Latency arbitrage strategies involve exploiting small price differences between two markets or exchanges with different latency levels. These price differences can be fleeting, making it crucial to have a robust system in place to detect and capitalize on them.

One key aspect of latency arbitrage is the concept of "latency arbitrage opportunities", which occur when a trade is executed at a price that is not yet known to the market. According to research, these opportunities can arise due to differences in market data feeds or order book updates.

To succeed in latency arbitrage, traders must have a deep understanding of market dynamics and be able to quickly identify and act on these opportunities. This requires sophisticated trading algorithms and a high-speed order execution system.

Latency arbitrage carries significant risks, including the possibility of losing money quickly due to market fluctuations or system downtime.

For another approach, see: Low Latency Trading

What is Latency Arbitrage

Latency arbitrage is a trading strategy that aims to profit from the time delay between price feeds on different trading platforms. It involves buying or selling currency pairs at different prices on different trading platforms, with different brokers.

The goal of latency arbitrage is to execute trades faster than other brokers or traders and profit from the price difference. This requires a high degree of technical knowledge and expertise.

Latency arbitrage is a complex strategy that needs a deep understanding of the forex market, trading platforms, and the technology that underpins them. Traders also need access to high-speed internet connections and powerful computers.

The controversy surrounding latency arbitrage is that some traders argue it's unethical and unfair to exploit time delays between price feeds. Others see it as a legitimate strategy that takes advantage of market inefficiencies.

Brokers now have tools to detect latency arbitrage behaviour, which can limit a trader's ability to trade on their prices. These tools include third-party software and in-house systems built by larger brokers.

For your interest: Xauusd Strategy

Defenses Against Latency Arbitrage

Companies have developed tools to fight latency arbitrage by slowing down the fastest orders. This is an attempt to level the playing field for traders who don't have access to high-speed trading platforms.

High-frequency programs are being used to deliver orders to all exchanges at the same time, making it harder for latency arbitrageurs to profit. This is a defensive measure to prevent traders from taking advantage of tiny price differences between exchanges.

Latency arbitrage strategies are trying to get even faster to adapt to these defenses, making it a race of speed. This means that traders need to be extremely fast and efficient to stay ahead of the game.

In our futures day trading, we use analytical and trading strategy tools to track big orders and profit using this information. This allows us to stay one step ahead of the competition and make informed trading decisions.

Latency Arbitrage in Forex

Latency arbitrage in Forex is a trading strategy that involves taking advantage of time delays between price feeds of different brokers. It's not as easy as it sounds, as most brokers now have the ability to easily identify this behaviour.

Brokers consider latency arbitrage a form of market manipulation, especially if they're managing the risk from all their client trades. This means traders using this strategy need to be aware of the risks and potential legal implications.

To execute a latency arbitrage trade, a trader needs a fast and reliable internet connection and access to multiple brokers. They then monitor price feeds and identify price discrepancies between them.

Brokers are on high-alert for latency arbitrage, and it's being weeded out by the industry. This means traders who want to use this strategy have a very finite window of opportunity.

Take a look at this: Linda Raschke Strategy

Role of Technology in Latency Arbitrage

Technology plays a crucial role in latency arbitrage, allowing traders to identify and exploit temporal price discrepancies between different markets.

To execute a latency arbitrage strategy successfully, traders need access to sophisticated software, fast connections, and powerful computing hardware.

Fast computers and better hardware are essential for good latency arbitrage, as they enable traders to act quickly on market flaws.

Direct access to markets is also vital, allowing traders to execute trades rapidly and maximize their reaction speed.

Advanced technology helps traders stay ahead in fast-paced trading, making it possible to detect and execute trades in microseconds.

A high-tech setup is necessary for latency arbitrage, with powerful computing systems at its heart.

A strong network infrastructure is also critical, cutting down latency and ensuring data moves quickly, reducing trade delays.

Here are the key components of a latency arbitrage setup:

Investing in top-notch technology is essential for success in latency arbitrage, but it's complex and requires balancing costs against benefits.

Mitigating Latency Arbitrage Risks

Latency arbitrage can be a major risk for traders, but there are ways to mitigate its effects.

