Life insurance coverage for suicidal death can be a complex and sensitive topic. Some policies may exclude or limit coverage for suicidal deaths, while others may not.

Most life insurance policies require the policyholder to be mentally sound and not have any intention to harm themselves. This is often stated in the policy's fine print.

The policy's exclusion clause may be triggered if the policyholder dies by suicide within a certain timeframe, usually two years. This timeframe varies by policy and provider.

If a policyholder dies by suicide, the insurance company may investigate to determine if the death was intentional or accidental.

For another approach, see: Does Life Insurance Cover Suicidal Death Uk

Life Insurance Coverage

Life insurance coverage for suicidal death is more complex than you might think. Most life insurance policies cover a wide range of causes of death, including suicide, but there's an important exception.

If the policyholder dies by suicide within the first two years of the policy, the insurer may deny the claim, even if they're required to cover it by law. This period is known as the contestability period, and insurers can investigate the death claim thoroughly during this time.

The deciding factor in group life insurance policies is often the suicide clause, specific exclusions, and applicable laws and regulations.

Is an Overdose an Accidental Death?

An overdose can be considered an accidental death if the insurance company determines it happened suddenly and unexpectedly. Insurance companies investigate the circumstances of the policyholder's death to make this determination.

In some cases, an overdose may be classified as accidental if it was due to the accidental ingestion of substances or medications. This is often determined through a toxicology report.

To be considered accidental, the death typically must have resulted from events like car accidents, slips and falls, drowning, or other unexpected events.

You might enjoy: Does Term Insurance Cover Accidental Death

Living with a Mental Health Illness

You'll need to do your research before committing to an insurance company, as each one has its own list of uninsurable events that may include certain mental health illnesses.

Being transparent about your mental health issues, including anxiety and depression, is crucial when applying for life insurance. If you're not honest, it could result in cancellation of your policy or denial of benefits to your beneficiary(s).

A different take: Does Life Insurance Cover Mental Health

Cover

Most life insurance policies cover a wide range of causes of death, including suicide. However, there's an important exception.

If you take your own life within the first two years of having a policy, your insurer might not pay out. This period is known as the contestability period.

Insurers will investigate the death claim thoroughly during this time and can deny it if they discover information that wasn't reported. This could include underlying mental health conditions, addiction, substance abuse, or other dangerous behaviors.

Group life insurance policies also have a suicide clause, which determines whether they'll pay out for a suicidal death. The specific exclusions and applicable laws and regulations will also play a role in this decision.

Suicidal Death and Insurance

Life insurance policies typically include a suicide clause that's active for a certain period after the policy goes into effect. This period can last from one to three years, but it's usually two years.

If the insured dies by suicide within this time, the insurer may deny or limit the death benefit, depending on the policy terms. The insurer could also deem the death a result of suicide and investigate the policyholder's death.

Some states like California and Washington allow doctor-assisted suicide, but most traditional life insurance policies don't explicitly exclude coverage for it. However, if the policyholder chooses voluntary euthanasia, the insurer may still investigate the death to ensure it complies with the policy terms.

The deciding factor for group life insurance is the suicide clause, specific exclusions, and applicable laws and regulations. Group life insurance policies have a suicide clause, which can affect whether the insurer pays out for a suicidal death.

