Navigating the health insurance claim process can be overwhelming, but understanding the basics can make a big difference.

Most health insurance plans require you to pay a deductible before your insurance kicks in, and this can range from a few hundred to several thousand dollars.

To file a claim, you'll typically need to submit a claim form to your insurance company, which may include documentation such as receipts and medical records.

The average processing time for a health insurance claim is around 30-60 days, but this can vary depending on the complexity of the claim and the insurance company's workload.

You'll receive a claim status update via mail or email, and if your claim is approved, you'll receive a reimbursement check or direct deposit.

Readers also liked: Claim Insurance Company

What Is Health Insurance Claim Process

The health insurance claim process is a crucial step in getting the medical care you need.

The process typically starts with a healthcare provider submitting a claim to the insurance company after you've received treatment.

You'll usually receive an Explanation of Benefits (EOB) document that outlines the services rendered, the amount charged, and the amount paid by the insurance company.

What Is a Claim?

A medical claim is essentially a request for payment from an insurance company to cover the cost of medical services rendered to a patient. This process starts with the provider submitting a request for payment to the insurance company.

The claim is reviewed for accuracy and completeness, and the insurance company will assess whether it will cover the claim. They'll review any supporting documentation and codes for services rendered, as well as the patient's name and dates of service.

If the claim is approved, payment is made through the insurance company's coverage plan, usually within a few weeks via electronic transfer or check. If the claim is denied, providers may be given the opportunity to submit additional information or evidence to support their claim.

Here's an interesting read: Insurance Claim Services

Know Your Plan

To navigate the health insurance claim process, it's essential to have a solid understanding of your health plan. This includes knowing if your plan has network providers, which can significantly impact the cost and accessibility of care.

Having a network provider means you've chosen a specific group of doctors and hospitals that your insurance company has contracted with to provide care at a reduced rate. If your plan allows for out-of-network providers, you may still be able to receive care, but you'll likely pay more out of pocket.

Your health plan's deductible, copay, or coinsurance amounts are also crucial to know. These are the amounts you'll need to pay for medical expenses before your insurance kicks in, and they can vary significantly from plan to plan.

For example, a plan with a high deductible may require you to pay a certain amount out of pocket before your insurance starts covering costs. On the other hand, a plan with a lower deductible may have higher monthly premiums.

Finally, be aware of any referral or pre-authorization requirements that may apply to your plan. This means that you may need to get approval from your primary care physician or insurance company before receiving certain treatments or services.

Here's a quick rundown of what to consider:

Patient Registration and Eligibility

Patient registration is the first step in the health insurance claim process. Accurate and complete information is a claims processing best practice, and registration information includes demographics, name, policy type, policy number, and group number.

To ensure no important details are missed, training staff to complete all steps is crucial. This includes collecting personal and insurance details from the patient during the initial check-in.

Insurance eligibility verification is the next step, where the care provider confirms the patient's insurance coverage and benefits policy. This helps determine coverage and eligibility, and assesses the following: what the patient's policy benefits are, whether they have accumulated co-pay, deductible or out-of-pocket expenses, and whether their insurance provider requires pre-authorization.

Here are the key details to verify:

- Policy benefits

- Accumulated co-pay, deductible, or out-of-pocket expenses

- Pre-authorization requirements

Patient Registration

Patient registration is the first step in the medical billing process, where patients provide personal details and insurance information to their provider.

Accurate and complete information is crucial for claims processing, and this includes demographics, name, policy type, policy number, and group number.

Patient registration typically occurs during the initial check-in process, where staff collect all necessary details from the patient.

Training staff to complete all steps is essential to ensure that no important details are missed, which can lead to denied claims or delays in processing.

Broaden your view: Medicare Health Insurance Claim Number

Eligibility Verification

Eligibility verification is a crucial step in the patient registration process. It helps care providers determine coverage and eligibility, and assess what the patient's policy benefits are.

Accurate and complete information is a claims processing best practice, including demographics, name, policy type, policy number, and group number. This ensures that no important details are missed.

To avoid claim denials, a medical practice must be diligent in confirming eligibility, including confirming patient insurance coverage and the benefits policy. This is conducted by healthcare providers to ensure services offered to patients are covered by their respective plans and to know limitations such as deductibles, copays, and coinsurances.

Verification helps avoid delays in claim processing and patients should have a clear understanding of the policies to avoid surprises and better manage their medical bills.

