Ethereum options can seem overwhelming, but don't worry, we've got you covered.

Ethereum is the second-largest cryptocurrency by market capitalization, and its options market is growing rapidly.

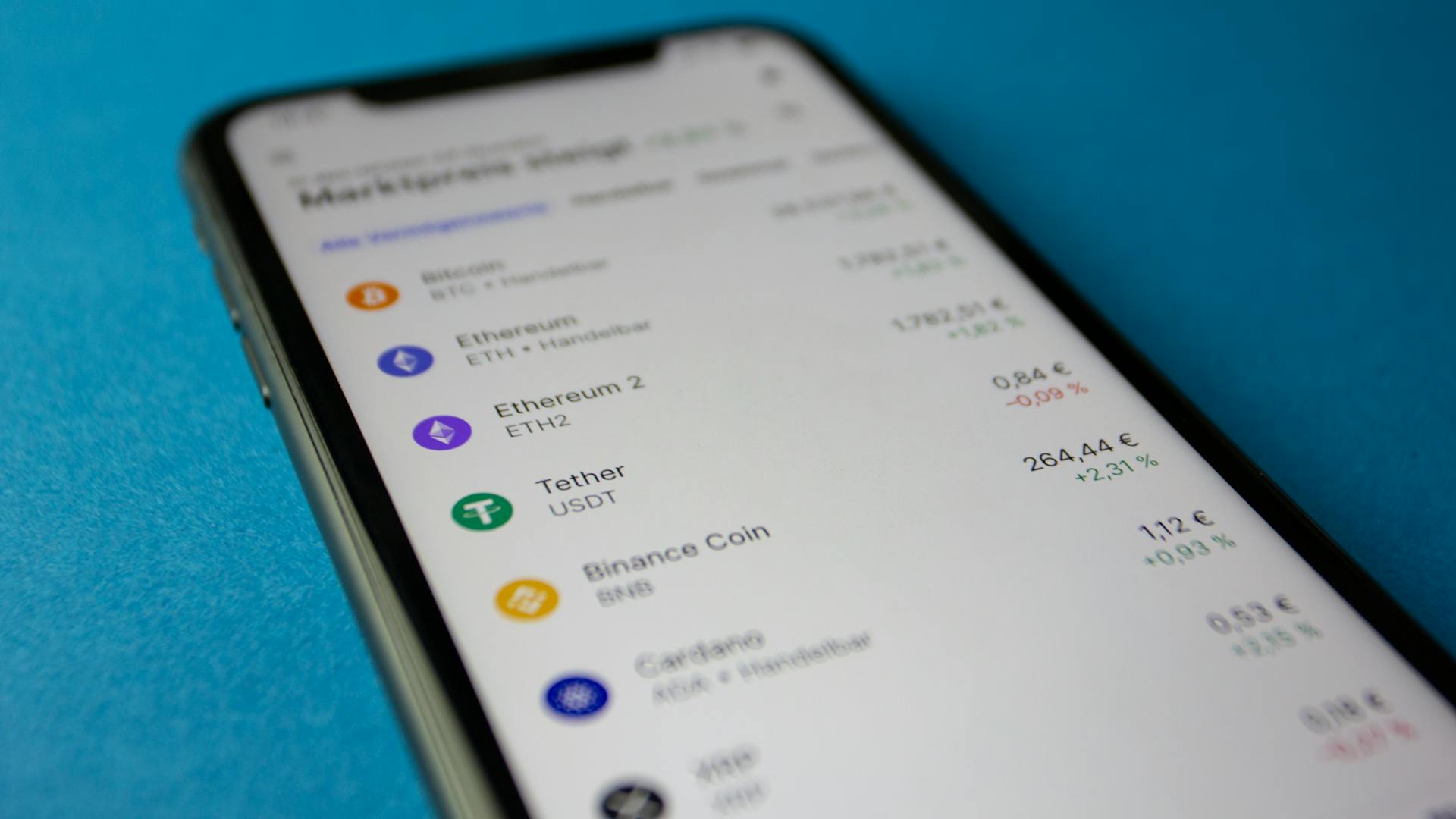

To start trading Ethereum options, you'll need to choose a reputable exchange, such as Binance or Kraken.

