Debanking is a legitimate and growing trend in the financial industry, with over 50% of consumers considering switching to digital-only banks. This shift is driven by consumer demand for more convenient and cost-effective banking services.

The debanking movement is not just about closing traditional bank accounts, but also about embracing digital banking as a primary means of financial management. In fact, 75% of consumers prefer to use mobile banking apps for everyday transactions.

One common misconception about debanking is that it's a radical departure from traditional banking practices. However, many digital banks are actually licensed and regulated by the same authorities as traditional banks, providing similar levels of security and protection for customers' funds.

Explore further: Synchrony Financial Earnings

Causes and Risks

Understanding the causes of de banking is crucial to finding a solution. Removing the underlying problem is often the most effective way to resolve the issue, but it requires identifying the root cause.

Identifying the problem can be straightforward, but it's not always obvious. It may require working with different specialists to gather information and improve the individual's profile.

Removing the issue that caused the bank to make its decision can be achieved through various legal and non-legal routes. This may involve working with investigators, communications, and search engine optimisation professionals to improve the individual's online presence.

Regulatory Environment

In the UK, banks have long had the ability to close customer accounts due to various reasons, including suspected fraudulent activities or money laundering.

Banks have developed the practice of conducting routine due diligence searches on HNWI customers using online searches, database providers, and external investigators to manage their own reputational risk.

This practice has become standard, with banks relying on contractual bases to close accounts, including where the customer may put the bank in a position to break the law or expose it to action from regulators.

In recent years, the reputation clause has been removed from many bank agreements, but the practice of de-banking customers without explanation continues.

Compliance Rise

In the late 2010s, banks developed the practice of conducting routine due diligence searches on HNWI customers using basic online searches, database providers, and external investigators to manage their own reputational risk.

This practice was typically buried in the terms and conditions, with a clause that allowed the bank to close an account if continuing the facility could cause reputational harm to the bank, without needing to provide any reason for its decision.

The reputation clause has since been removed from most UK retail bank agreements, but the practice of de-banking customers without explanation or challenge continues.

Banks now rely on contractual bases to close accounts, including where the customer may put the bank in a position where it might break the law, regulation, code, or other duty, or if keeping the account would expose the bank to action or censure from any government, regulator, or law enforcement agency.

This is a sufficiently loose and wide-ranging basis to give banks a wide discretion, especially when they refuse to give their reasoning.

Legal Recourse

Taking on a bank can be a daunting and costly endeavor. Direct legal action against a bank for alleged breaches of contract or discriminatory practices is unlikely to be successful.

In most cases, banks will not accept that an account has been closed incorrectly and will be reluctant to provide information about the reason for closure, even if the terms suggest otherwise. This can make it difficult to obtain a clear explanation for why your account was closed.

Taking a bank to court requires substantial financial and legal resources, as well as a significant amount of time. This can be a huge burden, especially if you're already dealing with the stress of having your account closed.

Debunking and Misinformation

Banks often rely on information from the internet and database reports, which can be inaccurate, incomplete, or outdated.

These databases scrape publicly available online sources and use that information to create reports, which can be flawed.

As a result, banks may not make allowances for misinformation, partly because they lack the knowledge to do so.

Debunking

Debunking misinformation is crucial in today's digital age. Misinformation can spread quickly online, causing harm to individuals and communities.

According to a study, 63% of adults in the US get their news from social media, making it a breeding ground for misinformation.

The 24-hour news cycle can also contribute to the spread of misinformation, as news outlets may rush to report on breaking stories without fact-checking.

A survey found that 70% of people believe that fake news is a major problem in the US.

Debunking misinformation requires a critical thinking approach, where people question the credibility of sources and look for evidence-based information.

The "red flag" method, which involves looking for obvious signs of bias or misinformation, can be an effective way to debunk false information.

A study found that fact-checking initiatives can be effective in reducing the spread of misinformation, with a 50% decrease in false information being shared after implementation.

Misinformation can have serious consequences, including the erosion of trust in institutions and the spread of conspiracy theories.

Misinformation

Banks often rely on flawed due diligence, which can be based on outdated or inaccurate information found online. This can lead to serious problems for customers.

Banks frequently don't make allowances for the limitations of online information, partly because they lack the knowledge to do so.

Databases used by banks are problematic because they scrape publicly available online sources to create reports.

Nigel Farage and Debanking

Nigel Farage has launched a website called AccountClosed.org to help people who have been denied bank accounts due to their political views.

