The iShares Silver Trust stock price has been a topic of interest for many investors. The trust's net asset value (NAV) per share is calculated by dividing the total value of the trust's silver holdings by the number of outstanding shares.

Investors who are interested in silver prices may want to consider the iShares Silver Trust as a way to gain exposure to the metal. Silver prices have historically been volatile, but the trust's shares have provided a way to invest in the metal without having to physically hold it.

The trust's shares have been available for trading since 2006 and have an average daily trading volume of over 10 million shares. This liquidity can make it easier for investors to buy and sell the shares quickly.

Suggestion: Gold Trust Etf

SLV Stock Price and Forecast

As of April 2023, SLV's stock is trading at around $20 per share, with a market capitalization of around $15 billion. The stock has experienced significant volatility in recent years, with a year-to-date return of around 10%.

Investors should be aware that the price of silver can be highly volatile, and the value of SLV's shares can fluctuate rapidly based on changes in supply and demand. Additionally, changes in government policies or regulations can also impact the price of silver and, by extension, SLV's stock price.

The price of SLV's shares is determined by the underlying value of the silver held by the trust, which as of April 2023, holds around $10 billion worth of silver.

Related reading: Class S Shares

SLV Stock Forecast

The price of SLV's shares is determined by the underlying value of the silver held by the trust, which as of April 2023 is around $10 billion worth of silver.

SLV's stock has experienced significant volatility in recent years, with a year-to-date return of around 10% as of April 2023.

The ongoing global economic uncertainty and inflation concerns could drive demand for silver as a store of value, but decreased industrial demand and increased competition from alternative investments could negatively impact SLV's stock performance.

Expand your knowledge: Santa Claus Rally 2023

As of April 2023, SLV's stock is trading at around $20 per share, with a market capitalization of around $15 billion.

SLV's prospects appear mixed, with some analysts believing that the trust's underlying value will continue to drive the stock's price, while others are concerned about the potential risks and challenges facing the trust.

Explore further: S B I Card Share Price

Gold Rallies on Tame CPI Data

Gold prices got a modest price boost due to cooler U.S. PPI data.

Ernest Hoffman, a seasoned Crypto and Market Reporter for Kitco News, has over 15 years of experience in writing, editing, and broadcasting for various organizations.

The recent U.S. CPI data was tame, causing gold and silver prices to rally.

Jim Wyckoff, a financial journalist with over 25 years of experience in the stock, financial, and commodity markets, notes that the tame CPI data had a positive impact on precious metals.

Gold and silver prices are often influenced by inflation data, and a tame CPI reading can be a bullish signal for these metals.

See what others are reading: Sentinelone Stock Symbol

Market Trends and Analysis

The iShares Silver Trust stock price has been influenced by various market trends and analysis.

The price of silver has a strong correlation with the US dollar, with a decrease in the dollar's value often resulting in higher silver prices.

The price of silver has also been affected by the global economic downturn, with many investors turning to silver as a safe-haven asset.

In 2020, the iShares Silver Trust stock price experienced a significant surge, increasing by over 50% in just a few months.

The global demand for silver is expected to continue growing, driven by the increasing use of silver in solar panels and other renewable energy technologies.

The iShares Silver Trust stock price has historically been more volatile than other precious metal ETFs, with a beta of 2.25 compared to the S&P 500.

As the global economy continues to recover from the pandemic, investors are likely to remain interested in silver as a hedge against inflation and economic uncertainty.

Suggestion: Capital Trust Stock Price

Risk Management and Strategies

Rising government debt in major economies is a bullish catalyst for the precious metals markets, including SLV, which can provide a hedge against excessive debt issuance.

Investors in SLV can potentially benefit from its inverse relationship with government debt, which can lead to increased demand for precious metals as a safe-haven asset.

SLV and the precious metals markets may provide a hedge against the excessive issuance of government debt in China, Japan, and the U.S.

The excessive issuance of government debt in major economies is a concern for investors, and SLV can offer a way to mitigate this risk through its exposure to precious metals.

Rising government debt in major economies is a key driver of the bullish catalyst for the precious metals markets, including SLV.

A different take: Ticker Symbol Slv

Frequently Asked Questions

What is the price of iShares silver today?

The current price of iShares silver is $26.76. Check our site for the latest market updates and expert analysis.

