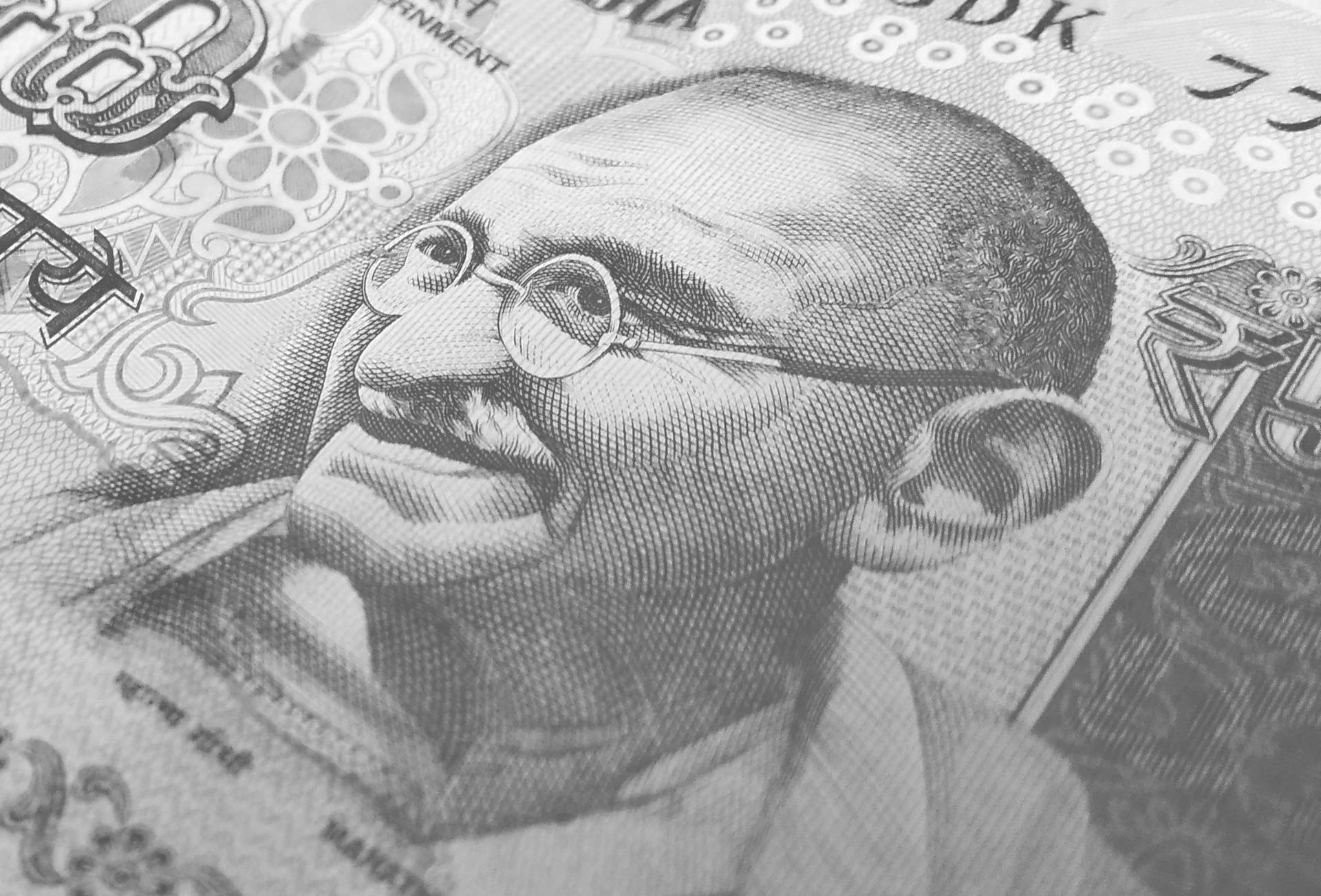

The Indian rupee is the official currency of India, denoted by the symbol ₹. It's widely accepted and used for everyday transactions.

The rupee is divided into 100 paise, with coins and banknotes available in various denominations. You can exchange currency at airports, banks, and currency exchange offices.

The exchange rate of the rupee fluctuates with global market trends, so it's essential to check the current rate before traveling to India.