The law states that every person in the UK has a legal right to hold a basic bank account that gives them the ability to receive and make payments.

This right is protected by legislation that prohibits banks from discriminating against consumers based on their nationality, place of residence, sex, race, color, ethnic or social origin, genetic features, language, religion, or political opinion.

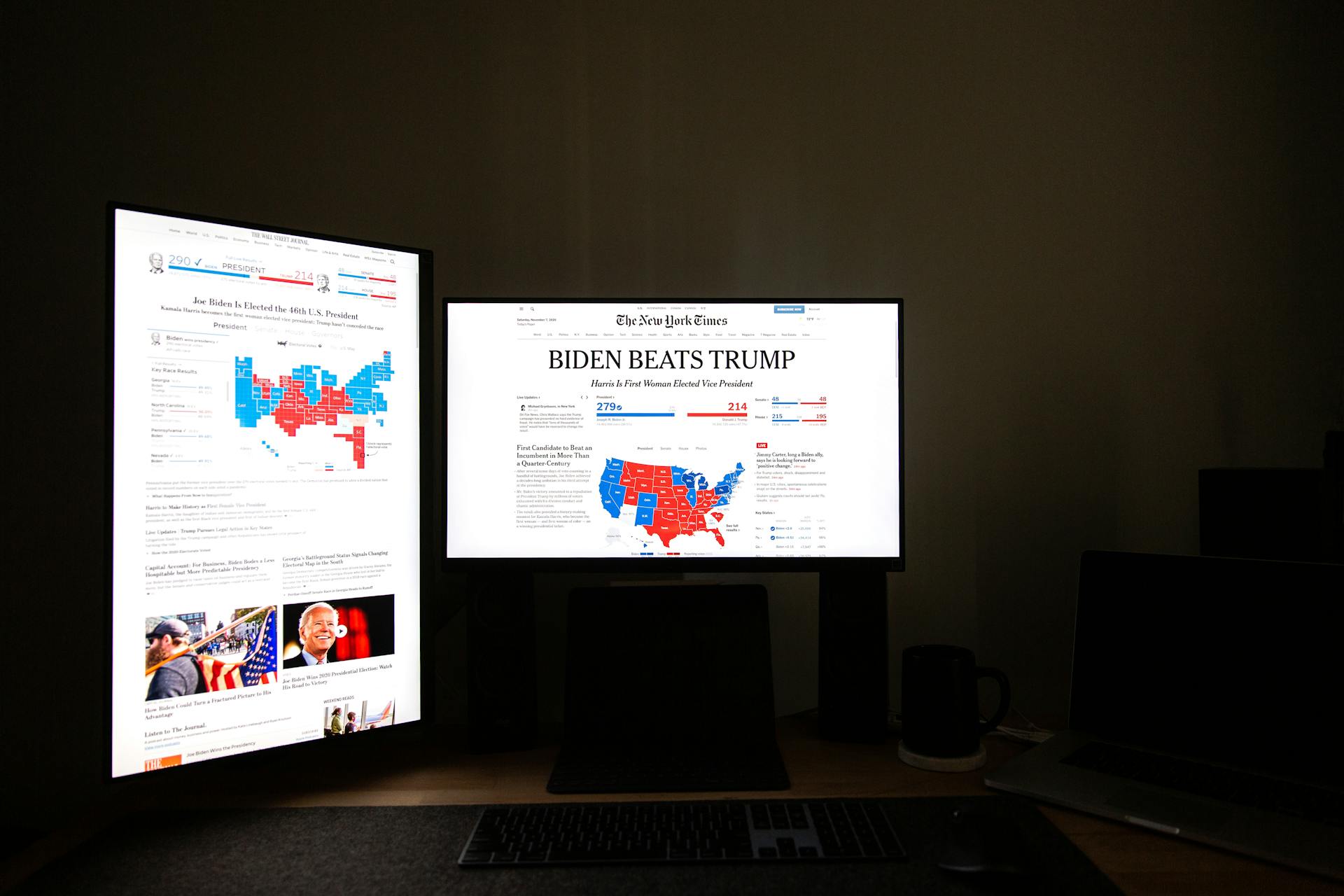

The row over Nigel Farage's Coutts account closure has led to the resignation of two bank bosses, Dame Alison Rose and Peter Flavel.

A report from Coutts indicated that Nigel Farage's political views were considered a factor in his account closure.

Despite facing calls to resign, NatWest chairman Sir Howard Davies has vowed to remain in post to ensure the bank's stability.