These exchanges offer a range of trading options, including call and put options, as well as various expiration dates.

Ethereum options are often used for hedging, speculation, and income generation.

The most common Ethereum options trading strategies include buying calls, buying puts, and selling spreads.

For another approach, see: Day Trading Ethereum

Getting Started

To get started with Ethereum options, it's essential to understand the basics. American options allow buyers to exercise their contracts at any given time before expiration, giving them more flexibility and a higher price.

There are three types of option settlements: American, European, and Bermuda. European options can only be exercised on the day of expiry, while Bermuda options have two dates – expiry and one day in between – on which the option can be exercised.

Here's an interesting read: Crypto Mining Earnings per Day

You'll need to familiarize yourself with the strike price, which is the price at which the option is exercised. If you hold a call with a strike price of $10,000, it gives you the right to buy Ethereum at $10,000 even if the price is higher upon expiration.

Options trading involves buying and selling "call options" and "put options." Buying a call option gives you the right to buy an asset at the designated strike price, while buying a put option gives you the right to sell an asset at the strike price.

Check this out: Crypto Asset Security

Mastering the Basics

Options trading can be a bit confusing at first, but understanding the basics is key to getting started.

There are three types of option settlements: American, European, and Bermuda. American options allow the buyer to exercise their contracts at any given time before expiration.

Since American options give buyers more flexibility, they tend to be priced higher than others.

You can buy options and expose yourself to capital appreciation, or sell options and earn a premium. Neither of these actions is without risk.

An option's strike price is the price/level at which the option is exercised. If you hold a call option with a strike price of $10,000, it gives you the right to buy the underlying asset at $10,000 even if the price is higher upon expiration.

Buying a call option gives you the right to buy an asset at the designated strike price. The premium call buyers pay goes to the person taking the other side of the trade, a call seller.

If you buy a call option, you're essentially hoping the price of the asset will go up. If it does, you can exercise the option and buy the asset at the strike price, then sell it at the higher market price for a profit.

A put option, on the other hand, gives you the right to sell an asset at the strike price. If you buy a put option, you're hoping the price of the asset will go down so you can sell it at the higher strike price for a profit.

Options trading is not black and white. Several factors contribute to pricing, and all must be considered before entering a trade.

Discover more: Sell Ethereum

When

When you're considering buying Bitcoin, it's essential to understand the market conditions. Implied volatility can be a good indicator of the market's potential.

Prices can fluctuate rapidly, and it's crucial to be aware of the range in which the price is moving. In December, prices ranged between $6.5k and $7.5k.

If you're bullish on the overall trend but don't want to take the risk of getting liquidated, buying options can be a good strategy. Buying options allows you to participate in the market without tying up a large amount of capital.

Low implied volatility can be a sign that prices are stable, but it's not a guarantee of future prices. In July, when implied volatility was high, it was a sign that prices might be topping out.

A buy signal from your technical analysis can be a good reason to buy a call option. This can help you avoid getting liquidated by market noise or flash crashes.

On a similar theme: What Are Bitcoins Good for

Understanding Options

Options contracts allow the buyer or seller to buy or sell an underlying asset at a stipulated price by a specified date, but they do not bind them to do so. This means that options trading is all about speculation on the future direction of the market.

Speculating on the future direction of the stock market, individual bonds, and stocks is what options trading is all about.

On a similar theme: Trading Ethereum

At the Money (ATM)

If the strike price equals the asset's market value, this option would have no potential gain or loss.

The strike price is the price at which you can purchase the asset, as mentioned in Example 3, and it's predetermined, set in advance.

In Example 2, a strike price of $7000 is used as a target price, but it doesn't have to be hit for the option to be profitable.

As mentioned in Example 5, if the strike price equals the asset's market value, the option would have no potential gain or loss, making it a neutral position.

The strike price is a crucial factor in determining the potential gain or loss of an option, as seen in the example where a call option's strike price is $12000 and the market price is $9600, resulting in a potential profit of $353.

A fresh viewpoint: Altcoins with Most Potential

Implied Volatility

Implied volatility is the expected future volatility of the price implied by options prices, and it's a crucial concept to understand when trading options.

