A credit expense account is a type of account that can help you manage your finances more effectively. It's essentially a way to track and categorize your expenses.

To understand how a credit expense account works, let's first look at debit transactions. A debit transaction occurs when you use cash, a credit card, or a debit card to make a purchase. This type of transaction decreases your account balance.

A credit expense account, on the other hand, is used to record expenses that have been incurred but not yet paid. This can include expenses like rent, utilities, or subscription services.

What Are Debits?

Debits are an entry made on the left side of an account. They either increase an asset or expense account or decrease equity, liability, or revenue accounts.

To illustrate, you debit the purchase of a new computer by entering it on the left side of your asset account. This is because debits increase asset accounts.

See what others are reading: Accounts Receivable Current or Noncurrent

Debits are a crucial part of recording transactions in your accounting books. They are equal but opposite entries in your books, with credits decreasing the opposite account.

For example, if you debit the purchase of a new computer, you would credit the decrease in cash, which is an asset account. This is a fundamental principle of double-entry bookkeeping.

General Rules for Debits

In accounting, debits and credits are equal but opposite entries in your books. If a debit increases an account, you must decrease the opposite account with a credit.

The total dollar amount of debits must equal the total dollar amount of credits in each business transaction. This is called double-entry procedure, or duality.

A debit is an entry made on the left side of an account, increasing an asset or expense account or decreasing equity, liability, or revenue accounts.

Debits and credits must always balance, just like the accounting equation: Assets = Liabilities + Equity. This balance is enforced by the rules of debit and credit.

Here are the general rules for debits:

Remember, the accounting requirement that each transaction be recorded by an entry that has equal debits and credits is essential for maintaining balance in the accounting equation.

Debit Accounts

Debit accounts are a crucial part of accounting, and understanding how they work is essential for managing your finances effectively.

Debit accounts increase asset or expense accounts, or decrease equity, liability, or revenue accounts. This is a key concept to grasp, as it will help you make accurate journal entries and balance your books.

For example, if you purchase a new computer, you debit the asset account for the purchase price. This increases the asset account, reflecting the new computer as an asset of your business.

Assets, such as land, equipment, and cash, are increased by debits. This is because assets are physical or non-physical types of property that add value to your business.

Here's a quick reference guide to help you remember how debits affect different accounts:

By understanding how debits affect different accounts, you'll be able to make accurate journal entries and keep your financial records in order.

Debit vs Credit

Debits and credits are the two sides of an account, and they're neither increases nor decreases, but rather a way to reflect the effects of transactions on the accounting equation.

In accounting, debits and credits must always be equal, just like the scales. This is known as the accounting equation: Assets = Liabilities + Equity.

To determine whether a debit or credit is needed, you need to analyze the transaction and identify the account type. Assets, for example, have a normal debit balance, while liabilities have a normal credit balance.

Here's a quick guide to recording debits and credits:

Debits and credits can be tricky to understand at first, but once you master the technique, analyzing them will become second nature. Remember, debits and credits are equal but opposite entries in your books, and they must balance out to maintain the accounting equation.

The main accounts in accounting include assets, expenses, liabilities, equity, and revenue/income. Each account is affected differently by debits and credits, as shown in the chart above.

In each business transaction, the total dollar amount of debits must equal the total dollar amount of credits. This is known as double-entry procedure, or duality.

Debit Examples and Rules

A debit increases an asset or expense account, or decreases equity, liability, or revenue accounts.

To determine if a debit is needed, look for keywords like "purchased", "supplies", or "asset." These words indicate an increase in assets, which requires a debit.

Debits are recorded on the left side of an account, as seen in the example of purchasing a new computer.

The rule is that debits and credits must balance, just like the accounting equation. This means that if a debit increases an asset, a corresponding credit must decrease a liability or equity.

Here are some key terms to look out for when determining if a debit is needed:

- Purchased: Indicates an increase in assets, requiring a debit.

- Supplies: A type of asset, increasing the asset balance, which requires a debit.

- Asset: A resource owned by the business, increasing in value, which requires a debit.

To illustrate this, let's consider an example: On March 1, ABC Company purchased $1,000 worth of supplies on account from EFG Company. In this case, a debit is needed to increase the asset balance, as supplies are an asset.

Debit Accounting

Debits and credits are equal but opposite entries in the accounting books, which means that if a debit increases an account, a credit must decrease the opposite account.

The accounting equation, ASSETS = LIABILITIES + EQUITY, must always be in balance, and the rules of debit and credit enforce this balance. Debits simply mean the left side, and credits mean the right side of the T-account.

In each business transaction, the total dollar amount of debits must equal the total dollar amount of credits. This is called the double-entry procedure, or duality.

Here's a quick summary of debit accounting:

In short, debits and credits are essential tools in accounting that help track and balance transactions effectively, ensuring that the accounting equation remains in balance.

Debit Journal Entry

A debit journal entry is a record of a transaction that involves debits. It's a way to track and balance transactions in accounting. The debit journal entry must always balance with a corresponding credit.

