Invoice factoring UK is a financial solution that can help businesses manage their cash flow.

Factoring involves selling outstanding invoices to a third-party provider, known as a factor, at a discounted rate. This allows businesses to receive immediate payment for their invoices, rather than waiting for customers to pay.

The factor then takes on the responsibility of collecting payment from the customer, eliminating the need for businesses to chase after debts.

Businesses can use the funds received from factoring to pay bills, invest in new opportunities, or simply cover operational costs.

Discover more: Payment Service Providers

What Is It?

Invoice factoring is a way for UK-based businesses to raise money by selling invoices owed to their business to a third-party factoring company at a discount.

In the UK, invoice factoring involves selling your outstanding invoices to a lender, who will then advance you up to 90% of the money owed to you.

Invoice factoring is a type of invoice finance, and its success depends on the strength of your debtors.

Your clients will have to change the account they pay into, and it can be admin-heavy.

Invoice factoring is sometimes referred to as "accounts receivable factoring" and comes with a factoring company's fee.

You can choose to opt for selective invoice finance, where you select a few invoices to factor or discount, rather than borrowing against the entire ledger.

Invoice factoring is available to any business in the UK that trades with other businesses.

How Invoice Factoring Works

In the UK, invoice factoring works by involving three key parties: the factor, the debtor, and the unpaid invoice. The factor is a financial institution that buys business debt or unpaid invoices.

To be eligible for factoring, your business must submit details of your invoice to the factor, who will assess your client's credit scores and offer a quote. This is a crucial step in determining whether you're eligible for the factoring facility.

