Silverfort's free cyber insurance coverage is a game-changer for businesses looking to boost their cybersecurity. By partnering with leading insurance providers, Silverfort offers comprehensive coverage to protect against cyber threats.

This coverage is available to businesses of all sizes, from small startups to large enterprises. Silverfort's unique technology integrates with existing security systems to provide real-time threat detection and prevention.

With Silverfort's free cyber insurance coverage, businesses can expect to receive compensation for losses resulting from cyber attacks. This can include costs associated with data breaches, ransomware attacks, and other types of cyber threats.

What Is Insurance?

Insurance is a contract where one party transfers some of their risks to another party in exchange for a monthly or quarterly fee. This is a crucial concept to understand when it comes to cyber insurance.

Cyber insurance emerged in the late 1990s due to the growing reliance on technology and the increase of cyber threats. Cybercrime has seen a 600% increase since the start of the COVID-19 pandemic, making cyber insurance a necessity for many businesses.

A typical insurance policy includes first-party coverage, which applies to losses that directly affect a company, and third-party coverage, which applies to losses suffered by others from a cyber event or incident. Cyber insurance policies can help you cover financial losses and costs associated with remediation.

Cyber insurance policies are sold by many providers that offer related business insurance, business liability, and commercial property insurance.

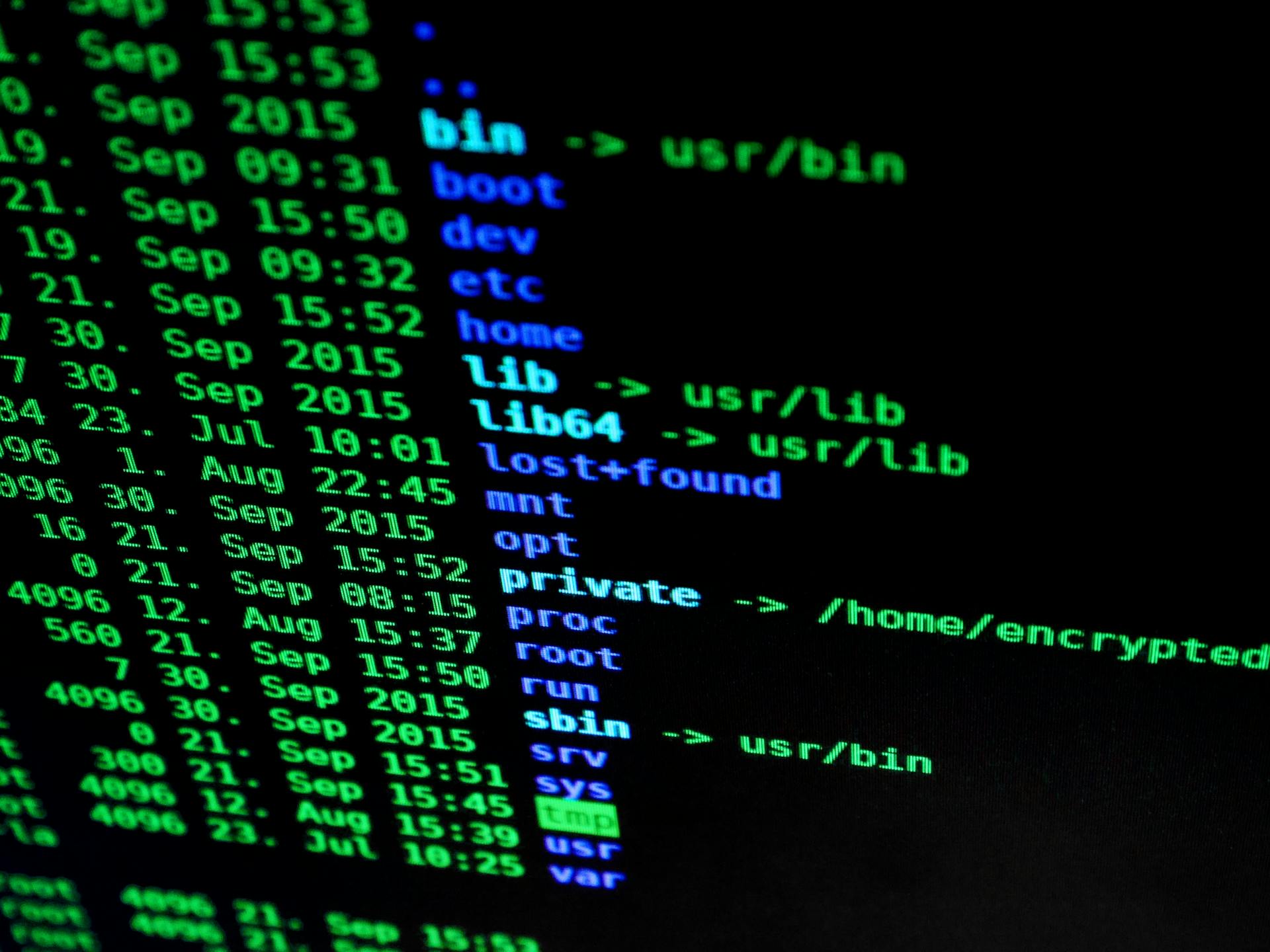

Identity Security Hygiene

Silverfort's assessment tool can identify security weaknesses in your environment that reduce its resilience to identity threats, exposing it to various attack methods.