One way to mitigate latency arbitrage is to use trading algorithms that detect and respond to arbitrage opportunities. These algorithms can level the playing field by identifying and executing trades at the same time as latency arbitrage traders.

Co-location services can also help reduce latency arbitrage by placing trading servers close to exchange servers, reducing the time it takes to transmit data.

MT4 and MT5 trading platforms offer features to mitigate latency arbitrage, such as averaging to smooth out price fluctuations and tools to identify and respond to arbitrage opportunities.

Random latencies in telecommunication networks can be exploited by high-frequency traders, but using co-location services can help reduce this risk.

Latency arbitrage can result in a rent for high-frequency traders, adding to the cost for investors acquiring stocks on certain exchanges.

Latency Arbitrage Strategies

Latency arbitrage is a trading strategy that exploits small differences in the time it takes for prices to update across different exchanges. This strategy relies on advanced software and algorithmic solutions to quickly identify and execute trades on these price discrepancies.

To implement latency arbitrage, traders need to surveil multiple price feeds, recognizing price gaps and executing trades in a matter of milliseconds. The process involves using smart algorithms to find and use arbitrage chances quicker than old ways.

Explore further: Placing Trades with Tradestation

Latency arbitrage trading combines speed, precision, and technology. It involves using advanced algorithms to execute trades quickly and accurately, relying on cutting-edge systems to minimize delays. Real-time monitoring and smart routing are crucial to finding the best places for executing trades.

Traders use latency arbitrage to exploit random latencies in telecommunication networks, buying and selling stocks at different prices across exchanges. This strategy can yield a rent for high-frequency traders (HFTs) and add to the cost at which an investor acquires stocks on exchange L.

However, latency arbitrage is a controversial strategy, as it can be seen as taking advantage of other market participants who do not have access to the same low latency connections. Critics argue that it can create an uneven playing field and contribute to market instability.

To mitigate the effects of latency arbitrage, traders can use trading algorithms designed to detect and respond to arbitrage opportunities. Co-location services can also help reduce the time it takes to transmit data, minimizing the impact of latency arbitrage.

Here are some key strategies to consider:

- Surveillance of multiple price feeds

- Recognition of price gaps

- Trade execution with utmost speed

- Use of smart algorithms to find and use arbitrage chances

- Real-time monitoring and smart routing

- Co-location services

By understanding and implementing these strategies, traders can effectively use latency arbitrage to their advantage.

Latency Arbitrage in Financial Markets

Latency arbitrage sparks a lot of debate in financial markets. With high-frequency trading's growth, people argue if it's good or bad for market efficiency.

Market inefficiencies are crucial for latency arbitrage. They happen when information spreads slowly across different places.

Traders use these time gaps to make money from price differences. They turn these market flaws into chances to profit.

High-frequency trading firms will pay the most money for a retail trader's market order. As a result, the exchange generates more revenue.

Over 60% of all market volume is now done by high-frequency trading computers. Latency arbitrage is just unfairly skimming off the top of these investors and traders.

Milliseconds matter in latency arbitrage. Even a small delay in the transmission of information can mean the difference between a profitable trade and a loss.

Random latencies in telecommunication networks can be exploited by high-frequency traders. They can quickly buy or sell stocks to take advantage of price differences.

Latency arbitrage involves using algorithms to identify and take advantage of small price differences that exist for only a few milliseconds.

Latency Arbitrage Risks and Benefits

Latency arbitrage trading is a high-risk strategy that requires advanced technical knowledge and sophisticated software. It's not suitable for novice traders.

Brokers are often hesitant to offer their services to traders who engage in latency arbitrage due to the high risk involved. If identified, they may widen the spreads seen by the trader or even close the account.

One of the main risks of latency arbitrage is that it can be affected by market conditions. If the market is volatile or there is a sudden change in prices, latency arbitrage can become less profitable or even result in losses.

Despite the risks, latency arbitrage can generate profits quickly and consistently by taking advantage of small price discrepancies.

Risks

Latency arbitrage trading is a complex strategy that requires advanced technical knowledge and sophisticated software, making it unsuitable for novice traders.

