Computer repair insurance is a must-have for businesses that rely heavily on technology. This type of insurance can provide financial protection in the event of hardware or software failures.

A single data breach can cost a business an average of $3.86 million, making it crucial to have a plan in place to prevent and respond to such incidents.

Common Risks and Protection

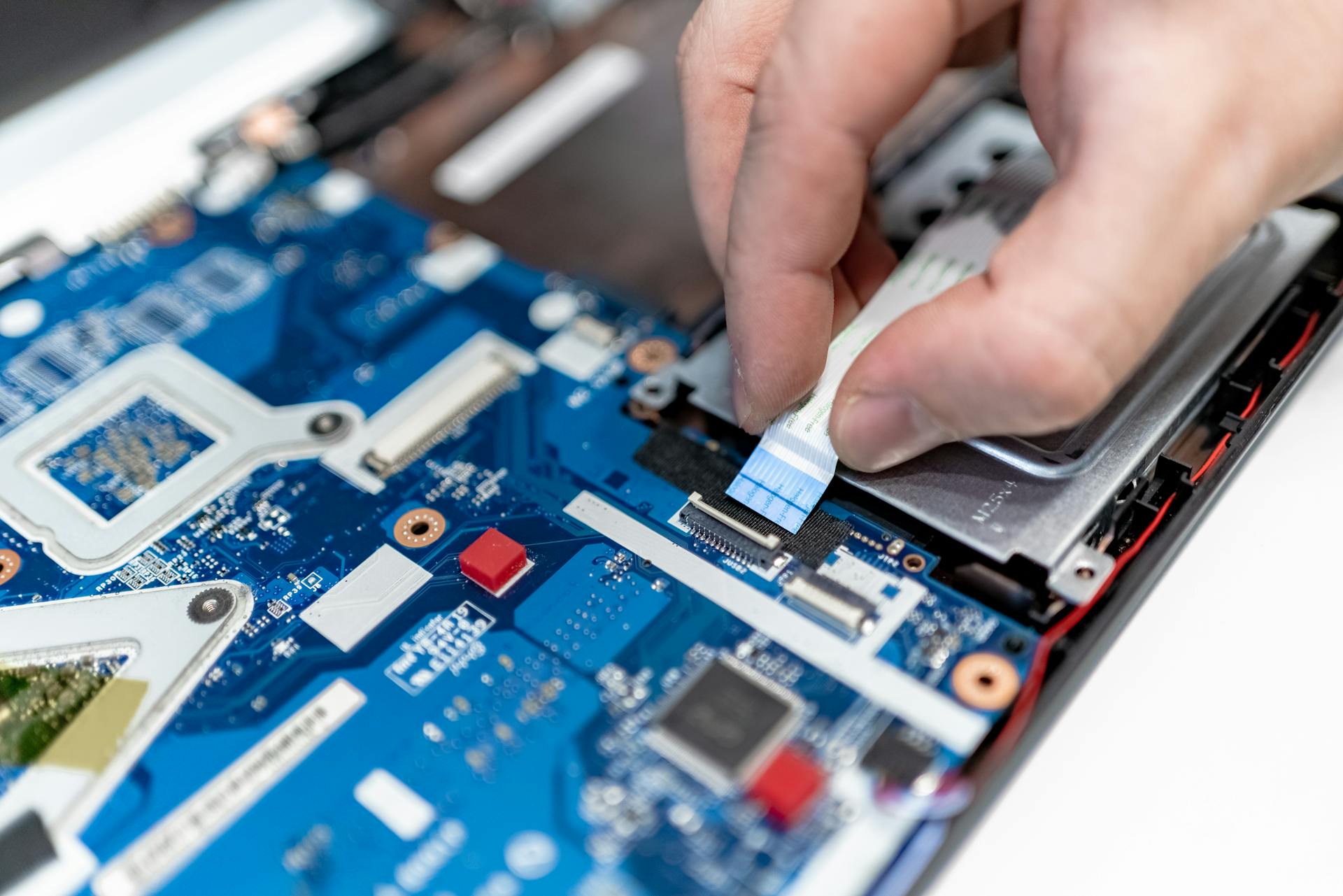

Accidental damage to customer property or equipment is a common risk associated with a computer and laptop repair company. This can lead to costly repairs or replacement, and in some cases, you could be held financially responsible for stolen equipment.

General liability policies usually don't cover damage to customer property or equipment unless caused by your or your employee's negligence. That's why businesses should consider additional policies, such as inland marine insurance, when operating away from their physical locations.

Damage from natural disasters like floods or fires can also be a significant threat to your business. Commercial property insurance can provide coverage against loss, theft, or damage of your business property, including office equipment, furniture, and computer equipment stored in your business premises.

