Ekso Bionics is a company that's been making waves in the medical technology space with their innovative exoskeletons. Their stock symbol is EKSO.

The company's financial news and data can be found on various platforms, including their official website and reputable financial websites like Yahoo Finance.

Ekso Bionics has been publicly traded since 2014, listing on the NASDAQ stock exchange.

Explore further: Paramount Class B Stock

Ekso Bionics Financials

Ekso Bionics went public in 2014 with an initial public offering (IPO) that raised $20 million.

The company has since struggled to turn a profit, with a net loss of $23.8 million in 2018.

In 2019, Ekso Bionics reported a net loss of $16.4 million.

As of 2020, the company's market capitalization was around $120 million.

Ekso Bionics has received significant funding from investors, including a $10 million investment from the US Department of Defense in 2015.

The company's revenue has been growing steadily, from $1.5 million in 2015 to $10.3 million in 2020.

Ekso Bionics has also received funding from other sources, including a $5 million grant from the National Institutes of Health in 2017.

A unique perspective: Public Storage Stock Symbol

Analyst Insights

Ekso Bionics has received consistent analyst support, with H.C. Wainwright & Co. maintaining a Buy rating since at least April 30, 24.

H.C. Wainwright & Co. has been a long-time supporter of Ekso Bionics, maintaining their Buy rating since at least April 30, 24.

The analyst's price target has varied over time, with the highest price target mentioned being $10, as seen on July 30, 24, and January 22, 24.

On the other hand, Lake Street maintained a Buy rating on June 24, 24, with a price target of $2.5.

H.C. Wainwright & Co. has consistently maintained their Buy rating since at least March 5, 24.

Here is a list of the analyst's ratings and price targets:

Ekso Bionics Data

Ekso Bionics Holdings is expected to see a significant increase in revenue over the next few years, with estimates ranging from $24 million in 2025 to $49 million in 2028.

The company's net profit is also expected to turn positive, with estimates showing a net profit of $12 million in 2028.

A different take: Stock Symbol B

Ekso Bionics Holdings has a relatively low number of analysts following the company, with only 2 analysts providing estimates for the next year.

The average earnings estimate for the next year is -$0.095 USD, with a range of -$0.223 USD to -$0.133 USD for the previous year.

Here's a breakdown of the estimated revenue for Ekso Bionics Holdings:

The company's research and development expenses have been relatively stable, ranging from $3 million to $3 million over the next few years.

Ekso Bionics Holdings is expected to generate significant cash flow from operations, but this information is not provided in the estimates.

Ekso Bionics Calendar

Ekso Bionics Calendar is a significant aspect of the company's operations. The company was founded in 2005.

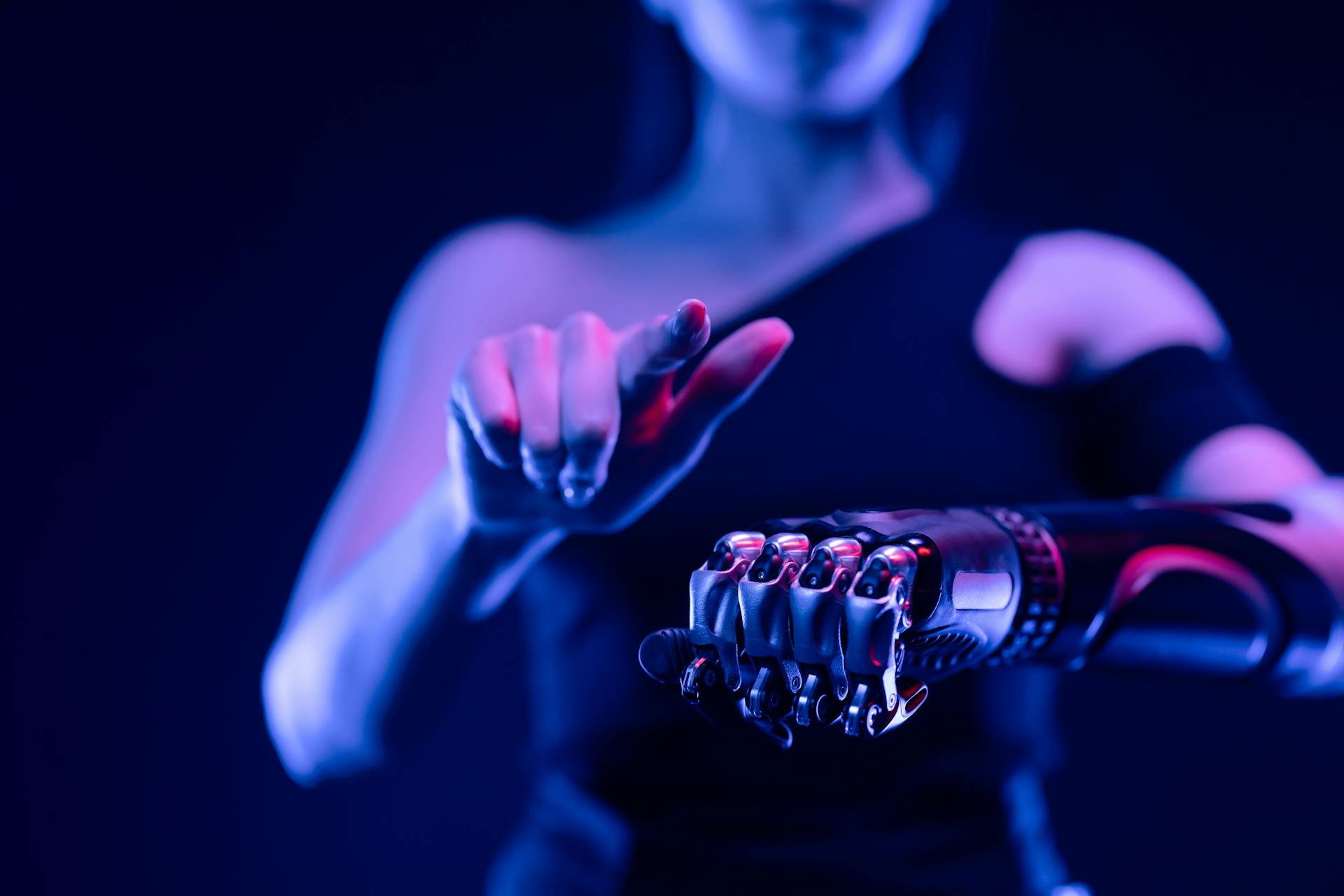

Ekso Bionics has a rich history, with its first product being the Ekso Bionic Exoskeleton, a wearable device that enables individuals with spinal cord injuries or paralysis to stand and walk.

The Ekso Bionics calendar is marked by several key events, including the company's initial public offering in 2014, where it raised $20 million in funding.

Ekso Bionics has made significant strides in developing exoskeleton technology, with a focus on rehabilitation and mobility. The company's products have been used in various settings, including hospitals and rehabilitation centers.

Frequently Asked Questions

What is the stock price forecast for Ekso in 2025?

Ekso Bionics Holdings is forecasted to reach $5.50 by Oct 29, 2025, with a potential upside of 801.64% from its current share price of $0.61. This significant growth potential makes Ekso Bionics Holdings a stock worth considering for investors looking for high returns.

Featured Images: pexels.com