Credit Mutuel Des Enseignants offers a range of financial services designed to meet the unique needs of teachers.

Their services cater to the specific requirements of educators, providing them with a more personalized and supportive financial experience.

With Credit Mutuel Des Enseignants, teachers can enjoy competitive interest rates on their loans and savings accounts, as well as exclusive benefits and discounts.

Their team of experts is dedicated to providing personalized advice and guidance to help teachers make the most of their financial resources.

You might enjoy: Changement Pare Brise Credit Mutuel Rapide Pare Brise

About Credit Mutuel Des Enseignants

The Crédit Mutuel Enseignant (CME) is a unique bank created by teachers for teachers. It offers tailored support to its members, with a wide range of insurance and savings products.

The CME has a strong focus on serving its members, with a goal of providing solutions that meet their specific needs. This is achieved through a network of local advisors who have an excellent understanding of the teaching profession.

The CME is a mutual bank, meaning it is owned and controlled by its members, rather than external shareholders. This allows it to prioritize its members' interests and provide services that are tailored to their needs.

Here are some of the key benefits of being a member of the CME:

* Accompagnement sur-mesure (tailored support)Large choix de produits d’assurance et d’épargne (wide range of insurance and savings products)Expertise spécifique à l’enseignement (expertise in education)Conseiller CME proche de chez vous (local advisor)

The CME is committed to providing its members with the support they need at every stage of their lives and careers. Whether you're an active teacher or a retiree, the CME is there to help.

Our Commitments

We're dedicated to the world of education, research, and culture, which helps us understand and connect with our clients in a meaningful way.

At Crédit Mutuel Enseignant, we strive for proximity and reciprocal trust, which is essential for building strong relationships with our clients.

We believe in transparency, and it's not just a value, but a promise we make to our clients-sociétaire. This is reflected in our Convention Clarté, which ensures clear tariffs and a formalized commercial proposal.

We cultivate respect for our clients-sociétaire, fostering an atmosphere of listening, counseling, and dialogue. Our goal is to provide personalized advice and support.

Our Caisses are managed by volunteer educators who work in collaboration with banking and insurance specialists. This unique approach allows us to offer a more personalized service.

We're a modern and living mutual bank, where clients are encouraged to become sociétaires. This means they have a voice in our decision-making process and can participate in our annual general assembly.

Financial Services

The Crédit Mutuel Enseignant (CME) offers a range of financial services tailored to the needs of educators. Their expertise is specifically designed to help teachers navigate their financial lives.

Their credit options are designed to help you finance personal projects, such as travel, weddings, or home equipment, without breaking the bank. A credit can be a great way to achieve your goals, but it's essential to verify your repayment capabilities before committing.

Related reading: Do Credit Cards Help Your Credit Score

You can choose from a variety of credit options, each with its own terms and conditions. One option is a specific credit designed for teachers, which can help you cover unexpected expenses or plan for the future.

Here are some of the key features of the CME's financial services:

- Accompagnement sur-mesure

- Large choix de produits d’assurance et d’épargne

- Expertise spécifique à l’enseignement

- Conseiller CME proche de chez vous

These features can provide you with a more personalized and tailored financial experience, helping you make informed decisions about your money.

Financez Vos Projets

When you're starting out in life, you've got a million projects buzzing around in your head. Whether it's a dream vacation, a wedding, or finally getting that new kitchen, it's easy to get caught up in the excitement and forget about the finances.

As a teacher, you've got a unique set of financial needs that a standard bank might not be equipped to handle. That's where the Crédit Mutuel Enseignant comes in – a bank specifically designed for the teaching profession.

This bank offers a range of products and services tailored to the needs of teachers, including a special type of credit designed just for them.

Here are some of the benefits of using the Crédit Mutuel Enseignant:

- Accompagnement sur-mesure

- Large choix de produits d’assurance et d’épargne

- Expertise spécifique à l’enseignement

- Conseiller CME proche de chez vous

What does this mean for you? It means having a dedicated financial advisor who understands the ins and outs of teaching and can offer personalized advice and solutions.

Quelques Exemples Projets

The Crédit Mutuel Enseignant (CME) offers a range of projects to promote financial education and awareness among students. They publish a documentation of return to school, which includes a welcome booklet and key statistics.

They also participate in classroom interventions, where salaried employees from the CME network introduce students to banking careers. This helps bridge the gap between theory and practice, making complex concepts more accessible.

