Government invoice factoring can be a game-changer for businesses that struggle with cash flow. By selling outstanding invoices to a third party, businesses can receive immediate payment and free up resources to focus on growth.

This process is often referred to as invoice discounting or factoring, and it's a common solution for businesses that work with government agencies. Government invoice factoring is specifically designed to help businesses that have a high volume of invoices with the government.

The benefits of government invoice factoring are numerous, including improved cash flow, reduced administrative burdens, and increased working capital. Businesses that have used government invoice factoring report an average increase in cash flow of 20-30%.

Recommended read: B H P Billiton Share Price

What Is Government Invoice Factoring?

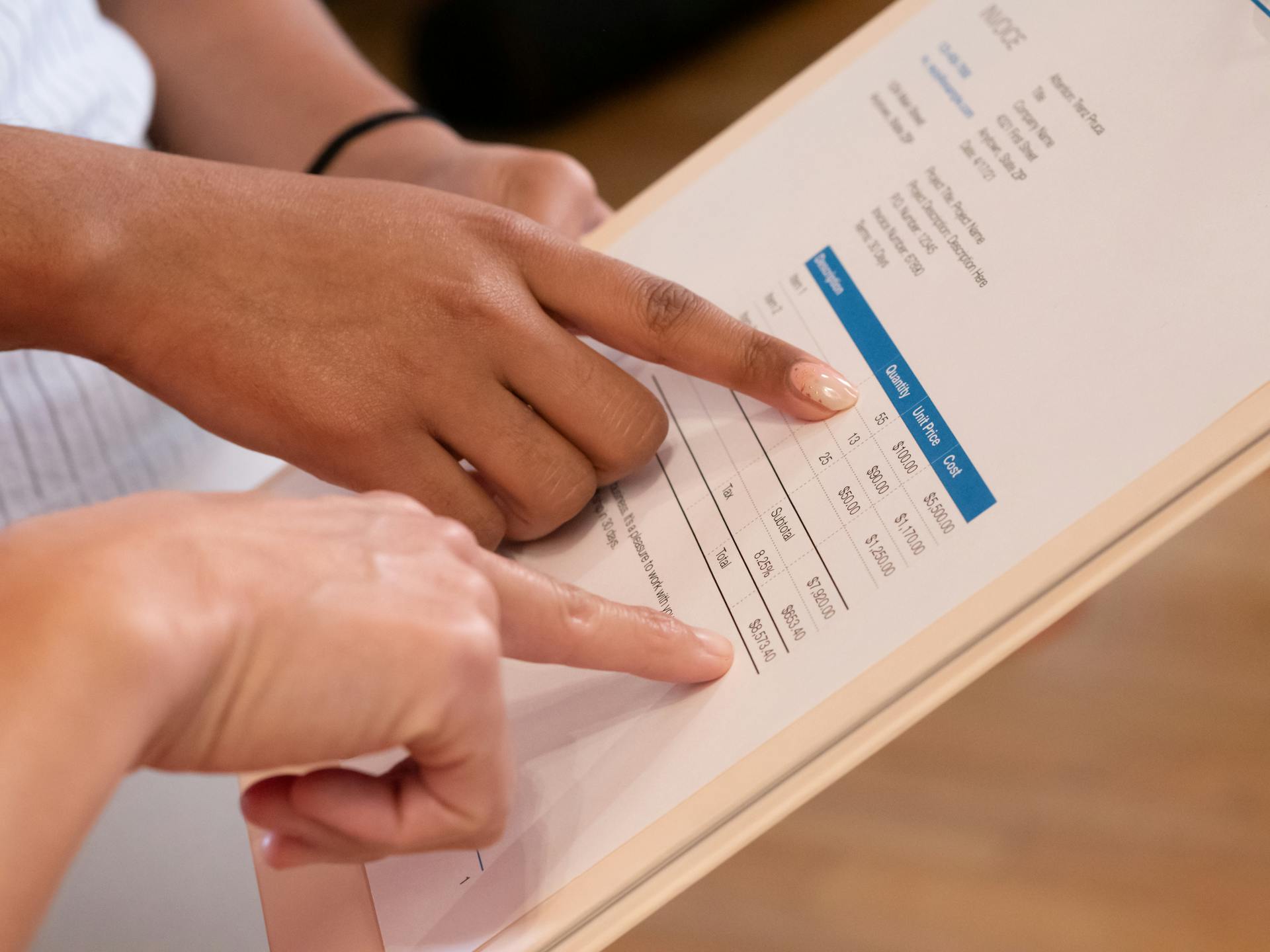

Government invoice factoring is a financing option that allows businesses to receive quick cash in exchange for selling their government invoices to a factoring company. This process is similar to other invoice types, where you deliver products or services to a government agency and send an invoice for payment.

You can sell the invoice to a factoring company for an advance payment of between 80% and 90% of the total invoice amount. This means you don't have to wait for the government agency to pay you, giving you instant access to cash.

The factoring company is responsible for collecting payments from the government entity, freeing you from worrying about collecting money from late-paying clients. This can be a huge relief, especially when dealing with government contracts that can take time to pay.

Once payment is received, the factoring company deducts its fee and other charges, and the remaining balance is remitted to you. This process allows you to focus on business growth and other important tasks, rather than getting bogged down in administrative tasks.

Government invoice factoring is a debt-free alternative funding method that can get you the funds you need to complete a project or run day-to-day operations. Advances can be made within one day, and the remainder is held in a reserve account until the invoice is paid.

The advance given from the factoring company can be used to cover payroll, continue running operations, and even complete the project you took on. This can be a huge help when dealing with large government contracts that can dry up your cash flow.

Readers also liked: Trade Futures Contracts

Eligibility and Requirements

To determine if your business is eligible for government invoice factoring, you need to review the requirements and criteria set by the agency involved and the conditions of the factoring agreement. A reliable factoring company is vital to guarantee a successful and seamless arrangement.

Certain agencies may require the factoring company to register, and they may also place limitations on the proportion of invoices that can be factored. You should review the terms of the contract and factoring agreements before starting invoice factoring.