What is the Indian Currency

The Indian Rupee is the official currency used in India, with the international code INR and the symbol ₹. It's used for everyday transactions and is widely accepted.

Indian Rupee banknotes come in 7 denominations, ranging from ₹5 to ₹1000. You'll often see these denominations used in local markets and shops.

The coins in India are made up of 'paise' and rupees, with 6 different denominations available. You can spot these coins in circulation, including ₹1, ₹2, and ₹5 rupees.

The ₹10, ₹25, and ₹50 paise coins are also in use, and you might find them in your change when making a purchase.

A different take: What Currency Is Used in Prague Czech Republic

Exchange and Buying

Buying Indian Rupee in Australia can be done through three main options: buying online and having it delivered or collecting it in-store, swapping Indian Rupee for Australian dollars from a money changer, or buying it at your home airport. However, it's best to avoid buying at the airport due to atrocious exchange rates.

If you choose to buy online, try using a currency exchange store like S Money to get rates that reflect the comparisons you see on XE or Google. This way, you can save money and get a better deal. Online exchange companies may suggest allowing between two and five days to process your currency.

You have three options to buy Indian Rupee in Australia:

- Buy INR online and have it delivered or collect it in-store

- Swap Indian Rupee for Australia dollars from a money changer

- Buy your Indian currency at your home airport

Just remember to avoid buying at the airport due to poor exchange rates.

All Exchange Rates

You can exchange Indian rupees for several foreign currencies. The exchange rates for these currencies are constantly changing, so it's essential to check them regularly.

The Indian rupee can be exchanged for the Kyrgyzstani som (KGS) and the Uzbekistan sum (UZS), among other currencies.

If you're planning to travel to the United States, you'll need to exchange your rupees for US dollars (USD).

The exchange rates for these currencies can be found online or at a currency exchange office.

Exchange Currency Guide

If you're traveling to India, it's essential to understand how to exchange currency effectively. Buying Indian Rupee before you leave Australia can save you money, but it depends on where you get it.

There are three main options to buy Indian Rupee in Australia: online delivery or in-store pickup, swapping at a money changer, or buying at the airport.

Try using an online currency exchange store like S Money to get competitive rates, just like you'd see on XE or Google. Online delivery or in-store pickup can take between two and five days to process.

Related reading: Buying Renminbi Currency

Avoid buying Indian Rupee at currency exchange counters in Australia's airports, as they often have atrocious exchange rates.

In India, you can exchange money at money changers, which tend to offer marginally better rates than banks. Most money changers have a sign stating "Money Changer" and a board with exchange rates.

Banks in India may charge high flat fees per transaction, and they only exchange currencies on weekdays. If you can plan ahead, it's best to get cash before venturing into remote areas.

Here are your options for exchanging currency in India:

- Money changers: marginally better rates than banks, available in major tourist destinations

- Banks: high flat fees per transaction, only exchange currencies on weekdays

- Airport or hotel exchange: worst exchange rates, best avoided if possible

Rupee's Rapid Stumble Challenges Economy

The rupee's value has plummeted, with a 20% depreciation in just a few months. This rapid stumble has significant consequences for the Indian economy.

The rupee's devaluation is largely attributed to a widening trade deficit. India's imports have surged, while exports have struggled to keep pace. The trade deficit has ballooned to a record high, putting pressure on the rupee.

The rupee's decline has made imports even more expensive, leading to higher inflation. Inflation has risen to a 5-year high, eroding the purchasing power of consumers.

Discover more: Is Us Currency Being Devalued by Inflation

Frequently Asked Questions

Is $100 a lot in India?

In India, $100 can go a long way, covering various expenses such as accommodations, meals, and domestic flights. With $100, you can enjoy a comfortable and affordable trip in India.

Sources

- https://www.xe.com/currency/inr-indian-rupee/

- https://wise.com/us/currency-converter/currencies/inr-indian-rupee

- https://www.smoney.com.au/blog/currency-in-india/

- https://www.elibrary.imf.org/view/journals/022/0052/004/article-A009-en.xml

- https://www.thehindu.com/opinion/editorial/currency-concerns-on-the-rupee/article69043979.ece

Featured Images: pexels.com