Shipping insurance can be a lifesaver for online sellers who want to protect their packages from damage, loss, or theft. According to a study, 50% of online sellers have experienced a shipping-related loss in the past year.

For many online sellers, shipping insurance is a necessary expense to ensure they can recover from unexpected losses. In fact, a survey found that 75% of online sellers would not be able to afford to replace lost or damaged inventory without insurance.

The cost of shipping insurance can vary widely depending on the carrier and coverage level, but on average, it can add 1-3% to the cost of shipping a package. This may seem like a small price to pay for peace of mind, but it's essential to weigh the costs against the potential benefits.

You might like: How Much Is Shipping Insurance

What is Shipping Insurance?

Shipping insurance is a type of insurance that protects against loss or damage to goods during transit. It's usually offered by shipping carriers, but you can also purchase it from third-party providers.

Shipping insurance typically covers against loss, damage, or theft of goods, and it can be purchased for a one-time fee or as part of a recurring subscription. The cost of shipping insurance varies depending on the value of the goods and the shipping route.

Some shipping carriers, like USPS, offer free shipping insurance for packages valued up to $50, but for higher-value items, you'll need to purchase additional coverage. This coverage can range from 1% to 2% of the item's value, depending on the carrier and the type of shipping.

In the event of a claim, shipping insurance can provide reimbursement for the value of the damaged or lost goods, minus any deductible. This can be a significant cost savings, especially for high-value or irreplaceable items.

For another approach, see: Shipping Insurance Rates Ups

Benefits of Shipping Insurance

Shipping insurance is a safety net that safeguards your valuable items against damage, loss, or theft. It's especially crucial for high-value items like electronics or jewelry.

Suggestion: Shipping Insurance for High Value Items

Shipping insurance can help offset financial losses from lost, stolen, or damaged packages. If something happens to an uninsured shipment, you could be looking at a significant loss, including the cost of the item itself, shipping, and handling.

Shipping insurance can save you money on losses. In the U.S., one out of every 180 packages was stolen last year, costing consumers an average of $112 per incident.

Shipping protection takes the customer worry out of package delivery by protecting packages from loss, damage, and theft, and meeting customer expectations around promised deliveries.

Here's a comparison of shipping insurance coverage offered by major carriers:

Shipping insurance isn't just an extra – it's a necessary investment to protect your business and customers.

Types of Shipping Insurance

Shipping insurance comes in various forms, each catering to different business needs. Some businesses work with major shipping carriers to negotiate special rates and tailor policies to specific business needs.

Broaden your view: Insurance Small Business Uk

Carrier liability coverage is a good option for infrequent, low-value shipments, but it may not be enough for businesses with high shipping volumes. Third-party insurance, on the other hand, is often cheaper and provides broader coverage, including protection against porch piracy.

Major carriers will automatically cover domestic shipments with a value of up to $100, but this may not be sufficient for businesses shipping high-value items. Third-party providers can sometimes be less expensive than working with major carriers, making them a viable option for businesses looking to save on shipping insurance costs.

Third-party shipping insurance can be easily added to an ecommerce store with an app or extension like Norton Shopping Guarantee, allowing customers to purchase insurance during checkout or have it automatically added to their purchase.

Related reading: High Net Worth Insurance Broker

Cost and Pricing

Shipping insurance costs can add up quickly, but it's essential to understand the fees involved to make an informed decision. The cost of shipping insurance varies depending on the carrier, with USPS having a maximum liability of $5,000 per package, while UPS and FedEx have a maximum liability of $50,000 per package.

USPS charges no fee for packages worth up to $100, but for packages worth $100.01-$200.00, the fee is $4.60. In contrast, UPS charges no fee for packages worth up to $100, but for packages worth $100.01-$300.00, the fee is $4.35.

Here's a breakdown of the shipping insurance costs for each carrier:

Offsets Financial Losses

One out of every 180 packages was stolen last year in the U.S., costing consumers an average of $112 per incident.

Shipping insurance can help mitigate these losses by reimbursing you for damaged or lost packages.

