The healthcare industry is a complex and ever-changing landscape, with numerous medical companies vying for dominance. One of the most notable players is Johnson & Johnson, which has been a household name for over a century.

Johnson & Johnson's pharmaceutical division is responsible for some of the most widely used medications on the market, including pain relievers and antibiotics.

Pfizer, another giant in the industry, has a long history of innovation, dating back to the discovery of penicillin in the early 20th century.

What Are Major Medical Companies?

Major medical companies are the backbone of the healthcare industry, providing essential services and products to people all over the world.

Johnson & Johnson is a leading medical company that has been in operation for over 130 years. They have a diverse portfolio of products, including pharmaceuticals, medical devices, and consumer goods.

Pfizer is another giant in the medical industry, with a long history of developing life-saving medicines and vaccines. Their COVID-19 vaccine has been instrumental in the global fight against the pandemic.

Pharmaceutical companies like Merck and Novartis also play a crucial role in the medical industry, developing and manufacturing a wide range of medications to treat various health conditions.

Philips

Philips is a leading health technology company with a strong presence in the medical industry. They generated sales of €19.5 billion in 2019.

Philips is headquartered in the Netherlands and employs approximately 80,495 employees worldwide. Their health technology portfolio includes diagnostic imaging, image-guided therapy, patient monitoring, and health informatics.

Philips' innovative products, such as the 12-lead electrocardiogram (ECG) machine, have given them a strong push in the industry. This at-home ECG solution is the first comprehensive one in the industry.

In 2022, Philips Healthcare reported an annual revenue of €17.83 billion, a 3.91% increase from the previous year.

Conmed

Conmed is a medical technology company that has been around since 1970, when it was first incorporated on February 10th of that year. It's a global player in the development, manufacture, and sale of surgical devices and related equipment.

The company's products are used by surgeons and physicians in various specialties, including orthopedics, general surgery, gynecology, neurosurgery, and gastroenterology. Conmed has a significant presence in the market, with a market cap of $2.78 billion USD.

Conmed's products are distributed directly to thousands of hospitals, surgery centers, and other healthcare institutions, as well as through medical specialty distributors. This wide reach is a testament to the company's commitment to making its products available to those who need them.

Conmed employs a significant workforce, with a total of 9,872 employees. This is a substantial increase from the 3,100 employees mentioned earlier, highlighting the company's growth and expansion over the years.

Abbott

Abbott is a multinational medical equipment and healthcare corporation based in the United States, founded in 1888 by Chicago physician Wallace Calvin Abbott.

It offers a wide range of medical devices, diagnostics, branded generic medicines, and nutritional products. Abbott Laboratories is a leading manufacturer of medical devices for diagnosing and treating cardiac conditions.

The company's products include Left Ventricular Assist Devices (LVAD), Pacemakers, Cardiac Resynchronization Therapy (CRT) Devices, Pulmonary Pressure Monitors, and Insertable Cardiac Monitors (ICM).

In 2022, Abbott Laboratories reported an annual revenue of $31.27 billion, a 4.20% increase from the previous year. This growth was largely attributed to the sales of at-home COVID-19 self-testing kits and the introduction of over 125 new products with an approved FDA label.

Abbott's CEO, Robert B. Ford, credits the company's diversified business strategy for its success, which ensures growth even in challenging environments.

Top 100 Companies

The top 100 medical device companies are a diverse group, with market caps ranging from under $50 million to over $200 billion. These companies are classified into five categories based on their market cap: Micro-cap, Small-cap, Mid-cap, Large-cap, and Mega-cap.

Here's a breakdown of the market cap categories:

- Mega-cap medical device companies have a market cap in excess of $200 billion.

- Large-cap medical device companies have a market cap of $10 billion to $200 billion.

- Mid-cap medical device companies have a market cap of $2 billion to $10 billion.

- Small-cap medical device companies have a market cap of $300 million to $2 billion.

- Micro-cap medical device companies have a market cap of $50 million to $300 million.