Stale passwords in use, accounts with passwords that never expire, and admin users with SPN are just a few examples of these security weaknesses.

Admin users with SPN make them vulnerable to Kerberoasting attacks, a type of attack that exploits the use of Service Principal Names.

The use of weak protocols like NTLM and NTLMv1 is another security weakness that can be identified by Silverfort's assessment tool.

Resolving these previously undetected hygiene issues is a key step in reducing a threat actor's ability to attack your environment.

By addressing these security weaknesses, you can significantly improve your environment's resilience to identity threats and reduce the risk of a cyber attack.

Active Identity Threats

Silverfort's free identity security assessment can spot live identity threats active in your environment at the time of the assessment.

These threats can include common lateral movement techniques, such as Pass-the-Ticket and Pass-the-Hash, which enable ransomware actors to spread within a targeted environment.

Credential capture, like Kerberoasting, and brute force attempts are also detected by Silverfort's risk assessment.

Silverfort's Role

Silverfort's role is to protect user identities and credentials from all identity-based threats, including account takeovers and advanced persistent threats.

By utilizing artificial intelligence, Silverfort's platform can detect suspicious behavior patterns and adapt authentication policies to match assessed risk levels.

This means that Silverfort doesn't require software agents or network proxies, allowing organizations to implement its solutions quickly without impacting system performance.

Silverfort's approach is holistic, ensuring sensitive data and critical systems remain secure against the evolving landscape of cyber attacks.

The platform protects without disrupting legitimate user access, empowering organizations to safeguard their assets while maintaining seamless access for authorized users.

Benefits and Compliance

With Silverfort's free cyber insurance coverage, you'll enjoy several benefits that can help reduce your premiums and enhance your overall security posture.

Reducing premiums is a major advantage, as strong authentication and access controls can lower the likelihood of a breach, making your company a lower risk for insurers and potentially lowering premiums.

Silverfort's comprehensive access security features protect against unauthorized access, helping you meet insurer requirements. This is crucial for demonstrating compliance to both regulators and insurers.

Real-time monitoring capabilities enable faster detection and response to threats, reducing the potential damage from incidents covered under cyber insurance.

To summarize the benefits of Silverfort's free cyber insurance coverage, here are the key advantages:

- Reduced Premiums: Lower likelihood of breach, lower risk for insurers

- Comprehensive Access Security: Protects against unauthorized access, meets insurer requirements

- Enhanced Response to Cyber Incidents: Faster detection and response to threats

- Improved Compliance: Demonstrates regulatory standards to insurers

Access Management

Access management is a crucial aspect of a robust cybersecurity posture, and Silverfort has got it covered. By enabling centralized access management and real-time monitoring of access attempts, Silverfort detects unusual access attempts and responds to potential threats in real-time.

This level of visibility is essential for detecting anomalies and preventing unauthorized access before it escalates into a major incident. Real-time access monitoring is a valuable feature for demonstrating strong security to insurers.

Dynamic policy enforcement is another key feature of Silverfort, allowing for dynamic access policies that adjust based on the risk level. This adds an extra layer of security that insurers find appealing.

Here are some key benefits of Silverfort's access management features:

- Real-Time Access Monitoring: Detects unusual access attempts and responds to potential threats in real-time.

- Dynamic Policy Enforcement: Allows for dynamic access policies that adjust based on the risk level.

By implementing Silverfort's access management features, organizations can significantly reduce the risk of a costly breach or cyber incident, which can also lower insurance premiums.

Introduction

Silverfort is a free cyber insurance coverage that offers a unique approach to protecting businesses from cyber threats.

This innovative solution is designed to provide real-time threat detection and response, helping to prevent data breaches and financial losses.

Silverfort's AI-powered technology can detect and block suspicious activity in real-time, reducing the risk of a cyber attack.

By offering this free coverage, Silverfort is helping businesses to stay ahead of the curve when it comes to cyber security.

Businesses can benefit from Silverfort's free cyber insurance coverage by reducing their risk of financial loss due to cyber attacks.

Frequently Asked Questions

How do I claim cyber insurance?

To claim cyber insurance, you'll need to submit a completed claim form along with supporting documents such as an FIR copy, legal notices, and correspondence with financial institutions. Review our detailed claim process to ensure a smooth and efficient application.

What is covered under a cyber insurance policy?

A cyber insurance policy covers financial losses and costs related to a cyberattack or data breach, including investigation, crisis communication, legal services, and customer refunds. This coverage helps organizations recover from a cyber incident and minimize its impact.

Is cyber insurance worth it?

Having cyber insurance can protect your organization from significant financial losses, reputation damage, and costly fines. Consider investing in cyber insurance to safeguard your business against potential cyber threats

Sources

- https://www.silverfort.com/blog/need-an-insurance-policy-against-ransomware-attacks-get-silverforts-free-identity-security-assessment/

- https://ticktocktech.com/blog/2024/03/28/cyber-insurance-silverfort/

- https://www.linkedin.com/posts/taleisner_eligibility-assurance-and-peace-of-mind-activity-7198675555494309890-SO5e

- https://securityboulevard.com/2022/11/silverfort-your-one-stop-mfa-solution-for-cyber-insurance-compliance/

- https://medium.com/@aleksej.gudkov/cyber-insurance-coverage-and-silverfort-enhancing-cybersecurity-for-insurance-protection-3eb5ace3d33c

Featured Images: pexels.com