Cash credit from unsettled activity can be a bit confusing, but don't worry, we've got you covered. Settlement funds are used to pay for unsettled activity, and they're typically deducted from your available cash credit.

Settlement funds are usually calculated as a percentage of the unsettled activity, which can range from 2% to 5% depending on the credit card issuer. This means that if you have $1,000 in unsettled activity, you might be charged a settlement fund of $20 to $50.

To avoid unnecessary settlement fees, it's essential to pay off your unsettled activity as soon as possible. This will help you save money on settlement funds and keep your cash credit available for other expenses.

Curious to learn more? Check out: Available Credit for Cash Meaning

Understanding Unsettled Activity

Liquidating an unsettled trade can have consequences, such as a 90-day restriction on the account. This occurs when you sell a security purchased with unsettled funds before the settlement date.

Selling a security on Thursday and then buying a different one on Friday is not a problem, but selling the second ETF on Friday before the first sale settles is a different story.

You can avoid this issue by waiting for the settlement date to pass before making further trades. But if you do liquidate an unsettled trade, be aware of the 90-day restriction that may follow.

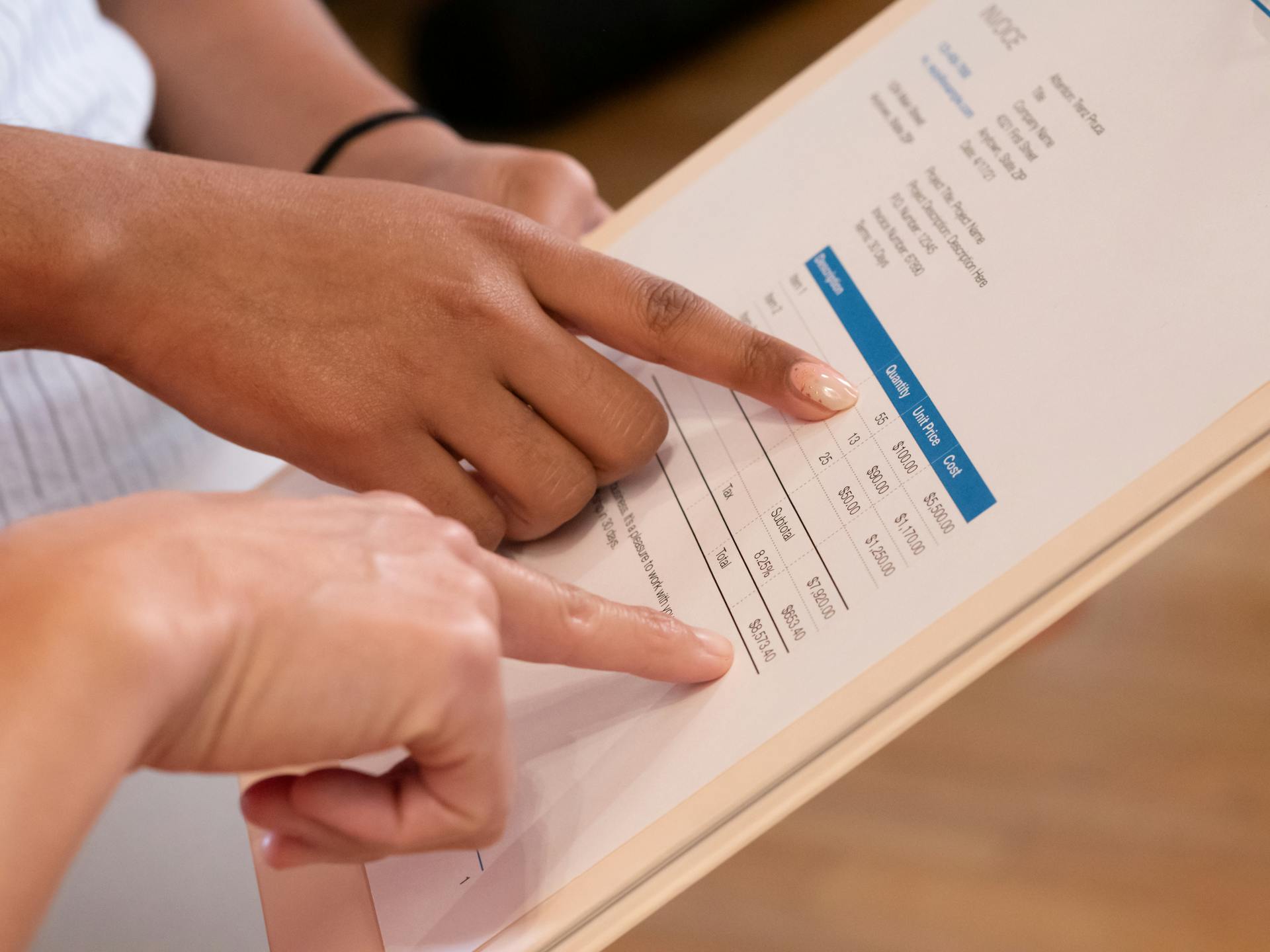

Here's a brief overview of the different balance update methods:

Settlement Period History

The settlement period has a rich history that's still relevant today. Congress directed the SEC to establish a national clearance and settlement system in 1975.

