Most health insurance plans cover anesthesia for surgeries and procedures, but the specifics can vary depending on the type of procedure and the insurance provider.

In general, major medical insurance plans are required to cover anesthesia services, including general anesthesia, regional anesthesia, and conscious sedation.

However, some insurance plans may have limitations or exclusions for certain procedures, such as cosmetic surgeries or experimental treatments.

For example, a 2019 study found that 70% of major medical insurance plans covered general anesthesia for surgical procedures.

Broaden your view: Comprehensive General Liability Coverage

Insurance Coverage

Medicare covers anesthesia services for inpatient hospital care, paying for both hospital stay and anesthesia costs. Medicare Part A covers inpatient hospital care, while Part B covers outpatient hospital care and doctor services.

Medicare spent about $2 billion on anesthesia services for Medicare beneficiaries in 2018. This highlights the importance of understanding insurance coverage for anesthesia services.

Original Medicare covers most anesthesia costs associated with Medicare-covered medical or surgical services. However, Medicare Advantage plans may require using an in-network anesthesiologist to avoid additional costs.

On a similar theme: Life Insurance That Covers an Insured's Whole Life

What Anesthesiologist Insurance Covers

Anesthesiologist insurance is a must-have for medical professionals in this field. Your policy is personalized to your needs and requirements.

Commercial General Liability Insurance, also known as CGL insurance, covers you for injuries, bodily harm, and property damages to third parties during business operations. This includes lawsuits, losses, and medical expenses.

Protecting your equipment and tools is crucial to your business's success, and Commercial Property Insurance does just that. It covers damage or loss due to fires, vandalism, floods, or other insured perils.

Professional liability insurance, also known as medical malpractice insurance or errors & omissions insurance, covers claims of negligence, misconduct, errors, and more that result in an injury or death while under your care. This type of insurance is essential for anesthesiologists.

Medicare covers most anesthesia services associated with a Medicare-covered medical or surgical service. In 2018, Medicare spent about $2 billion on anesthesia services for Medicare beneficiaries.

See what others are reading: What Does Liquor Liability Insurance Cover

Coverage Dispute

If you're facing a coverage dispute with your insurance company, it's essential to know your rights. Federal law now offers some protection against surprise bills from out-of-network ancillary providers.

Explore further: Does Insurance Cover Plan B

Patients who receive denied claims for anesthesia-related procedures should proactively file complaints or seek assistance from insurance advocates. This can help resolve the issue and prevent further financial burdens.

Insurers often deny anesthesia claims due to categorization as "not medically necessary", especially for routine procedures like MRIs and CT scans. This can lead to unexpected costs for patients.

Patients should always verify their insurance coverage prior to treatment, especially if they anticipate the need for anesthesia. This can help prevent unexpected financial burdens.

Original Medicare provides coverage for procedures deemed "medically necessary", like surgeries necessitating anesthesia.

Broaden your view: Insurance Cover or Coverage

Types of Anesthesia

Anesthesia is a crucial part of many medical procedures, and understanding the different types can help you navigate the process. There are four main categories of anesthesia: General, regional, sedation (sometimes called “monitored anesthesia care”), and local anesthesia.

General anesthesia is the most intense type, rendering you completely unconscious during the procedure. You may be familiar with this type if you've had surgery under general anesthesia.

Regional anesthesia numbs a specific area of your body, allowing you to remain awake but free from pain in that area. This type is often used for procedures like cesarean sections.

Sedation, also known as monitored anesthesia care, is a lighter form of anesthesia that helps you relax during a procedure. This type is often used for minor procedures like colonoscopies.

Local anesthesia numbs a small area of your body, allowing you to remain awake and alert during the procedure. This type is often used for minor procedures like dental work.

You might like: Does Insurance Cover Nitrous Oxide

General Information

General anesthesia is typically what people think of when they hear "anesthesia". This type of anesthesia requires complete unconsciousness and the assistance of a machine for breathing.

General anesthesia is usually administered via gases or vapors given through a breathing tube or mask, or via medications given through an IV.

