Cold storage REITs are a rapidly growing sector, with companies like Americold Realty Trust and Lineage Logistics leading the charge.

The demand for cold storage space is driven by the growth of the e-commerce industry, which requires efficient and reliable logistics to get products from warehouses to consumers quickly.

Cold storage REITs are well-positioned to capitalize on this trend, with Americold Realty Trust reporting a 12.5% year-over-year increase in revenue in 2020.

Investors are taking notice, with cold storage REITs experiencing significant appreciation in value over the past few years.

Intriguing read: Kimco Realty Stock Market Quote

Market Trends and Opportunities

The market for cold storage REITs is growing rapidly, with a projected 15% annual growth rate through 2025.

This growth is driven by the increasing demand for e-commerce and online shopping, which requires efficient and reliable cold storage facilities.

Cold storage REITs are well-positioned to capitalize on this trend, with the ability to provide scalable and flexible storage solutions.

Worth a look: Mgm Growth Properties Llc Stock

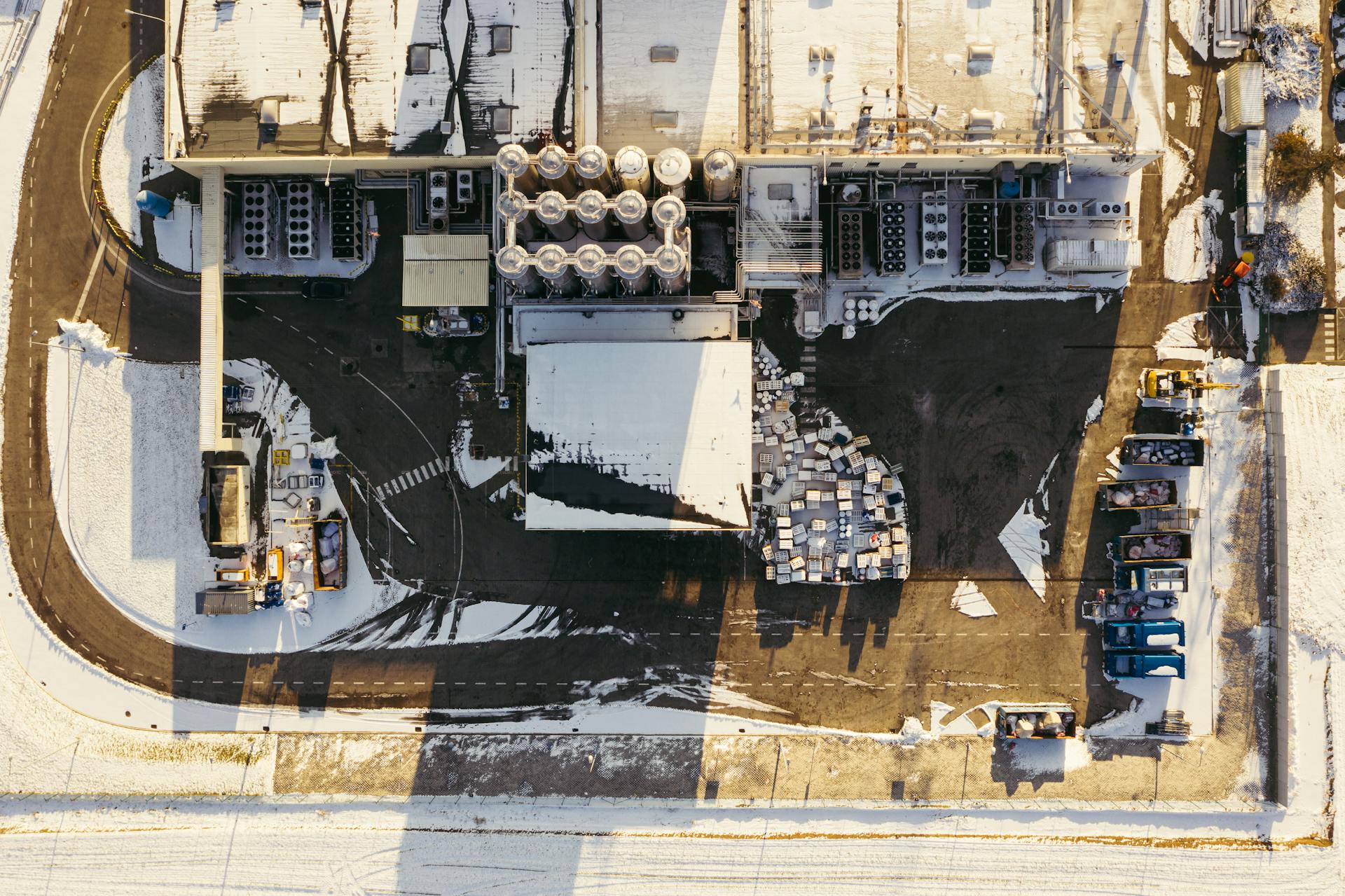

Many cold storage REITs are investing in modern and sustainable facilities, such as the 1.1 million square foot facility mentioned in the article, which features advanced climate control and energy-efficient systems.

These investments are paying off, with some cold storage REITs reporting occupancy rates of over 95%.

The cold storage REIT sector is also benefiting from the increasing demand for pharmaceutical and biotechnology storage, which requires specialized and secure facilities.

In fact, some cold storage REITs are reporting significant revenue growth from these specialized storage services.

Additional reading: Do Reits Issue K1

Industrial REIT Sector

The industrial REIT sector has seen significant growth due to manufacturing and logistics companies' shift away from owning real estate. This trend is driving the sector's expansion.

Industrial REITs benefit from long-term triple net leases, which provide steady cash flow and make them relatively recession-resistant. This is a key advantage for investors looking for stable returns.

However, industrial REITs also face risks such as overbuilding, which can lead to a surplus of available properties. This can negatively impact stock prices and financing.

Some industrial REITs are worth considering, but it's essential to carefully evaluate their strengths and weaknesses.

Consider reading: Industrial Reits List

Risks and Considerations

Cold storage REITs, like industrial REITs, face risks and considerations that investors should be aware of.

Overbuilding is a significant risk in the industrial real estate industry, including cold storage. If developers build too much speculative capacity in certain markets, occupancy levels and rental rates can decline.