What is the symbol for iShares silver?

The symbol for iShares silver is SLV. This ETF tracks the price of silver and is one of the most popular ways to invest in the precious metal.

What is the iShares Silver Trust?

The iShares Silver Trust is an investment that tracks the price of silver, aiming to reflect its performance before expenses. It's a passive investment, meaning it's not actively managed.

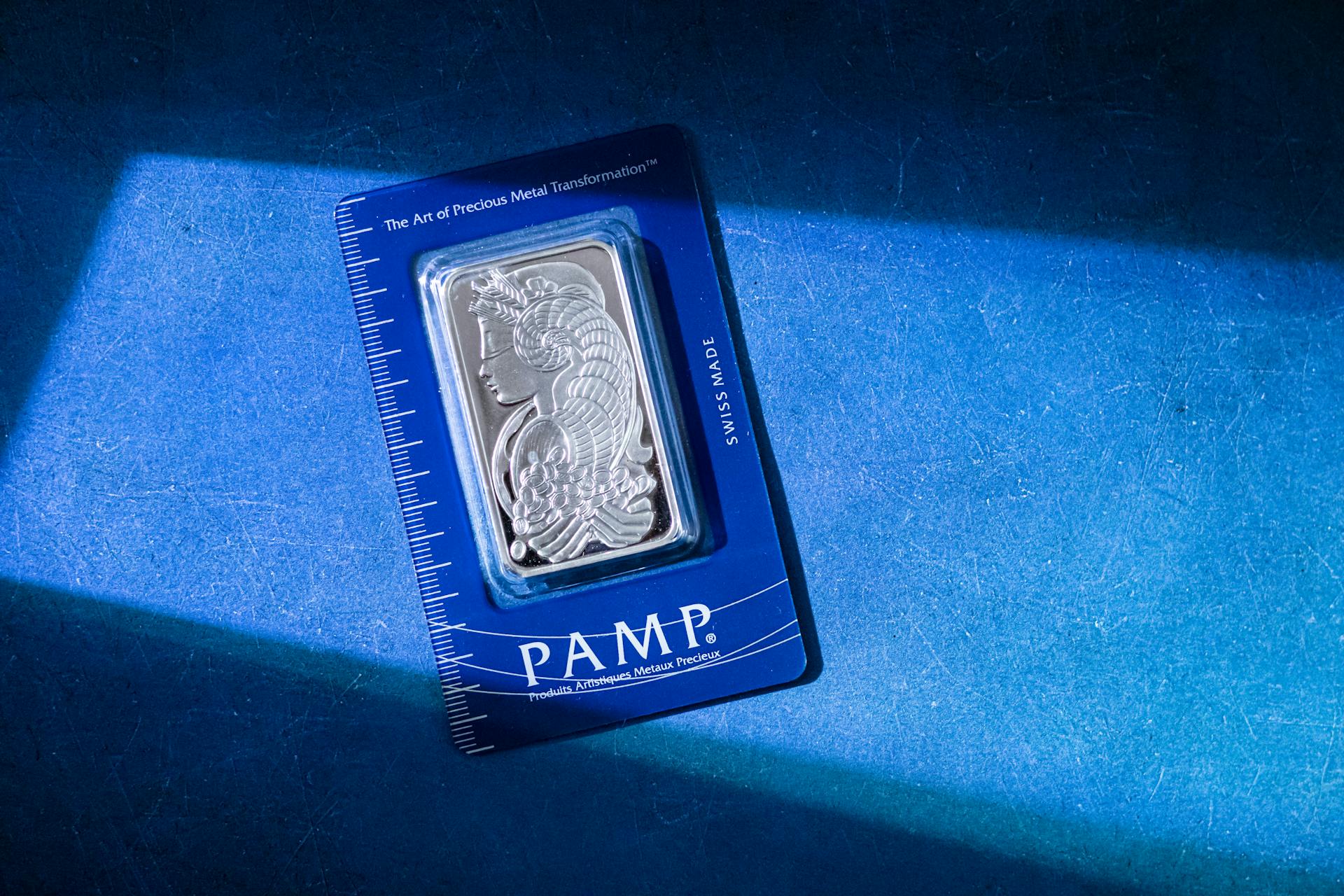

Featured Images: pexels.com