The deferred revenue waterfall process can be a bit overwhelming, but it's actually quite straightforward once you understand the basics. Deferred revenue is essentially money that's been paid in advance for a product or service that hasn't been delivered yet.

The process starts with recognizing revenue, which is typically done when a customer pays for a product or service. However, in the case of deferred revenue, the revenue is recognized over a period of time, not all at once.

As we'll see, the deferred revenue waterfall process involves several steps, including revenue recognition, deferred revenue, and amortization. It's a bit like a waterfall, where revenue flows from one step to the next.

You might enjoy: Payment Service Providers

Deferred Revenue Overview

Deferred revenue is a type of liability that arises when a company receives payment from a customer for goods or services that have not yet been delivered.

This can happen when a customer pays for a subscription or a service that will be delivered over time, such as a software-as-a-service (SaaS) model.

Curious to learn more? Check out: When Are Deferred Taxes Due

Deferred Balance Calculation

The deferred revenue balance for a contract line item in each period is calculated directly by the dashboard using a specific formula.

This formula, Deferred Revenue Balance for the period = Deferred Revenue Balance of the previous period + Scheduled Billing - Scheduled Revenue, takes into account the previous period's balance, scheduled billing, and scheduled revenue.

The deferred revenue balance is cumulative, which means it's still displayed even if there's no scheduled billing and revenue for a period, with scheduled billing and revenue set to zero.

If the billing contract's currency is different from the corporate currency, the deferred revenue balance is automatically rounded to zero if it's 0.01 or less, ensuring accurate values in the dashboard.

This rounding is done before converting the value from the corporate currency to another currency, and it prevents misleading values for contract lines that are fully recognized.

Discover more: Bhp Billiton Stock Quote

Detail Report

The Deferred Revenue Waterfall Detail report is a powerful tool that helps reconcile the deferred revenue account balance on the balance sheet and provides a forecast of the expected revenue stream. It's essential to run this report after creating revenue recognition and deferred revenue reclassification journal entries for the current period.

Check this out: A Deferred Revenue Liability Appears on the Balance Sheet For:

To access the report, navigate to Reports → Revenue → Deferred Revenue Waterfall → Detail. From there, you can select the default value in the "As of" field, which defaults to the current period. If you're using OneWorld account, you'll also need to select a value in the Subsidiary Context field.

The report categorizes deferred revenue into four main categories: Prior Unrecognized, Short-term deferred revenue, Long-term deferred revenue, and Unplanned deferred revenue. These categories help you understand the different types of deferred revenue and their expected recognition periods.

Here's a breakdown of the categories:

- Prior Unrecognized: Billed and planned for recognition by the end of the current period but not yet recognized.

- Short-term deferred revenue: Billed and planned for recognition in the short term, divided into columns for each of the months.

- Long-term deferred revenue: Billed and planned for recognition after the number of months set for short-term deferred revenue.

- Unplanned deferred revenue: Billed, unrecognized, and not yet in actual revenue plans.

The report also includes additional columns, such as Customer, Unbilled Receivable Group, Currency, Source Document #, Source Type, Item, Deferred Revenue Account, Revenue Account, and Deferred Revenue Balance. Report results are grouped by customer, making it easier to analyze and understand the data.

Take a look at this: Credit Report Tradeline

Revenue

Revenue is a critical metric for any business, especially those that rely on long-term contracts. It's what you actually receive from customers, not just a contractual obligation.

Bookings, on the other hand, is a contract, a promise to pay that's not yet in your pocket. You can't count on it as revenue until you're paid.

Revenue is recognized as accounting revenue as you ratably provide the service over the life of the contract, governed by your accounting rules under IFRS or GAAP.

Letters of intent (LoI) and verbal/handshake agreements are not revenue or bookings, they're just promises that may not hold up.

Here's a breakdown of the difference between bookings and revenue:

Reporting and Analysis

Reporting and Analysis is a crucial step in understanding the Deferred Revenue Waterfall.

The waterfall is typically reported on a monthly basis, with each month's revenue recognized as it's earned.

To accurately analyze the waterfall, you need to know the initial balance, which is usually reported as a liability on the company's balance sheet.

The initial balance is the starting point for the waterfall, and it's essential to understand how it's calculated.