To learn more about these companies, you can navigate to their website and download their annual report, which includes information on expenses, profits, and cash flow statements.

Baxter International Inc

Baxter International Inc is a global leader in the healthcare industry with a rich history dating back to 1931. The company was founded with the goal of providing healthcare products that improve patients' lives.

One of the key areas of focus for Baxter International is treating kidney disease and other chronic and acute medical conditions. They achieve this through their portfolio of healthcare products, which includes peritoneal dialysis and hemodialysis, as well as sterile intravenous (IV) solutions, IV therapies, and infusion pumps.

Baxter International's product range is quite extensive, with a focus on consumable medical supplies and therapy for renal diseases. Some of their notable products include self-injection systems, micro injection molding, laparoscopic instruments, and infusion system devices.

Here are some of the key statistics about Baxter International:

- Total Revenue: $11.1B USD

- Market Cap: $129B USD

- R&D Spend: $655M USD

- Employee Size: 50,000

With a strong commitment to research and development, Baxter International continues to innovate and improve its products to meet the evolving needs of patients and healthcare professionals.

The Cooper Companies

The Cooper Companies is a global medical device company with a rich history. It was incorporated on March 4, 1980.

The company operates through two business units: CooperVision Inc. and CooperSurgical Inc. These units work together to advance the health of families through a portfolio of products and services.

CooperVision is a leading manufacturer of soft contact lenses for the vision-correction market. Its products are designed to solve vision challenges, such as astigmatism, presbyopia, ocular dryness, and eye fatigue.

CooperVision develops, manufactures, and markets a range of single-use, two-week, and monthly contact lenses. These lenses feature various materials and optics, including spherical, toric, and multifocal designs.

The Cooper Companies Inc. has a market capitalization of $16.49B USD and a total revenue of $2.53B USD in 2022. This revenue represents a significant increase in the company's overall business.

Here are some key statistics about The Cooper Companies Inc.:

The company's success can be attributed to its innovative products and services, as well as its commitment to advancing the health of families worldwide.

Allergan AGN

Allergan AGN is a multinational company that produces branded drugs and performs pharmaceutical research and development. They market a portfolio of leading brands and best-in-class products for various therapeutic categories.

Their R&D spend is a significant $2.22B USD, which is one of the highest among the companies listed. This investment has led to Allergan building one of the broadest development pipelines in the pharmaceutical industry.

Allergan is an industry leader in Open Science, their R&D model that defines their approach to identifying and developing game-changing ideas and innovation for better patient care. This approach has led to them making significant contributions to the field.

They have a relatively small employee size of 16,900, which is significantly lower than some of the other companies listed.

Resmed Inc

ResMed Inc is a holding company that has been around since 1994. It's a well-established player in the medical device industry.

The company has a significant market presence, with a market cap of $24.4B USD. This is a substantial amount of money, indicating the company's size and influence.

ResMed Inc has a strong focus on research and development, spending $180.6M USD on R&D. This investment in innovation is likely to drive future growth and advancements in the company's products.

The company has a large employee base, with 7,240 people working for ResMed Inc. This suggests a significant workforce and a diverse range of skills and expertise.

ResMed Inc's products are used to diagnose, treat, and manage respiratory disorders, including sleep-disordered breathing and chronic obstructive pulmonary disease.

Stroumann Holding (Stmn.Sw)

Straumann Holding, also known as STMN.SW, is a leading company in the dental industry. They have a total revenue of 1.59B CHF.

Their market capitalization is a staggering $15.09B, indicating a significant presence in the market. Straumann Holding employs 7,590 people worldwide.

Straumann conducts research with leading universities, which helps them stay at the forefront of technological advancements in dentistry. This research enables them to develop innovative products and solutions.

Their product range includes dental implants and other products that cater to conventional treatment and digital workflows. Guided surgery, intraoral scanning, and CAD/CAM restorations are some of the solutions they offer.