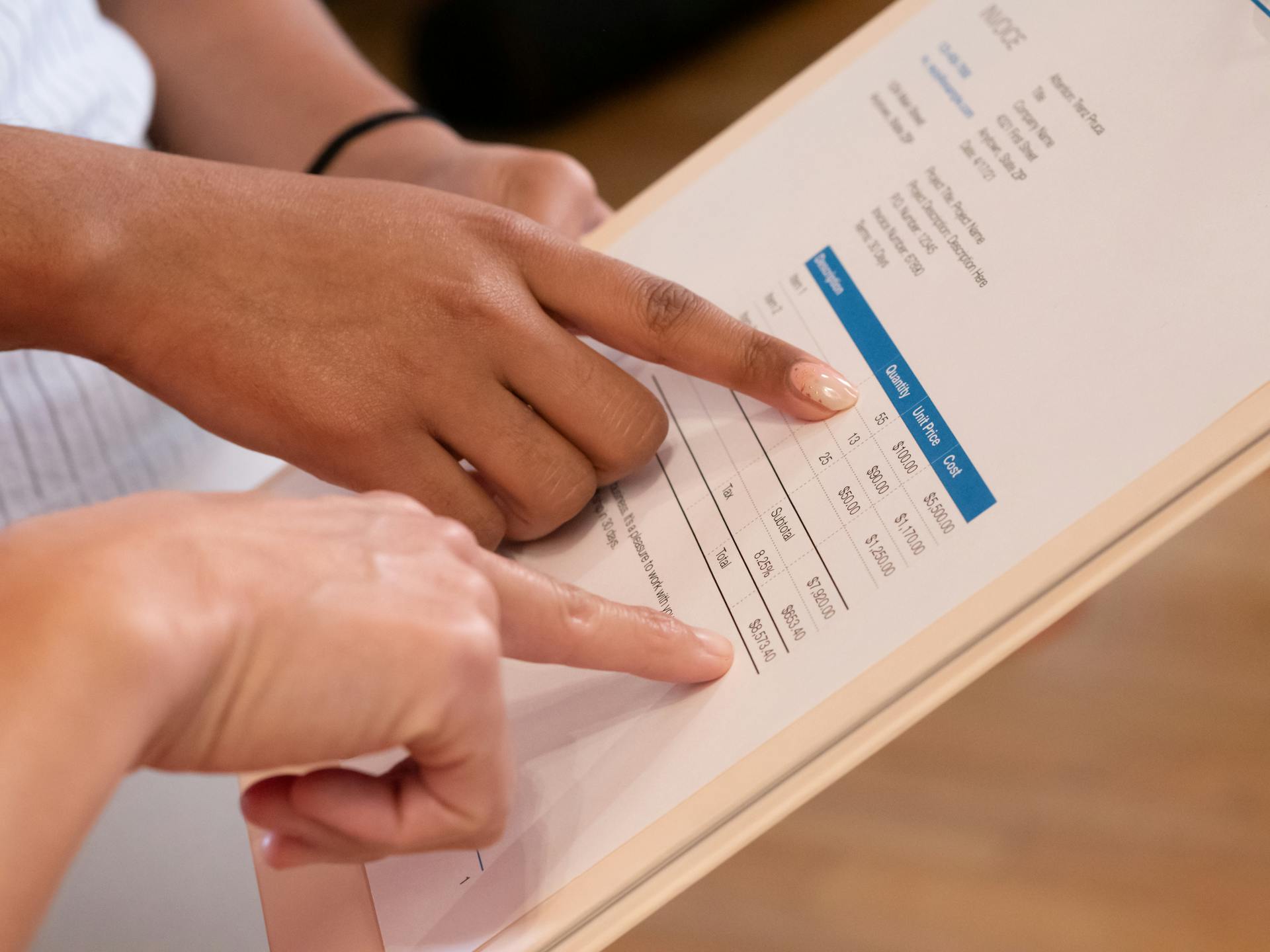

Once you agree to the terms and conditions, the factor will advance you the money, usually in two instalments. The first instalment covers the bulk of the receivables, while the remaining amount is paid when your client settles their invoice.

Collection of outstanding invoice amounts with your customers will commence, and once the amount is collected, the factor will pay you the remaining balance of your money, minus their fee. This fee is typically 5-10% of the remaining amount.

Factoring only covers business-to-business transactions, so you'll need to check the factor's conditions to see if your business qualifies. Each factor has its own set of requirements, which may depend on your company's turnover and industry.

When to Use

If your organisation sells on 30-day payment terms, you might find yourself chasing clients who pay late, which can tie up a large portion of your revenue.

Using factoring allows you to release this tied-up cash almost immediately, which could be used to cover short-term expenses.

Factoring can also help ease cash flow constraints, allowing you to make repayments to a loan or take advantage of business opportunities.

Invoice factoring can be particularly useful for larger projects, as it can alleviate concerns about the time between invoice payment and paying suppliers.

Here are some potential uses for the released cash:

- Allow you to cover short-term expenses

- Make repayments to a loan

- Take advantage of business opportunities you may come across

- Allows for cash flow constraints to be eased

Types of Invoice Factoring

There are different types of factoring available. Selective invoice factoring is one of them, which allows you to choose which invoices you finance.

Selective factoring lets you keep control of your sales ledger and client relationships. It's also known as selective invoice discounting, which works in a similar way to spot factoring.

You'll need to ensure you have a good collections policy to collect outstanding monies, as you're responsible for credit control.

Finance Types

Finance Types can be complex, but let's break it down simply. There are different types of factoring available.

Factoring finance can be categorized into various types, including recourse and non-recourse factoring. Recourse factoring allows the lender to pursue the debtor for payment if the buyer defaults.

Non-recourse factoring, on the other hand, protects the lender from pursuing the debtor in case of default. This type of factoring is often used by companies with a high risk of buyer default.

For your interest: Factoring (finance)

Another type of factoring is selective factoring, where the lender only purchases a specific invoice or a group of invoices. This type is often used by companies with a large number of invoices to manage.

Spot factoring is also available, where the lender purchases a single invoice or a small group of invoices. This type is often used by companies with a one-time need for cash flow.

Factoring finance can also be categorized into types based on the level of involvement, such as full-service factoring and limited-service factoring.

For more insights, see: Staffing Invoice Factoring

Selective

Selective invoice factoring is a great option for businesses that want to keep control of their sales ledger and client relationships. It allows you to choose which invoices to finance, giving you more flexibility.

This type of factoring is also known as selective invoice discounting, and it works similarly to spot factoring. FundInvoice offers an independent quotation search for invoice finance quotations, which can help you find the right selective invoice factoring option for your business.

On a similar theme: The Intersection of MIS and Finance

By choosing selective invoice factoring, you'll be responsible for credit control and collections, so it's essential to have a good collections policy in place. FundInvoice's invoice finance experts can help you find the right finance partner and provide guidance on the process.

Selective factoring doesn't require you to sell your whole sales ledger, giving you more autonomy over your business. Contact FundInvoice to learn more about selective invoice factoring and how it can benefit your business.

For your interest: What Is Invoice Finance Factoring

Discounting

Discounting is a type of invoice finance that allows you to choose which invoices you finance, giving you control over your sales ledger and client relationships.

You can retain control of your credit control processes and customer interactions with invoice discounting, making it a discreet and confidential way to improve your cash flow.

This type of funding solution is suitable for businesses that want to be in charge of sending and chasing invoices, as it can be less expensive than factoring.

Curious to learn more? Check out: Factoring & Invoice Discounting

Invoice discounting typically requires a minimum turnover of £250k, and you'll need to have a good collections policy in place to collect outstanding monies.

You'll receive a percentage of the invoice value upfront, and once the customer pays, you'll get the balance minus any fees.

Invoice discounting is often preferred by businesses that value their customer relationships, as it doesn't involve outsourcing credit control processes to a factoring company.

This approach can also be less expensive, as you won't be paying service fees for collections and debt management.

Broaden your view: Invoice Discounting

Recourse vs Non-Recourse Factoring

In the UK, recourse factoring accounts for approximately 90% of all invoice factoring arrangements.