In the equity market, rising stock prices lead to lower implied volatility, as optimism reduces the equity market's expectation of risk and hence price variation.

Implied volatility tends to rise when the market is not calm, which is the opposite of what happens in traditional markets.

Rising implied volatility can be a double-edged sword, as it can both increase the potential reward of a call option and increase the risk of a trade.

One place to check implied volatility is on skew, specifically on the Bitcoin options dashboard at skew.com/dashboard/bitcoin-options.

With options, your risk can be small, but your reward can be significant, especially if you're willing to take on a bit of risk.

See what others are reading: Bitcoin Block Reward

Types of ETH

There are several types of ETH options, including European, American, Bermudan, and Asian options.

European options, also known as vanilla options, can only be exercised on the expiration date.

American options, on the other hand, can be exercised at any time before the expiration date.

Bermudan options can only be exercised on specific dates, known as exercise dates.

Asian options have a unique feature called the "Asian barrier" which requires the underlying asset to reach a certain level before the option can be exercised.

Recommended read: Asian Option

Trading Options

Trading options allows you to speculate on the future direction of the cryptocurrency market without getting liquidated. You can buy or sell an underlying asset like Ethereum at a stipulated price by a specified date, but you're not bound to do so.

To trade Ethereum options, you can use platforms like DBOE, which supports trading on the Polygon Chain. You'll need to have Matic for transaction fees and USDt of the Polygon chain. To start trading, you'll need to choose a price range and authorize trading from MetaMask.

Intriguing read: When Will Ethereum Etf Start Trading

Here are the four main positions in options trading:

- Long Call: You believe the price will go up after the expiration session ends.

- Long Put: You believe the price will go down after the expiration session ends.

- Short Call: You sell a call option contract to other users, requiring you to pledge an amount of money equal to the price range you choose.

- Short Put: You sell a put option contract to other users, requiring you to pledge an amount of money equal to the price range you choose.

Professional Crypto Traders' Hub

Trading options on DBOE offers a fast and low-spread liquidity trading experience due to its high liquidity for all listed cryptocurrencies. This is particularly beneficial for professional crypto traders.

DBOE uses the Black – Scholes formula in the options pricing model to calculate the price of options. This formula is a widely used and reliable method for pricing options.

To trade Ethereum options on DBOE, you need to have Matic for transaction fees and USDt of the Polygon chain. This is a straightforward process that can be completed in three simple steps.

DBOE's options pricing model allows you to calculate profit and loss using a simple formula: (Last Price – Entry Price)*Amount – Gas Fee = Profit. This formula provides a clear and concise way to determine your profit or loss.

DBOE offers a range of features designed specifically for professional crypto traders, including option calculators and constant maturity basis. These tools can help you optimize your investment strategies and identify mis-pricings in the market.

Here are some key features of DBOE's options trading platform:

Calls

Calls are a type of options trading that allows you to bet on the market going up. With a call option, you have the right to buy an asset at a fixed price.

Buying a call option is like buying a "green buy button" in margin or futures trading, where you're betting that the price will rise. This is a key difference between calls and long positions, which is the type of trading you'd do in futures or margin.

There are four main positions in options trading, and one of them is the long call. A long call is when you believe the price will go up after the expiration session ends. You're essentially buying the right to buy an asset at a fixed price, hoping it will rise above that price before expiration.

Here's a simple breakdown of the four main positions in options trading:

In options trading, you speculate on the future direction of the stock market, including individual bonds and stocks. Options contracts allow the buyer or seller to buy or sell an underlying asset at a stipulated price by a specified date, but they do not bind them to do so.

Sources

- https://dboe.io/how-to-buy-sell-ethereum-options-eth-on-dboe-exchange/

- https://romanornr.medium.com/bitcoin-and-ethereum-options-trading-at-deribit-and-ftx-f23a12e06986

- https://cryptobriefing.com/trade-like-chad-guide-ethereum-options-trading/

- https://business-review.eu/money/what-are-ethereum-options-complete-guide-on-eth-options-235492

- https://www.amberdata.io/ad-derivatives

Featured Images: pexels.com