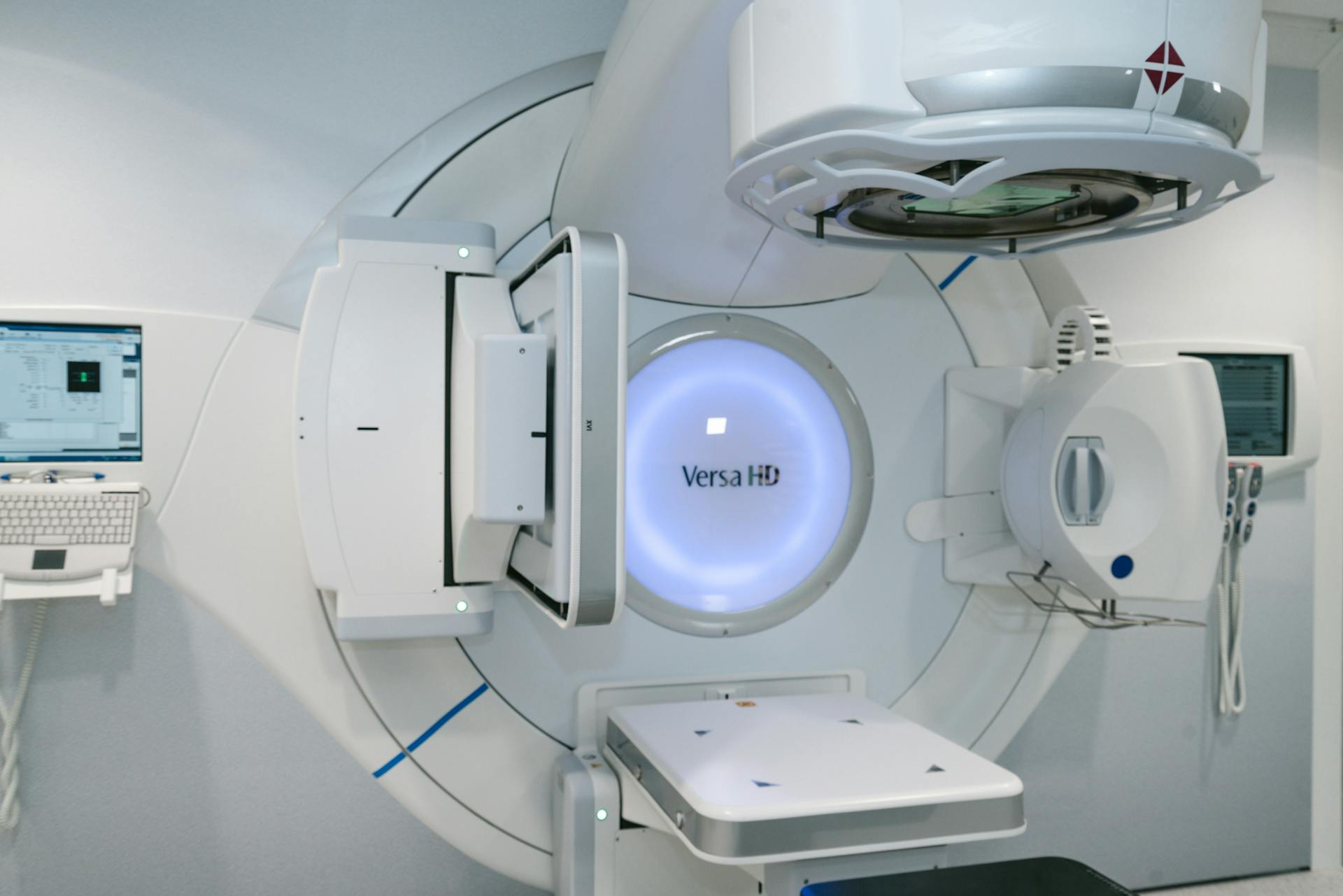

Varian Systems Inc

Varian Systems Inc is a leading manufacturer of medical devices and software for treating cancer and other medical conditions. They were incorporated on January 22, 1976.