Recourse factoring means you take all the responsibility for any unrecoverable funds, which can be a risk, but it allows invoice factors to lend money without carrying the risk of bad debt. This type of facility is also offered to Sole traders, contractors and start-ups.

Non-recourse factoring arrangement, on the other hand, means the lender will carry full responsibility for any bad debt which are suffered, which can be beneficial but also comes with higher costs due to the risks associated.

A different take: Non Recourse Debt Factoring

Non-Recourse

Non-Recourse factoring is a type of invoice factoring facility where the lender carries full responsibility for any bad debt suffered.

This means if the invoice is unrecoverable, the factor will cover your loss, which can be a huge relief for businesses.

In the UK, non-recourse factoring arrangements are rarer due to the risks associated with this kind of facility.

The factors normally charge more for non-recourse factoring, which can be a drawback.

Non-recourse factoring is a good option if you're concerned about being held responsible for bad debt, but be prepared for potentially higher costs.

Check this out: Debt Factoring

Vs Discounting

Invoice factoring and invoice discounting are both popular options for businesses looking to improve their cash flow, but they have distinct differences.

Invoice factoring involves the lender handling payment collection, whereas with invoice discounting, you remain responsible for chasing up and collecting payments.

Invoice discounting is a more discreet way to benefit from invoice financing, as your customers don't need to know that you're working with a factoring company.

Related reading: Confidential Invoice Discounting

With invoice factoring, the lender takes on the burden of collecting payments, which typically comes with a higher service fee.

Invoice discounting, on the other hand, is usually less expensive because you're not paying to outsource your collections process.

To qualify for invoice discounting, you typically need to be an established business with a minimum turnover of £250k.

Invoice discounting allows you to retain more control over your relationships with your customers, which can be beneficial for building strong business relationships.

You can submit your unpaid invoices to the provider and receive a percentage of the value, minus any fees, with invoice discounting.

Invoice discounting is a discreet and confidential way to ensure your business continues to run smoothly without interrupting your customer relationships.

Benefits and Drawbacks

Invoice factoring in the UK can be a game-changer for businesses, but it's essential to consider both the benefits and drawbacks.

One of the most significant advantages of invoice factoring is that it can plug the cash flow gap of your business, providing a steady cash flow to help you take on new projects, pay contractors, or cover overheads.

Check this out: Cash Flow

Invoice factoring companies have a quick turnaround, often setting up debt factoring in just 24 hours, allowing you to start receiving the cash your business needs.

There's also less risk to your assets, as your unpaid invoices act as collateral, and you won't typically be asked to put valuable assets like real estate or equipment on the line.

However, it's worth noting that your clients will be aware that you're using an invoice factoring service, and the lender will contact them to collect the outstanding factored invoices.

Possible Risks or Drawbacks

Some possible risks or drawbacks to be aware of include the fact that your clients will be aware that you're using an invoice factoring service, and the lender will contact them to collect the outstanding factored invoices.

Most invoice factoring agreements are recourse arrangements, which means that you will be responsible for any unrecoverable invoices.

Invoice factoring companies will only agree to finance invoices if the customer has a favorable credit history, and they can even help you scope out potential clients, but this might deter you from going into business with unreliable customers.

Asking for money can be unpleasant or awkward, but having a third party take over can relieve this pressure, however, this might also lead to a loss of control over your business relationships.

The regulation of the invoice finance sector could contribute to the increasing costs of its services, which might make it a less attractive option for businesses.

Pros and Cons of a Company

Let's take a closer look at the pros and cons of a company. One of the biggest advantages of a company is its ability to provide job security, as we saw in the "Benefits of a Company" section, where it was mentioned that companies can offer stable employment opportunities.

A company's size can also be a pro, as larger companies often have more resources and expertise, making them better equipped to handle complex projects and tasks, as discussed in the "Types of Companies" section.

On the other hand, one of the main drawbacks of a company is its potential for bureaucracy, which can slow down decision-making and hinder innovation, as mentioned in the "Challenges of Working in a Company" section.

Expand your knowledge: Factoring Company

Another con of a company is the risk of job burnout, as employees may feel overwhelmed by the demands of their roles and the pressure to meet targets, as seen in the "Common Challenges in the Workplace" section.

However, many companies are actively working to mitigate these risks by implementing flexible work arrangements and promoting work-life balance, as highlighted in the "Benefits of a Company" section.

Ultimately, whether the pros or cons of a company outweigh the other depends on the specific circumstances and the individual's perspective, but by understanding the advantages and disadvantages, we can make more informed decisions about our careers and personal lives.

Worth a look: Limited Liability Company Llc

Sources

- https://invoice-funding.co.uk/invoice-factoring/

- https://www.fundinvoice.co.uk/invoice-finance/list-invoice-finance-companies-uk.html

- https://www.touchfinancial.co.uk/invoice-discounting-vs-invoice-factoring/

- https://www.fundingoptions.com/knowledge/invoice-factoring/

- https://www.sonovate.com/invoice-factoring/

Featured Images: pexels.com