Here are the key things that eligibility verification helps care providers determine:

- What the patient’s policy benefits are

- Whether the patient has accumulated co-pay, deductible or out-of-pocket expenses

- Whether the patient’s insurance provider requires pre-authorization

Patient Statement

Patient Statement is the final step in the medical billing process. Once the payor has reviewed a medical claim and agreed to pay a certain amount, they bill the patient for any remaining costs.

Broaden your view: Does Medical Ask for Bank Statements

This is a crucial step for patients to understand, as it helps them plan and prepare for their financial obligations. The patient statement will clearly outline the amount owed, any outstanding balances, and payment due dates.

The patient is expected to review and respond to the statement, either by paying the balance in full, setting up a payment plan, or disputing any charges they believe are incorrect.

Claim Submission and Processing

Before submitting a claim, providers or medical billing specialists list the charges they expect to receive through the charge entry process. This is the last step before submitting a claim for payment.

The claim is then submitted to the payor for adjudication, which involves evaluating the claim and deciding whether it's valid and how much to reimburse. If the claim is accepted, the payor will issue provider reimbursement and charge the patient for any remaining amount.

A claim can be denied if the patient has insufficient coverage or didn't get pre-authorization for a service, or it can be rejected if it doesn't meet formatting requirements or contains an error in medical coding.

What Is a Claims Clearinghouse?

A claims clearinghouse is an electronic intermediary between healthcare providers and payors, responsible for scrubbing, standardizing, and screening medical claims before sending them to the payor.

This process helps mitigate errors in medical coding and reduces the time to receive provider reimbursement. If a claim contains medical coding errors or fails to meet formatting requirements, the payor could reject it, delaying provider reimbursement.

Healthcare providers transmit their medical claims to a clearinghouse, which then formats medical claims data according to the unique requirements of each payer, helping payors streamline their medical billing process.

In some cases, healthcare providers send medical claims directly to a payor, but this is often limited to high-volume payors like Medicare or Medicaid, which can receive bills directly from providers to reduce the time to receive reimbursement.

The clearinghouse service is beneficial for both healthcare providers and payors, as it helps to reduce errors and delays in the claims process, ultimately leading to faster reimbursement for providers.

Coding

Coding is a crucial step in the claim submission process. It involves translating a patient's clinical documentation into standardized codes for billing and report generation.

Care providers use medical coding systems like ICD-10-CM and CPT to capture diagnosis codes, treatment codes, and procedure codes. These codes track patient health information and provide statistical data.

Some common medical coding systems include DRG, CPT, HCPCS, ICD-10, and NDC. These codes help providers describe the patient's condition and the medical services they received.

Care providers list the charges they expect to receive during the charge entry process. This is the last step before submitting their claim for payment.

Here are some common medical coding systems used in the healthcare industry:

- DRG (Diagnosis-related group)

- CPT (Current Procedural Terminology)

- HCPCS (Healthcare Common Procedure Coding System)

- ICD-10 (International Classification of Diseases, 10th Edition)

- NDC (National Drug Code)

Adjudication

Adjudication is the process by which the payor evaluates a medical claim and decides whether to reimburse it.

The payor may deny a claim if the patient has insufficient coverage or did not get pre-authorization for a service.

If a claim is accepted, the payor will issue provider reimbursement and charge the patient for any remaining amount.

A payor may reject a claim if it does not meet formatting requirements or contains an error in medical coding.

Rejected medical claims can be resubmitted for payment once the errors have been corrected.

The payer will either approve the claim or request additional information.

After reviewing, the insurance company will either issue a denial or payment.

Steps for Procedure

The payer will review the claim and either approve it or request additional information. They'll then issue a denial or payment.

After the payer reviews the claim, they'll either approve it, request more information, deny it, or make a payment. This is a crucial step in the claim submission and processing procedure.

The healthcare industry requires meticulous attention and scrutiny, and claim processing steps are a prime example of this complexity. The payer's decision to approve or deny a claim is often based on the information provided by the claimant.

In some cases, the payer may request additional information from the claimant before making a decision. This could include medical records or other documentation related to the claim.

The payer's decision to issue a denial or payment is typically based on their review of the claim and any additional information provided.