Their total revenue is a significant $2.61 billion USD, making them a substantial player in the medical industry. They have a market cap of $11.47 billion USD, indicating a strong financial position.

Varian Systems Inc has a large workforce of 10,062 employees, who are dedicated to developing and manufacturing medical devices. Their website is http://www.varian.com/ and they own the Ginzton Technology Center (GTC).

Their Varian Particle Therapy (VPT) business develops and manufactures products and systems for delivering proton therapy, a form of external beam radiotherapy.

Masimo (Masi)

Masimo (Masi) is a medical technology company that develops and markets noninvasive patient-monitoring technologies. They're a significant player in the industry, with a market cap of $9.5 billion USD.

Their product offerings include noninvasive monitoring of blood constituents and optical organ oximetry monitoring. This technology is designed to provide accurate readings even in low perfusion situations.

The company has a strong research and development focus, spending $76.9 million USD on R&D in recent years. This investment has likely contributed to their innovative products and technologies.

Masimo Corporation has a workforce of around 1,500 employees. This size allows them to maintain a strong presence in the industry while still being agile and responsive to changing market conditions.

Their website is a great resource for learning more about their products and services, and can be found at http://www.masimo.com/.

Top 100 Companies

The top 100 medical device companies are a diverse group, with market caps ranging from $50 million to over $200 billion.

These companies are classified into five categories based on their market cap: Mega-cap, Large-cap, Mid-cap, Small-cap, and Micro-cap. Mega-cap medical device companies have a market cap in excess of $200 billion.

For example, Medtronic, a well-known medical device company, has a market cap of over $170 billion. Stryker, another major player, has a market cap of around $100 billion.

The top 100 medical device companies are also characterized by their research and development spending. For instance, Cochlear Limited, a company that provides implantable hearing solutions, spent $184.4 million AUD on R&D in a recent year.

Here's a breakdown of the market caps of the top 100 medical device companies:

- Mega-cap: $200 billion+

- Large-cap: $10 billion-$200 billion

- Mid-cap: $2 billion-$10 billion

- Small-cap: $300 million-$2 billion

- Micro-cap: $50 million-$300 million

Haemonetics

Haemonetics is a health care company that provides various products to customers involved in the processing, handling, and analysis of blood.

The company was incorporated on August 29, 1985, and has a significant presence in the market with a market cap of $5.56B USD.

Haemonetics has a total revenue of $967M USD and spends $35.7M USD on research and development each year.

The company's products include plasma collection systems and software, enabling plasma fractionators to make pharmaceuticals, as well as analytical devices for measuring hemostasis.

Haemonetics has a global reach with segments including Japan, EMEA, North America Plasma, and the rest of the world.

The company has a sizeable workforce with 3,216 employees.

Insulet Podd

Insulet Podd is a company that's been around since 2000, and it's been making waves in the diabetes management space. The company is based in the US and has a market cap of $10.85B USD.

Their main product is the Omnipod Insulin Management System, which is a game-changer for people with insulin-dependent diabetes. This system eliminates the need for a bulky pump, tubing, and separate blood glucose meter.

In 2020, Insulet reported a total revenue of $738M USD. That's a significant chunk of change, and it's clear that the company is doing something right.

Their research and development spend was a respectable $129.7M USD, which is a good sign that they're investing in innovation. You can check out their website at http://www.insulet.com/ for more information.

Suggestion: Asset Management Firm

Globus GMED

Globus GMED is a medical device company that's been around since March 3, 2003. Their focus is on developing products for patients with musculoskeletal disorders, particularly those with spine disorders.

The company's products fall under two main categories: Innovative Fusion and Disruptive Technologies. Their Innovative Fusion products are designed to treat spinal disorders for the entire spine.

Globus Medical Inc. has a significant presence in the market, with a market cap of $4.7 billion USD. Their total revenue for the year was $785.4 million USD.

