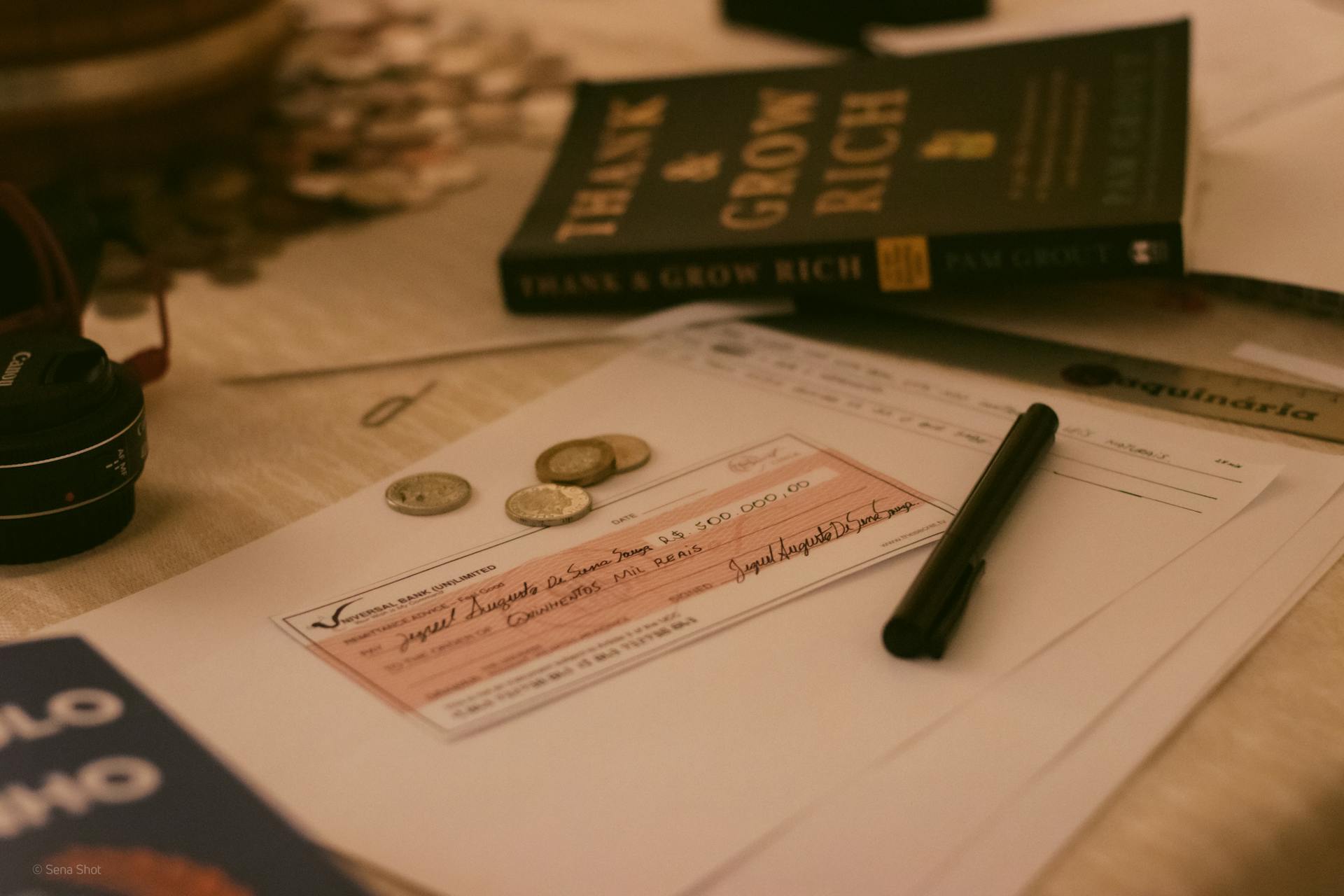

A cancelled check is a financial instrument that's been marked as paid or settled. It's a crucial document in the banking system.

A cancelled check is essentially a record of a transaction between a payer and a payee, where the payer has transferred funds to the payee. This transaction is then marked as completed by the bank.

The bank marks a cancelled check by writing "VOID" or "CANCELLED" across the front of the check, making it clear that the funds have been transferred and the check is no longer valid. This is a security measure to prevent the check from being reused or altered.

A cancelled check is usually kept by the payee as proof of payment, and it can be used as a record of the transaction for accounting and tax purposes.

Broaden your view: What Is Non Sufficient Funds

What Is a Cancelled Check?

A cancelled check is a check that has been processed and cleared by the bank, meaning the funds have been transferred from the payer's account to the payee's account.

Related reading: Do Banks Check Credit to Open a Checking Account

It's essentially proof that the transaction has been completed. The bank marks the check as paid, and it can no longer be used to withdraw funds from the account.

The cancellation stamp and signature of the bank on the check serve as proof of payment, which can be useful in case of disputes or for record-keeping purposes.

In the past, businesses and individuals relied heavily on checks for transactions, but today, while electronic payments are more common, checks remain important for certain types of payments, such as rent, utilities, and some business transactions.

A cancelled check can be used as evidence of payment for tax and business purposes, and it can also be requested from the bank if needed.

Most banks charge a fee for providing a copy of a cancelled check, but it can be useful in case of disputes or for record-keeping purposes.

To prevent the need for a cancelled check copy, it's recommended to keep a record of electronic payments and utilize online banking services for bill payments.

