Debt collectors can't just take your car without following the law. In most states, a debt collector must obtain a court judgment against you before they can take possession of your vehicle.

To do this, they'll typically need to prove that you owe the debt and that you've been given proper notice. If you're behind on payments, the collector may try to repossess your car, but this process is often complex and requires specific procedures to be followed.

If a collector does obtain a court judgment, they may be able to seize your vehicle, but this is not a guarantee. In some cases, you may be able to negotiate a payment plan or settle the debt to avoid losing your car.

Discover more: Sell Judgment to Collection Agency

Understanding Debt Collection

You have the right to be notified of any legal action taken against you, including lawsuits filed by creditors seeking judgment liens or repossession.

Only assets that were used as collateral for a secured loan can be repossessed by a debt collector.

You have the right to defend yourself in court and present evidence on your behalf to dispute any claims made by creditors.

Debt collectors must follow specific laws and regulations, which vary by area, so it's essential to understand the laws in your region.

You will be notified of any legal action taken against you, giving you the opportunity to take steps to protect your assets, including your car.

Take a look at this: International Debt Collection Laws

Protecting Your Assets

You can protect your car from creditors by understanding the laws in your area. In some states, like Florida, you can exempt up to $5,000 of equity in your car from creditors if you file for bankruptcy.

If you're worried about losing your car, it's essential to know the exemption limits in your state. For example, in Ontario, a motor vehicle worth up to $6,600 is exempt from seizure.

You can also consider using a wildcard exemption, like in Florida, to protect an additional $4,000 in equity in any asset, including your car. This brings the total protection up to $9,000.

Here's a breakdown of the exemption limits in some states:

Keep in mind that these exemption limits are subject to change, so it's crucial to stay informed about the laws in your area.

Unsecured Loans

Unsecured loans don't involve collateral, which means creditors can't directly take your assets.

Examples of unsecured loans include credit card debt, medical bills, or personal loans. Creditors can't repossess your car or other assets for these debts.

However, they can sue you in court if you don't pay. If they win a judgment, they can place a lien on your assets, including your car, to force a sale and recover the debt.

There are often exemptions for essential items like a car, but the value limit varies.

Additional reading: What If I Don't Pay Debt Collectors

Asset Protection Basics

Asset protection is a crucial aspect of financial planning, and understanding the basics can help you safeguard your assets from creditors. A secured loan can put your assets at risk if you default on payments.

If you've taken out a car loan or title loan, your vehicle can be repossessed by the lender if you miss payments. This can happen without a court order.

You might enjoy: New Jersey Student Loan Program

A home equity loan or line of credit can also put your home at risk if you fall behind on payments, but repossession isn't the immediate consequence. Instead, the lender will start foreclosure proceedings, a more complex and time-consuming process.

Here are some key facts to keep in mind:

By understanding the risks associated with different types of loans, you can take steps to protect your assets and avoid financial hardship.

Ontario Exemption Limits

In Ontario, there's a law called the Execution Act that determines the value of a motor vehicle that's exempt from seizure.

A motor vehicle worth up to $6,600 is exempt from seizure, as of December 1, 2015.

This exemption may not be as straightforward as it seems, but it's a good starting point for understanding how to protect your assets.

If your car is worth less than $6,600, you might think it's safe from seizure, but that's not necessarily the case.

See what others are reading: What Should You Not Say to Debt Collectors

Negotiating with Debt Collectors

Negotiating with debt collectors can be a challenging but sometimes effective way to resolve a debt issue. You may be able to negotiate a settlement with the debt collector to allow you to pay off the judgment under better terms.

Debt collectors may be willing to accept a lump sum payment to settle the debt, which can be a more manageable option than paying off the debt in full. This is a common tactic used by debt collectors to resolve outstanding debts.

If you're struggling to pay off a debt, negotiating with the debt collector may be a viable option.

Negotiate to Pay Off the Judgment

You may be able to negotiate a settlement with the debt collector to allow you to pay off the judgment under better terms.

Paying off a judgment under better terms can give you some much-needed relief from debt collector calls and letters.

To negotiate a settlement, you'll need to contact the debt collector and explain your situation.

Being honest and transparent about your financial struggles can help the debt collector understand your perspective and be more willing to work with you.

A settlement may involve paying a lump sum or making installment payments over time.

