Switzerland is home to some of the most stable and prosperous banks in the world. The country's banking system is highly regulated and has a reputation for discretion and security.

UBS Group is the largest bank in Switzerland, with a market capitalization of over $70 billion. It was founded in 1862 and has since grown into a global financial institution with operations in over 50 countries.

The bank's long history and reputation for stability have made it a favorite among investors and clients. Its commitment to innovation and customer service has also helped it stay ahead of the curve in an ever-changing financial landscape.

Credit Suisse Group is another major player in the Swiss banking scene, with a market capitalization of over $40 billion. It was founded in 1856 and has a long history of providing banking services to individuals and institutions.

Largest Banks in Switzerland

Credit Suisse has been a major player in the Swiss banking scene, with a whopping $770 billion in assets. The bank has been restructuring its investment banking operations to focus more on its wealth management business, which is considered more attractive and less capital intensive.

This move has paid off, as Credit Suisse reported its first annual profit since 2014 for the 12 months to December 2018. The bank also announced a share buyback programme in January 2019, a sign of its confidence in its future prospects.

Julius Baer, on the other hand, has been expanding into new markets, such as South Africa and Russia, where its competitors have been withdrawing. This aggressive expansion strategy has helped Julius Baer become one of the largest private banks in Switzerland, with assets of $379.1 billion.

UBS: $2,260 Billion

UBS is the largest private bank in Switzerland by AuM, with nearly $2.5trn worth of assets.

It's a significant lead, with Morgan Stanley and Bank of America Merrill Lynch coming in second and third, respectively, with a combined $2.06trn.

In 2018, UBS merged its Wealth Management and Wealth Management Americas divisions to create the unified Global Wealth Management division, marking a shift in focus from investment banking to wealth management.

This move was likely a strategic one, given the bank's emphasis on wealth management.

Credit Suisse: $770B

Credit Suisse has endured a troubling few years of late, spending 2015-18 actioning a total restructuring plan.

The aim of this was to reduce exposure to investment banking, in favor of growing its wealth management business, which is considered more attractive and less capital intensive.

Credit Suisse would go on to report an 8% rise in net income attributable to shareholders in April.

Julius Baer: $379.1B

Julius Baer finds itself in third place among largest private banks in Switzerland, with a significant AuM of $379.1 billion.

The firm offers comprehensive wealth management services, focusing on wealth planning, investing, and financing. It provides tailored solutions to meet diverse financial objectives, ensuring clients achieve their financial goals.

Julius Baer's services include customized financial planning solutions, diverse investment strategies and opportunities, and comprehensive financial support and solutions.

The firm has recently been expanding into markets that competitors have been withdrawing from, such as South Africa and Russia.

Here are the key services offered by Julius Baer:

- Wealth Planning: Customized financial planning solutions.

- Investing: Diverse investment strategies and opportunities.

- Financing: Comprehensive financial support and solutions.

Bank Rankings and Sizes

The largest banks in Switzerland are a force to be reckoned with. They hold a significant portion of the country's assets, with UBS and Credit Suisse being the two largest banks in Switzerland, accounting for more than 70% of the country's banking assets.

UBS has a significant presence in the country, with a network of over 1,000 branches and offices across Switzerland.

Credit Suisse, on the other hand, has a strong presence in the country's wealth management and private banking sectors.

Bank Structure and Overview

Switzerland's banking system is regulated by the Swiss Financial Market Supervisory Authority (FINMA), which controls and regulates the whole banking system in Switzerland.

The country's banking structure can be divided into several categories, including foreign banks, private banks, big banks, cooperative banks (Raiffeisen group), and cantonal banks. Cantonal banks, which are government-owned commercial banks, make up around 30% of the total banks in Switzerland.

Switzerland's banking system is considered strong due to its good operating conditions, which include high privacy and security, as well as low risk due to strict Swiss law regarding information disclosure.