The BBC initially reported that Nigel Farage's account was closed because he no longer met the wealth threshold for Coutts, but later apologized for the inaccurate story.

Nigel Farage said that people who have had their accounts closed feel helpless and that there's no one to speak for them.

The campaign on AccountClosed.org is for individuals and small to medium businesses who have faced unjust treatment from banks and financial services companies.

A fresh viewpoint: What Has a Bank with No Money?

A law firm, Travers Smith, has been appointed to conduct an independent investigation into the closure of Nigel Farage's account and how the information surrounding the issue was handled.

Former prime minister Liz Truss has spoken out against the treatment of Nigel Farage, saying it shows how a powerful technocracy presides over an increasingly opaque system.

Banking Alternatives

Navigating being de-banked can be overwhelming, but there is hope. Individuals and organisations can tap into alternative banking services that have less stringent requirements.

Online banks, for instance, have emerged as a viable option for those who have been de-banked. They provide a much-needed lifeline for those who need access to banking services.

Payment services and cryptocurrency platforms are also expanding their reach, offering more options for those who have been rejected by traditional banks.

Alternative Services

Alternative Services are worth exploring, especially for those who can't access traditional banking. Online banks, payment services, and cryptocurrency platforms have less stringent requirements.

These alternative services can provide a much-needed lifeline for de-banked individuals or organisations. They offer a chance to manage finances and make transactions without the usual banking restrictions.

Specialist

Some financial institutions specialise in serving high net worth individuals and politically exposed persons, focusing on understanding their unique needs and offering specialised services. This can be a good option for those who need a more tailored approach.

Navigating being de-banked is daunting, but certain specialist providers may be able to offer a lifeline. They often have less stringent requirements than traditional banks.

Specialist providers may be less likely to make an adverse decision, as they have a deep understanding of the needs of high net worth individuals and politically exposed persons. This can provide a sense of security and stability.

A fresh viewpoint: What Is Net Banking

Bank Resources and Reputation

De-banking has severe implications for individuals and organisations, making routine activities like paying bills and transferring funds challenging. This can even hinder international trade.

For HNWIs, potential ramifications of de-banking include reduced access to competitive financial products and reluctance from investors. This can lead to a catastrophic loss of personal and professional esteem.

Personal wealth and professional reputation are inextricably linked, and perceived financial improprieties can spiral a highly regarded individual into a whirlwind of questions and declining public opinion.

Take a look at this: Ally Financial Stock Plunges

Bank Resources

Navigating being de-banked is daunting. However, there are measures that individuals and organisations can take to address a de-banking decision or mitigate its fallout.

For those who have been de-banked, there are resources available to help. You can contact the Financial Ombudsman Service for guidance and support.

Being de-banked can have a significant impact on daily life, making it essential to explore alternative banking options. These can include prepaid cards, credit unions, and online banking services.

The Financial Ombudsman Service can help you understand the reasons behind a de-banking decision and provide guidance on how to resolve the issue.

You might like: Synchrony Financial News

Reputation as an Asset

Having a good financial reputation is as important as managing tangible assets.

De-banking can severely impact high-net-worth individuals (HNWIs) and organisations alike, making routine activities like paying bills and transferring funds challenging.

Financial reputation is an invisible asset that's often disregarded until it's too late.

Perceived financial improprieties can quickly spiral a highly regarded individual into a whirlwind of questions and declining public opinion.

Personal wealth and professional reputation are inextricably linked, and failures in ethical financial management can result in a catastrophic loss of personal and professional esteem.

Reduced access to competitive financial products, reluctance from investors, and scrutiny from regulators and tax authorities are potential ramifications for HNWIs who damage their financial reputation.

A different take: What Is Personal Banking

Frequently Asked Questions

What is the meaning of de banking?

De-banking refers to the closure of bank accounts by banks that perceive their customers as a financial, legal, or reputational risk. This practice, also known as de-risking, can have significant consequences for individuals and organizations affected.

What are the reasons for debanking?

Debanking can occur due to concerns over financial crime, regulatory compliance, risk management, or reputational damage. Banks may use these reasons to justify closing or restricting a customer's account with little explanation.

Sources

- https://www.bbc.com/news/uk-politics-66354476

- https://www.city-journal.org/article/debunking-de-banking

- https://www.imlpo.com/articles/institute-insights-causes-of-de-banking-in-the-uk

- https://www.farrer.co.uk/news-and-insights/de-banking-a-hidden-menace/

- https://www.bindmans.com/news-insights/blogs/debanking-an-explanation/

Featured Images: pexels.com