For another approach, see: Will Paying Debt Collectors Help My Credit

Right to Fairness

You have the right to be treated fairly and respectfully by creditors and collection agencies. Harassment, threats, or abusive tactics are prohibited by law. You have the right to report any violations to the appropriate authorities.

If you feel like you're being treated unfairly, don't hesitate to speak up. You can report any abusive or harassing behavior to the Federal Trade Commission (FTC) or your state's Attorney General's office.

Remember, you have the power to stand up for yourself and demand fair treatment.

On a similar theme: Truth in Lending Act Right of Rescission

Bankruptcy and Debt Relief

Navigating the complexities of bankruptcy law can be overwhelming, especially when your essential assets, like your car, are at stake. Filing for bankruptcy involves paperwork, deadlines, and court appearances, which can be daunting without guidance.

In Florida, understanding the vehicle exemptions available is key to making the most of bankruptcy protections. An experienced bankruptcy attorney can help you identify all applicable exemptions.

An attorney can guide you through every step of the bankruptcy process, ensuring that your documents are accurate and your case is filed correctly, reducing the risk of losing property unnecessarily. This can bring peace of mind during a stressful time.

Curious to learn more? Check out: Free Attorney for Debt Collectors

If you're behind on car payments, a bankruptcy attorney can negotiate with your lender to prevent repossession. They may help you set up a payment plan or reaffirm your car loan, allowing you to keep the vehicle and continue payments as agreed.

A bankruptcy attorney can help you understand your rights and make informed decisions about your debt and assets. They'll explain what steps to take to protect your car and other essential assets, giving you the security you need during a difficult time.

A fresh viewpoint: Legal Help with Debt Collectors

Repossessed Vehicles

A debt collector can repossess your car if you've used it as collateral for a secured loan, such as a car loan or title loan. This means if you fall behind on payments, the lender can take back the car without needing a court order.

If you have a car loan or title loan, your vehicle's title serves as collateral, making it vulnerable to repossession. Repossession is a serious consequence of defaulting on a secured loan.

Secured loans that can lead to repossession include:

- Car Loans

- Title Loans

- Home Equity Loans/Lines of Credit (although foreclosure proceedings are a lengthier process)

In general, only assets used as collateral for a secured loan can be repossessed by a debt collector.

Repossessed Car

A repossessed car is a stressful and overwhelming experience for many people. Repossession is the legal process where a creditor takes back an item you borrowed, usually a car, because you haven't made your loan payments.

Secured loans, like car loans, use the car as collateral. This means the lender can repossess the car to recoup their losses if you don't repay the debt. Creditors must follow specific legal requirements when repossessing property.

If you're behind on payments, the lender can repossess the car without a court order. This is the case for car loans and title loans, where the vehicle's title serves as collateral.

Repossession can be avoided if you pay off the debt or negotiate new terms with the creditor. Borrowers may have options to redeem the repossessed property, giving you a chance to get back on track.

The type of debt you have matters when it comes to repossessing your car. For secured debts like car loans, the lender has a lien on your vehicle and can repossess it if you fall behind on payments. However, for unsecured debts, a debt collector would need to win a lawsuit and obtain a judgment against you.

A fresh viewpoint: Title 12 of the United States Code

Common examples of secured loans that can lead to car repossession include:

- Car Loans: If your car is used as collateral for a loan and you fall behind on payments, the lender can repossess the car without a court order.

- Title Loans: Like car loans, the vehicle's title serves as collateral.

- Home Equity Loans/Lines of Credit: In some cases, these loans use your home's equity as collateral, but repossession wouldn't happen directly. The lender would start foreclosure proceedings, which is a lengthier legal process.

Voluntary Sale

You have the right to consent to a sale of your seized vehicle or asset if it's exempt. This means you can choose to let the creditor sell it, but you'll get to keep the proceeds up to your exemption limit.

The exemption limit is $6,600, as seen in an example where a car was sold for $8,000. The costs to sell were $1,200, leaving $6,800. The first $6,600 went to the owner, and the creditor got $200.

If you consent to the sale, the proceeds will cover the sale costs first. The remaining money up to your exemption limit will go to you. This is a good option if you don't want to keep the vehicle but want to get some of your money back.

