Insurance coverage for stem cell therapy varies widely depending on the type of treatment and the patient's condition. Some insurance plans may cover certain types of stem cell therapy, such as bone marrow transplants for leukemia.

The cost of stem cell therapy can be prohibitively expensive, with prices ranging from $20,000 to over $100,000 per treatment. In some cases, patients may need to undergo multiple treatments, which can add up quickly.

Insurance companies often require pre-authorization for stem cell therapy, and the approval process can be lengthy and complex. This can cause significant delays for patients who need treatment urgently.

You might like: Does Homeowners Insurance Cover Cell Phones

Understanding Insurance Coverage

Insurance companies may not cover certain types of stem cell therapy that are considered experimental or unproven, as they may not have sufficient evidence to support their effectiveness and safety.

Currently, most stem cell procedures approved by the FDA and likely to be covered by insurance are hematopoietic stem cell transplants, which promote the development of healthy blood cells in people with conditions such as leukemia and sickle cell diseases.

Expand your knowledge: What Does Homeowners Insurance Cover and Not Cover

Many stem cell procedures from fat and other tissues are considered surgeries, and the FDA does not regulate these procedures, making them unlikely to be "FDA approved".

Most insurance coverage is based on a deductible and will generally only cover part of the procedure costs after meeting the deductible.

It's essential to discuss and understand which associated costs are covered by your plan, such as consultations, facilities, or equipment.

What Is Covered?

Insurance companies' coverage of stem cell therapy costs can vary depending on several factors, such as the type of stem cell therapy and your insurance coverage.

Some types of insurance may cover specific stem cell therapies deemed medically necessary, such as bone marrow transplants.

Stem cell therapy from fat and other tissues is considered a surgery, and as such, the FDA does not have responsibility for approving these procedures.

Currently, most stem cell procedures approved by the FDA and likely to be covered by insurance are hematopoietic stem cell transplants, which promote the development of healthy blood cells in people with conditions such as leukemia and sickle cell diseases.

Insurance coverage for stem cell therapy is often based on a deductible, and will generally only cover part of the procedure costs after meeting the deductible.

Most insurance plans will cover associated costs, such as consultations, facilities, or equipment, but it's essential to discuss and understand which costs are covered.

Insurance companies may not cover certain types of stem cell therapy that are considered experimental or unproven, as they may not have sufficient evidence to support their effectiveness and safety.

Stem cell therapy from fat is considered safe, but the best way to process and deliver the cells has not been established, making decisions for insurance coverage difficult.

Insurance companies are working on standardizing stem cell offerings, which will help clarify what is covered and what is not.

Explore further: What Will Gap Insurance Not Cover

What Are?