General

General anesthesia requires complete unconsciousness and the assistance of a machine for breathing, and you have no awareness or sensations.

It's usually administered via gases or vapors given through a breathing tube or mask, or via medications given through an IV.

People often think of general anesthesia when they hear the term "anesthesia".

Why Are Anesthesiologists Important?

Anesthesiologists are crucial members of the healthcare team. They play a direct role in ensuring optimal patient safety and recovery, which makes their jobs risky.

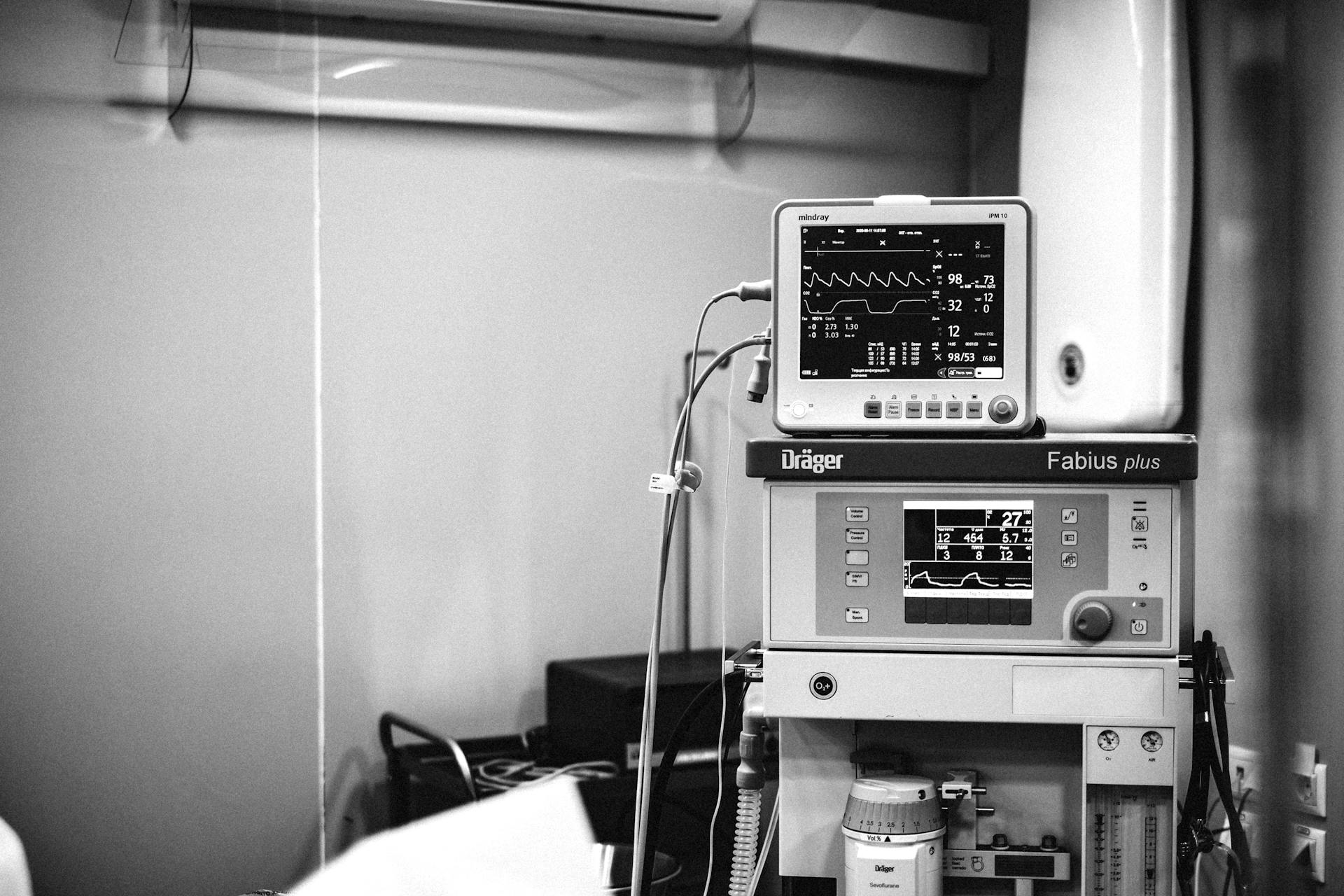

Their responsibilities include evaluating, monitoring, and supervising patient care before, during, and after treatment. This involves handling sensitive equipment and administering medication, which can have severe impacts if errors occur.