One notable example is the organization of a half-day discovery of banking careers for education personnel, including principals, inspectors, and professors. This initiative fosters a deeper understanding of the banking sector and its relevance to the education system.

Worth a look: Best Student Credit Cards No Credit

The CME also collaborates with the ONISEP to contribute to their documentation. This partnership highlights the importance of interdisciplinary collaboration in promoting financial literacy.

Here are some examples of projects and initiatives undertaken by the CME:

- Stages dans les caisses du Crédit Mutuel en particulier pour les BTS

- Dons d'équipements

- Intervention de professionnels du CM/CME dans les établissements sur des thématiques d’économie, de finances

These projects demonstrate the CME's commitment to promoting financial education and awareness among students and education personnel.

Assurance Crédit Immobilier pour Enseignant

As an educator, you have access to exclusive financial services that can help you secure a mortgage with ease. Your mutuelle professionnelle (MGEN) can act as a guarantee for your credit, allowing you to avoid a mortgage.

Your mutuelle will evaluate your debt-to-income ratio before agreeing to act as a guarantee, so it's essential to keep your finances in check. The fees associated with the guarantee will be covered by your mutuelle, subject to certain conditions.

Some financial institutions, like Cetelem, offer specialized credit options for civil servants, including teachers. These "crédit fonctionnaire" plans come with no fees for application, guarantee, or early repayment.

By leveraging your mutuelle's insurance, you can enjoy lower rates on your mortgage insurance. This can be a significant advantage, especially when compared to traditional bank rates.

Expand your knowledge: Will Paying off Credit Cards Improve My Credit Score

Avantages du Prêt Immobilier

The advantages of a mortgage loan are numerous.

With a mortgage loan, you can purchase a property with a lower down payment, typically ranging from 5% to 20% of the purchase price.

This can be a game-changer for many teachers who may not have a large amount of savings.

A mortgage loan also allows you to spread the cost of the loan over a longer period, often up to 25 years or more.

This can make monthly payments more manageable and help you budget for other expenses.

In addition, a mortgage loan can provide tax benefits, as the interest on the loan may be tax-deductible.

This can help reduce your taxable income and lower your tax bill.

Some mortgage loans, such as those offered by Credit Mutuel des Enseignants, may also offer flexible repayment terms and lower interest rates for teachers.

Related reading: Credit Union Personal Loan to Pay off Credit Cards

Partnerships and Collaborations

Credit Mutuel des Enseignants has formed partnerships with various organizations to provide its members with exclusive benefits. One notable partnership is with the National Education Ministry, which allows the credit union to offer specialized financial products to teachers.

Through this partnership, Credit Mutuel des Enseignants has been able to offer financial assistance to teachers in need, such as loans for home repairs or education expenses. This support helps teachers manage their financial stress and focus on their work.

The credit union has also partnered with the French Teachers' Union, which has helped to promote the credit union's services to its members. This partnership has been successful in increasing the number of teachers who join the credit union and take advantage of its benefits.

Partenariat Académie

The Académie partnership is a key component of our partnerships and collaborations. It brings together industry experts and academic institutions to foster innovation and knowledge sharing.

Through this partnership, we have established a joint research program with the prestigious École Polytechnique. This program focuses on developing cutting-edge technologies in artificial intelligence and data analytics.

One of the notable outcomes of this partnership is the creation of a joint research lab. This lab serves as a hub for collaborative research and development, bringing together experts from both academia and industry.

The Académie partnership has also led to the development of a series of joint courses and training programs. These programs aim to bridge the gap between theoretical knowledge and practical application, equipping students with the skills they need to succeed in the industry.

These courses have been well-received by students and industry professionals alike, with many praising the unique blend of academic and industry expertise.