The T-account is a visual representation of an account, and it's often used to track debits and credits. Debits are recorded on the left side of the T-account, and credits are recorded on the right side.

Here's a basic example of a debit journal entry:

In this example, if you increase one account, you need to decrease the other account and vice versa. The debit and credit must always be equal.

Debits in Accounting

Debits are increases to asset accounts, which means they represent the resources that a business owns.

In accounting, debits are recorded on the left side of the T-account, and they must always balance with credits on the right side.

Debits can be increases to asset accounts, such as supplies, or decreases to liability accounts, such as accounts payable.

For example, when ABC Company purchased $1,000 worth of supplies on account from EFG Company, they debited the supplies account by $1,000 to reflect the increase in assets.

A debit to an asset account like supplies increases its balance, while a debit to a liability account like accounts payable decreases its balance.

Here's a key point to remember: debits are used to increase asset accounts and decrease liability accounts.

Here are some examples of debits to asset accounts:

- Purchasing supplies: Debit supplies account

- Purchasing equipment: Debit equipment account

- Purchasing inventory: Debit inventory account

Debits are an essential part of double-entry bookkeeping, which requires making two or more entries for every transaction.

Frequently Asked Questions

What happens when I credit an expense account?

When you credit an expense account, you are actually decreasing its value. This is the opposite of what happens with income accounts, where crediting increases the value.

Can you have a credit balance in an expense account?

Yes, it's possible to have a credit balance in an expense account, but it's not the normal case. This occurs when an expense account is credited, typically when it's related to a liability or asset account.

What is an example of an account credit?

A credit is an accounting entry that decreases assets and increases liabilities, such as paying rent for a firm's office. This type of transaction is typically recorded on the right side of a journal.

Sources

- https://fitsmallbusiness.com/debits-and-credits/

- https://www.patriotsoftware.com/blog/accounting/debits-and-credits/

- https://www.accountingcoach.com/debits-and-credits/explanation

- https://courses.lumenlearning.com/suny-finaccounting/chapter/general-rules-for-debits-and-credits/