The company invests heavily in research and development, with a R&D spend of $60 million USD. This shows their commitment to innovation and improving their products.

Globus Medical Inc. employs a team of 1,800 people, all working together to develop and deliver their products. You can find more information about the company on their website, http://www.globusmedical.com/.

Additional reading: Million Dollar Medical Transportation Company Pdf

Tandem Diabetes Care

Tandem Diabetes Care is a medical device company that has been making waves in the industry. The company is engaged in designing, developing, and commercializing products for people with insulin-dependent diabetes.

One of the standout features of Tandem Diabetes Care is its technology platform, which features Micro-Delivery Technology. This technology allows for a miniaturized pumping mechanism that draws insulin from a flexible bag within the pump's cartridge.

Tandem Diabetes Care has a range of products, including the t:slim Insulin Delivery System, t:flex Insulin Delivery System, and t:slim G4 Insulin Delivery System. These products are designed to address the insulin-dependent diabetes market.

The company has a relatively small employee size of 643, which is a fraction of the 1,604 employees at Ypsomed Holding AG. Despite this, Tandem Diabetes Care has managed to make a significant impact in the industry.

Here's a comparison of Tandem Diabetes Care's financials with Ypsomed Holding AG:

Note that these figures are in different currencies, but they give an idea of the relative size of the two companies.

Inogen (Ingn)

Inogen Inc., also known as Inogen (INGN), is a medical technology company that's making a big impact. They develop, manufacture, and market portable oxygen concentrators in the US and internationally.

Their flagship product is the Inogen One, a portable device that concentrates the air around the patient to provide a single source of supplemental oxygen. This device is a game-changer for patients with chronic respiratory conditions.

Inogen Inc. has a significant market presence, with a market cap of $4.311B USD. This is a testament to their innovative products and business strategy.

The company's total revenue is $361.9M USD, which is a substantial amount and indicates a strong financial performance.

Icu (Icui)

ICU Medical Inc., or ICUI, is a company that's been around since January 9, 1992.

ICUI's revenue is a substantial $1.4B USD.

Their market cap is a whopping $4.15B USD.

ICUI spends a significant $52.8M USD on R&D each year.

They have a large workforce of 8,100 employees.

Their products are used in over 65 countries worldwide.

Nuvasive (Nuva)

Nuvasive (Nuva) is a medical device company that's been around since 1997. It's focused on developing products for spine surgery, specifically for spinal-fusion surgery.

Their product portfolio includes biologics used to aid in the spinal-fusion process. They also have a minimally disruptive surgical platform called Maximum Access Surgery (MAS).

Nuvasive has a large market presence, with a market cap of $3.42B USD. They've also managed to generate $1.1B USD in total revenue.

The company invests heavily in research and development, spending $61M USD on R&D annually. This is a significant investment, especially considering their employee size of 2,600.

You can find more information about Nuvasive on their website, http://www.nuvasive.com/.

Prestige Brands

Prestige Brands is a company with a significant presence in the over-the-counter health care market.

They have a total revenue of $975.77M USD, which is a substantial amount of money.

Their market cap is $1.93B USD, making them a notable player in the industry.

Prestige Brands was incorporated on June 24, 2004, which gives you an idea of their history.

They have a relatively small employee size of 530, which is a manageable workforce.

The company operates through two main segments: North American over-the-counter (OTC) health care and International OTC health care.

Cardiovascular Systems

Cardiovascular Systems is a fascinating field that's constantly evolving to improve patient outcomes. Companies like Edwards Lifesciences Corporation, Merit Medical Systems, and Cardiovascular Systems Inc. are at the forefront of this innovation.

Edwards Lifesciences Corporation, with a market cap of $44.53B USD, is a leading manufacturer of heart-valve systems and repair products. Their products are categorized into three areas: Transcatheter Heart Valve Therapy, Surgical Heart Valve Therapy, and Critical Care.