Intriguing read: Business Computer Insurance

The average cost of errors and omissions insurance for computer repair technicians is around $59 per month, or $713 annually. This policy bundles errors and omissions insurance with cyber insurance at a lower cost than buying the policies separately.

Small business liability insurance is a must for computer repair shops, as it protects against financial losses resulting from damage to customer equipment and property during the course of doing repairs.

Curious to learn more? Check out: Laptop Computer Insurance

Technology Errors

Computer repair shops are exposed to many common risks, including errors and omissions occurring by the technicians. This can lead to financial losses and damage to your business reputation.

The cost of errors and omissions insurance depends on factors such as the coverage limits you choose, the size of your business, and the repair services you offer. You can expect to pay an average of $59 per month, or $713 annually, for tech E&O insurance.

Errors and omissions insurance provides financial protection against claims of professional negligence, such as failing to repair a client's computer by a promised deadline. This can result in a lawsuit and financial losses for your business.

Related reading: Errors and Omissions Agreement

This insurance policy bundles errors and omissions insurance with cyber insurance at a lower cost than buying the policies separately. It's a good idea to consider this type of insurance to protect your business from these types of risks.

The average E&O insurance for computer repair technicians who buy from Insureon includes policy limits of $1 million per occurrence and $1 million aggregate, with a deductible of $2,500. This can provide significant financial protection for your business in the event of a claim.

Expand your knowledge: 2m Term Life Insurance

What If…

You've spent years building your computer repair business, but accidents can happen to anyone. A customer's laptop can be damaged in your care.

What if you drop a client's computer? You could be liable for the damage. A fire at your workshop could destroy all your equipment and data.

Who is liable when one of your employees spills a drink on a client's laptop? The employee, the business owner, or both. Computers in your possession can be stolen from your car, and you'll need insurance to cover the loss.

A customer's laptop can be damaged in your care, and without the right insurance, you could be facing significant financial losses.

See what others are reading: Bcbs Alabama Customer Service

Liability and Workers' Compensation

Computer repair businesses need to consider liability and workers' compensation insurance to protect themselves from potential risks.

General liability insurance, which costs an average of $30 per month or $362 per year, can help cover costs related to customer property damage or bodily injury, as well as lawsuits for copyright infringement and defamation.

A business owner's policy, which bundles general liability insurance with commercial property insurance, is usually recommended for small, low-risk computer repair businesses and costs around $46 per month or $550 per year.

Workers' compensation insurance, which costs an average of $48 per month or $581 annually, is typically required for computer repair companies with one or more employees to comply with state requirements and avoid penalties.

If an employee suffers a work-related injury or illness, workers' comp coverage pays for medical expenses and disability benefits, and also often includes employer's liability insurance to cover defense costs and other legal fees in the event of a lawsuit.

For more insights, see: What Auto Insurance Companies Offer 12 Month Policies

General Liability

General liability insurance is a must-have for computer repair businesses, protecting them from accidents that harm customers or damage their property. Computer repair stores pay an average of $30 per month, or $362 per year, for general liability insurance.

A general liability policy helps pay for legal costs from accidents that harm a customer or damage a customer's property, along with advertising injuries. For example, it would cover costs if a customer trips over a loose cable in your shop and suffers a concussion or other bodily injury.

Most policies include product liability insurance, which covers costs related to faulty motherboards and other defective products. You may need to add bailee coverage to protect against accidental damage to customers' computers and other electronic devices in your care, custody, or control.

The average general liability coverage for computer repair businesses that buy from Insureon has a premium of $30 per month, policy limits of $1 million per occurrence; $2 million aggregate, and a deductible of $500.

A unique perspective: Desktop Computer Shipping Services with Insurance

A business owner's policy (BOP) is often recommended by licensed agents, combining general liability insurance with commercial property insurance at a discount. For computer repair shops, the average premium for a BOP is $46 per month or $550 per year.

Business interruption insurance can be added to a BOP to protect against financial losses from a forced closure due to a fire or storm. The cost of general liability insurance depends on factors such as the coverage limits you choose, the size of your business, the amount of foot traffic, and any subcontractors or additional insured endorsements.

You might enjoy: How Much Is Car Insurance in Ireland per Month

Workers' Compensation

Workers' compensation insurance is a must-have for many computer repair businesses, especially those with employees. Computer repair business owners spend an average of $48 per month, or $581 annually, for workers' compensation insurance.

This policy pays for medical expenses and disability benefits when you or an employee suffers a work-related injury or illness. For example, if an employee at your computer repair shop develops carpal tunnel, a workers' comp policy would pay for their treatments and lost income while they recover.