Documents Required

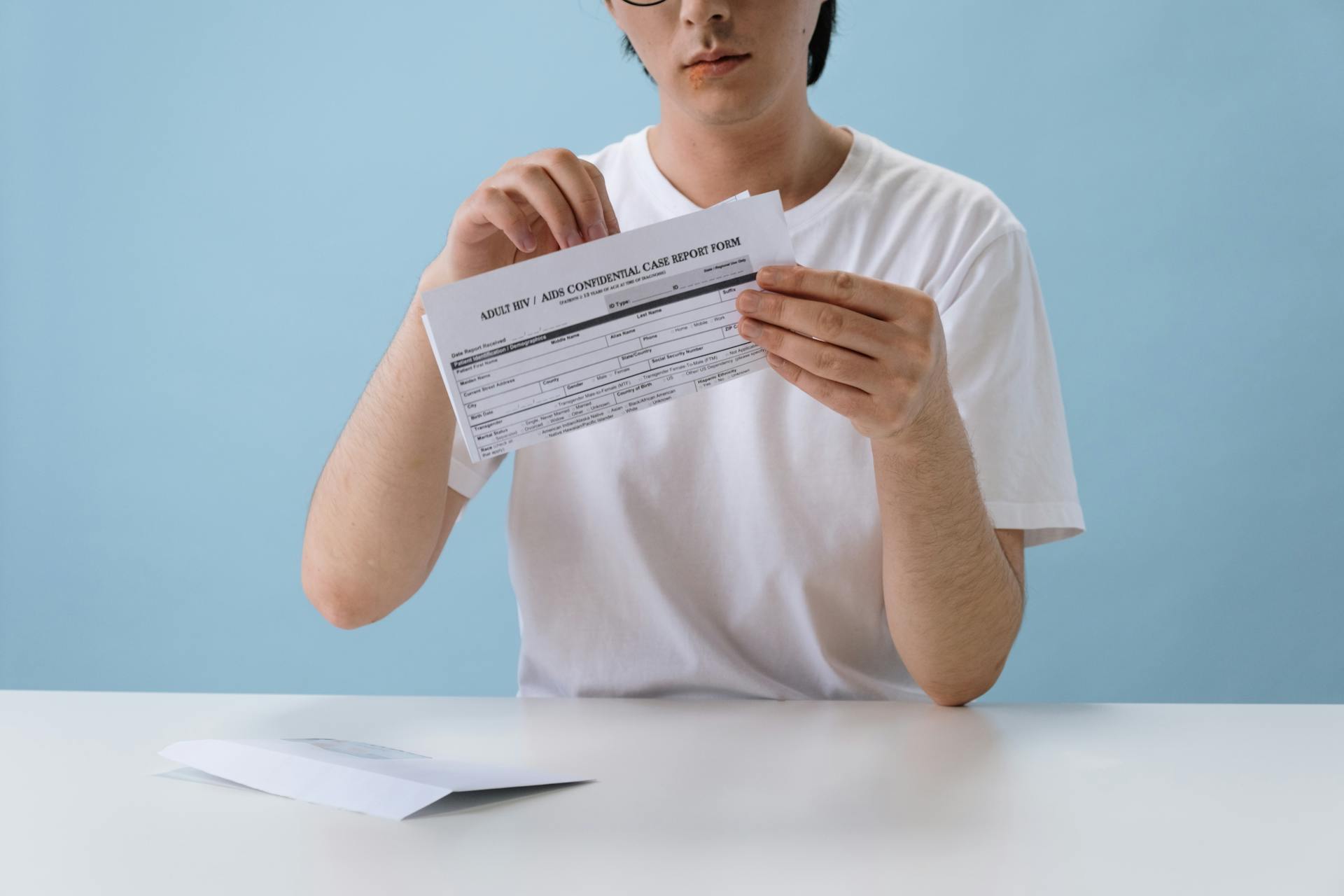

To submit a health insurance claim, you'll need to gather a range of documents.

A duly filled and signed claim form is the first document you'll need.

You'll also need to provide your doctor's prescription and referral letter. This is essential for verifying the medical treatment you received.

Diagnostic tests and medical reports are also required to support your claim.

Original bills, receipts, and discharge papers from the hospitalization are necessary for reimbursement.

In addition, you'll need to provide original bills from the pharmacy or chemist.

If the claim is related to a personal accident, you'll need to include a police FIR.

A policy copy, including the policyholder's name, contact number, and address, is also required.

Claim Payment and Settlement

If you need to be treated at a non-network hospital, you'll typically have to pay the initial medical costs upfront.

You'll receive reimbursement for these costs after filing a claim with supporting documents after discharge.

To initiate the reimbursement process, inform your health insurance provider about your hospitalisation at a non-network hospital.

You'll need to pay the bill upfront during discharge and collect related documents.

The claim management team will review your submitted documents and send their approval as per policy terms and conditions.

After approval, you'll receive the claim amount.

Here's a step-by-step summary of the reimbursement process:

- Inform your health insurance provider about your hospitalisation at a non-network hospital

- Pay the bill upfront during discharge and collect related documents

- Fill out the claim form and attach the required documents

- The claim management team will review your submitted documents and send their approval as per policy terms and conditions.