Merit Medical Systems, on the other hand, operates in two segments: cardiovascular and endoscopy. Their cardiovascular segment consists of cardiology and radiology devices, which assist in diagnosing and treating coronary arterial disease, peripheral vascular disease, and other nonvascular diseases.

Cardiovascular Systems Inc. is a medical technology company that develops orbital atherectomy technology for both peripheral and coronary commercial applications. Their peripheral artery disease (PAD) systems are catheter-based platforms capable of treating a range of plaque types in leg arteries both above and below the knee.

Here are some key statistics for these companies:

These companies are dedicated to improving patient outcomes through innovative technologies and devices. By understanding their products and services, we can appreciate the complexity and importance of cardiovascular systems.

Cryolife Inc

Cryolife Inc is a leading medical device company that's been around since 1984. It's estimated that their products and tissues have been implanted in over 1 million patients worldwide.

Cryolife's mission is to restore patients' health and quality of life by delivering innovative technologies. They provide a range of products, including preserved human tissues for cardiac and vascular surgeries.

Their total revenue is $262.8M USD, which is a significant amount for a company in the medical device industry. Cryolife's market cap is $990M USD, indicating a strong financial position.

The company has a significant research and development spend of $23.6M USD, which is essential for staying ahead in the medical device industry. This investment likely contributes to the development of innovative technologies.

Cryolife has a workforce of 1,100 employees, which is a substantial team for a company in this industry. Their products are used in a variety of medical procedures, including cardiac and vascular surgeries.

Natus

Natus is a company that specializes in medical equipment and services for newborns and those with neurological disorders. It's a significant player in the industry with a market cap of $940M USD.

The company offers a wide range of products and services across three strategic business units: neuro, newborn care, and otometrics. Natus focuses on diagnosis, monitoring, and treatment of impairments and disorders affecting newborns, nerves, muscles, balance, mobility, hearing, and the brain.

Natus Medical Incorporated has a total revenue of $495.1M USD, which is a substantial figure in the medical industry. Its employee size is 1,484, which indicates a moderate level of staff.

The company invests heavily in research and development, with a R&D spend of $58.73M USD. This investment is crucial for the development of new medical equipment and services.

Recommended read: Payment for Medical Services

Intersect Ent (Xent)

Intersect Ent (Xent) is a commercial-stage drug-device company that has been around since 2003. The company has a market cap of $730M USD.

They specialize in developing drugs for patients with ear, nose, and throat (ENT) conditions. Their technology allows for targeted and sustained release of therapeutic agents.

Intersect Ent has developed a drug-releasing bioabsorbable implant technology. This technology is designed to enable ENT physicians to manage patient care more effectively.

Their commercial products are the PROPEL and PROPEL Mini drug-releasing implants. These implants are used to treat chronic sinusitis in patients undergoing sinus surgery.

The company's research and development (R&D) spend is $19.26M USD. This investment is crucial in developing new products and improving existing ones.

Intersect Ent has a team of 393 employees. This number is likely to grow as the company continues to expand its operations.

Their total revenue is $108.47M USD. This figure is a testament to the company's success in the market.

Advanced Solutions (Ams)

Advanced Solutions (AMS) is a medical technology company that designs, develops, manufactures, and distributes products for the advanced wound care, surgical, and wound-closure markets worldwide.

Its products are used in various medical applications, including advanced wound-care dressings under the ActivHeal brand and medical adhesives for closing and sealing tissue under the LiquiBand brand.

The company operates through two segments: Branded and OEM. Its Branded segment focuses on developing and marketing products under its own brands, while the OEM segment focuses on providing products to other companies.

Advanced Medical Solutions Group PLC, the parent company, was incorporated in the UK, but the article does not provide specific information on its market cap or revenue.

Axogen Axgn

Axogen Inc. is a company that offers surgical solutions for peripheral nerve injuries. It was incorporated on June 20, 1977.

Their total revenue is $106.71M USD.