In the U.S., major carriers automatically cover domestic shipments with a value of up to $100, but if the item is worth more than that, you may need to purchase additional insurance.

You can offer customers the option to add package protection at checkout, which can give them peace of mind and establish your brand as trustworthy.

Here are some benefits of shipping insurance:

- Offsets some financial losses from lost, stolen, or damaged packages

- Helps to mitigate shipping costs related to lost, stolen, or damaged packages

- Reimburses you for losses, so you're not left footing the bill

Package Insurance Costs

Package insurance costs can add up quickly, but knowing what to expect can help you budget and make informed decisions.

USPS shipping insurance costs a maximum of $12.25 plus $1.90 per $100 in declared value over $600, with a maximum liability of $5,000 per package.

UPS shipping insurance costs a maximum of $1.45 for each $100 in declared value, with a maximum liability of $50,000 per package.

FedEx shipping insurance costs a maximum of $1.40 per $100 in declared value, with a maximum liability of $50,000 per package.

If you're shipping packages worth over $100, you'll need to pay for additional insurance coverage. Here's a breakdown of the costs:

Keep in mind that these costs are in addition to the cost of shipping itself.

When to Buy Shipping Insurance

If you ship high volumes or valuable or fragile products, insurance is a good idea. Some merchants provide shipping insurance for all purchases, often increasing prices or shipping costs to cover the insurance fees.

You can also give customers the option to purchase insurance at checkout for a small fee. This way, they can choose whether or not to insure their packages.

Consider the following factors when researching shipping insurance options: Does the policy cover loss, damage, and theft? What carriers and service levels are covered? Does the policy cover international shipments?

The cost to purchase shipping insurance depends on the value of the items being shipped. Businesses in the United States often work with major shipping carriers to negotiate special rates and tailor policies to specific business needs.

Most major carriers will automatically cover domestic shipments with a value of up to $100. However, you may need to pay extra for insurance on higher-value packages.

Here are some general guidelines for when to buy shipping insurance:

- If you're sending high-value items like electronics, jewelry, or packages with sentimental value, it's worth insuring them.

- If you're shipping fragile or valuable products, insurance can provide peace of mind and financial protection.

- If you're unsure about the value of your packages or the shipping risks involved, it's always better to err on the side of caution and purchase shipping insurance.

Average costs for shipping insurance range from $1 to $5 per $100 of declared value. Some companies include basic coverage (usually between $50 and $100) at no additional cost.

Shipping Insurance for Businesses

Shipping insurance can make a big difference for businesses, especially those selling high-value items like electronics or jewelry. Insured shipping safeguards these items, ensuring you're not out hundreds or thousands if something goes wrong.

For eCommerce businesses, the average cost of shipping insurance is generally 1% to 2% of the product's value. This cost can be a small price to pay for the peace of mind that comes with knowing your shipments are protected.

Shipping insurance helps protect you against losses or damages during shipping, improves customer satisfaction, and reduces the risk of returns or chargebacks. In fact, insuring a $1,000 order with DHL could cost you between $10 and $20, but avoids larger losses in case of incidents.

Consider external insurers like ShipStation Insurance or Shipsurance, which often have more competitive rates for large or frequent shipments. These options can help you save money compared to using the carrier's inflated prices.

By insuring your packages, you can build trust with your customers and show them that you care about their orders. In fact, people are more likely to buy again from businesses that protect their orders. It's a simple way to show you care and keep them coming back.

Here are some benefits of shipping insurance for businesses:

- Protects against losses or damages during shipping

- Improves customer satisfaction

- Reduces the risk of returns or chargebacks

- Builds trust with customers

- Positions your business as trustworthy and reliable

Overall, shipping insurance can be a valuable investment for businesses, especially those selling high-value items. By insuring your shipments, you can protect your customers and your business, while also building trust and credibility with your customers.

