Celestia's tokenomics is designed to incentivize participation and growth within the network. The token, CELESTIA, is used to pay for services and storage on the network.

The total supply of CELESTIA is capped at 1 billion tokens. This cap helps maintain the token's value and prevents inflation.

The token's value is also influenced by the network's growth and adoption. As more users join the network, the demand for CELESTIA increases, which can drive up its value.

Suggestion: Manta Network Tokenomics

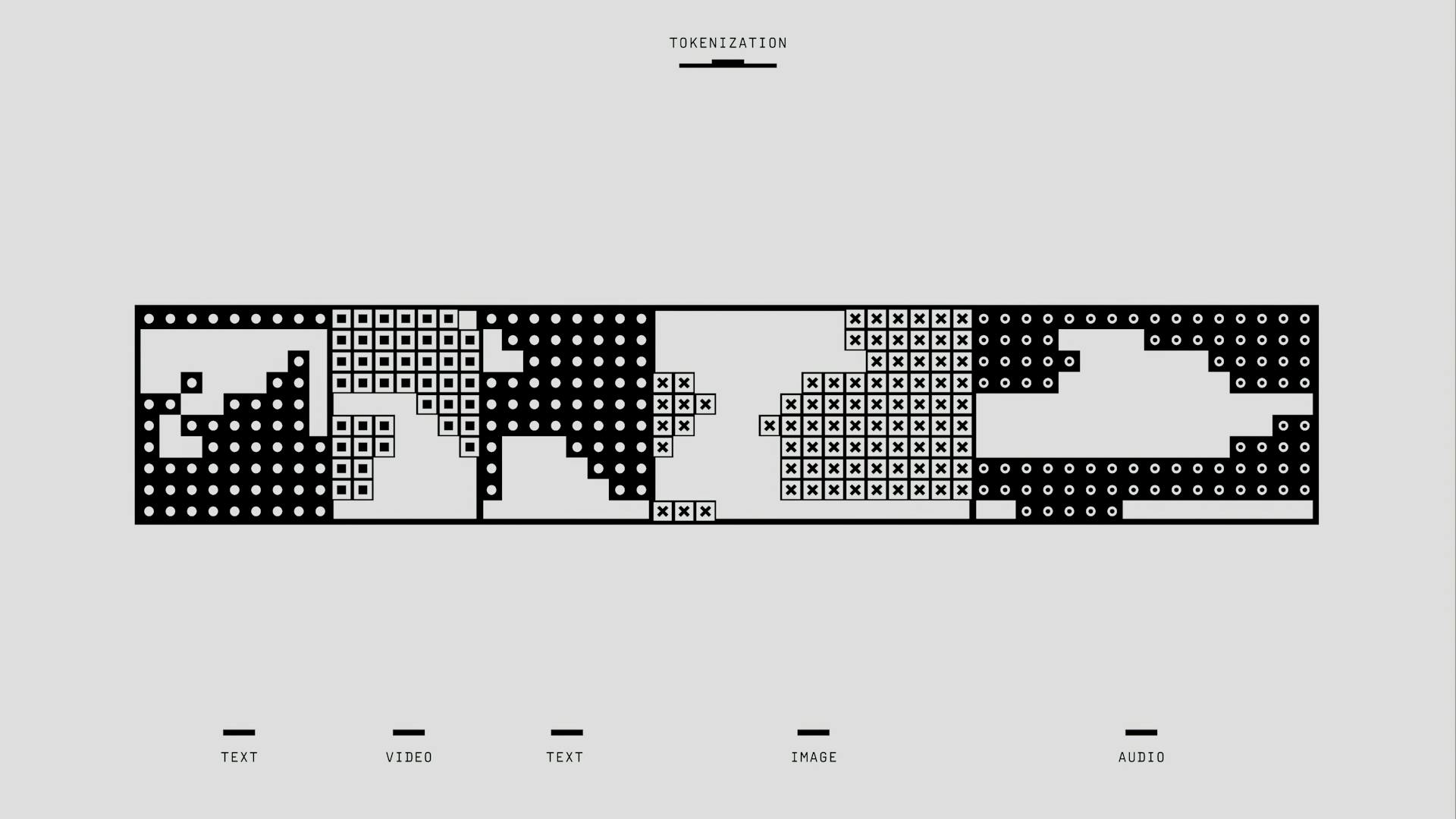

Tokenomics Basics

Tokenomics is the economic system based on the use of tokens within a blockchain ecosystem. Tokens can serve various functions, such as a medium of exchange, a store of value, and a governance right within the project.