The company has a market cap of $470M USD.

Axogen spends $17.5M USD on research and development each year.

They have a team of 297 employees working for the company.

You can find more information about Axogen on their website at http://www.axogeninc.com/.

Utah Products

Utah Medical Products Inc. (UTMD) is a company that produces medical devices for hospital use.

The company was incorporated on April 21, 1978.

UTMD markets a range of medical devices used in care areas such as the neonatal intensive care unit (NICU), the labor and delivery (L&D) department, and the women's health center in hospitals.

Their products are sold directly to clinical end-user facilities by the company's own direct sales representatives and independent manufacturers' representatives.

UTMD's medical devices are used in various product categories including labor and delivery, obstetrics; neonatal intensive care; gynecology/urology/electrosurgery; and blood pressure monitoring.

The company's revenue is $41.9M USD.

UTMD's market cap is $320M USD.

The company spends $454K USD on research and development each year.

Fonar

Fonar is a company that's been around since 1978, making it a seasoned player in the industry. It was incorporated on July 17, 1978.

The company is primarily involved in designing, manufacturing, selling, and servicing MRI scanners. These scanners use MRI technology to detect and diagnose medical conditions.

Fonar operates its business through two main segments: Medical Equipment, and Physician Management and Diagnostic Services. The Medical Equipment segment is conducted through Fonar itself.

Its Medical Equipment segment is a significant part of the company's operations. Fonar's website is http://www.fonar.com/, where you can find more information about the company.

Fonar has a relatively small market cap of $130M USD. This is likely due to its focused business model.

The company has a small but dedicated workforce, with 547 employees as of the latest update. This is a notable increase from its previous employee size of 525.

Fonar's research and development spend is a modest $1.7M USD. This is likely a strategic decision to focus on core areas of the business.

Researching the Top 100 Companies

To research the top 100 companies, you'll want to start by gathering financial data from their annual reports. For publicly traded companies, this data is publicly available and can be found on their investor information websites.

You might like: Medical Payment Data

Publicly traded companies release their financial data, including total revenue and total R&D spending, in annual and quarterly reports. These reports are usually published at the end of their fiscal year, which can be at different times for different companies.

The market cap, a measure of the value of all stocks available for a company, is a useful metric to understand the size and financial health of a company. Companies are often classified into categories based on their market cap, ranging from mega-cap to micro-cap.

Here's a breakdown of the different market cap categories:

- Mega-cap medical device companies have a market cap in excess of $200 billion.

- Large-cap medical device companies have a market cap of $10 billion to $200 billion.

- Mid-cap medical device companies have a market cap of $2 billion to $10 billion.

- Small-cap medical device companies have a market cap of $300 million to $2 billion.

- Micro-cap medical device companies have a market cap of $50 million to $300 million.

By researching the top 100 companies and understanding their financial data, you can gain valuable insights into their financial health and market position.

If this caught your attention, see: Chrysler Financial Company

GE

GE is a well-established company with a rich history in the medical technology industry. Founded in 1994, GE Healthcare has been a leading innovator in medical technology, pharmaceutical diagnostics, and digital solutions.

GE Healthcare offers a wide range of products, including imaging, ultrasound, anesthesia delivery, and diagnostic ECG. Their products are designed to enable physicians to make faster, more informed decisions using intelligent devices produced with modern technology like data analytics.

The company's revenue growth in 2022 was significant, with a 4.30% increase in annual revenue to $18.34 billion. This growth was largely driven by the ultrasound and imaging sector.

GE Healthcare has made strategic moves to expand its capabilities, including the acquisition of Caption Health to support new users with AI-powered image guidance that are FDA-approved. They also plan to acquire IMACTIS to enhance their interventional guidance capabilities.

Their product portfolio includes:

- Mammography

- Molecular Imaging

- Radiography (X-Ray)

- Surgical Imaging

- Invasive Cardiology

- Magnetic Resonance

Intuitive Surgical

Intuitive Surgical is a global technology leader in minimally invasive robotic-assisted surgery. Their da Vinci Surgical System enables surgeons to operate through a few small incisions while positioned at a nearby ergonomic console.