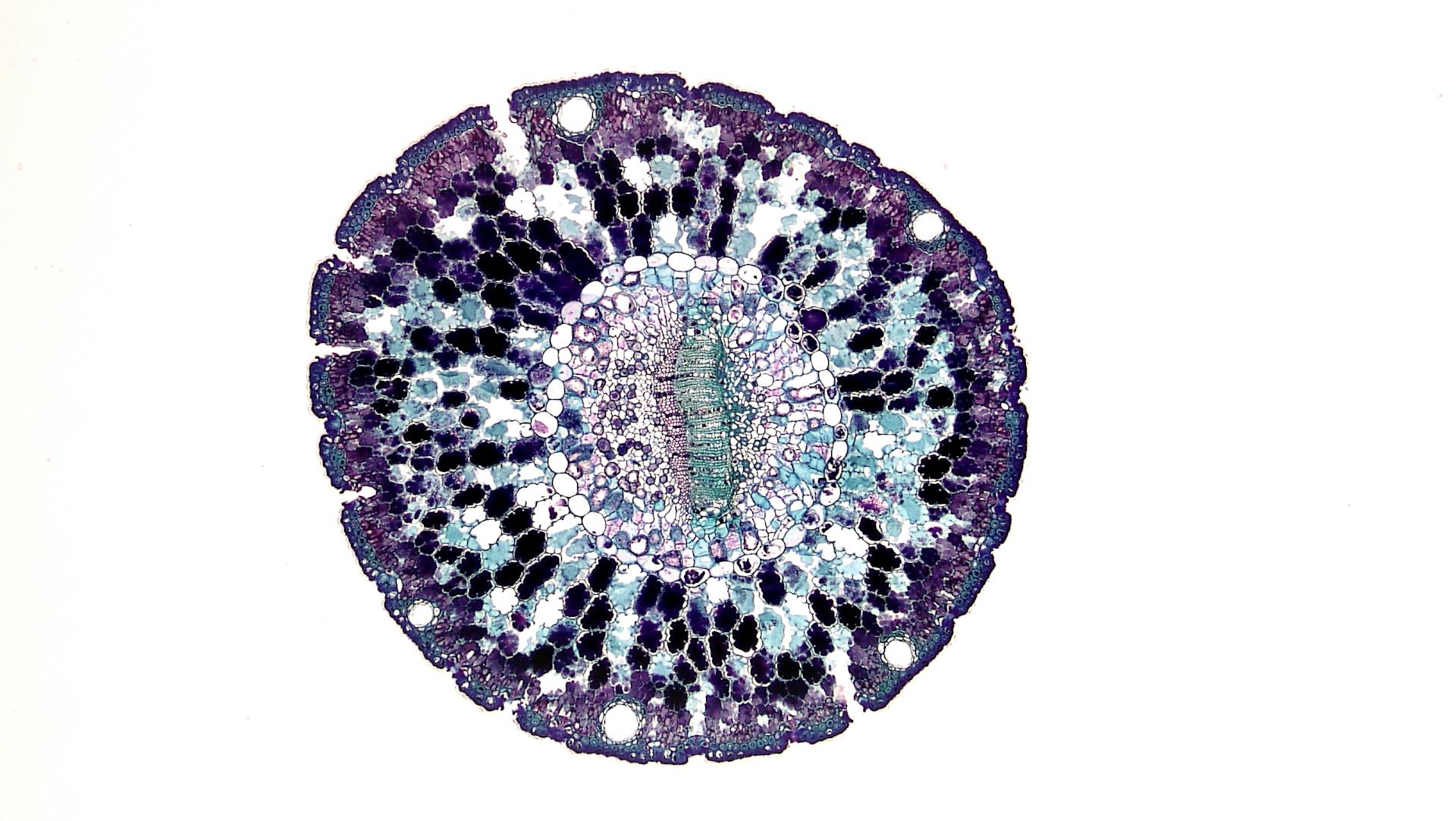

Stem cells are the solitary cells in the body able to convert into other kinds of specialized cells.

Stem cells have the potential to develop into several diverse cell varieties in the body during initial life and growth. They serve as the body's internal repair system, dividing without limitation to replenish other cells.

Cost and Payment

Most patients who pursue stem cell therapy find that financing options greatly relieve the financial burden of paying out of pocket, with costs ranging from $1,500 to $7,000 depending on the extent of their condition and the number of physical sites requiring treatment.

Providers generally base their pricing on several factors, including the length of time the patient has had their condition.

Some patients may need to space out their procedures to lower the initial financial burden, but this is ultimately an individual choice.

It's essential to check with your insurance company to determine whether they cover stem cell therapy for your specific medical condition, including the type of therapy you're considering.

Insurance companies' coverage of stem cell therapy costs can vary depending on several factors, such as the type of therapy and your insurance coverage.

Some plans may pay for specific portions of the treatment, such as IV placement and joint or ligament injections.

Here's a breakdown of the factors that affect the cost of stem cell therapy:

- The extent of the patient’s condition.

- The number of physical sites for which the patient needs treatment.

- The length of time the patient has had his or her condition.

More insurance carriers, including Medicare, will begin to cover procedures as stem cell therapy becomes standardized and results are proven in clinical trials.

Stem Cell Therapy Procedures

Stem cell therapy procedures can be complex and costly, which is why understanding insurance coverage is crucial. Maximum stem cell processes are not covered by health insurance plans.

Most health insurance plans won't cover procedures that aren't sanctioned by the Food and Drug Administration. If a process is not FDA-approved, it's unlikely to be covered.

Recognized bone marrow transplants/hematopoietic stem cell therapies, like those for leukemia, might be covered by insurance. These therapies are considered standard treatments.

In the future, more FDA-compliant stem cell therapies that are proven safe and effective through clinical trials may become available. These therapies are likely to be covered by insurers, reducing the financial burden on patients and their families.

Additional reading: Does Kaiser Health Insurance Cover Therapy

Insurance Provider Interaction

Insurance Provider Interaction is a crucial step when considering stem cell therapy. Most stem cell procedures approved by the FDA, such as hematopoietic stem cell transplants, are likely to be covered by insurance.

Contact your insurance provider to inquire about coverage for the specific form of stem cell therapy you're interested in. Currently, most insurance coverage is based on a deductible and will only cover part of the procedure costs after meeting the deductible.

It's essential to discuss and understand which associated costs are covered by your plan, such as consultations, facilities, or equipment. This will help you prepare for any out-of-pocket expenses.

Stem cell procedures from fat and other tissues are considered surgeries, and the FDA does not have responsibility for approving surgical procedures. This means that procedures like fat stem cell therapy may never be "FDA approved".

Worth a look: Will Insurance Cover Laser Hair Removal for Hidradenitis

Frequently Asked Questions

Why isn t regenerative medicine covered by insurance?

Insurance companies may not cover regenerative medicine if it's considered experimental or unproven, lacking sufficient evidence of effectiveness and safety. This can limit access to potentially life-changing treatments, making it essential to explore alternative funding options.

Sources

- https://www.bostonbiologic.com/does-insurance-pay-for-stem-cell-treatments/

- https://regenesisstemcell.com/faq/will-insurance-cover-stem-cell-therapy

- https://innovationsstemcellcenter.com/stem-cell/is-stem-cell-therapy-covered-by-insurance/

- https://www.stemcellcareindia.com/does-insurance-cover-stem-cell-procedures/

- https://giostarmexico.com/blog/is-stem-cell-therapy-covered-by-insurance

Featured Images: pexels.com