- After approval, you will receive the claim amount.

Claim Rejection and Optimization

If you're facing a claim rejection, don't panic. Review the coverage, benefits, and appeals sections of your health plan contract to understand your options.

To resolve a claim dispute, start by contacting the health plan and medical provider, and attempt to resolve the issue informally.

If informal resolution isn't possible, file an appeal with your health plan. Keep track of appeal due dates to avoid missing deadlines.

You can also file a complaint with the relevant office, but keep in mind that filing a complaint won't replace your appeal rights with your health plan.

Curious to learn more? Check out: How to File Insurance Claim against Other Driver without Insurance

Problems

If you encounter a problem with your claim, start by reviewing your health plan contract, specifically the coverage, benefits, and appeals sections. This will give you a clear understanding of your options and the process for resolving disputes.

You should contact your health plan and medical provider to attempt to resolve the issue informally. This is often the fastest and most effective way to resolve problems.

If you're unable to resolve the issue through informal means, you'll need to file an appeal with your health plan. Be sure to keep track of appeal due dates to avoid missing deadlines.

You can also file a complaint with our office, but keep in mind that this will not replace your appeal rights with your health plan.

Here are the steps to follow when dealing with a claim problem:

- Review your health plan contract for coverage, benefits, and appeals information.

- Contact your health plan and medical provider to resolve the issue informally.

- Filing an appeal with your health plan if necessary.

- Keep track of appeal due dates.

Reasons for Rejection

Not revealing pre-existing diseases at the time of buying a policy can lead to claim rejection. This is a common mistake that many people make, thinking they can get away with hiding this information.

Filing claims for treatments excluded from the policy is another reason for rejection. Make sure to carefully read your policy documents to avoid this.

Not raising a claim during the defined period can also result in rejection. This period is usually specified in the policy documents, so it's essential to keep track of it.

Raising a claim during the waiting period is another reason for rejection. This waiting period is usually a few months after the policy is purchased, so it's crucial to plan ahead.

Fake claims are a serious offense and can lead to claim rejection. This is not only a waste of time but also a breach of trust.

The claim amount exceeding the policy sum insured is another reason for rejection. This is a straightforward rule that's essential to understand when filing a claim.

Here are the top reasons for health insurance claim rejection in a concise list:

- Not revealing pre-existing disease at the time of buying the policy

- Filing claims for treatments excluded from the policy

- Not raising a claim during the defined period

- Raising a claim during the waiting period

- Fake claims

- When the claim amount exceeds the policy sum insured

Tips to Avoid Rejection

To avoid claim rejection, it's essential to be transparent about your health history. Avoid hiding any information, including pre-existing conditions, when buying a policy.

Filing a claim can be stressful, but it's crucial to be honest and upfront from the start. Inform your insurer about planned or emergency hospitalization with a definite time to ensure a smooth process.

Reading the fine print is key. Carefully review the inclusions, exclusions, waiting periods, claim procedures, features, and benefits of your policy before filing a claim.

Don't forget to submit all required documents, including medical reports, when filing a claim. This will help your insurer process your claim efficiently.

To take advantage of cashless claims, get admitted to a network hospital. This will save you from out-of-pocket expenses and reduce the hassle of reimbursement.

Intriguing read: What Is a Health Insurer

Efficient Optimization

Efficient Optimization is crucial in healthcare claims processing. It helps maintain cash flow and reduces revenue loss.

As healthcare professionals, your primary focus is patient care, but billing and insurance claims processing is a critical aspect of maintaining the health of your practice. Efficient medical claims processing is vital for healthcare providers to maintain cash flow, reduce revenue loss, and ensure complete and timely reimbursement.

One way to optimize your claims processing is to evaluate all the software your practice is using. Are there any areas in the claim process that slow down or delay the payment? There may be redundant claims processing workflows that can't be streamlined or eliminated to reduce the time and effort required to complete tasks.

Streamlining redundant workflows can significantly reduce the time and effort required to complete tasks. This can be achieved by identifying and eliminating unnecessary steps in the claim process.

By optimizing your claims processing, you can reduce revenue loss and maintain cash flow. This, in turn, will allow you to focus on providing better patient care.

For your interest: Time Limit to Submit Health Insurance Claim Bcbs

Special Cases and Procedures

In special cases, the medical health insurance claim procedure is a bit more complex. There are two main types of claims: cashless reimbursement claims and accidental injuries and deaths.