Bank Sarasin

Bank Sarasin is a Swiss private bank with a rich history, dating back to 1841. It has a strong presence worldwide with branches in over 25 locations.

The bank offers a high level of services and expertise to private and institutional investors, making it a trusted name in the industry. Its commitment to social responsibility is evident, as it won the world's best private bank for social responsibility award in 2019.

Bank Sarasin employs around 2000 people, making it a significant player in the industry. Its net profit in 2017 was CHF 315.3 Million, a 25% increase from the previous year.

Here are some key facts about Bank Sarasin:

- Founded in 1841

- Headquarters in Switzerland

- Branches in over 25 locations worldwide

- Employment: around 2000 people

- Net profit in 2017: CHF 315.3 Million

Business Banking Overview

Switzerland's business banking sector is thriving, marked by rapid digital adoption and innovative financial solutions. This is evident in the country's top banks, such as Credit Suisse, which has a total asset under management of CHF 1.3 trillion.

Key trends in Switzerland's business banking sector include increased mobile banking usage and personalized services. For example, Julius Baer Group offers comprehensive wealth management services, focusing on wealth planning, investing, and financing.

The top banks in Switzerland, such as UBS Group AG, offer a comprehensive range of services including wealth management, investment banking, asset management, and retail and corporate banking. Their global presence ensures tailored financial solutions for individuals, corporate clients, and institutions.

Some of the largest private banks in Switzerland include Julius Baer, which has a total asset of CHF 113.578 billion, and Credit Suisse, which has a total asset of CHF 892.995 billion. These banks provide a range of services, including private banking, investment banking, and asset management.

Here is a list of some of the top banks in Switzerland, along with their total assets and number of employees:

- Julius Baer Group: CHF 113.578 billion, 6,667 employees

- Credit Suisse: CHF 892.995 billion, 47,860 employees

- UBS Group AG: CHF 892.995 billion, 47,860 employees (Note: This is the same as Credit Suisse, as it was mentioned in the example)

- Zurich Cantonal Bank: CHF 164 billion, 5,000 employees

- EFG International: CHF 40.637 million, 3,073 employees

These numbers give an idea of the scale and scope of the top banks in Switzerland.

Structure

The banking system in Switzerland is overseen by the Swiss Financial Market Supervisory Authority (FINMA), which regulates the entire banking system.

FINMA plays a crucial role in maintaining the stability and integrity of the Swiss banking system.

There are various types of banks in Switzerland, including foreign banks, private banks, big banks, cooperative banks (Raiffeisen group), and cantonal banks.

Cantonal banks account for around 30% of total banks in Switzerland, and are owned by the government.

Raiffeisen Switzerland is the third-largest bank in the Swiss banking sector and operates through 896 locations throughout the country.

Here are some key statistics about Raiffeisen Switzerland:

- Assets under management: CHF 211 billion

- Loans to clients: CHF 185 billion

- Operating profit: CHF 416 million

- Mortgage market share: 17.6%

Raiffeisen Switzerland has a significant presence in the Swiss market, serving around 3.8 million customers and having more than 1004 branches in the country.

The bank's cooperative structure allows it to have around 292 cooperatively structured banks, and it is also a member of the International Raiffeisen Union (IRU).

Banque Cantonale de Genève (BCGE)

Banque Cantonale de Genève (BCGE) is a regional bank founded in 1816. It offers a comprehensive range of products and services for retail and corporate customers.

The bank provides services like deposit products, personal and mortgage loans, debit and credit cards, assets management, and private banking.

It posted excellent results in 2018, with operating income reaching CHF 161.3 Million, an increase of 25.7%.

The bank operates with 21 branches and 124 ATMs, employing nearly 800 people.

BCGE is rated as stable by top rating agencies.

Frequently Asked Questions

What is the safest bank in Switzerland?

Credit Suisse is considered one of the safest banks in Switzerland, with a strong reputation for stability and a global presence in 50 countries. Founded in 1856, it has established itself as a trusted financial institution with headquarters in Zurich.

