Cyber insurance can be a lifesaver in the event of a data breach. According to a study, the average cost of a data breach is $3.86 million.

Having cyber insurance can help mitigate these costs, but is it worth the investment? To answer this question, let's break down the benefits and drawbacks of cyber insurance.

Cyber insurance policies typically cover costs associated with data breaches, such as notification expenses and credit monitoring fees. For example, a policy might cover up to $100,000 in notification expenses.

The key is to understand what's covered and what's not, so you can make an informed decision about whether cyber insurance is right for you.

For another approach, see: Cyber Insurance Data Breach

Why Have Cyber Insurance?

Having cyber insurance is a no-brainer. Think about the impact of a cyberattack on your credit union - would your bottom line and reputation take a hit? Would you face legal ramifications? The consequences could be extremely costly, and having cyber liability insurance is a way to not just ensure you have the resources to recover some, if not all your losses, but also provide peace of mind for your credit union and your members.

Check this out: Cyber Insurance Does Not Cover

If you're a small business owner, you might think that cybercriminals have bigger fish to fry, but this assumption couldn't be further from the truth. Cybercriminals often view small businesses as easy targets due to their limited resources and potentially weaker cyber security measures.

Here are some types of cyber insurance coverage you can consider:

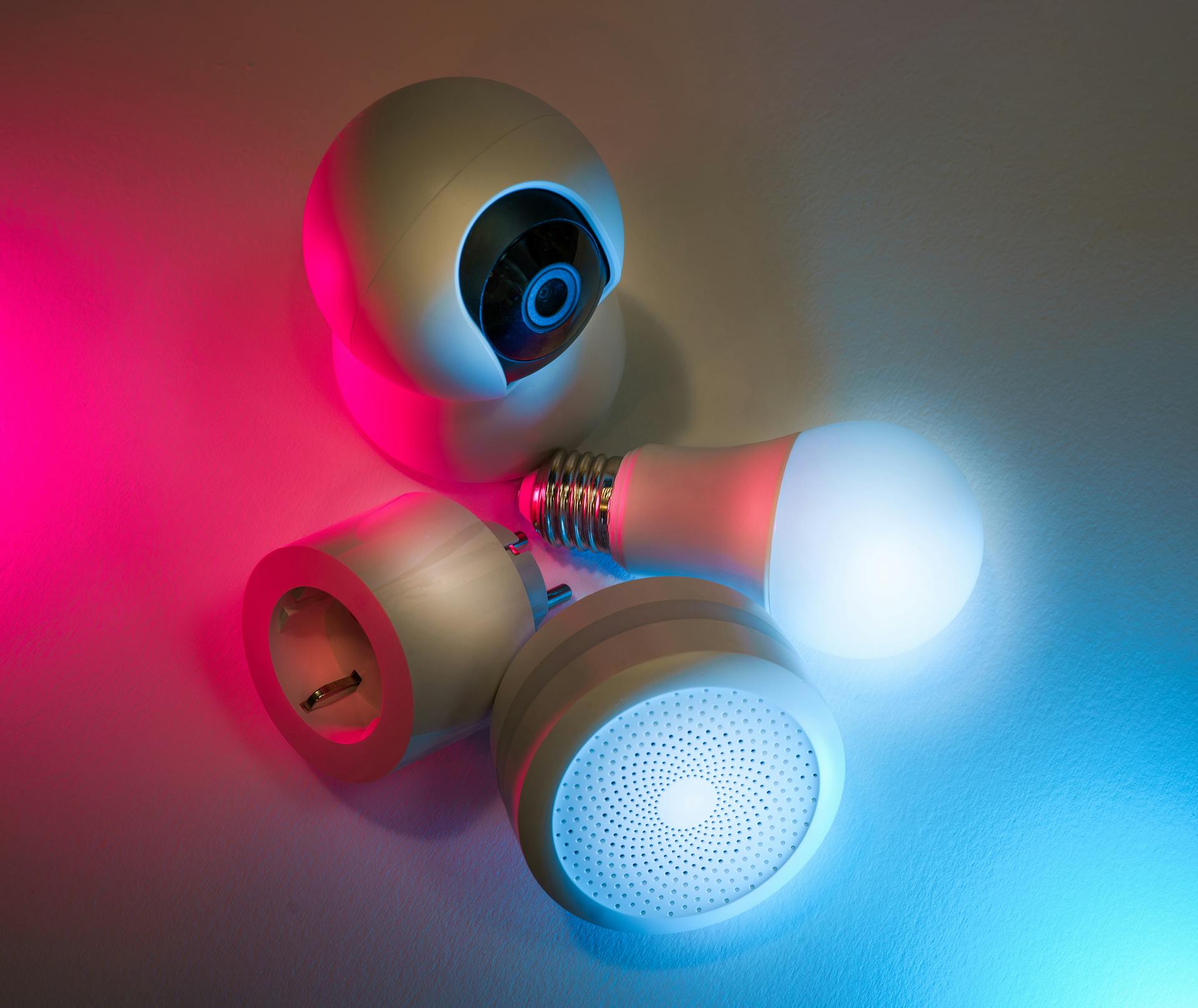

- Cyber attack coverage pays for the removal of a virus or reprogramming of desktops, laptops, smartphones, tablets, Wi-Fi routers and other internet access points, such as smart home devices and security systems.