In simple terms, tokenomics is like a game where tokens are the currency, and the rules of the game determine how they're used and valued. Tokenomics provides a framework for understanding how tokens work and how they're used within a blockchain ecosystem.

Tokenomics is based on the idea that tokens can serve multiple purposes, such as being a medium of exchange, a store of value, or a governance right.

What Is Tokenomics?

Tokenomics is the economic system based on the use of tokens within a blockchain ecosystem. Tokens can serve various functions, such as a medium of exchange, a store of value, and a governance right within the project.

A token can be used as a medium of exchange, allowing users to buy and sell goods and services within the blockchain ecosystem. This is similar to how traditional currencies like dollars or euros work.

Tokens can also serve as a store of value, meaning they can be held onto for future use or as a form of investment. This is similar to holding onto stocks or bonds in a traditional financial system.

Governance rights are another function of tokens, allowing holders to vote on decisions within the project. This gives token holders a sense of ownership and control over the project's direction.

Importance of Incentives

Incentives play a crucial role in maintaining the functionality and security of decentralized networks. This is especially true for Celestia, where its incentive system motivates participants to perform necessary actions to ensure the network's stability and efficiency.

Participants receive rewards for their activities, which encourages them to actively support the network. This is an example of Participation Rewards, where participants receive regular rewards for their efforts.

Reduced Fees are another incentive that benefits participants who delegate their tokens and support the network. By doing so, they can receive discounts on transaction fees, making it more cost-effective for them to participate.

Voting Rights are also an important incentive, allowing TIA token holders to participate in network governance by voting on proposals to improve the system. This gives them a say in the direction of the network and allows them to shape its future.

Here are some examples of incentives in action:

- Participation Rewards: Participants receive regular rewards for their activities.

- Reduced Fees: Participants receive discounts on transaction fees when they delegate their tokens and support the network.

- Voting Rights: TIA token holders can vote on proposals to improve the system.

Token Unlocks Timeline

Core contributors will receive their tokens after a 1-year cliff, with a vesting schedule of 2 years.

The allocated supply for future initiatives is 12.6%, and all tokens have already been unlocked.

A 25% unlock of the allocated supply for research and development is expected, with a 3-year vesting schedule.

Seed investors will receive their tokens after a 1-year cliff, with a vesting schedule of 1 year.

Series A and Series B investors will also receive their tokens after a 1-year cliff, with a vesting schedule of 1 year.

Here's a breakdown of the token unlocks timeline for each category:

Main Token: Tia

The Main Token: Tia is the primary token used in the Celestia ecosystem. It serves multiple functions, including transaction fees, staking, and voting.

Users pay fees for processing transactions and storing data on the Celestia network using TIA tokens. This helps to secure the network and maintain its integrity.

TIA token holders can participate in the staking mechanism, locking their tokens to support the network and earning rewards. Staking is a crucial aspect of the Celestia ecosystem, as it helps to secure the network and validate transactions.

TIA tokens grant holders the right to vote in network governance, allowing them to make decisions on updates and improvements. This ensures that the network is maintained and improved by its users.

Here are the main functions of TIA tokens:

- Transaction Fees: Users pay fees for processing transactions and storing data on the Celestia network.

- Staking: TIA token holders can participate in the staking mechanism, locking their tokens to support the network and earning rewards.

- Voting: TIA tokens grant holders the right to vote in network governance, allowing them to make decisions on updates and improvements.