You might enjoy: Class B Shares Private Company

As revenue is earned, it's recognized as revenue in the income statement, and the corresponding liability is reduced.

The waterfall is typically presented in a table format, showing the change in liability each month.

By analyzing the waterfall, you can see how revenue is being recognized over time and make informed decisions about your business.

For example, if the initial balance is $100,000 and $20,000 is recognized as revenue in the first month, the liability would be reduced to $80,000.

You might like: Private Equity Distribution Waterfall Example

Revenue and Bookings

Bookings and revenue are not the same thing. Bookings is a contractual obligation to pay, but it's not revenue until you're actually paid.

To illustrate this, let's consider a contract with Google worth $100. If Google stops paying, you're left with nothing. Bookings don't guarantee revenue, so it's essential to distinguish between the two.

Revenue, on the other hand, is recognized when you provide a service over the life of a contract. This is governed by accounting standards like IFRS or GAAP, depending on your location.

Here's a key takeaway: bookings are just a contract, while revenue is the actual payment you receive. This distinction is crucial for accurate financial reporting.

Explore further: Contract Liability vs Deferred Revenue

ARR

ARR is a simple metric to calculate, just divide the company's annual revenue by 12. If you want to convert ARR to MRR, you just divide ARR by 12.

ARR is often used to determine a company's stage of growth, with $1.2m ARR indicating a series-A stage, a reasonable-sized team, and a solid PMF.

Calculating ARR is straightforward if you've calculated MRR correctly. There's just not much to it.

ARR can be calculated by simply multiplying MRR by 12.

Readers also liked: Trailing 12 Months Ttm

Bookings vs. Revenue

Bookings is just a contractual obligation to pay, but it's not the same as revenue.

Bookings don't guarantee payment, as we see with Google stopping payments, leaving you with nothing.

Revenue is recognized as you provide the service over the life of the contract, which is governed by your accountant under IFRS or GAAP.

Letters of intent and verbal agreements are neither revenue nor bookings, and should be avoided when dealing with investors.