Rising interest rates can also impact cold storage REITs, making it harder for them to finance operations and potentially weighing on stock prices.

Industrial REITs, including those that focus on cold storage, face two common risks: interest rates and financing risks. Rising interest rates can drive up expenses and make it harder to finance operations.

Here are some key risks and considerations to keep in mind:

- Overbuilding risks: Cold storage REITs may build too much capacity in certain markets, leading to declining occupancy levels and rental rates.

- Interest rate risks: Rising interest rates can drive up expenses and make it harder to finance operations.

- Financing risks: Higher interest rates can make it harder for cold storage REITs to finance their operations, including expansions and development projects.

These risks are not unique to cold storage REITs, but rather common to the industrial REIT sector as a whole.

Americold Realty

Americold Realty has a significant presence in the cold storage REIT space, but unfortunately, we don't have any information about them in the provided article sections. However, we can discuss some general characteristics of a successful cold storage REIT, which might be relevant to Americold Realty.

For another approach, see: Sila Realty Trust Investor Relations

A strong financial position is crucial for a cold storage REIT, and Prologis Inc's financials are a great example of this. They have a debt-to-EBITDA ratio under 5.0, which is considered financially strong.

Americold Realty's financials might be similar, but we can't say for sure without more information.

Prologis Inc's total gross assets under management (AuM) is $199 billion, with only 25% outside the US. This level of assets and geographic focus might be similar for Americold Realty.

I'm not aware of any specific information about Americold Realty's AuM or geographic focus, but Prologis Inc's numbers are certainly impressive.

Prologis Inc generates revenue from 5,576 real estate, typically leased to logistics facilities. This type of revenue stream might be similar for Americold Realty, which focuses on cold storage facilities.

On a similar theme: Realty Income Corporation O

Sources

- https://www.investing.com/analysis/2-cold-storage-reits-to-buy-as-industry-heats-up-200650473

- https://www.freightwaves.com/news/cold-storage-reit-lineage-ipo-hauls-in-4-4b

- https://talkmarkets.com/content/real-estate--reits/increased-demand-for-cold-storage-warehouses-is-a-profit-opportunity

- https://www.fool.com/investing/stock-market/market-sectors/real-estate-investing/reit/industrial-reit/

- https://www.freightwaves.com/news/cold-storage-reit-lineage-files-for-ipo

Featured Images: pexels.com