Your oldest account credit score is a crucial factor in determining your overall credit health.

It's the oldest account credit score, which is the age of your oldest credit account, that can impact your credit score.

This is because a longer credit history is often viewed more favorably by lenders.

A longer credit history can also help to reduce the impact of any negative marks on your credit report.

Understanding Credit Scores

Your credit score is a crucial factor in determining the interest rates you'll qualify for on loans and credit cards, and it's influenced by several key elements, including your credit age.

A good credit age can make a big difference in your credit score, as lenders use it to predict your future behavior. A long history of good credit use can advocate that you'll continue to make payments on time and be a low-risk borrower.

To establish your credit history, you can apply for a secured credit card, which is a card where you provide cash collateral for the line of credit. FICO Scores look at secured cards the same as any credit card, and most banks and lending institutions report secured card activity to the credit bureaus.

For another approach, see: What Credit Score Does Chase Use for Credit Cards

Here are some key credit age-related metrics that credit scoring models use when calculating your credit score:

- The average age of your accounts

- The age of your oldest account

- How long it's been since you opened an account

A longer credit history is generally better for your credit scores, and it can impact the relative importance of other scoring factors.

What Is Credit?

Credit is a complex system that can be hard to wrap your head around, but let's break it down. Credit is essentially a measure of how well you manage your money.

Your credit history, also known as credit age, is a key component of your credit score. It makes up between 15% and 21% of your total score.

Older accounts generally help your credit score, offering lenders a longer look at your money management skills. This is because the credit age category takes into account your average, oldest, and youngest account age.

Revolving debts, like credit cards, and installment loans, like auto loans and mortgages, are both considered when calculating your credit age. People who show they can handle both types of credit well typically receive higher scores.

Expand your knowledge: How Does the Age of an Account Affect Credit Score

Why Is Credit Important?

Your credit score is like a report card for how well you manage your finances. It's a number that lenders use to decide whether to give you a loan, and if so, what interest rate to charge you.

A good credit score can earn you lower rates on loans, making it easier to borrow money when you need it. This is because a high credit score indicates to lenders that you're a reliable borrower who will pay back the money on time.

Credit age is one of the five elements that make up your credit score. A longer credit history can be a good thing, as it shows lenders that you've been consistently making payments on time.

However, having a long credit history can't make up for a pattern of late and missed payments. So, it's essential to keep your payments on track to maintain a good credit score.

Here are some ways a good credit score can benefit you:

- Earn lower rates on loans.

- Get better terms from a landlord on a lease.

- Ultimately save money on mortgage, rent, and insurance payments.

How to Establish Your

Establishing a good credit history is a crucial step in building a strong credit profile. You can't have a good credit score without a good credit history, and that's why it's essential to start building yours as soon as possible.

To establish your credit history, you can apply for a secured credit card, which is a card where you provide cash collateral for the line of credit. FICO Scores look at secured cards the same as any credit card, and most banks and lending institutions report secured card activity to the credit bureaus.

Another option is to see if you can get a friend or family member with good credit to be a co-applicant with you, or to authorize you on their card. This can help you establish your credit history and get a head start on building your credit score.

A long credit history is better for your credit scores, and it can impact the relative importance of other scoring factors. The credit scoring models get all this information by analyzing your credit reports from the three national credit reporting companies, including Experian, TransUnion, and Equifax.

A fresh viewpoint: Understanding Credit Scores

Here are some key statistics about credit age:

These metrics are used by credit scoring models to calculate your credit score, and they can make up between 15% and 21% of your total score, depending on the measure used.

Factors Affecting Credit Scores

Credit history length is a crucial factor, making up 15% of your credit score. Keeping your oldest credit cards open is essential to maintain a good score.

Occasional charges on older cards can prevent issuers from closing them for lack of use. This helps maintain your total available credit and lower credit utilization rate.

Closing an old card reduces your average credit age and available credit, which can negatively impact your credit score. Obtaining new credit products also reduces your average credit age by adding a new account with zero credit history.

Opening multiple new accounts at once can significantly lower your average credit age and hurt your credit score. Closing multiple old credit accounts with positive credit histories can also have a negative effect.

A year's worth of credit history is often enough for car loans and mortgages, but it's essential to have a good credit history overall. Credit cards are a great way to build your credit score and history, and you can expect approval even without a credit history.

Broaden your view: Does Closing an Account Hurt Your Credit

Calculating Credit Scores

Your credit score is a number that lenders use to determine how likely you are to repay a loan on time. A good credit score can earn you lower rates on loans.

To calculate your credit score, lenders consider five elements, but today we're focusing on credit age. Credit age is one of the most important factors in determining your credit score.

A longer credit history can positively impact your credit score, as it shows lenders that you have a track record of managing credit responsibly.

But don't worry if you're just starting out – having no credit history can be just as bad as having a poor credit history.

Here's a breakdown of how credit age affects your credit score:

A good credit age can help you qualify for better loan terms and lower interest rates.

Managing Credit Accounts

Keeping your oldest credit card open is crucial, as it contributes to 15% of your credit score. This is why you should always aim to keep your oldest credit card active.

Occasional charges on your older cards can prevent an issuer from closing it for lack of use. This is especially important for maintaining your total available credit.

Opening new credit products reduces your average credit age by adding a new account with zero credit history. However, this won't severely hurt your credit score, as it only accounts for 15% of your FICO Score.