In 1975, the SEC made a bunch of rules, one of which was that trades settle five days after the trade date, known as "T+5." This gave buyers and sellers time to take care of necessary tasks.

The settlement period has been shortened over the years. In 1993, it was shortened to three days (T+3), and in 2017, it was shortened to two days (T+2).

Today, most securities settle in two days, except for government securities, options, commercial paper, and certificates of deposit, which settle in one or the same day, respectively.

Check this out: Capital One Savorone Cash Rewards for Good Credit

Here's a breakdown of the settlement periods for different types of securities:

- Stocks: Two days

- ETFs: Two days

- Corporate Bonds: Two days

- Municipal Bonds: Two days

- Foreign Exchange: Two days

- Government Securities: One day

- Options: One day

- Commercial Paper: Same day

- Certificates of Deposit: Same day

In May 2024, the settlement period will be shortened to one day (T+1), which will likely impact brokerages and their cash reserves.

Readers also liked: Net Income and Cash Flow from Operating Activities Will

Managing Unsettled Trades

Liquidating an unsettled trade can get you into trouble, literally. If you sell a security purchased with unsettled funds before the settlement date, you'll face a 90-day restriction on trading unsettled funds in the account.

To avoid this, pay attention to the trade date, not just the settlement date. The trade date is when you start owning the security, which is what matters for returns and dividend payments.

Late sales, also called trade liquidations, happen when you don't get settled money into the settlement account on time. This can lead to a 90-day restriction on trading unsettled funds in the account, and it's not just a matter of a delayed payment.

Discover more: Cash Advance from Credit Card to Bank Account

What Are Settlement Funds?

Settlement funds are the funds that are available after a trade has been fully completed, or settled. They are the result of a trade being finalized.

The settlement period is the time between the trade date and the settlement date, during which the trade is not yet finalized. This period can vary, but it's usually a few days.

Until the trade is settled, the funds are considered unsettled, and you don't have access to them. It's like holding onto a check until it's cashed.

The settlement date is when the trade is finalized, and the funds are released. This is when you start earning interest on your cash or dividends on your investments.

Unsettled Trade Liquidation

Late sales can occur when you don't get settled money into the settlement account on time, resulting in a 90-day restriction on trading unsettled funds in the account if it happens three times a year.

This restriction can be triggered if you sell a security purchased with unsettled funds before the settlement date, a process known as liquidating an unsettled trade.

Swapping from ETF to Fund

Swapping from an ETF to a fund can be tricky, especially if you're not aware of the settlement timelines. If you sell an ETF that settles on T+2 to buy a fund that settles on T+1, there won't be any cash in your account on T+1 to make the purchase.

This can lead to a problem, as you won't have the funds to buy the fund on the next business day. The ETF sale will settle two business days after the trade date, while the fund purchase will settle one business day after the trade date.

Discover more: Can U Buy a House with Cash without Credit

Penalties and Fees

If you're not careful, you could be hit with hefty penalties and fees for cash credit from unsettled activity. These fees can be as high as 25% of the credit amount.

Late payment fees can add up quickly, and some credit providers charge a flat fee of $30 or more for each missed payment.

In some cases, you may also be charged interest on the credit amount, which can range from 15% to 20% per annum.

If you're unable to pay back the credit, you may be charged a fee for dishonouring the payment. This can range from $15 to $30.

Some credit providers may also charge a fee for closing the account early, which can be as high as $100.

A fresh viewpoint: Wells Fargo Active Cash Card Foreign Transaction Fee

Frequently Asked Questions

What is unsettled cash credit?

Unsettled cash credit refers to available funds from selling securities, but be aware that using them before settlement can lead to a good-faith violation

How do I withdraw unsettled cash?

You can't withdraw unsettled cash until it's fully processed and settled. Once settled, you can access the funds for withdrawal.

Sources

- https://www.fidelity.com/products/stocksbonds/content/cash-total-account-value.shtml

- https://chaka.crunch.help/en/trading-investing-stocks/what-is-good-faith-violations

- https://www2.advisorchannel.com/wc/channel/jsp/sp3help/content/fwchlpaccountbalancesuic.htm

- https://developer.drivewealth.com/implementation/docs/account-trading-types

- https://www.whitecoatinvestor.com/unsettled-funds/

Featured Images: pexels.com