- https://www.principlesofaccounting.com/chapter-2/accounts-debits-and-credits/

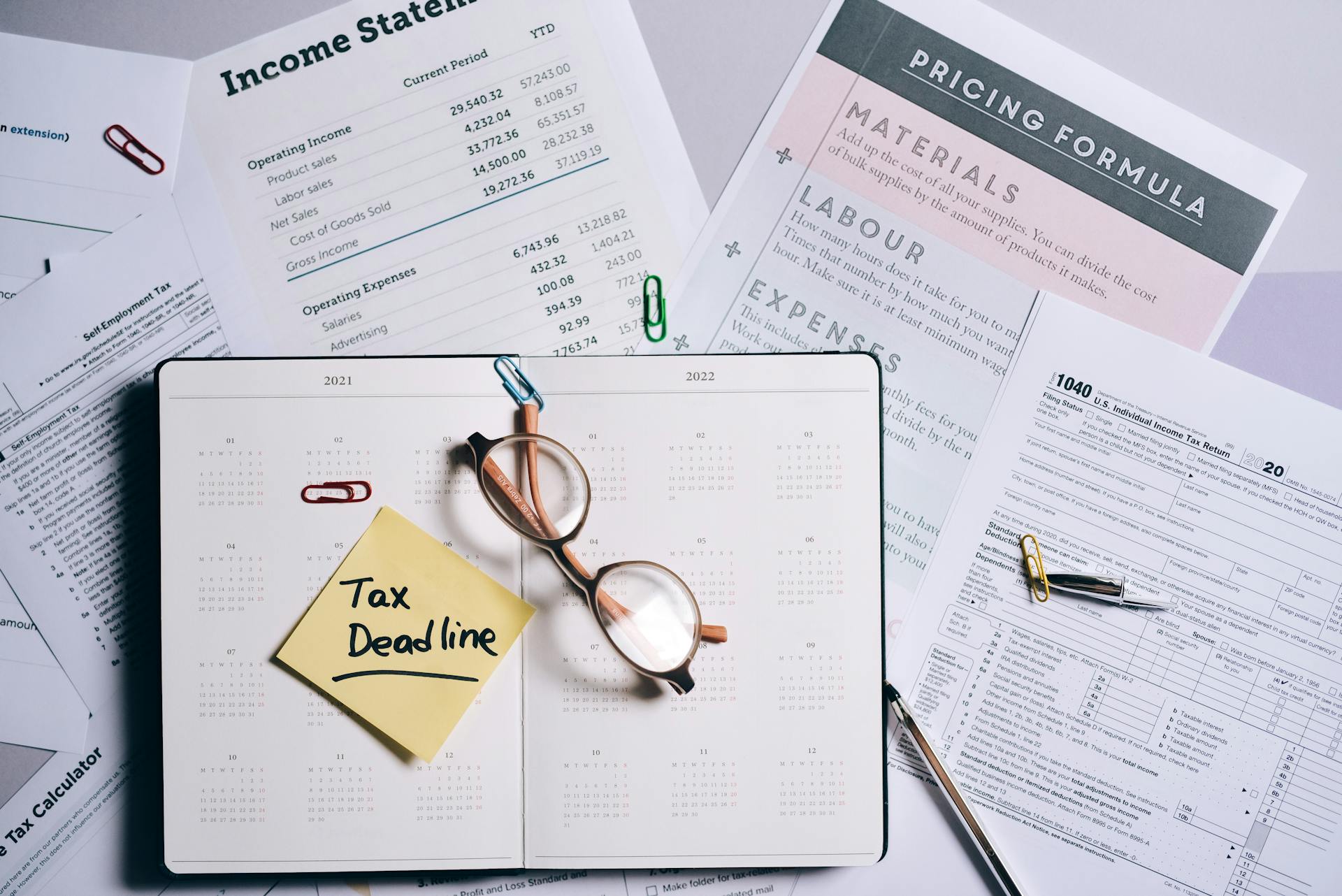

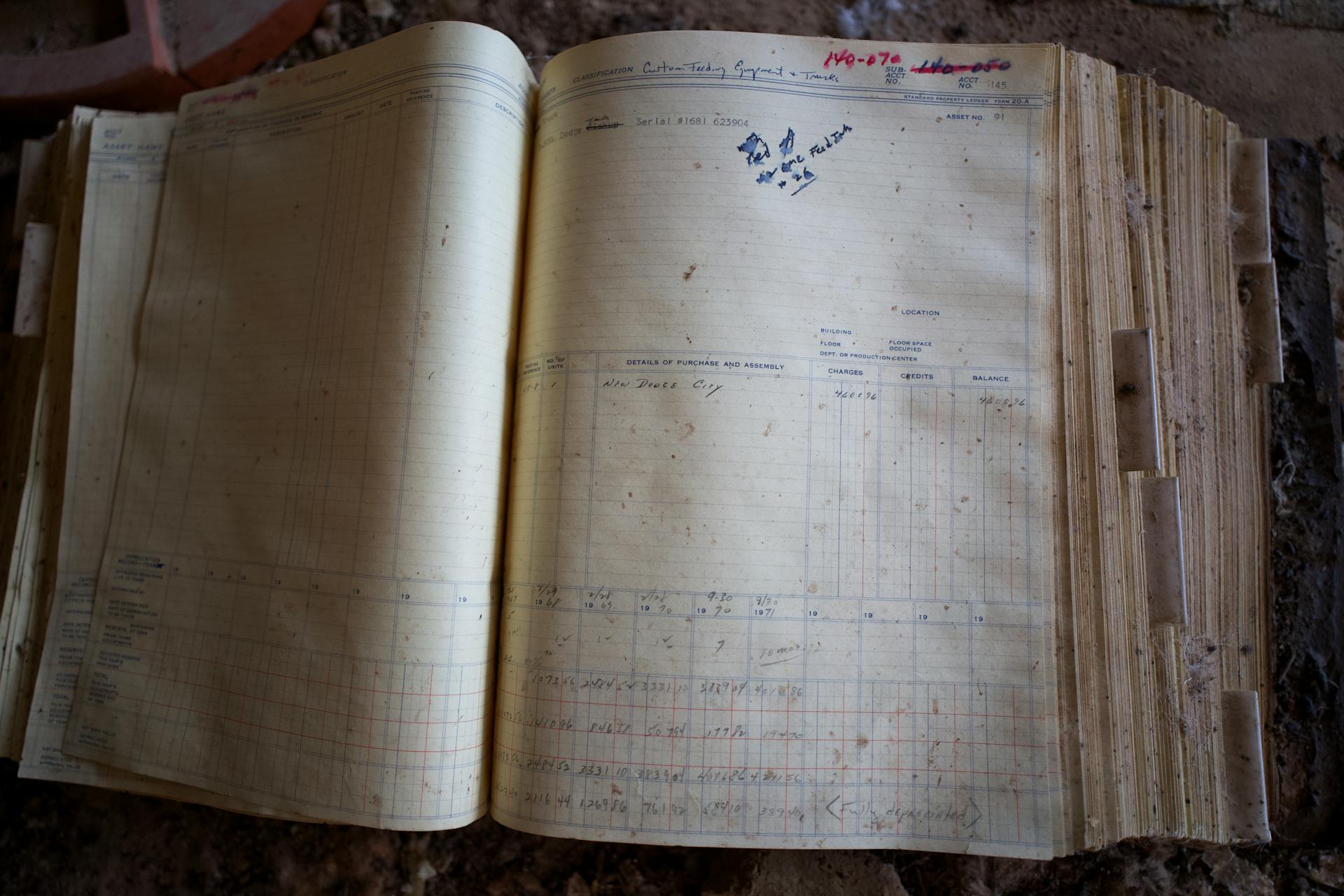

Featured Images: pexels.com