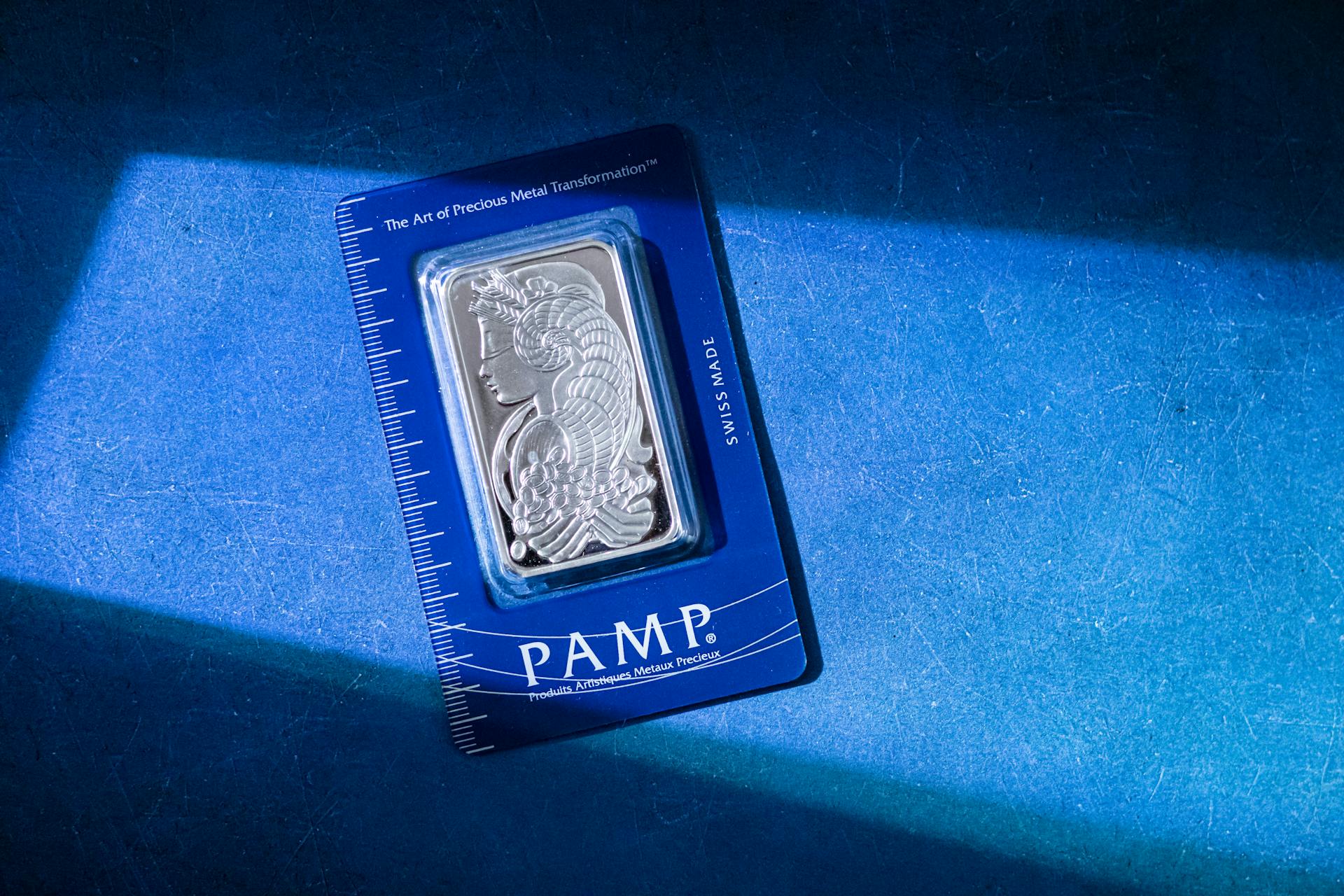

Featured Images: pexels.com