To qualify for factoring, your company will need to have the following items: invoices to factor, creditworthy clients, a completed factoring application, an accounts receivable aging report, a business bank account, a tax ID number, and a form of personal identification.

Here are some industries that are eligible for receivables financing:

- IT and computer services

- Logistics and transportation

- Military products and supply

- Communication systems

- Distributors and manufacturers

In order to qualify for government receivables factoring, the invoice must have been accepted by the government agency for the delivered product or completed service, and the accounts receivable owned by the company must be unpledged.

Benefits and Advantages

Government invoice factoring can be a lifesaver for businesses facing cash flow issues. It provides instant liquidity by selling accounts receivable at a discounted rate, which can be used to pay ongoing bills and invest in growth initiatives.

Businesses can access funds quickly, even in the face of government reimbursements delays. This eliminates the need for debt accumulation.

Improving cash flow is just one of the many benefits of government invoice factoring. It can also help improve a business's credit standing by providing prompt access to funds and timely bill settlement.

If you're considering government invoice factoring, you may be a good fit if you have B2B customers, offer payment terms between 30 and 90 days, have fair or poor credit, have limited operating history, or have few or no assets to borrow against.

Here are some characteristics that may make your business a good fit for government invoice factoring:

- B2B customers

- Payment terms between 30 and 90 days

- Fair or poor credit

- Limited operating history

- Few or no assets to borrow against

Types of Factoring

Government invoice factoring offers various types of factoring options, each with its own benefits and requirements.

There are different types of invoice factoring, and understanding them is crucial when finding a factoring company to work with.

Accounts receivable factoring involves selling outstanding invoices to a third-party company, which then collects the payments from the customers.

This type of factoring can be particularly useful for businesses with a large number of outstanding invoices, as it can help to improve cash flow quickly.

Asset-based factoring, on the other hand, involves using a company's assets as collateral to secure funding.

This type of factoring can be beneficial for businesses with a strong asset base, as it can provide access to larger amounts of funding.

Government invoice factoring typically involves factoring invoices related to government contracts or projects.

This type of factoring can be beneficial for businesses that work with government agencies, as it can help to improve cash flow and reduce the risk of non-payment.