It's better to focus on timely payments than to worry about signing up for a new line of credit. This is because your credit score doesn't significantly lean on credit history.

Avoid opening multiple new accounts all at once, as this could force your average credit age to take a significant step back and negatively influence your credit score.

Readers also liked: T Account Debit Credit

Frequently Asked Questions

What is oldest account age in credit score?

The oldest account age in credit score refers to the age of your longest-held credit account, such as a credit card or loan, over the past 10 years. This factor helps lenders assess your credit experience and history.

How rare is an 800 credit score?

Only about 21.2% of Americans have an exceptional FICO credit score of 800 or above, making it a relatively rare achievement. Reaching this milestone requires a long history of responsible credit behavior and financial management.

Can a 20 year old have a 700 credit score?

A 20-year-old can have a 700 credit score, but it's less common and typically requires excellent credit habits from a young age. Achieving a 700 credit score in your 20s is a great sign of financial responsibility and a strong foundation for future credit.

Sources

- https://www.experian.com/blogs/ask-experian/how-short-account-history-affects-fico-score/

- https://education.savvymoney.com/credit/credit-strategies-how-do-i-improve-my-credit-age/

- https://www.experian.com/blogs/ask-experian/length-of-credit-history-affect-credit-scores/

- https://www.myfico.com/credit-education/credit-scores/length-of-credit-history

- https://borrowell.com/blog/how-does-the-length-of-credit-history-affect-credit-score

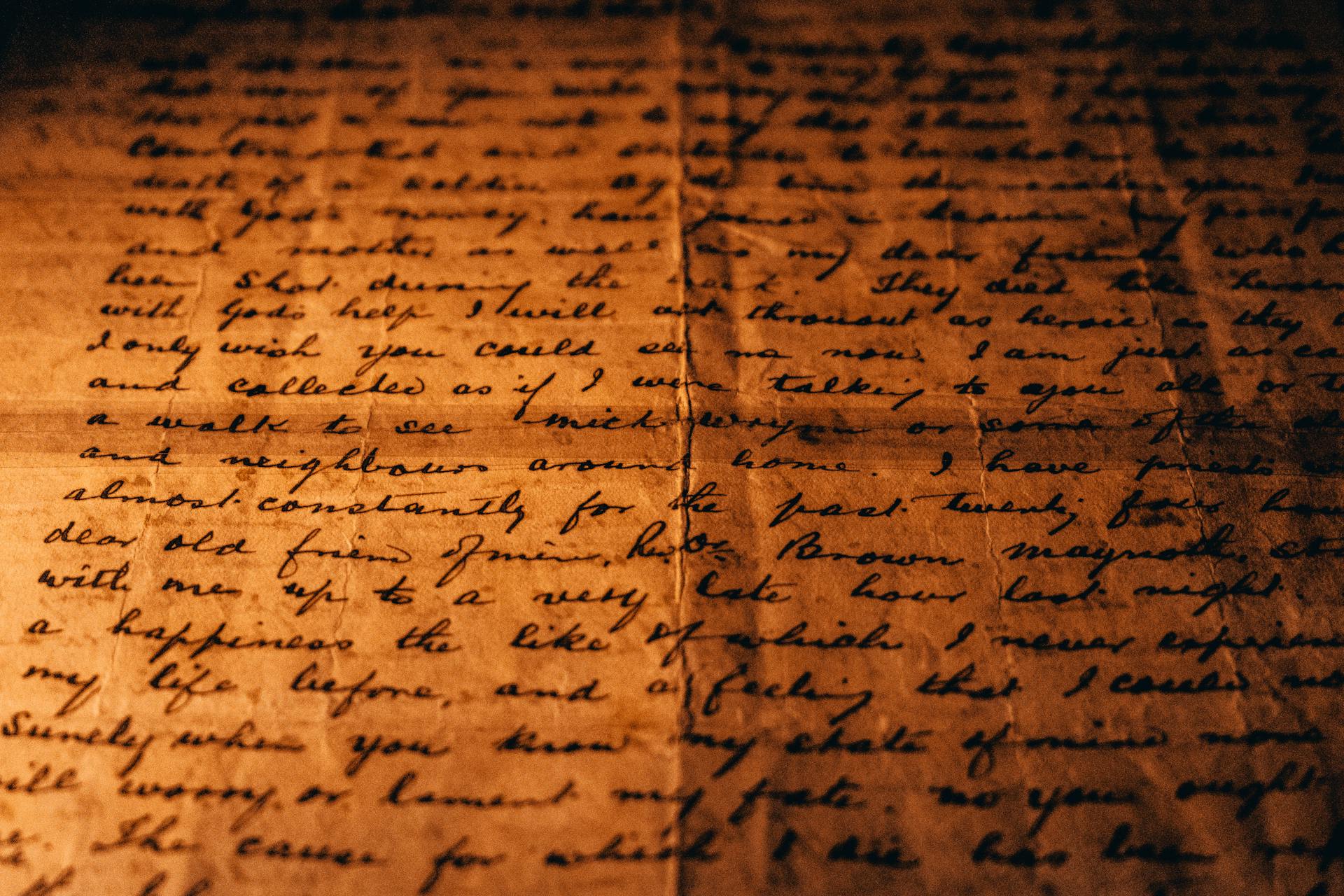

Featured Images: pexels.com