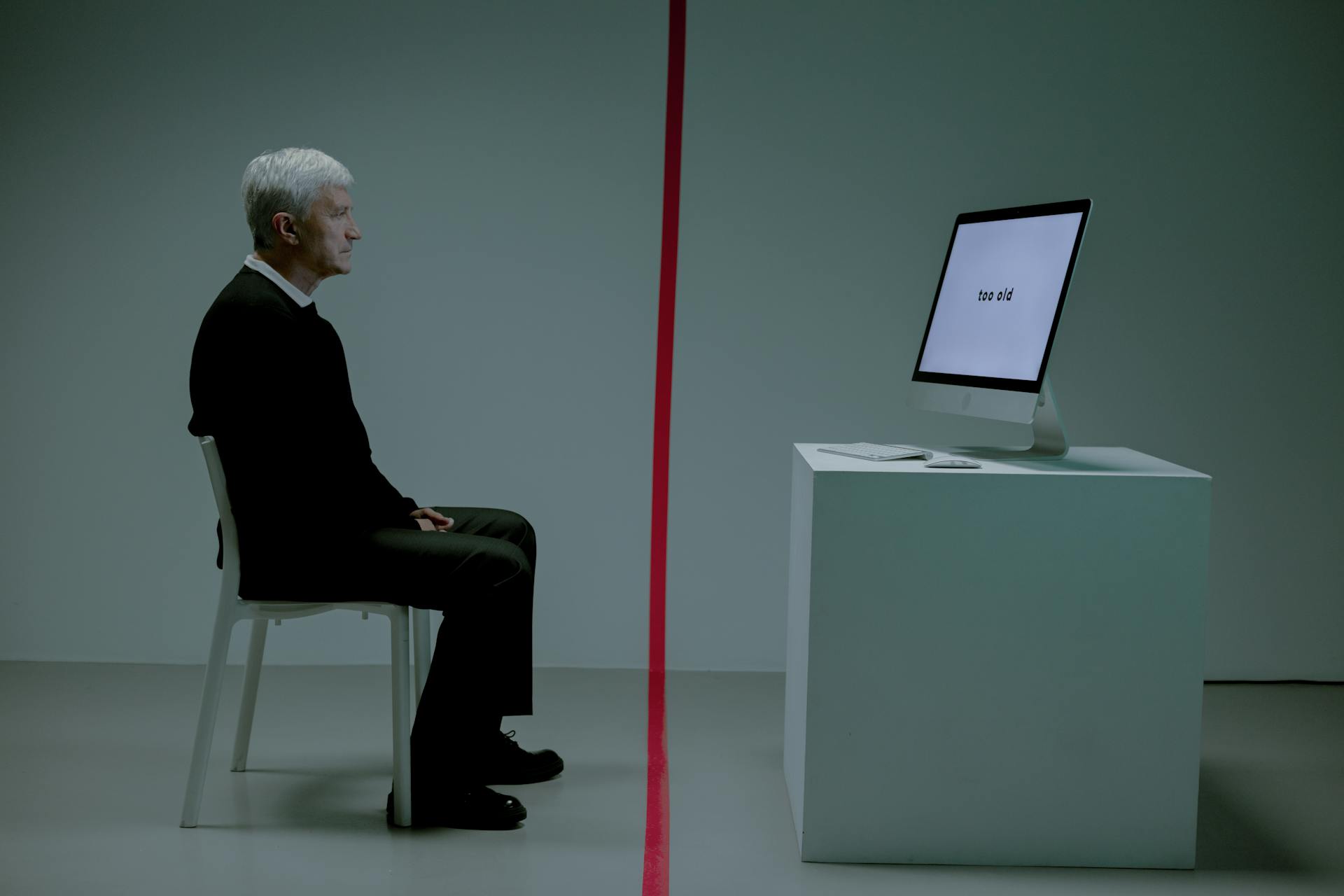

Insurance companies want to prevent people from having a financial incentive to take their own lives, so many policies have a suicide clause. This clause typically won't pay a death benefit if the insured party dies by suicide within the first two years of coverage.

For another approach, see: Settlement Options Life Insurance More than Death Benefit

Death with Dignity

Most traditional life insurance policies do not explicitly exclude coverage for doctor-assisted suicide. However, if the insured chooses voluntary euthanasia, the insurer may still investigate the policyholder's death to make sure it complies with the policy terms.

The insurer could deem the death a result of suicide, and coverage may be denied or limited depending on the suicide clause of the specific policy. This is because insurance companies want to prevent people from having a financial incentive to take their own lives.

Some states like California or Washington allow doctor-assisted suicide, but this doesn't necessarily mean that life insurance policies will cover it. It's essential to review your policy terms to understand the specific exclusion or provision related to voluntary euthanasia.

In cases where the policyholder dies from voluntary euthanasia, the insurer may investigate the circumstances surrounding the death to determine if it meets the policy's terms. This can be a complex process, and it's crucial to seek professional advice if you're unsure about your policy's coverage.

Here's a summary of how some states' laws on doctor-assisted suicide may impact life insurance policies:

Please note that this is not an exhaustive list, and laws may change over time. It's essential to consult with a licensed insurance professional or attorney to understand the specifics of your policy and the laws in your state.