Each type of factoring has its own unique features and requirements, and businesses should carefully consider which option best suits their needs.

A fresh viewpoint: What Type of Government Does China Have Brainly?

Costs and Fees

The cost of government invoice factoring can vary depending on several factors. The size of your borrowing need, the creditworthiness of your customers, invoice amount, and the age of your receivables all impact the total factoring cost.

The discount fee for paying your invoices in advance can range from 1.5–5% of the invoice value each month. This is a significant factor to consider when selecting a factoring service.

Invoice factoring fees vary from company to company, so it's essential to check with your service provider before getting started. Some factors may charge an additional fee of 2–3% or more for every 30 days that the receivable is outstanding beyond the original 30 days.

Here are some key factors to consider when evaluating the cost of government invoice factoring:

- Size of borrowing need

- Creditworthiness of customers

- Invoice amount and age of receivables

- Whether all or select invoices will be financed

Non-Recourse

Non-Recourse factoring is a lower-risk option for businesses that can't absorb the cost of unpaid invoices, but it does come with higher factoring fees.

In non-recourse factoring, the factor assumes all the risk of collecting the debt, which is a big advantage for small businesses.

Larger corporations often favor recourse factoring because they can afford to return the funds they received from selling the uncollectible invoice to the factoring company.

However, if you're selling to a large and creditworthy customer like WalMart or the Federal Government, the chances of not being paid due to credit reasons are small, making non-recourse factoring less attractive.

Non-recourse invoice factoring agreements can be expensive, with fees that can drive up the cost of services, but they can also reduce bad debt and increase cash flow for your business.

With non-recourse invoice factoring, if your customer pays the invoice in 45 days or less, your total invoice factoring cost can average approximately 3.9% of the invoice.

Here's an interesting read: H B L Power Share Price

Cost

The cost of invoice factoring can vary widely depending on several factors. The size of your borrowing need, creditworthiness of your customers, invoice amount, and age of your receivables all play a role in determining the cost.

If this caught your attention, see: Fixed vs Variable Cost

Invoice factoring fees can differ significantly from one company to another, so it's essential to check with your invoice factoring service before getting started.

The discount fee for paying invoices in advance can range from 1.5-5% of the invoice value each month. This wide disparity highlights the importance of understanding your factoring costs upfront.

If your invoices go beyond 30-45 days, you can expect an additional charge of 2-3% or more for every 30 days that the receivable is outstanding beyond the original 30 days.

Non-recourse factoring, which assumes responsibility for losses if customers fail to pay, typically comes with higher factoring fees.

Here's a breakdown of the key factors that impact factoring costs:

- The size of your borrowing need

- The creditworthiness of your customers

- Invoice amount and the age of your receivables

- Whether all or only select invoices will be financed

Choosing a Factoring Option

Government invoice factoring can be a lifesaver for businesses struggling with cash flow. A reputable factoring company can provide the necessary financing to help you meet your financial obligations.

With government invoice factoring, you can receive payment on your invoices within hours of submitting them to a factoring company. This is particularly useful for businesses with limited liquid assets, delayed payment collection, and cash flow problems.

For another approach, see: Cash Flow

Factoring companies, like Bankers Factoring, have experience with government contracts and can provide flexible financing options to meet your unique requirements. They can also customize their offerings to fund invoices selectively, allowing you to choose which invoices to factor.

To find the best factoring company for your business, consider the following factors:

- Experience with government contracts

- Service flexibility

- Transparent fee structures

- Reputable track record

- Outstanding customer service

- Speedy turnaround

Non-Notification

Non-notification factoring is a type of factoring where borrowers' customers are not informed of the factoring agreement.

In non-notification factoring, the factor doesn't send a Notice of Assignment to the debtor, instead communicating with them as if it's an extension of the borrowing business. This approach is also known as confidential invoice factoring or undisclosed factoring.

Explore further: Non Recourse Debt Factoring

Choosing the Best

Government contract factoring provides a flexible financing option, allowing companies to customize their cash flow to meet their unique requirements. This is in contrast to traditional loan options, which can be constrained by strict conditions.