Brokers often hesitate to offer their services to traders who engage in latency arbitrage due to the high risk involved.

One of the main risks of latency arbitrage is that it can be affected by market conditions, such as volatility or sudden changes in prices, which can make it less profitable or even result in losses.

Traders who engage in latency arbitrage use advanced technology to place trades milliseconds before other traders, but this can lead to their accounts being identified and closed by brokers.

Brokers may widen the spreads seen by latency arbitrage traders or even close their accounts altogether, as seen in the case of traders who trade around the overnight close at 22.00 London.

Risks and Advantages

Latency arbitrage trading is highly risky due to its reliance on very small price differences.

Brokers are often hesitant to offer their services to traders who engage in latency arbitrage due to the high risk involved.

This type of trading requires advanced technical knowledge and sophisticated software, making it unsuitable for novice traders.

Latency arbitrage can be affected by market conditions, such as volatility or sudden price changes, which can make it less profitable or even result in losses.

Institutional investors have recognized the importance of low latency in trading, investing heavily in high-end programs and hardware to minimize time.

Slippage

Slippage can have a significant impact on the profitability of a trade, especially in latency arbitrage where traders are looking to profit from small price discrepancies.

Slippage is the difference between the expected price of a trade and the actual price at which it is executed, occurring when there is a delay in the execution of a trade or when market conditions change rapidly.

Traders need to factor in the cost of data feeds and server rental when calculating their profits, as this can be a high expense.

To minimize slippage, traders should use advanced algorithms for faster, more accurate trades and rely on cutting-edge systems to minimize delays.

Real-time monitoring and smart routing are also crucial in finding the best places for executing trades and managing risks effectively.

A unique perspective: Stocks to Trade Paper Trading

Related Literature

Latency arbitrage relies on exploiting price discrepancies between markets with different latency levels.

Research has shown that latency arbitrage can be profitable, with some studies indicating returns of up to 15% per month.

The concept of latency arbitrage was first introduced by researchers in the field of high-frequency trading, who identified the potential for profit in exploiting latency differences.

This strategy is often used in conjunction with other high-frequency trading techniques, such as market making and order flow analysis.

The use of latency arbitrage is not without risk, as it requires a deep understanding of market dynamics and the ability to react quickly to changing market conditions.

A study by researchers at a top-tier university found that latency arbitrage strategies are most effective in markets with high liquidity and short trading hours.

Advantages

Latency arbitrage can generate profits quickly and consistently by taking advantage of small price discrepancies.

This strategy can be automated, allowing traders to take advantage of opportunities 24/5.

However, brokers are now deploying analytical tools to scan their clients' behavior, making it harder to execute arbitrage trades.

Using stop-loss orders can limit losses and protect capital, making latency arbitrage a useful risk management tool.

By automating latency arbitrage, traders can make the most of small price discrepancies, but they must be aware of the changing landscape of broker risk management.

Latency Arbitrage in Practice

Latency arbitrage is a high-frequency trading strategy that involves exploiting small price discrepancies between different brokers.

A trader can quickly execute a buy order at the lower asking price and simultaneously sell to the other broker at the higher bid price, pocketing a profit of 0.0005 per unit within milliseconds.

The difference between these prices may seem negligible, but for high-frequency traders, it presents a significant opportunity to generate profits.

Over time, HFT firms using this strategy can execute a high volume of trades with small margins, resulting in substantial profits.

This strategy can be applied to various currency pairs, such as the EUR/USD, where a price discrepancy of 0.0005 per unit can add up quickly.

In the case of the EUR/USD currency pair, a trader can quickly execute a buy order at the lower asking price and simultaneously sell to the other broker at the higher bid price, pocketing a profit of 0.0005 per unit within milliseconds.