Data and Categories

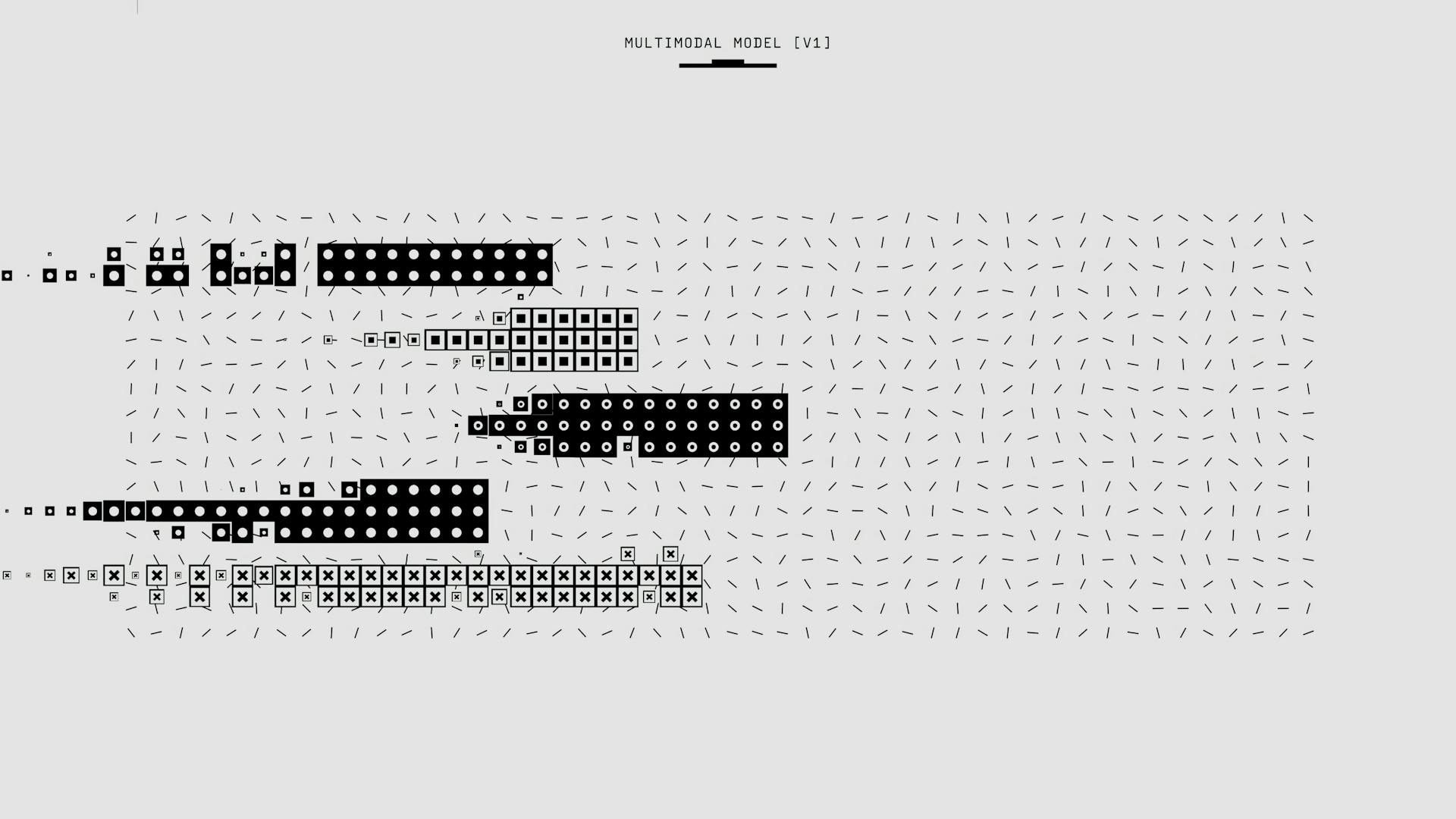

The data behind a deferred revenue waterfall is sourced from three main datasets. These datasets provide the necessary information to accurately track and analyze revenue.

The Revenue Waterfall dataset pulls data from Revenue Management and Billing Central, using objects and fields that are crucial for understanding revenue flow. The Financial Periods dataset uses fields derived from the Period object in Accounting, which helps to categorize and track revenue over time.

Three primary datasets are used to display data in the dashboard: Revenue Waterfall, Financial Periods, and Currencies. The Currencies dataset contains the corporate currency and currencies configured in your organization.

For more insights, see: Waterfall Bdsp

Data

Data is a crucial part of any organization, and understanding where it comes from can be really helpful.

The data displayed in this dashboard is derived from three main datasets: Revenue Waterfall, Financial Periods, and Currencies.

These datasets contain objects and fields from various systems, such as Revenue Management and Billing Central, Accounting, and Financial Analytics.

The Revenue Waterfall dataset uses objects and fields derived from Revenue Management and Billing Central, which can be found in the Revenue Waterfall Output Fields.

The Financial Periods dataset uses fields derived from the Period object in Accounting, and you can find more information about these fields in Financial Periods Fields.

The Currencies dataset contains the currencies configured in your org and identifies the corporate currency, which can be found in the Currencies Dataset Output Fields (Financial Analytics).

Here are the main datasets used in this dashboard, along with their sources:

- Revenue Waterfall: Revenue Management and Billing Central

- Financial Periods: Accounting (Period object)

- Currencies: Financial Analytics (Currencies Dataset)

Deferred Revenue Categories

Deferred revenue is a crucial aspect of financial management, and understanding its categories can help you make informed decisions.

You can run the Deferred Revenue Waterfall Detail Run after creating revenue recognition and deferred revenue reclassification journal entries for a current period.

The report divides deferred revenue into categories that are essential for tracking and analysis.

A different take: H B L Power Share Price

Sources

- https://help.financialforce.com/main/2024.3/Content/FinancialAnalytics/Features/DeferredRevenueWaterfallDashboard/DeferredRevenueWaterfall.htm

- https://help.financialforce.com/main/2022.3/Subsystems/BAN/Content/FMA/SettingUpFMA/SettingUpDeferredRevenueWaterfallDashboard.htm

- https://a2q2.com/netsuites-deferred-revenue-waterfall-detail-report/

- https://netsuitedocumentation1.gitlab.io/netsuitedocumentation1/section_4334524551.html

- https://www.alexanderjarvis.com/decipher-key-top-line-saas-terms-like-bookings-billings-and-revenue/

Featured Images: pexels.com