Experience with government contracts is crucial when choosing a factoring company. A company with experience will be familiar with the complexity related to government contracts. This can be a major factor in ensuring that your factoring needs are met.

Expand your knowledge: Nevada Invoice Factoring Company

Transparent fee structures are essential when selecting a factoring company. You should understand all fees, including upfront expenditures, discount percentages, and collection charges. A company with reasonable and transparent prices will save you from unexpected costs.

A reputable track record is vital when choosing a factoring company. Research the company's background and read reviews to get an idea of their past work. A company with a track record of accomplishments will give you peace of mind.

Outstanding customer service is also important. A company that provides excellent customer service will result in a better experience. You should be able to ask questions and get insightful help when you need it.

Here are some key factors to consider when choosing a factoring company:

- Experience with government contracts

- Service flexibility

- Transparent fee structures

- Reputable track record

- Outstanding customer service

- Speedy turnaround

These factors will help you choose a factoring company that meets your needs and provides the best possible service. By considering these factors, you can ensure that you get the most out of your factoring experience.

See what others are reading: What Are the Factors of 56?

Common Myths and Considerations

Government invoice factoring can be a game-changer for businesses, but there are some common myths and considerations to keep in mind.

Experience with government contracts is crucial, as it can make a huge difference in navigating the complexities involved. A company with experience in dealing with government contracts will be a valuable partner.

Reputation is also key, so it's essential to research a company's background and read reviews to get an idea of their past work. A reputable business with a track record of accomplishments is a safer bet.

Here are some factors to consider when choosing a government invoice factoring company:

- Experience with Government Contracts

- Service Flexibility

- Transparent fee structures

- Reputable Track Record

- Outstanding Customer Service

- Speedy Turnaround

In fact, invoice factoring can be beneficial for businesses of all sizes and stages of growth, not just those struggling financially.

Common Myths About

Invoice factoring often gets a bad rap, but it's not all doom and gloom. Factoring is not only for struggling businesses, but can be a great cash flow solution for businesses of all sizes and stages of growth.

On a similar theme: Which of the following Is Not a Factor of Production?

Some people think factoring is too expensive to be sustainable, but most businesses that are a good fit for factoring have pricing power, meaning they can incrementally increase their prices to compensate for factoring costs.

You don't need perfect credit to use factoring, either. Invoice factoring is often the best fit for businesses with bad credit, because factoring companies really only care about the creditworthiness of your customers, not you as a business.

Not all factoring companies are created equal, though. Some will try to take advantage of you with hidden fees, float, and other added costs that make factoring unsustainably expensive and unpredictable.

Some businesses have concerns about factoring, seeing it as a sign of financial instability. However, many big companies see factoring as a tactical instrument to maximize cash flow and streamline accounts receivable procedures.

You might enjoy: Staffing Invoice Factoring

Considerations in Choosing

Choosing the right invoice factoring company can be a daunting task, but there are key factors to consider. Experience with government contracts is crucial, as an experienced company will be familiar with the complexity related to government contracts.

Curious to learn more? Check out: Benefits of a Captive Insurance Company

A company's service flexibility is also essential. Look for a company that will customize its offerings to meet your needs, allowing you to fund invoices selectively.

Transparent fee structures are a must. Ensure that you understand all fees, including upfront expenditures, discount percentages, and collection charges.

A reputable track record is vital. Research the company's background and read reviews to get an idea of their past work. Choose a reputable business with a track record of accomplishments.

Outstanding customer service is also a top priority. Give priority to a business that provides excellent customer service, with an attentive account management that will result in a better experience.

Here are some key factors to consider in choosing a government invoice factoring company:

- Experience with government contracts

- Service flexibility

- Transparent fee structures

- Reputable track record

- Outstanding customer service

- Speedy turnaround

Alternatives and Comparisons

If you're considering government invoice factoring, it's essential to understand the alternatives and comparisons.

Traditional Line of Credit, Purchase Order Financing, and SBA Loans are other types of small business lending options, but they may not be the best fit for every business.

Some types of small business loans require a certain credit score or minimum operating history, while others can be fast and easy but expensive and predatory.

Factoring vs. other types of small business lending can be a challenge, but it's worth exploring.