Here's an interesting read: Bit Currency Trading

Sources

- https://tradeproacademy.com/latency-arbitrage-explained/

- https://liquidityfinder.com/insight/other/latency-arbitragein-forex-trading-easy-profits-not-really

- https://b2prime.com/cy/news/understanding-latency-arbitrage-in-forex-trading/

- https://market-bulls.com/latency-arbitrage-trading/

- https://jfin-swufe.springeropen.com/articles/10.1186/s40854-023-00491-5

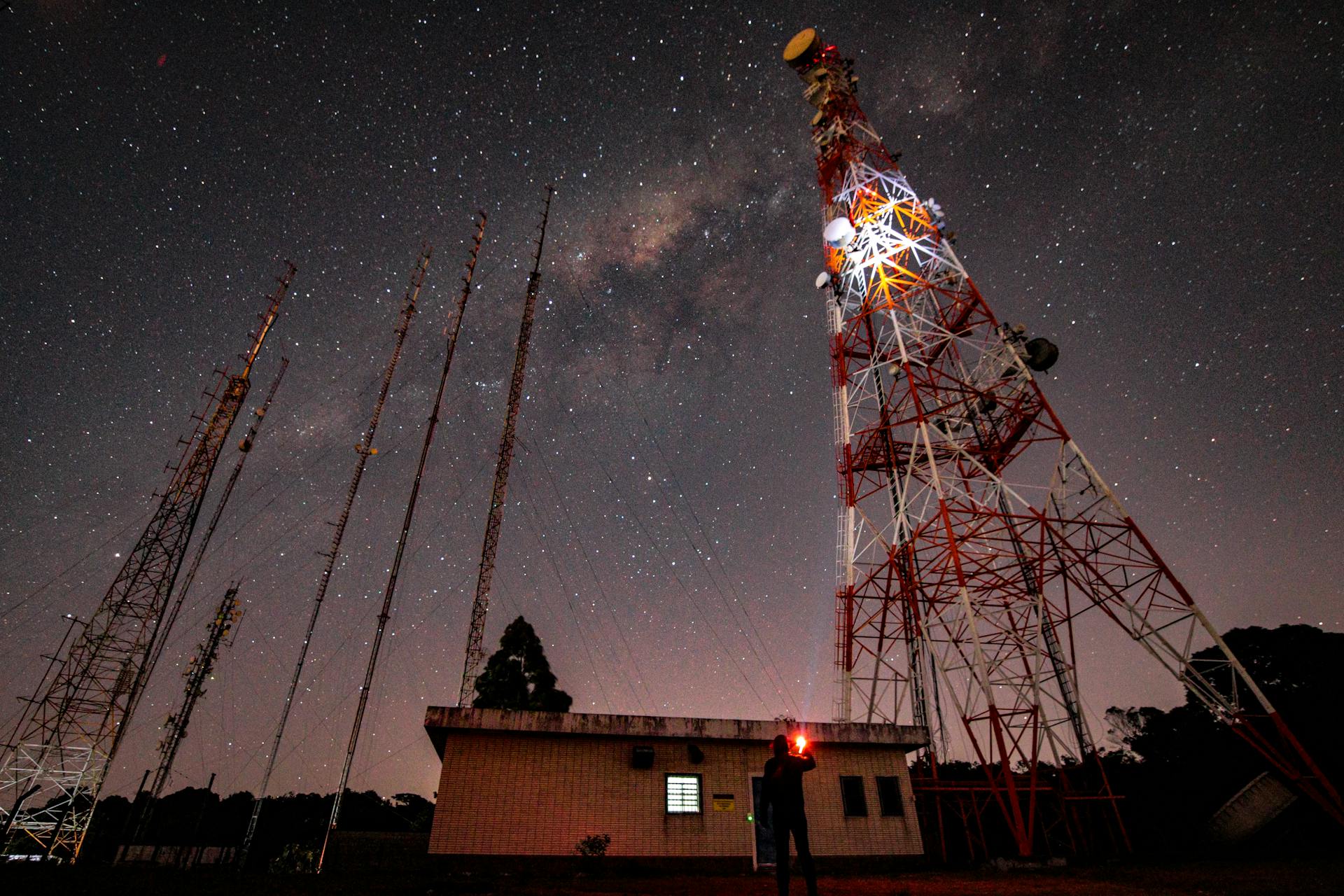

Featured Images: pexels.com