The mortgage belt is a region in the United States where home prices are rising faster than the national average. This is due to a combination of factors, including limited housing supply and high demand.

Homebuyers in the mortgage belt are facing higher interest rates and stricter lending standards. In some areas, mortgage rates are 1-2% higher than the national average, making it harder for people to afford homes.

The mortgage belt includes states such as California, Florida, and Texas, which have seen significant population growth and rising housing costs.

Explore further: Wear Weight Belt

What is the Mortgage Belt?

The Mortgage Belt is a region in the United States where home prices are relatively affordable.

It spans across parts of the Midwest and South, including states like Ohio, Indiana, and Illinois.

This region is characterized by lower median home prices compared to other parts of the country.

The median home price in the Mortgage Belt is around $170,000, making it an attractive option for first-time homebuyers.

Recommended read: Conveyor Belt

Homeownership rates in the Mortgage Belt are higher than the national average, with around 70% of residents owning their own homes.

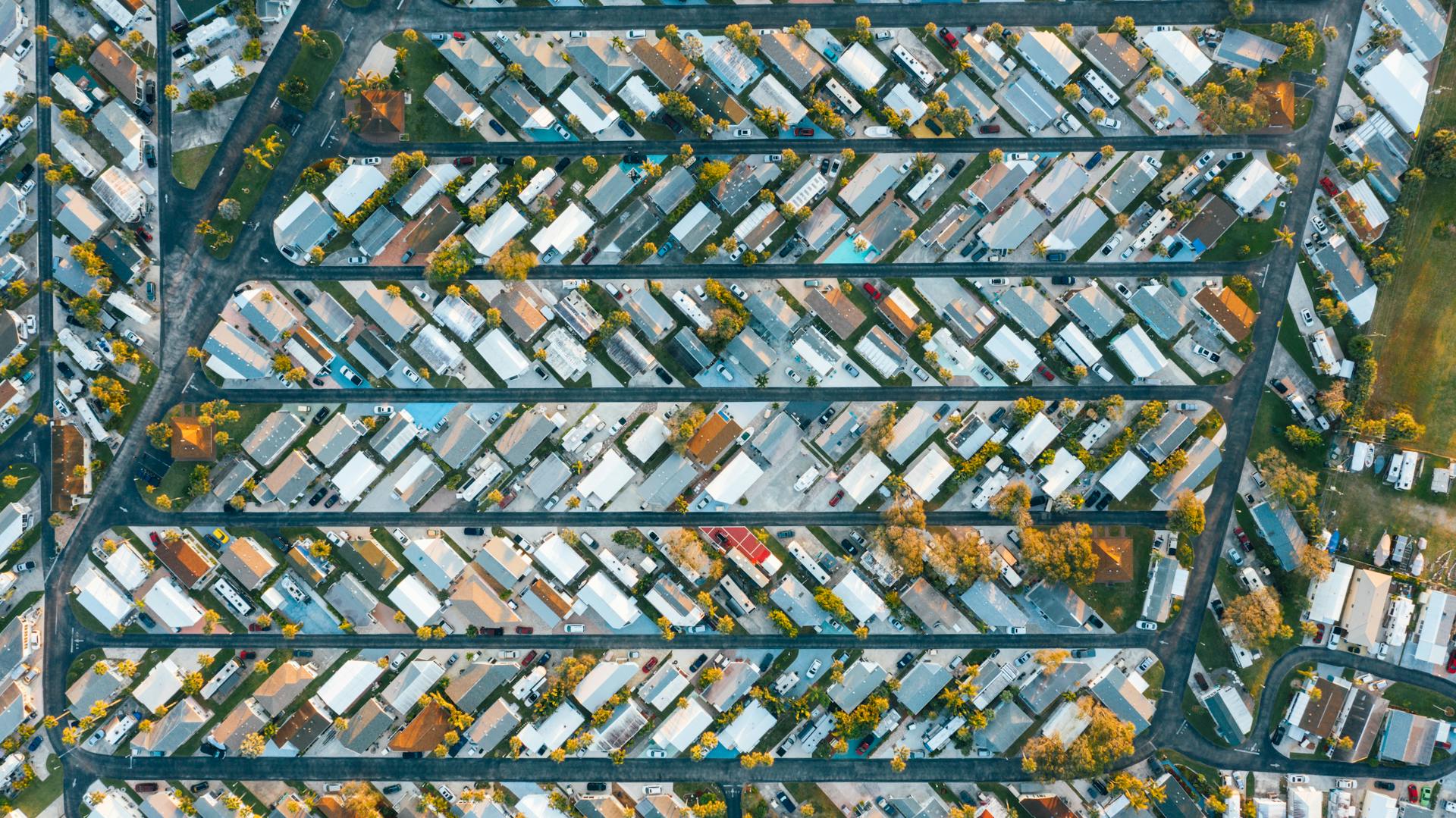

The Mortgage Belt is also home to many established neighborhoods with a mix of old and new homes, offering a range of housing options for buyers.

The region's affordability and housing options have made it a popular destination for people looking to relocate from more expensive areas.

Current Situation

The current situation in the mortgage belt is a mixed bag. Some areas are seeing a slowdown in home value growth, while others are experiencing a surge.

In Greater Melbourne's Wyndham region, home values have dropped by 4.5% over the past three months. This is a stark contrast to the 29.3% increase seen in Greater Adelaide's Onkaparinga region.