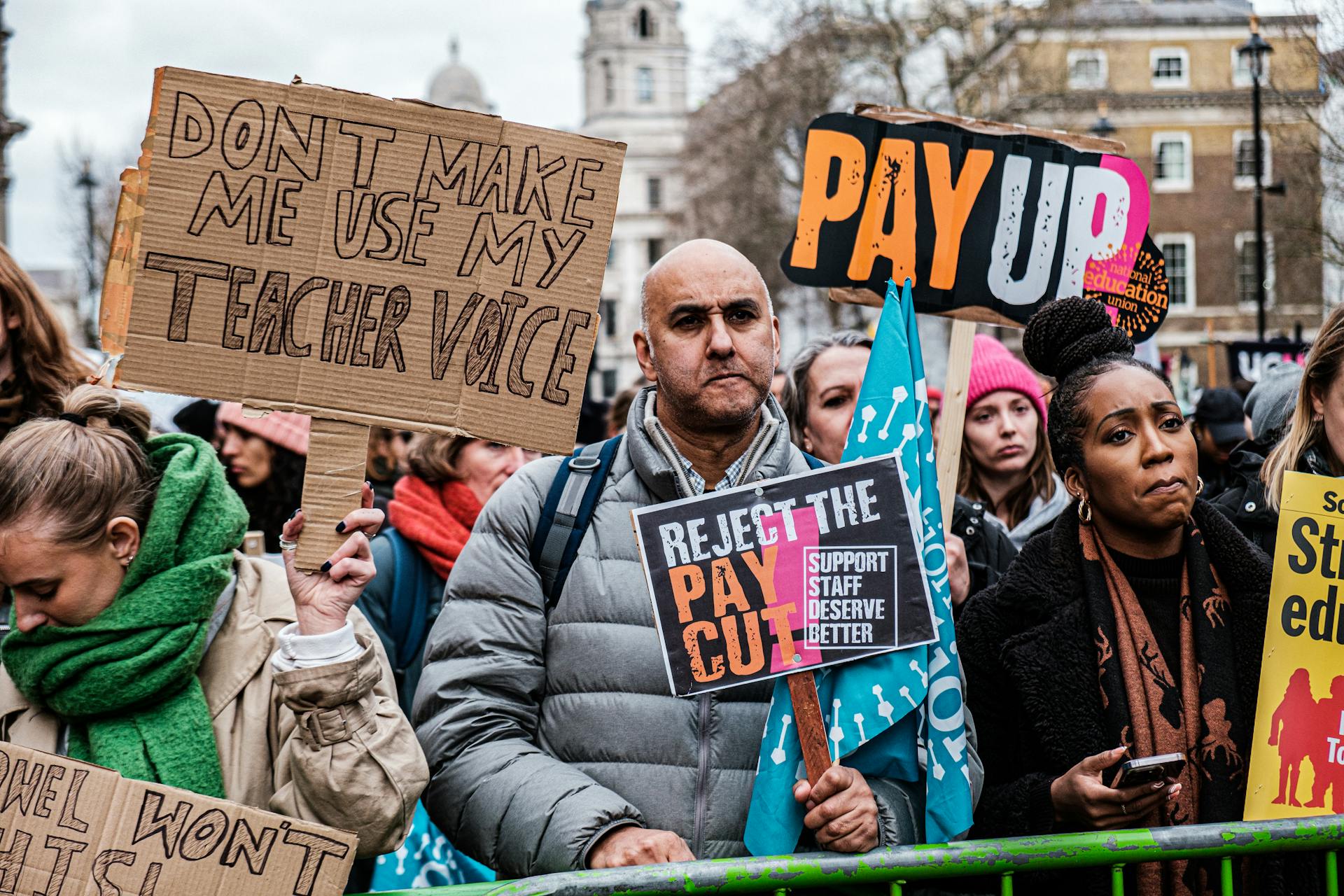

Deux Types De Banques

When exploring partnerships and collaborations, it's essential to understand the different types of banks available to teachers.

There are two types of banks for teachers: those exclusively for teachers and those open to everyone but with dedicated offers for teachers.

Teachers can choose from banks that accept all government officials, or those specifically designed for a particular group of teachers.

Some banks cater to a broad range of teachers, while others focus on a specific subset.

Other Credit Establishments

Credit Mutuel Enseignants De Nice has a presence that extends beyond its headquarters.

The company has 1 establishment in addition to its main office.

Sources

- https://www.creditmutuel.fr/fr/particuliers/enseignants.html

- https://pedagogie.ac-strasbourg.fr/ecoleentreprise/partenariat-academie-et-credit-mutuel-enseignant/

- https://www.monemprunt.com/guide-immo/emprunter-selon-son-profil/le-pret-immobilier-pour-un-enseignant/

- https://rubypayeur.com/societe/caisse-de-credit-mutuel-enseignant-de-martinique-438863797

- https://entreprises.lefigaro.fr/credit-mutuel-06/entreprise-811475979

Featured Images: pexels.com