Bruce Wasserstein's life was a true rags-to-riches story, born in Chicago to a family of modest means, his father a psychologist.

He grew up in a household that valued education and hard work, which would serve him well in his future endeavors.

Wasserstein's early career was marked by a series of internships at top investment banks, where he honed his skills and made valuable connections.

These early experiences laid the foundation for his future success in the cutthroat world of investment banking.

Bruce Wasserstein's rise to the top was nothing short of meteoric, with his first major deal coming at the age of 25 when he advised on a $1.2 billion transaction.

Readers also liked: Investment Agreement Contract

Early Life and Education

Bruce Wasserstein was born and raised in Midwood, Brooklyn, New York. His father, Morris Wasserstein, was a Jewish immigrant from pre-World War II Poland who settled in New York City and started a ribbon company.

Wasserstein's maternal grandfather, Simon Schleifer, was a Jewish teacher in the yeshiva in Wloclawek, Poland, who later immigrated to Paterson, New Jersey and became a Hebrew school principal.

Recommended read: What Is the Ny New Rule for Business Taxes

Bruce had four siblings: Sandra Wasserstein Meyer, Wendy Wasserstein, Abner Wasserstein, and Georgette Levis. Sandra was a businesswoman who passed away in 1998.

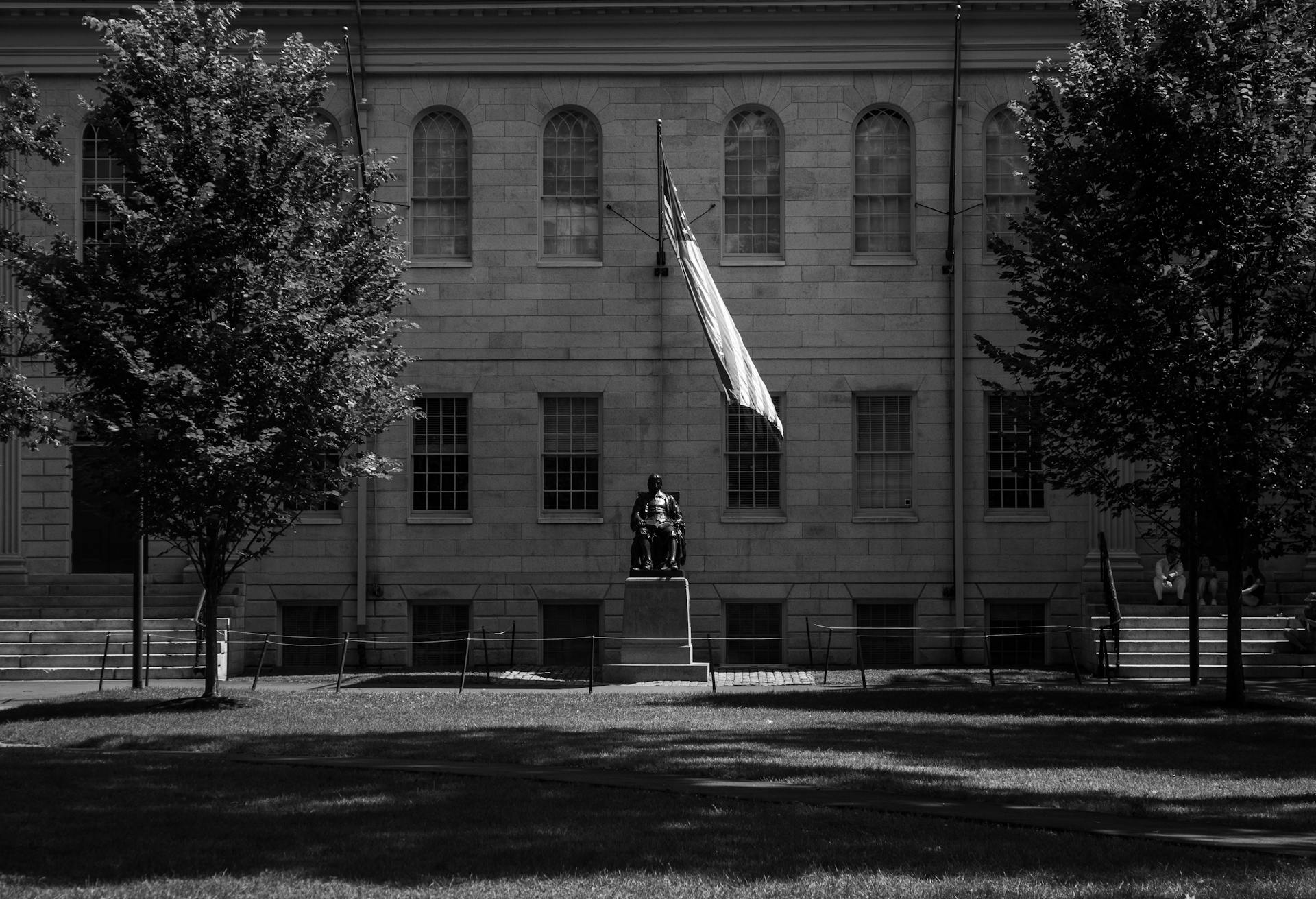

Bruce attended the Yeshiva of Flatbush for high school. He was a graduate of the McBurney School, the University of Michigan, Harvard Business School, and Harvard Law School.

Explore further: Bill Ackman Letter to Harvard

Career and Achievements

Bruce Wasserstein's career was marked by significant milestones. He started as an attorney at Cravath, Swaine & Moore before moving to First Boston Corp. in 1977.

Wasserstein rose to co-head of First Boston's merger and acquisition practice, a position he held before leaving to form Wasserstein Perella & Co. in 1988. He sold the company to Dresdner Bank in 2000 for around $1.4 billion in stock.

Wasserstein went on to lead Dresdner Kleinwort Wasserstein before becoming head of Lazard in 2002. He led Lazard's initial public offering in 2005 and became the firm's first chairman and CEO.

Additional reading: Peter S Lynch

Preeminent Investment Banker

Bruce Wasserstein was a preeminent investment banker who redefined the merger.

He was hospitalized two days earlier with an irregular heartbeat, but the cause of death was not immediately known.

Wasserstein headed Lazard since 2002, taking the firm public in May 2005.

He initiated many hostile takeovers and redefined how mergers and acquisitions could be accomplished.

Wasserstein's most high-profile deal was Kohlberg Kravis Roberts' 1988 leveraged buyout of RJR Nabisco, on which he advised.

This takeover was the subject of the book "Barbarians at the Gate."