Here are some key differences between cancelled checks and bounced checks:

Overall, a cancelled check is an important financial tool that provides proof of payment and aids in record-keeping, even in today's digital banking era.

Examples and Uses

A canceled check is one that's cleared and paid by the bank, with funds transferred and the transaction completed.

You might hear people use the term "canceled check" incorrectly to refer to a check with a stop payment request, but that's not exactly what's happening.

A voided check is one you write "void" on, often needed for transactions like direct deposit.

These checks are out of circulation and not to be reused, which is why you'll see them referred to as canceled checks in certain situations.

When setting up direct deposit, you may need to provide a canceled check to your employer or financial institution.

Check this out: Cancelled Check for Direct Deposit

Fees and Charges

If you need to cancel a check, there's no fee involved if your bank cancels it after clearing it. This is a standard transaction at your bank or credit union.

A stop payment request, on the other hand, can cost between $15 to $35, depending on the bank.

You won't be charged a fee if you void a check.

Banking and Payment Checks and Cancelled Checks

A canceled check is a document that shows the details of a payment, including the payee name, amount paid, and date of payment. It's proof that a check has been processed and funds have been transferred between accounts.

To get a canceled check, you typically need to contact your bank, either by phone, in person, or through their website or app. This process is usually quick and easy, but it may take some time to receive a duplicate copy, especially if you're using a bank with strict security protocols.

Canceled checks are standard practice and don't incur any additional fees. They're also a secure way to verify payment, as they show that the funds have been cleared by the bank.

In contrast, stop payment requests are a different story. They require a call or visit to your bank right away and can incur fees. Stop payments are typically used to halt a payment that's already been made, such as if you think your check was stolen or lost.

A canceled check is different from a returned check, which is not paid or cleared by the bank because the account holder has insufficient funds. Returned checks can lead to negative consequences, including overdraft fees, bounced check fees, and potential damage to your credit standing.

Disputes and Issues

Acting promptly when raising a dispute is crucial to avoid legal implications. You can request a copy of the canceled check to clarify issues with transaction amounts or parties involved.

Contact your bank to request a copy, providing relevant details such as account number, check number, transaction date, and amount.

Explore further: Bank Routing Code Aba

Stop Payment Requests

Stop Payment Requests are a must-know for anyone who's ever had to cancel a check. They're a way to temporarily halt a payment, but they're not the same as canceling a check.

You'll need to contact your bank right away to request a stop payment, either by calling, visiting, or using their website or app. This needs to be done quickly, before the check is presented to deposit or cash.

Stop payment requests come with a fee, so be prepared to pay for this service. The good news is that many bank phone support lines operate 24/7, so you can reach out to your bank at any time.

A stop payment request usually lasts for up to six months, and you may need to renew it after that if you think there's a chance someone might still try to cash the check. Once it's paid by your financial institution, it's final and can't be reused.

Disputed Transactions

Disputed transactions can be a real headache, but knowing how to handle them can make all the difference. Bank customers disputed over $2.9 billion of fraudulent transactions in 2019 alone.

To resolve a transaction dispute, you may need to request a copy of the canceled check. This can help clarify issues with transaction amounts or parties involved.

Acting promptly when raising a dispute is crucial to avoid legal implications. The sooner you address the issue, the better.

You can request a copy of the canceled check by contacting your bank and providing relevant details such as account number, check number, transaction date, and amount.

Tax Purposes

Requesting a copy of a canceled check can be extremely useful for tax-related purposes, allowing you to provide concrete proof of payment.

Having a copy of the canceled check can help you answer critical questions and back up your claims with tangible proof.

Complying with the bank's or institution's procedure on obtaining copies of canceled checks is essential, as the process may vary depending on factors like the age of the check and your account holder status.

Don't miss out on critical opportunities because you don't have access to necessary documents like canceled checks, so make timely requests and keep them safe for future use.

I always request a copy of my canceled checks after a business trip to prove that my expense report isn't just a work of fiction, and it's a great way to ensure you have all necessary information at hand in case of any inquiry from authorities.

Tips and Information

Record each check you write and each checking account deposit you make in the transaction register. Include check number, date, payee, and amount.

Use the columns with a check mark on top to keep track of deposits or checks paid once they are cleared by your bank and reflected in your balance.

Keep your checkbook in a safe place, as you would a debit or credit card, to prevent checks from being forged by another person.

For important payments, consider keeping a copy of canceled checks, including the front and back, to maintain a record of your transactions.

Banks used to return canceled checks with paper statements, but now you can often download PDF images or request scanned images from your bank, sometimes for a fee.

Frequently Asked Questions

What is a cancelled check vs. voided check?

A canceled check is one that's been paid by a financial institution, while a voided check is one you've intentionally marked as "void" to prevent it from being used. Understanding the difference between these two can help you manage your finances more effectively.

Does a Cancelled check mean it was cashed?

A cancelled check indicates that the clearing process has been completed, but it doesn't necessarily mean the check was physically cashed. It means the check was deposited or cleared, rendering it null and void for further transactions.

Sources

- https://portal.ct.gov/DOB/Consumer/Consumer-Education/Checks-and-Related-Issues

- https://www.sofi.com/learn/content/what-is-a-canceled-check/

- https://bankquality.com/blog/understanding-cancelled-check/

- https://www.acquire.fi/glossary/canceled-check-definition-and-how-to-get-a-copy

- https://www.wallstreetmojo.com/canceled-check/

Featured Images: pexels.com