New listings have been steadily increasing in some areas, such as the Blacktown-North market in Greater Sydney, where they've risen by 24.3% over the past four weeks. However, other areas like the western suburbs of Melbourne are seeing a decline in new listings, down by 9.6% over the same period.

Here's a breakdown of the current situation in some key regions:

Prices Rising

Mortgage belt prices are on the rise, with average home values increasing by 3.1% since the 2021 Census.

This growth is significantly higher than the national housing market, which saw a mere 1% increase in the same period.

The capital growth in mortgage belt locations is a crucial consideration for financial stability in the Australian housing market.

In some areas, like Salisbury, home values have risen by as much as 40.5% since the 2021 Census.

On the other hand, some areas, like Gosford, have seen a decline of 8.9% in home values over the same period.

The Melton – Bacchus Marsh region of Melbourne also holds some uncertainty in terms of capital growth trends.

This variation in growth rates highlights the importance of understanding local market trends when making decisions about buying or selling a property.

Readers also liked: How to Market to Realtors as a Loan Officer

Rising Listings

Rising listings are a welcome sign in some markets, bucking the national trend of a seasonal slowdown. In the Blacktown – North market, new listings have increased from 185 in the four weeks to May 2023, to 230 in the past four weeks.

This uptick in new listings is a positive development, as it may lead to an accumulation of total stock as interest rates continue to climb and buyer uncertainty increases. The monthly median time on market across Blacktown – North has been rising since February, indicating a potential shift in the market.

New listings have also increased steadily in the western suburbs of Melbourne, a popular destination for overseas migrants. The pace of decline in home values has been easing, suggesting a possible stabilization in the market.

Here are some key statistics on the rise in listings:

While listings are rising in some areas, it's essential to note that total listings are still low relative to historical averages.

In Stress Before Elections

Mortgage stress is spiking in outer suburban communities, affecting up to 70% of households in some areas. This trend could shape the federal election, according to a new analysis of Digital Finance Analytics survey data.

The analysis identifies 12 mainly outer suburban areas of Sydney and Melbourne where the combined total of financially stressed tenants and homebuyers now equates to more than half of all households. Four of these areas are electorally marginal.

Households in stress are found in electorates such as Werriwa (61.4%), Greenway (58.2%), La Trobe (57.9%), and Hume (57.3%). These areas are mostly in outer metropolitan regions.

A new report from UNSW's City Futures Research Centre argues that Australia's housing system needs to be stabilised. The report finds that household debt is now at a record national high, with 185% of GDP in debt by 2020.

Here's a list of some of the electorates with high household stress:

- Macarthur (68.0%)

- Chifley (63.9%)

- Werriwa (61.4%)

- Greenway (58.2%)

- La Trobe (57.9%)

- Hume (57.3%)

The report suggests that a re-balanced and less volatile housing market would reduce long-term reliance on intermittent 'macro-prudential lending' interventions.

New Battleground for Home Lending

The mortgage belt is a growing concern for home lenders. Average home values in these locations have risen by 3.1% since the 2021 Census, compared to national housing market growth of just 1% in the same period.

Discover more: 1 Percent Mortgage Loans

Some areas, like Salisbury, have seen significant capital growth, with a 40.5% increase in home values. However, others, like Gosford, have actually seen a decline of 8.9%.

The Blacktown-North market is experiencing a rise in new listings, with 230 new listings in the past four weeks, up from 185 in May. This is a significant increase, but still lower than historical levels.

The western suburbs of Melbourne are a popular destination for overseas migrants, and while home values have fallen, the pace of decline is easing. This could indicate a stabilizing market.

In the Wyndham region of Melbourne, 47.8% of households have a mortgage, and home values have risen by 47.8% since August 2021. However, listings have decreased by 9.6% in the past four weeks.

You might like: Mortgage Rates in 2002

Regional Focus

The mortgage belt is a region in the UK where property prices are relatively affordable. This region spans from the north of England to the Midlands.

The north of England is home to many affordable towns and cities, such as Liverpool and Manchester. These cities offer a great quality of life at a lower cost than the south of England.

The Midlands is another key area within the mortgage belt, with cities like Birmingham and Nottingham offering affordable housing options. The region's diverse economy and lower cost of living make it an attractive choice for first-time buyers.

In the north of England, the average house price is around £170,000, making it a more affordable option for those looking to buy a home. This is significantly lower than the average house price in London, which is around £470,000.

The mortgage belt is also characterized by its diverse range of housing types, from Victorian terraces to modern apartments. This variety means that there's something to suit every budget and lifestyle.

Many first-time buyers are drawn to the mortgage belt because of its relatively low property prices and lower cost of living. This makes it easier for them to get on the property ladder.

On a similar theme: First Time Homeowner Loan Qualifications

Sources

- https://en.wikipedia.org/wiki/Mortgage_belt

- https://www.miragenews.com/mortgage-belt-in-stress-as-election-looms-635059/

- https://www.brokernews.com.au/news/breaking-news/meet-the-mortgage-belt-the-new-battleground-area-for-home-lending-279030.aspx

- https://thepropertytribune.com.au/market-insights/australias-mortgage-belt-suffering-most-from-higher-rates/

- https://www.realestate.com.au/news/geelongs-mortgage-belt-widens-at-the-fringes/

Featured Images: pexels.com