Here are some common types of small business lending options:

- Traditional Line of Credit

- Purchase Order Financing

- SBA (Small Business Administration) Loans

- Asset Based Loans

- Equipment Financing

- Inventory Financing

- ACH Loans

- Merchant Cash Advance

Invoice factoring and invoice financing are two alternatives that benefit businesses by providing funds in advance of collection.

Invoice factoring offers greater flexibility, but AR financing typically offers preferred financing terms due to stricter underwriting criteria.

With invoice factoring, the factoring company assumes the role of collecting on the invoices they purchased, whereas with invoice financing, you retain control of collection.

Both forms of financing provide professional credit services and receivables management, and many providers offer both factoring and AR financing.

Here's an interesting read: Owner Financing in Real Estate

Preparing for Factoring

Government invoice factoring can be a bit more complicated than traditional business-to-business factoring, due to regulations and compliance requirements.

To get started, you'll need to gather the required documents. Invoices are the first step, so prepare all the invoices that show both finished or ongoing business dealings with government agencies.

Government contracts are also essential, as you'll need to offer proof or information that they've been completed. This helps verify the legitimacy of the invoices meant to be factored.

Financial accounts are also necessary, as they help determine your business's stability and finance strength. The factoring company will review these statements to assess your organization's financial stability.

Here are the key documents you'll need to prepare:

- Invoices: Show finished or ongoing business dealings with government agencies

- Government Contracts: Provide proof or information that they've been completed

- Financial accounts: Help determine your business's stability and finance strength

Preparing for and Finding

Finding government contracts can feel overwhelming, with Uncle Sam putting out many calls for proposals each day.

Sorting through them and selecting the most likely options can be a daunting task for small business owners. Be sure you are ready to take on the complexities of a government contract lineup with a government purchase order finance company on your side.

Government contracts often show low-profit margins, which can be harder to finance for private companies. This can result in high business volume and a regular revenue stream, but with cash flow challenges on slow-paying government entities.

Government invoices can take 90 days to pay, creating a cash flow gap that can be bridged with the help of a government factoring company.

Required Documents

To prepare for factoring, you'll need to gather specific documents that showcase your business's financial stability and legitimacy.

Invoices are a crucial part of the factoring process, so make sure to prepare all invoices related to government dealings, including those for finished or ongoing business dealings with government agencies.

Government contracts can also provide valuable proof of your business's legitimacy, so be prepared to offer information or proof that these contracts have been completed.

Financial accounts are another essential document, as they help determine your business's stability and financial strength. The factoring company will use these statements to review your organization's financial stability.

Suggestion: Why Are Interest Rates so High on Credit Cards

You'll need to provide thorough financial accounts, which may include information about your business's income, expenses, and cash flow. This will give the factoring company a clear picture of your business's financial health.

Here are the key documents you'll need to prepare for factoring:

- Invoices for government dealings

- Proof of completed government contracts

- Thorough financial accounts

PO Funder

As a PO funder, we understand the challenges that small businesses face in getting the funding they need to fulfill government contracts. Fully 23% of U.S. government contracting funds go to small businesses.

We specialize in providing government purchase order funding to start-ups and small businesses that struggle to get a line of credit or supplier financing from traditional lenders or banks. Many government contractors use government invoice factoring and purchase order funding to fulfill their contracts and fill working capital gaps.

Our team has over 50 years of combined experience in government contract financing and government PO funding, making us a trusted partner for businesses looking to succeed in this space. We can provide the working capital you need to fulfill the contracts you've been awarded.

Intriguing read: Equity Debt Financing

Our government purchase order financing solutions can bridge cash flow gaps faster than a bank loan, giving you the flexibility to focus on growing your business. We aim to be your preferred choice as a government purchase order financing company and a government factoring company.

From Hawaii to Florida, from Alaska to New York, we can fund your government accounts receivable and government contracts across the United States. We understand the culture of the federal government agencies and how to work with government receivables.

Recommended read: Factoring Company

Frequently Asked Questions

What are the disadvantages of invoice factoring?

Disadvantages of invoice factoring include higher costs and potential strain on customer relationships due to the involvement of a third-party factoring company

Sources

Featured Images: pexels.com