- Cyberbullying coverage helps you deal with online harassment that results in wrongful termination, discipline from school, temporary relocation expenses, temporary private tutoring, lost wages and legal expenses.

- Cyber extortion coverage helps you recover from ransomware attacks that block you from accessing your personal data and demanding a fee to regain control.

- Data breach coverage helps pay for services if personal data entrusted to you is lost, stolen or published.

- Online fraud coverage pays for direct financial losses due to problems like identity theft, unauthorized banking or credit card transfers, phishing schemes and other types of fraud.

Personal Insurance

Personal cyber insurance is a type of coverage that can be added to your homeowners insurance policy. It's designed to help you recover from cybercrimes such as cyberattacks, cyberbullying, and data breaches.

This type of insurance can cover a range of expenses, including the removal of a virus, reprogramming of devices, and temporary relocation expenses. You can also get help recovering from ransomware attacks, which can block access to your personal data and demand a ransom to regain control.

Some personal cyber insurance policies may include additional services such as access to fraud specialists, active cyber monitoring, and lawsuit protection. These services can be a huge help in preventing or minimizing a cyber loss.

Discover more: Electronic Data Liability Coverage

If you're the victim of a cyberattack, you can file a claim to help pay for expenses such as legal fees or document recovery. Your policy will have a coverage limit and a deductible, so it's essential to understand what's covered and what's not.

For example, if you have a policy with a $15,000 limit and a $500 deductible, you might get a check for $1,500 if you're hit with a $2,000 online scam. But don't pay any ransom without getting your insurance company's approval first, as this can lead to more problems.

Personal cyber insurance is a growing market, and more people are starting to see its value. In fact, over 66% of past cyberattack victims said they'd be willing to pay for personal cyber insurance if it was offered.

A different take: What Is My Life Insurance Policy Worth

Is It Worth It for Small Businesses?

Cyber insurance is a must-have for small businesses, as it can provide peace of mind and financial protection from the devastating consequences of a cyber attack. The potential financial losses, tarnished reputation, and legal consequences of a serious cyber incident can far outweigh the cost of coverage.

A single serious cyber attack incident can lead to substantial financial losses, and small businesses are not immune to these attacks. They are often targeted precisely because of their relatively weaker cybersecurity measures.

Cyber security insurance provides a safety net for small businesses, allowing them to recover from cyber attacks and maintain their operations. This is especially important for small businesses that may not have the resources to absorb a significant financial hit.

Cybercriminals often view small businesses as easy targets due to their limited resources and potentially weaker cyber security measures. By investing in cyber security insurance, small businesses can reduce their vulnerability to these attacks.

Cyber insurance is a proactive step toward safeguarding your business from a security breach or other cyber incidents. It's a crucial component of a comprehensive cybersecurity strategy, along with implementing firewalls, encryption protocols, regular software updates, a security audit, and employee training.

Benefits and Features

Cyber insurance can provide critical financial protection against the costs of a cyberattack, including financial losses and expenses, response actions, system and data recovery, and crisis management.

A cyber liability insurance policy can help cover costs associated with a business interruption, such as lost income, as well as legal and regulatory proceedings following a cyberattack.

Notifying members, providing credit monitoring services, and regaining access to locked systems are just a few of the steps your credit union may need to take in response to a cyber incident.

These costs can be covered by cyber liability insurance, helping to mitigate the financial impact of a cyberattack.

System and data recovery costs, such as paying for outside expertise to help regain access to systems or restore data, may also be covered by cyber liability insurance.

Cyber liability insurance can provide support for crisis management, including media management and communications strategies, to help handle the public relations aspect of recovery.

A study found that businesses employing less than 500 individuals face an average expense of $2.98 million due to data breaches, with each compromised data record amounting to an average cost of $164.

Cyber insurance acts as a safety net for companies, offering financial protection and support when preventive measures are not enough to fend off an attack.

A cyber insurance policy can cover the costs of decryption, legal assistance, and the implementation of enhanced security measures to prevent future attacks, as seen in the example of a small e-commerce business that fell victim to a data breach.

Here are some key benefits of cyber insurance:

- Financial protection against cyberattack costs

- Coverage for response actions, such as notifying members and providing credit monitoring services

- Support for system and data recovery, including paying for outside expertise

- Crisis management support, including media management and communications strategies

- Protection against data breach costs, including decryption and legal assistance

Cost and Policy

The cost of cyber insurance can vary significantly depending on several factors. For small businesses, the average premium is around $145 per month, or about $1,740 annually, based on data from Insureon customers.

Cyber insurance costs can be broken down into different ranges. 38% of Insureon's small business customers pay less than $100 per month, while 33% pay between $100 and $200 per month.

Your provider calculates your cyber insurance premium based on factors such as your policy limits and deductible, cyber threats in your industry, type of cyber insurance purchased, amount of sensitive information handled, number of employees, and history of insurance claims.