Sources

- https://u-pic.com/is-shipping-insurance-worth-it

- https://www.uschamber.com/co/start/strategy/shipping-insurance-breakdown

- https://blog.norton.buysafe.com/how-much-is-shipping-insurance

- https://www.extend.com/post/shipping-insurance-vs-shipping-protection-which-is-better-for-your-business

- https://outvio.com/blog/shipping-insurance/

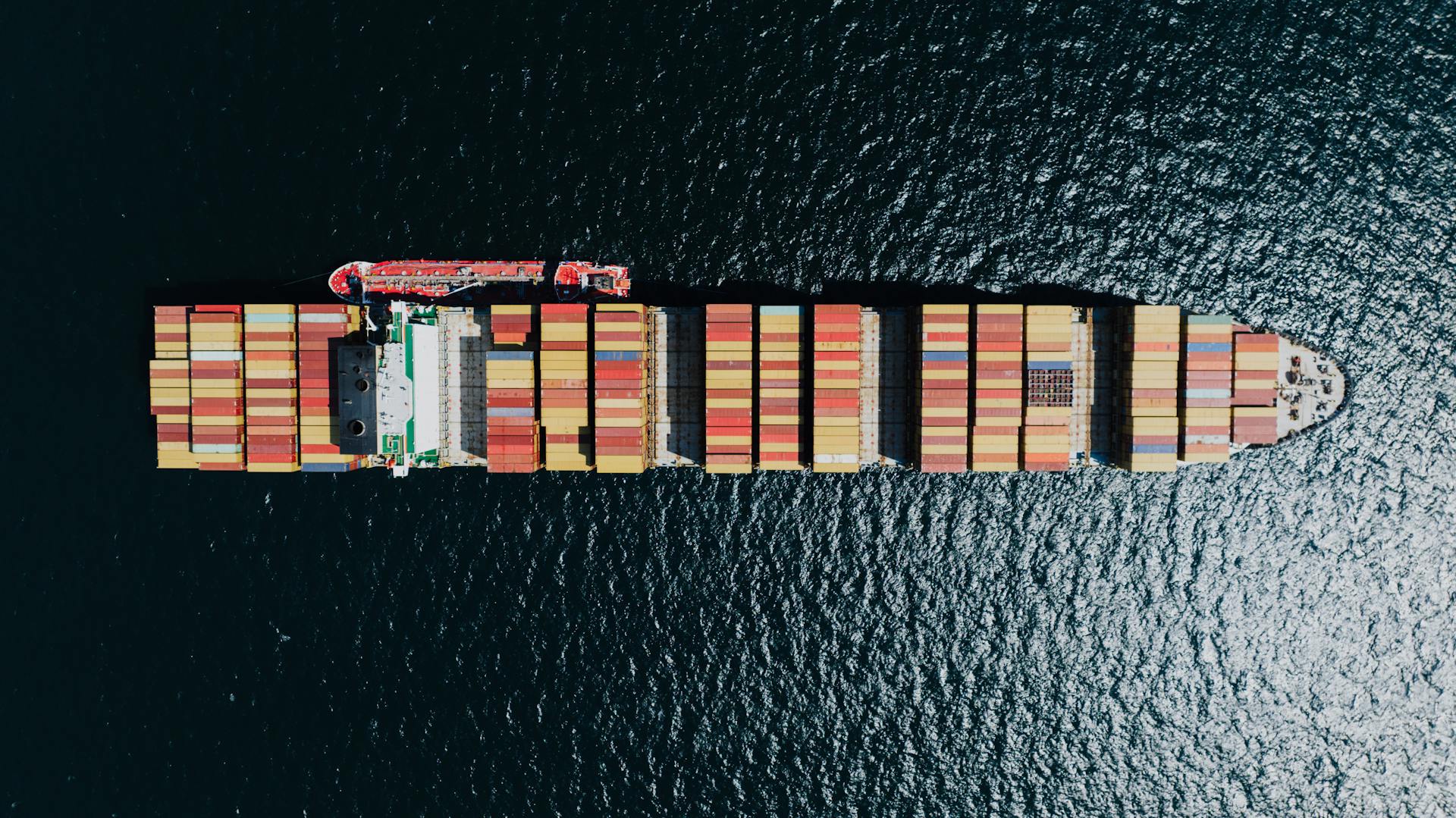

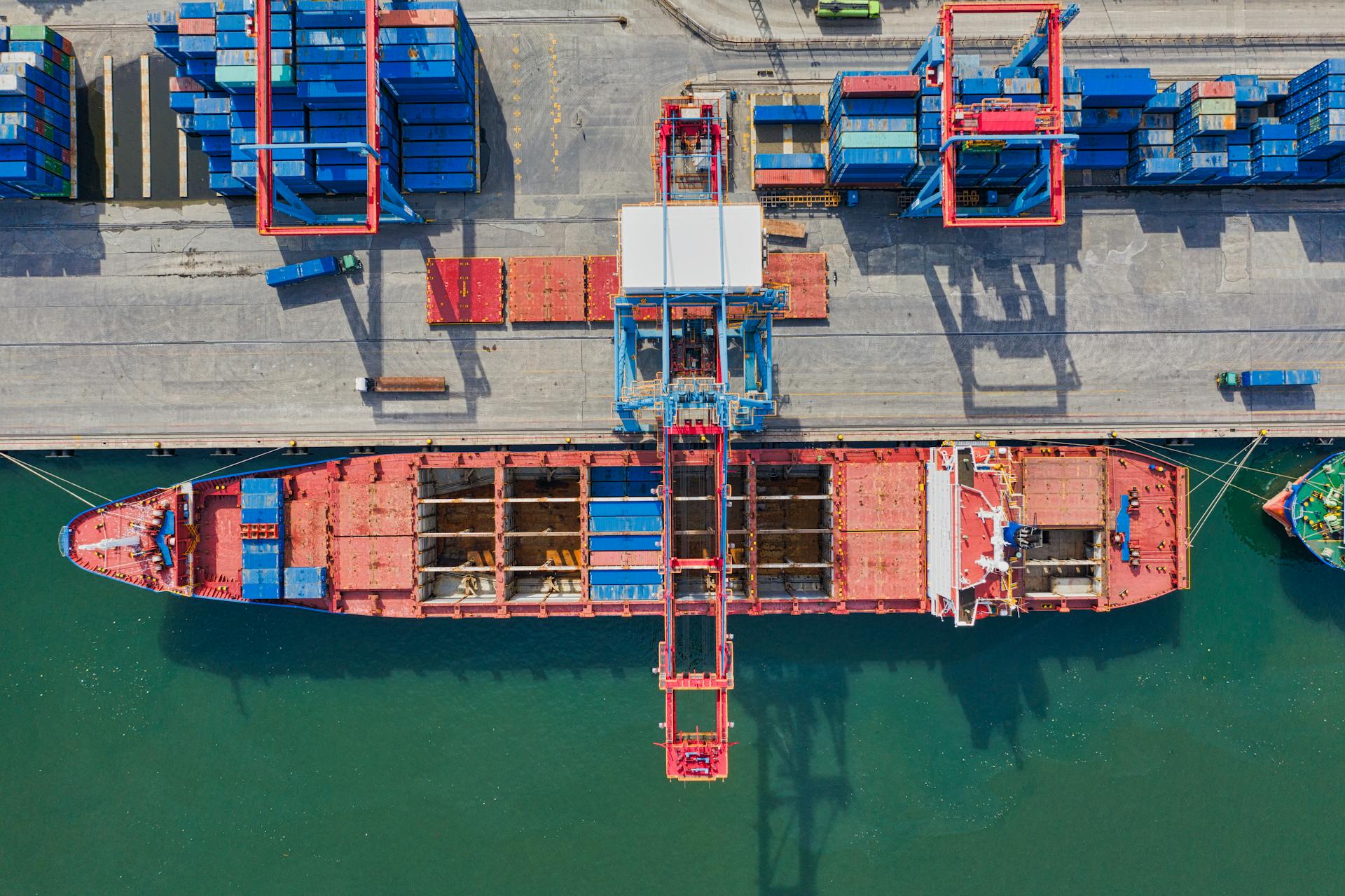

Featured Images: pexels.com