For cashless reimbursement claims, the procedure is streamlined to minimize delays. The insurance company directly reimburses the hospital or healthcare provider, making it easier for policyholders to receive the care they need.

Accidental injuries and deaths, on the other hand, require a separate procedure. The insurance company will investigate the incident and determine the coverage and compensation.

Accidental Injuries

In the event of a medical emergency due to an accident, it's essential to inform your insurance provider as soon as possible.

The first step in filing a claim for accidental injuries is to inform your insurance provider about the accident. This will initiate the process and ensure you receive the necessary support.

You'll need to submit a claim form along with vital documents including a police FIR, medical certificate, discharge form, report from a medical examiner, and medical documents from the hospital.

To get cashless benefits at our network hospitals, you'll need to show the health insurance card provided by us.

Accidental Death Case

If you've suffered a severe injury that's led to the accidental death of the policyholder, the process for making a claim is quite straightforward.

The nominee needs to fill out the former's death claim form along with a bunch of required documents.

Police FIR is mandatory in case of unnatural death, so make sure to get that sorted out first.

A post-mortem report is also essential, as it helps establish the cause of death.

You'll need to provide original policy documents, a death certificate, and a medical certificate with hospital records.

Don't forget to include the policyholder's age proof and a cremation certificate, if applicable.

If the policyholder was employed, you'll need to provide an employer certificate as well.

Here's a list of the required documents for an accidental death claim:

- Police FIR in case of unnatural death

- Post-mortem report

- Original policy documents

- Death certificate

- Medical Certificate and hospital records

- Age proof of the insured

- Cremation certificate and employer certificate

Claim Filing and Tracking

To file a medical claim, you'll need to use the correct claim form and submit paperwork accurately and on time. This means gathering all necessary documents, including doctor's notes, lab results, and hospital records, before filing the claim.

To ensure a smooth claims process, it's essential to understand the coverage plan with your patients. This will help you avoid any delays or issues down the line. You can use the online facility to check the status of your claim, but only if you have opted for a policy from the insurance provider.

Here are the steps to track the status of your health insurance claim:

- Visit the official website of the insurance provider.

- Enter relevant details to track the status of your claim.

- Check the reimbursement claim or cashless claim status.

Remember to track the status of your claim frequently, as this will help you stay on top of the process and avoid any unnecessary delays.

How to File a Case

Filing a medical claim can be a straightforward process if you follow the right steps. Use the correct claim form to submit paperwork accurately and on time.

Gathering all necessary documents is crucial before filing a medical claim. Ensure you have all the required paperwork, including doctor's notes, lab results, hospital records, or other evidence needed to prove eligibility.

Submit the claim form before the time limit to ensure quick and correct processing. This will also help you avoid any potential delays.

It's essential to make sure your patients understand their coverage plan to ensure a smooth claims process. This will help prevent any misunderstandings or delays.

To track the status of your medical claim, check with the insurance company frequently for updates on its approval or denial status.

Expand your knowledge: How Do I Check the Status of My Bcbs Settlement

Tracking Your Status

You can check the status of your health insurance claim online, which is a convenient and efficient way to stay informed.

To track your claim status, you need to visit the official website of your insurance provider, if you have opted for a policy from them.

The online facility allows you to track your reimbursement claim or cashless claim status by entering relevant details.

Explore further: Bcbs Claim Status

Claim Management Software

Claim management software can make a huge difference in your healthcare practice's efficiency. Evaluating all the software your practice is using is a great place to start.

Streamlining or eliminating redundant claims processing workflows can significantly reduce the time and effort required to complete tasks. This can help you stay focused on patient care.

Optimizing your claims processing is crucial for maintaining cash flow and reducing revenue loss. Efficient medical claims processing ensures complete and timely reimbursement.

By identifying areas that slow down or delay payment, you can make targeted improvements to your claims management software. This will help you get paid faster and reduce the stress of delayed reimbursements.

For your interest: Help Insurance Claim

Frequently Asked Questions

What are the steps for health insurance?

To choose the right health insurance, start by considering your family's needs and reviewing your coverage options, including premiums, copayments, deductibles, and provider networks. This will help you make an informed decision and ensure your medications are covered.

Sources

- https://www.definitivehc.com/blog/medical-claims-101-what-you-need-to-know

- https://www.insurance.wa.gov/how-your-health-insurance-claims-process-works

- https://www.medicaladvantage.com/blog/guide-to-healthcare-claims-processing/

- https://www.relyservices.com/blog/medical-claims-process-guide

- https://www.careinsurance.com/health-insurance/health-insurance-claim

Featured Images: pexels.com