Anesthesiologists are trained to handle a wide range of patient scenarios, including those with allergies or pre-existing conditions. They take into account these factors when administering anesthesia to minimize the risk of adverse reactions.

Here are some potential risks that can arise during anesthesia administration:

- A patient can have allergies or pre-existing conditions that cause an adverse reaction to the anesthesia.

- A side effect of anesthesia, like dizziness, can cause the patient to injure themselves.

- The equipment that anesthesiologists operate can cause property damage or injuries.

These risks highlight the importance of having a customized insurance policy to protect anesthesiologists and clinics from liability.

Regional and Surgery-Specific

Regional anesthesia is a type of anesthesia that numbs a specific area of the body, preventing pain during surgery. It's commonly used for childbirth and total knee and total hip replacements.

The two most common types of regional anesthesia are spinal and epidural anesthesia. Nerve blocks are another type of regional anesthesia that can provide pain relief and numbing to smaller areas, such as an arm or leg.

You don't have to be completely awake for regional anesthesia, and most patients prefer to get some sedation so they can relax during the procedure.

Regional

Regional anesthesia is a type of anesthesia that numbs a larger area of the body, making it a popular choice for procedures like total knee and total hip replacements. It's administered via an injection near the cluster of nerves that provides sensation to that area.

Regional anesthesia can completely block sensations to the area of the body that requires surgery, and it's often used in conjunction with sedation to help patients relax during the procedure. Most patients prefer to get some sedation so they can relax during the procedure.

Spinal and epidural anesthesia are two of the most common types of regional anesthesia, often used for childbirth. Nerve blocks are another type of regional anesthesia that can provide pain relief and numbing to smaller areas, such as an arm or leg.

Regional anesthesia can be administered in a hospital or office setting, and the cost can vary depending on the type and setting of administration. For uninsured patients, regional anesthesia in an office can be a more affordable option, ranging from $500 to over $3,500.

Non-Elective Surgery

Non-elective surgeries, also known as medically necessary procedures, are covered by insurance to a certain extent.

Even when insurance covers a non-elective surgical procedure, costs may still be incurred.

According to Dr. Lisa Cassileth, a board-certified plastic surgeon in Los Angeles, having one issue covered doesn't guarantee full payment of the surgeon's fees by the insurance company.

Misunderstandings arise from the difference between "elective" surgeries—procedures you can choose to have or not—and those that are "medically necessary."

Insurance generally covers anesthesia for emergency surgeries, independent of network status, though coordination post-emergency is necessary.

Medically required procedures usually receive anesthesia coverage, including those under Original Medicare, which pays for services during inpatient and outpatient surgeries.

Costs for anesthesia without insurance can range between $200 and $3,500, influenced by the type of anesthesia and whether the anesthesiologist is in-network.

To understand your specific benefits, it is essential to contact your insurance provider, as each health plan has unique terms.

Discover more: Why Is Anucort-hc Not Covered by Insurance?

Reviewing your Summary of Benefits and Coverage (SBC) is crucial to understanding your coverage for non-elective surgeries.

Most health insurance plans will cover a significant portion of costs for surgeries essential for saving lives or improving health.

However, elective cosmetic surgeries, like facelifts or liposuction, usually don't qualify for insurance coverage.

A different take: What Does My Health Insurance Cover

Sources

- https://clearmatchmedicare.com/blog/medicare/does-medicare-cover-anesthesia

- https://www.alignedinsurance.com/anesthesiologist-insurance/

- https://carepointanesthesia.com/insurance/

- https://www.retireguide.com/medicare/treatments/surgery/anesthesia/

- https://snhhealthcare.com/does-anesthesia-for-plastic-surgery-get-covered-by-insurance.html

Featured Images: pexels.com