need for adjusters. This can help keep costs down and make your business more efficient.

Swift and transparent payouts are another key benefit of parametric flood insurance. With clear payout criteria, clients can get the financial relief they need quickly and easily.

Parametric flood insurance offers a comprehensive safety net for clients, providing robust protection against the impacts of flooding.

You might like: Cyber Insurance Payouts

Frequently Asked Questions

What is parametric insurance cover?

Parametric insurance cover pays a fixed amount based on the severity of a specific event, rather than the actual losses incurred. This type of coverage provides predictable payouts and can be more cost-effective for policyholders.

What is an example of a parametric policy?

A parametric policy is a type of insurance policy that pays out a fixed amount based on a specific event or condition, such as an earthquake of a certain magnitude. For example, a construction business might have a policy that pays $5 million if a 6.0 or higher magnitude earthquake hits a defined location.

Sources

- https://descartesunderwriting.com/solutions/flood

- https://descartesunderwriting.com/white-papers/parametric-flood-paper

- https://www.munichre.com/us-non-life/en/solutions/reinsurance/parametric-solutions.html

- https://www.arbol.io/post/parametric-flood-insurance-navigating-the-future-of-coverage-for-agents

- https://www.insurancebusinessmag.com/us/news/breaking-news/parametric-flood-insurance-has-compelling-proposition-amid-troubled-markets-440360.aspx

Featured Images: pexels.com