Worth a look: Cyber Insurance Quotes

Businesses that face higher risks may choose to pay more for higher policy limits. Typically, policy limits range from $1 million to $5 million, with two limits: a per-occurrence limit and an aggregate limit.

The average deductible for a cyber liability policy is $2,500 for Insureon customers. A higher deductible results in a lower premium, but make sure it's an amount you can easily afford.

Here's a breakdown of the types of cyber insurance and their impact on cost:

Different types of cyber insurance can impact the amount you'll pay for coverage. Most businesses only need first-party cyber liability insurance, while tech companies and consultants usually need third-party cyber coverage.

Explore further: What Is Cyber Insurance and Why Do You Need It

Types of Cyber Insurance

Personal cyber insurance can be customized to fit your specific needs, with various types of coverage available.

First-party cyber liability insurance, also called data breach insurance, is a common type of coverage that helps businesses defend against cyber risks at their own business. This type of insurance is often required by law for companies that handle sensitive customer information.

Data breach coverage, a type of first-party cyber liability insurance, helps pay for services if personal data entrusted to you is lost, stolen or published. For example, if you sell tickets for a school fundraiser and have credit card information from buyers on your tablet and the tablet is stolen, this coverage would pay for services to the individuals who were affected by the data breach.

Third-party cyber coverage, on the other hand, pays for legal costs if a client blames your business for failing to prevent a cyber incident. This type of coverage is often used by tech companies and consultants who need to protect themselves against lawsuits.

Some common types of cyber insurance coverage include:

- Cyber attack coverage

- Cyberbullying coverage

- Cyber extortion coverage

- Data breach coverage

- Online fraud coverage

How Different Types Impact Cost

Different types of cyber insurance can impact the cost of coverage. Most businesses only need first-party cyber liability insurance, also called data breach insurance, to defend against cyber risks at their own business. The cost depends on how much customer information they handle, such as credit card numbers or Social Security numbers.

Worth a look: Cyber Insurance Uk Cost

Tech companies and consultants usually need third-party cyber coverage, which pays for legal costs if a client blames their business for failing to prevent a cyber incident. They can often combine this policy with professional liability insurance in a policy bundle called technology errors and omissions insurance, or tech E&O.

The type of cyber insurance purchased is a key factor in determining the cost. First-party cyber liability insurance typically has a lower cost compared to third-party cyber coverage.

Here's a brief overview of the types of cyber insurance and their associated costs:

Businesses that face higher risks may choose to pay more for higher policy limits. The amount of cyber liability coverage your business needs depends on your industry, your type of business, and the type of customer data you handle.

If this caught your attention, see: Cyber Insurance Business Interruption Coverage

Small Business Cyber Insurance

For small businesses, cyber insurance is a must-have to protect against cyber threats. The average cost for a cyber insurance policy for Insureon customers is $145 per month, with 38% paying less than $100 per month and 33% paying between $100 and $200 per month.

For another approach, see: Cyber Insurance Not Paying Out

Cyber liability insurance is the most common type of cyber insurance for small businesses, which pays for legal costs if a client blames the business for failing to prevent a cyber incident. This type of insurance is often combined with professional liability insurance in a policy bundle called technology errors and omissions insurance, or tech E&O.

The cost of cyber insurance for small businesses varies depending on their risks and the coverage they choose. Factors that affect the cost include policy limits, deductibles, cyber threats in the industry, the amount of sensitive information handled, and the number of employees.

Here are some key factors to consider when choosing a cyber insurance policy:

- Policy limits: Typically range from $1 million to $5 million, with two limits: per-occurrence and aggregate.

- Deductibles: The average deductible for a cyber liability policy is $2,500 for Insureon customers.

- Risk profile: Small businesses that handle sensitive information, such as credit card numbers or Social Security numbers, may need higher policy limits and more comprehensive coverage.

Don't assume your small business is immune to cyber threats. Cybercriminals often target small businesses because they have fewer resources to protect themselves. In fact, 98% of cyber insurance claims come from small and medium businesses.

Frequently Asked Questions

What is the average payout for cyber insurance?

For small to medium enterprises, the average cyber insurance payout is around $345,000, with ransomware events costing significantly more at approximately $485,000.

What is the value of cyber insurance?

Cyber insurance provides financial protection against cyberattacks, covering losses up to $5 million per occurrence, helping businesses recover from costly data breaches and cyber incidents. By investing in cyber insurance, businesses can safeguard their assets and reputation against the growing threat of cybercrime.

Does cyber insurance pay out?

Yes, cyber insurance pays out for various costs associated with a cyber attack, including recovery of stolen data and lost income due to business interruption. Coverage may also extend to cyber extortion, forensic services, and other related expenses.

Sources

- https://blog.vfccu.org/is-cyber-liability-insurance-worth-it/

- https://www.tenable.com/source/cyber-insurance

- https://www.forbes.com/advisor/homeowners-insurance/personal-cyber-insurance/

- https://www.insureon.com/small-business-insurance/cyber-liability/cost

- https://visualedgeit.com/cyber-insurance-a-vital-role-in-safeguarding-small-businesses/

Featured Images: pexels.com