Wasserstein established the model for mergers and acquisitions.

He was just remarkable, according to Michael Williams, dean of Touro College's Graduate School of Business in New York.

Wasserstein graduated from Harvard Business School and earned a law degree from Harvard Law School.

As the co-head of investment banking at The First Boston Corp., Wasserstein rose to prominence in the industry.

He served as an attorney at Cravath, Swaine & Moore before starting his career in investment banking.

Broaden your view: Key Business Banking Online

Net Worth

As of September 17, 2008, Wasserstein's net worth was estimated to be $2.3 billion. He amassed a substantial fortune through his business ventures.

Wasserstein owned a luxurious apartment at 927 Fifth Avenue in New York City, showcasing his taste for high-end real estate. This property was just one of many he owned.

An estate in Santa Barbara, California, and an Atlantic oceanfront estate in East Hampton (Long Island) were also part of his impressive property portfolio. These properties reflect his love for beautiful and exclusive locations.

He also owned a house at 38 Belgrave Square in London and another apartment in Paris, demonstrating his global interests and wealth.

Recommended read: How Do Real Estate Brokerages Make Money

Frequently Asked Questions

What happened to Wasserstein Perella?

Wasserstein Perella was acquired by Dresdner Bank in 2001 and later merged with Allianz, leading to a significant change in the firm's leadership. The firm's founder, Bruce Wasserstein, left the company in 2002 to head Lazard, but tragically passed away in 2009.

How old was Bruce Wasserstein when he died?

Bruce Wasserstein was 61 years old when he passed away. He died just three days after being hospitalized for an irregular heartbeat.

Who is Wasserstein?

Wasserstein is a surname associated with notable individuals in various fields, including classicists, historians, and investment bankers. The Wasserstein family has a rich history with notable figures such as Abraham, Bernard, and Bruce Wasserstein.

How did Bruce Wasserstein die?

Bruce Wasserstein died from complications related to aconitum poisoning, which caused an irregular heartbeat. He passed away on October 14, 2009, at the age of 61 in Manhattan.

When did Angela Chao marry Bruce Wasserstein?

Angela Chao married Bruce Wasserstein in January 2009. Their marriage was a short-lived one, as Bruce passed away in October of the same year.

Sources

- https://en.wikipedia.org/wiki/Bruce_Wasserstein

- https://www.nytimes.com/2009/10/15/business/15wasserstein.html

- https://www.theguardian.com/business/2009/oct/22/bruce-wasserstein-obituary

- https://money.cnn.com/2009/10/14/news/newsmakers/bruce_wasserstein/index.htm

- https://nypost.com/2009/10/15/wasserstein-dead/

Featured Images: pexels.com