The da Vinci System features a magnified 3D HD vision system with instruments that bend and rotate far greater than that possible by the human hand. This technology allows surgeons to operate with enhanced vision, precision, and control.

With a total revenue of $3.08 billion USD, Intuitive Surgical is a significant player in the medical device industry. Their market cap is a staggering $64.84 billion USD, making them one of the most valuable companies in the sector.

The company's da Vinci Surgical System has been a game-changer in the field of surgery, enabling surgeons to perform complex procedures with greater ease and precision. Since its development, the da Vinci System has been used to perform numerous surgeries, improving patient outcomes and reducing recovery times.

Abbott Laboratories

Abbott Laboratories is a leading medical equipment and healthcare corporation based in the United States. Founded in 1888 by Chicago physician Wallace Calvin Abbott, the company has a long history of developing medications and medical devices.

Their product portfolio includes medical devices for diagnosing and treating cardiac conditions, such as BurstDR Stimulation, Assurity MRI Pacemaker, and Left Ventricular Assist Devices (LVAD). They also manufacture Pacemakers, Cardiac Resynchronization Therapy (CRT) Devices, Pulmonary Pressure Monitors, and Insertable Cardiac Monitors (ICM).

Abbott Laboratories' revenue soared in 2022, with a 4.20% increase in annual revenue to $31.27 billion. This growth was largely driven by the success of their at-home COVID-19 self-testing kits and the introduction of over 125 new products with an approved FDA label.

Their Freestyle Libre 3 is the world's smallest glucose sensor monitoring device, and it's also the most accurate product in the market. This technology was enhanced by a strategic partnership with WeightWatchers in 2022, which integrated the product with a weight management program for people with diabetes.

Here are some key statistics about Abbott Laboratories:

- Year Founded: 1888

- Annual revenue for 2022: $31.27 billion

- Percent increase/decrease: 4.20% increase

Fresenius Care

Fresenius Care is a leading provider of dialysis care and related services. They operate 4,116 dialysis centers in 50 countries.

Their major source of income comes from dialysis care services. This is a significant aspect of their business.

Fresenius Medical Care AG & Co. KGaA, the parent company, reported a total revenue of €16.54B EUR in 2022. This is a substantial amount of money.

Their revenue has been increasing over the years, with a 10.10% increase in 2022. This is a notable achievement.

Here are some key statistics about Fresenius Medical Care:

Their employee size is approximately 112,658, making them a large and complex organization.

Frequently Asked Questions

Who is the biggest medical company?

According to market value, Johnson & Johnson is the largest medical company with a valuation of $85.2 billion. This makes it a leader in the pharmaceutical and healthcare industry.

Is Medtronic bigger than Stryker?

Medtronic has a higher market cap at $152.54B compared to Stryker's $91.43B, indicating a larger market presence. This difference in market value suggests Medtronic's brand is more valuable.

Who is the largest company in medical devices?

Medtronic is the largest company in medical devices, with a revenue of $31.22 billion. It leads the industry, followed closely by other major players such as J&J and Abbott Laboratories.

What is the best major for medical devices?

For a career in medical devices, consider majors like Mechanical Engineering or Electrical Engineering, which provide a solid foundation in design, materials, and electronics. These fields are crucial for developing innovative medical technologies and devices.

Sources

- https://www.peoplekeep.com/blog/top-25-health-insurance-companies-in-the-u.s

- https://www.greenlight.guru/blog/top-100-medical-device-companies

- https://www.investopedia.com/articles/markets/030916/worlds-top-10-health-care-companies-unh-mdt.asp

- https://www.seaskymedical.com/top-10-medical-equipment-manufacturers-in-usa/

- https://www.targetnxt.com/blog/top-medical-device-companies/

Featured Images: pexels.com