Depression Support

If you're struggling with depression, know that you're not alone. Many people have successfully managed their mental health and gotten life insurance.

You can likely get life insurance if you have a history of depression or anxiety. Any health issues can affect your rate, but well-managed conditions may have less of an impact. For most life insurance policies, you'll need to provide your medical history and undergo a life insurance medical exam.

There are also no-medical-exam policies, including simplified issue life insurance and instant life insurance, which may be a more accessible option. However, these policies often come with higher premiums.

A different take: Does Life Insurance Cover Medical Bills

Policy Details

Most life insurance policies cover a wide range of causes of death, including suicide, but there's an important exception.

During the contestability period, which typically lasts for two years, insurers have the right to thoroughly investigate the death claim and may deny it if they discover information that should have been reported.

If you purchase a life insurance policy after January 1, 2014, there's a change in the suicide clause. For a market-linked life insurance plan, your nominees will receive the policy's total value if you commit suicide within one year from the issue of the plan.

Policy Benefits After Death

Life insurance policies can provide coverage in the case of suicide, but many contain special provisions, called suicide clauses, that limit the payment of benefits.

The exclusion period for suicide is typically two years, during which the insurer may deny or limit the death benefit if the policyholder dies by suicide.

If the insured dies by suicide within the first two years of the policy, the death benefit is likely to be denied or limited to a return of premiums paid.

The exclusion period can be reset if changes are made to the policy, such as adding coverage or converting a term policy into a whole life policy.

In some cases, the insurer may not pay the beneficiary if the policyholder dies during the contestability period, which can last from one to three years depending on the insurer.

Here are the typical exclusions in life insurance policies:

- Suicide clause: If the insured dies by suicide within the first two years of the policy, the death benefit is likely to be denied or limited to a return of premiums paid.

- Acts of war: Insurers generally don’t pay out the death benefit if the policyholder dies from war-related acts.

- Other exclusions: Other examples of possible exclusions are high-risk activities, illegal acts, pre-existing medical conditions, and natural events.

In the case of policies issued after January 1, 2014, the suicide clause is different. For a market-linked life insurance suicide clause, if the insured commits suicide within one year from the issue of the plan, the nominees will receive the policy’s total value. For traditional Life Insurance Plans, nominees will receive 80% of the premium paid for death due to suicide within one year from the start of the policy.

If the suicide exclusion period has ended and no terms in the policy have been violated, life insurance can cover suicide and pay out the death benefit.

How It Works?

Life insurance can aid in debt settlement, estate planning, education expenses, and funeral arrangements after a loved one's passing.

A life insurance coverage can provide financial assistance to families who lose the breadwinner.

For families who receive a life insurance payout, it can help cover expenses such as funeral arrangements, which can be a significant financial burden.

However, challenges may arise in the form of unpaid premiums, policy exclusions, or bad-faith insurance dealings that prevent beneficiaries from receiving the proceeds of the life insurance policy.

In such cases, an experienced life insurance dispute lawyer can be a strong advocate in fighting for your rights.

Consider reading: Does Term Life Insurance Cover Funeral Costs

Plans Issued Before 2014

If you have a life insurance policy that was issued before January 1, 2014, it's essential to know the rules surrounding suicide claims.

The policy will become void and no claim will be accepted if the insured commits suicide within 12 months from the start of the policy or the date of revival.

This means that if the insured takes their own life before the policy completes one year, the family will not receive any benefits.

If the insured does survive the first year, however, the family will receive a death benefit if they pass away due to any other reason.

On a similar theme: Who Is the Insured on a Life Insurance Policy

Frequently Asked Questions

What type of death is not covered in term insurance?

Term insurance does not cover death due to pre-existing health conditions not disclosed at policy purchase, self-inflicted injuries, or sexually transmitted diseases like AIDS/HIV

Sources

- https://www.wallaceinsurancelaw.com/does-life-insurance-pay-for-suicidal-death/

- https://www.progressive.com/answers/does-life-insurance-cover-suicide/

- https://www.investopedia.com/does-life-insurance-cover-suicide-5105027

- https://www.kotaklife.com/insurance-guide/about-life-insurance/does-life-insurance-pay-for-suicidal-death

- https://disabilitydenials.com/blog/life-insurance-denial-for-suicide-exclusion/

Featured Images: pexels.com