Token Distribution and Staking

The token distribution in Celestia is designed to ensure the long-term sustainability of the network, with 20% allocated to Team and Developers, 25% to Early Investors, 15% to Eco Fund, and 40% to Staking Rewards. This distribution helps balance the interests of developers, investors, and network participants.

A significant portion of the tokens, 40%, is allocated to Staking Rewards, which is a key mechanism for securing the network and incentivizing participation. This is a crucial aspect of Celestia's tokenomics.

The token distribution also includes allocations for Core Contributors, Future Initiatives, Genesis Drop & Testnet, Research / Development & Ecosystem, Seed, and Series A, Series B investors. For example, Core Contributors receive 17.6% of the allocated supply, with a cliff of 1 year and monthly vesting over 2 years.

Here's a breakdown of the token distribution:

Staking is the process of locking tokens to support the network and earn rewards. In Celestia, this process includes validator selection, token locking, and rewards for validators and delegators. Validators are responsible for verifying transactions and adding blocks to the chain, and delegators can delegate their tokens to these validators.

Tokenomics Analysis

The Celestia tokenomics are designed to incentivize participants to contribute to the network, with a total supply of 100 million tokens.

The token distribution is as follows: 40% of tokens are allocated to the community, 20% to the foundation, and 10% to the core team, with the remaining 30% reserved for future development.

A total of 50% of the tokens will be unlocked in the first 5 years, with 10% unlocked annually.

The token price is expected to increase as the network grows and more users join, with a projected price of $1 in the first year and $10 in the fifth year.

The token has a fixed supply, which helps to prevent inflation and maintain the token's value.

The tokenomics are designed to create a long-term sustainable economy, with a focus on community participation and growth.

Examples and Surges

The Celestia tokenomics model is designed to encourage long-term participation and investment in the network.

The token's supply is capped at 10 billion, with a 5% annual inflation rate.

As a result, the token's value is expected to surge in the long term.

This is because the scarcity of tokens will increase their value over time.

The tokenomics model also includes a vesting schedule, which means that a portion of the tokens are locked up for a certain period of time before they can be sold.

This helps to prevent a sudden surge in token supply and maintain the token's value.

Examples of Incentives

In the world of blockchain and cryptocurrency, incentives play a crucial role in motivating people to participate and contribute to the network. Participation Rewards are a great example of this, where individuals receive regular rewards for actively supporting the network.

Participants who delegate their tokens and support the network can receive discounts on transaction fees, making it a more cost-effective way to use the network.

Voting Rights are also a powerful incentive, allowing TIA token holders to participate in network governance and make decisions on updates and improvements.

Here are some examples of incentives that can motivate people to participate in the Celestia network:

These incentives can help surge participation and activity on the network, making it a more vibrant and dynamic community.

Celestia's Tia Token Surges 200% Since Debut

Celestia's TIA token has risen 200% since its debut, reaching a price of $6.30 despite muted on-chain activity. This is a remarkable feat, especially considering the token's slow start.

The token's rise doesn't correlate to an uptick in blockchain usage, with Celestia facilitating only 160,000 transactions since its launch, compared to 350,000 in the first two days.

TIA's trading volume is around $900 million over the past 24 hours, exceeding the market cap of all tokens in circulation. This is a staggering amount, and it's no wonder that traders are taking notice.

The token's tokenomics have caught the attention of traders, with just 141 million tokens of the 1 billion hard cap circulating. The majority of the total supply is locked up until October 2024 and October 2026.

This surge is reminiscent of Aptos, which also saw a massive increase in value after its release, despite low on-chain activity.

Sources

- https://tokentrack.co/tokens/celestia

- https://medium.com/@NODERS_TEAM/analyzing-economic-models-in-celestia-tokenomics-and-incentives-d95e106fa959

- https://en.cryptonomist.ch/2024/01/16/unstoppable-celestia-everything-you-need-to-know-about-the-tia-cryptocurrency-tokenomics/

- https://substack.com/home/post/p-148584763

- https://markets.businessinsider.com/news/currencies/celestias-tia-token-rises-200-since-debut-despite-muted-on-chain-activity-1032824237

Featured Images: pexels.com