Additional reading: Employee Benefits Insurance Broker

Workers' comp coverage also often includes employer's liability insurance, which pays for defense costs and other legal fees in the event of a lawsuit related to workplace injuries. Most health insurance plans can deny claims for injuries that occur at your jobsite, making workers' comp highly recommended even for sole proprietors or independent contractors.

The cost of workers' comp is based on numerous factors, including the number of employees you have and their occupational risks.

Related reading: Workers Comp Insurance Carriers

Cyber and Auto Insurance

Cyber and Auto Insurance are two essential policies for computer repair companies. Cyber insurance provides protection against cyber threats and data breaches, and the average monthly cost is $82.

If you're not already taking steps to secure your business online, you may be putting yourself at risk. This type of insurance can help cover the costs of a data breach, including notifying customers and providing credit monitoring.

The cost of cyber insurance may seem steep, but it's a necessary investment to protect your business. Here's a breakdown of the average monthly costs for cyber insurance and other policies:

Commercial auto insurance is also a must-have for computer repair companies that use company vehicles. The average monthly cost for this type of insurance is $205.

Why and How to Get Covered

As a computer repair technician, you're no stranger to dealing with frustrating and complex situations. The process of finding the right insurance coverage can be just as daunting, slowing down your ability to service your customers.

You know how it feels to be left exposed and vulnerable to unexpected costs and liabilities. Having the right insurance coverage can give you peace of mind and financial protection.

The process of getting covered can be overwhelming, but it's a crucial step in protecting your business and reputation. We'll walk you through your new policy step by step, so you can focus on what you do best – fixing computers and helping your customers.

Discover more: Business Process Outsourcing Insurance Industry

Prevention and Safety

Accidents happen, and it's essential to take preventive measures to minimize risks. Having a clear understanding of your potential risks is the first step to creating a safe working environment.

Employee negligence can lead to significant financial losses. Accidents such as an employee spilling coffee on a client's computer can cause thousands of dollars in damages and legal fees.

Check this out: Employee Health Insurance Taylor Benefits Insurance

Regular training and supervision can help prevent accidents. This includes teaching employees about proper handling and care of equipment.

Businesses should also consider implementing safety protocols to prevent damage to customer property or equipment. This can include using protective covers or taking extra precautions when working on sensitive equipment.

Data breaches and cyberattacks are also a significant risk for computer repair companies. Having cyber liability coverage can help mitigate these costs and give you peace of mind.

Having a clear plan in place for disaster recovery can help minimize downtime and financial losses. This includes having a backup plan for data storage and a process for quickly restoring systems in case of a disaster.

By taking these preventive measures, you can significantly reduce the risk of accidents and minimize financial losses.

Suggestion: Life Insurance Retirement Plan Lirp

Key Takeaway

When it comes to computer repair insurance, it's essential to consider a variety of insurance types to protect your business from different risks.

You should consider errors and omissions insurance (e&o), which can help protect your company from lawsuits and financial losses due to mistakes or negligence.

Cyber liability insurance is also crucial, as it can help cover costs associated with data breaches and cyber attacks.

Fidelity bonds can provide protection against employee theft and dishonesty, which is a common risk in the computer repair industry.

General liability insurance can help cover costs associated with property damage, personal injury, and other accidents.

Worker’s compensation insurance is necessary to protect your employees in case of work-related injuries or illnesses.

Commercial auto insurance can help cover costs associated with company-owned vehicles.

Working with an experienced business insurance agency, like The Allen Thomas Group, can help you find the right insurance for your computer repair business.

Not all insurance programs are available in all states, so be sure to check the availability of insurance programs in your area.

Here are the different types of insurance you should consider for your computer repair business:

Frequently Asked Questions

Does insurance cover a broken computer?

Insurance may cover a broken computer if it's damaged by a covered peril, such as a fire or theft, but check your policy for specific details

How much does it cost to insure a computer?

The cost to insure a computer is based on its value, with a rate of $1 per $100 in value, or $1.75 for items valued $100,000 or more. The annual premium will be calculated accordingly.

What is repair cost insurance?

Repair cost insurance pays for damage repairs or replacements without considering depreciation, up to the policy limit, for total losses. It settles partial losses at functional replacement cost, also up to the policy limit.

Sources

- https://www.insureon.com/technology-business-insurance/computer-repair-businesses/cost

- https://www.techinsurance.com/technology-business-insurance/computer-repair/cost

- https://allenthomasgroup.com/commercial-insurance/industries/technology/computer-repair/

- https://www.insuranceadvisor.com/technology-business-insurance/computer-repair-businesses

- https://smallbusinessliability.com/computer-repair-business-insurance/

Featured Images: pexels.com