Additional reading: Debt Collectors Keep Calling Me

Sources

- https://selfhelp.courts.ca.gov/debt-lawsuits/judgment

- https://hsapclaw.com/how-can-my-creditors-take-my-car/

- https://www.attorneyfortampabay.com/blog/can-debt-collectors-take-your-car/

- https://www.hoyes.com/blog/can-unsecured-creditors-take-my-car-for-an-unpaid-debt/

- https://bankruptcycanada.com/exemptions-what-you-keep/can-unsecured-creditors-take-my-car-if-i-dont-pay-my-debt/

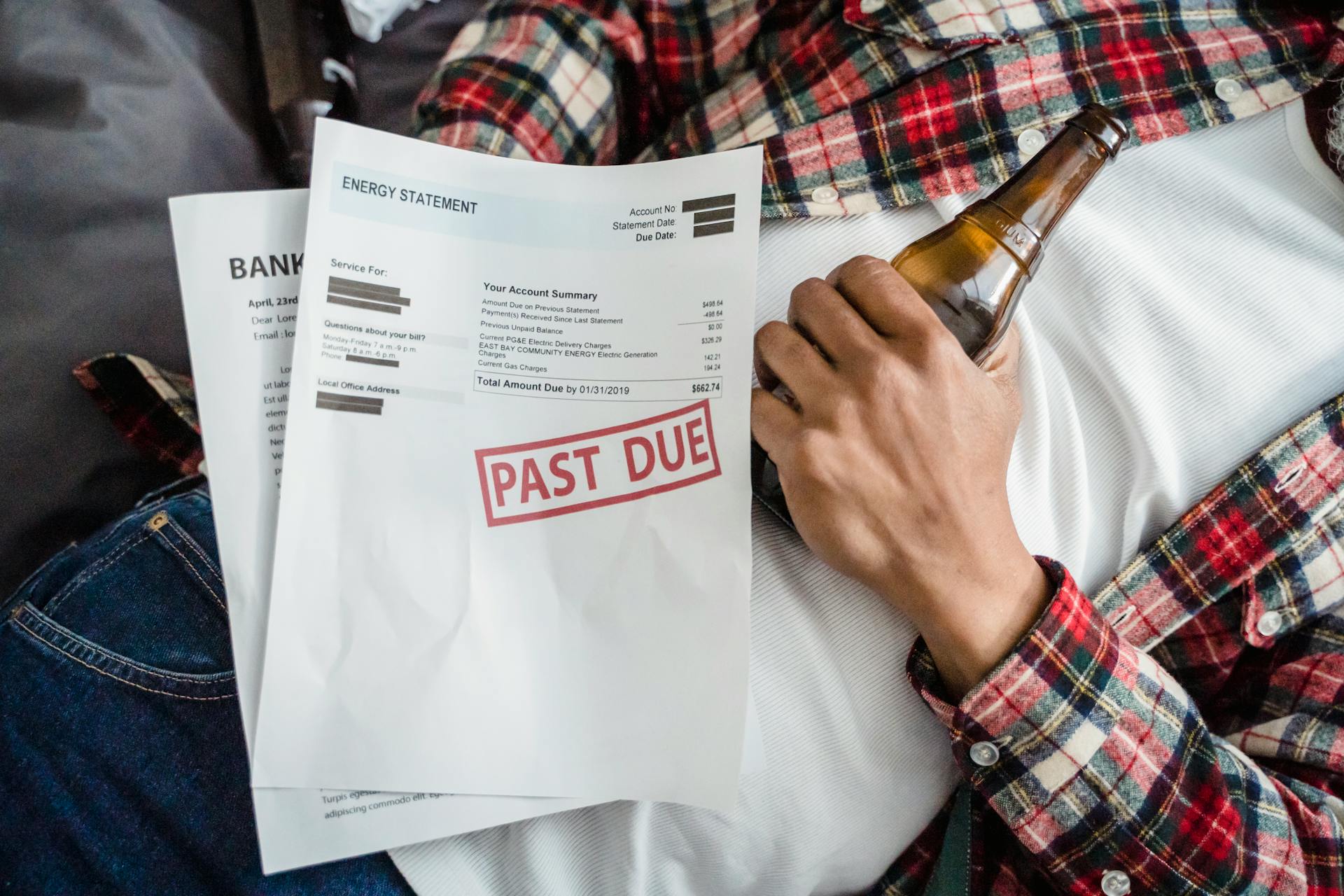

Featured Images: pexels.com