The black market exchange rate can have a significant impact on the economy. It can lead to a loss of revenue for the government due to unreported income.

In some countries, the black market exchange rate can be as much as 20% higher than the official rate, which can make it difficult for businesses to operate. This can lead to a decrease in economic activity and a rise in inflation.

The black market exchange rate can also lead to a lack of trust in the official exchange rate, causing people to lose confidence in the economy. This can have long-term effects on the economy, making it harder for businesses to grow and for people to invest.

The black market exchange rate can also lead to a decrease in foreign investment, as investors may be deterred by the uncertainty and volatility of the unofficial rate.

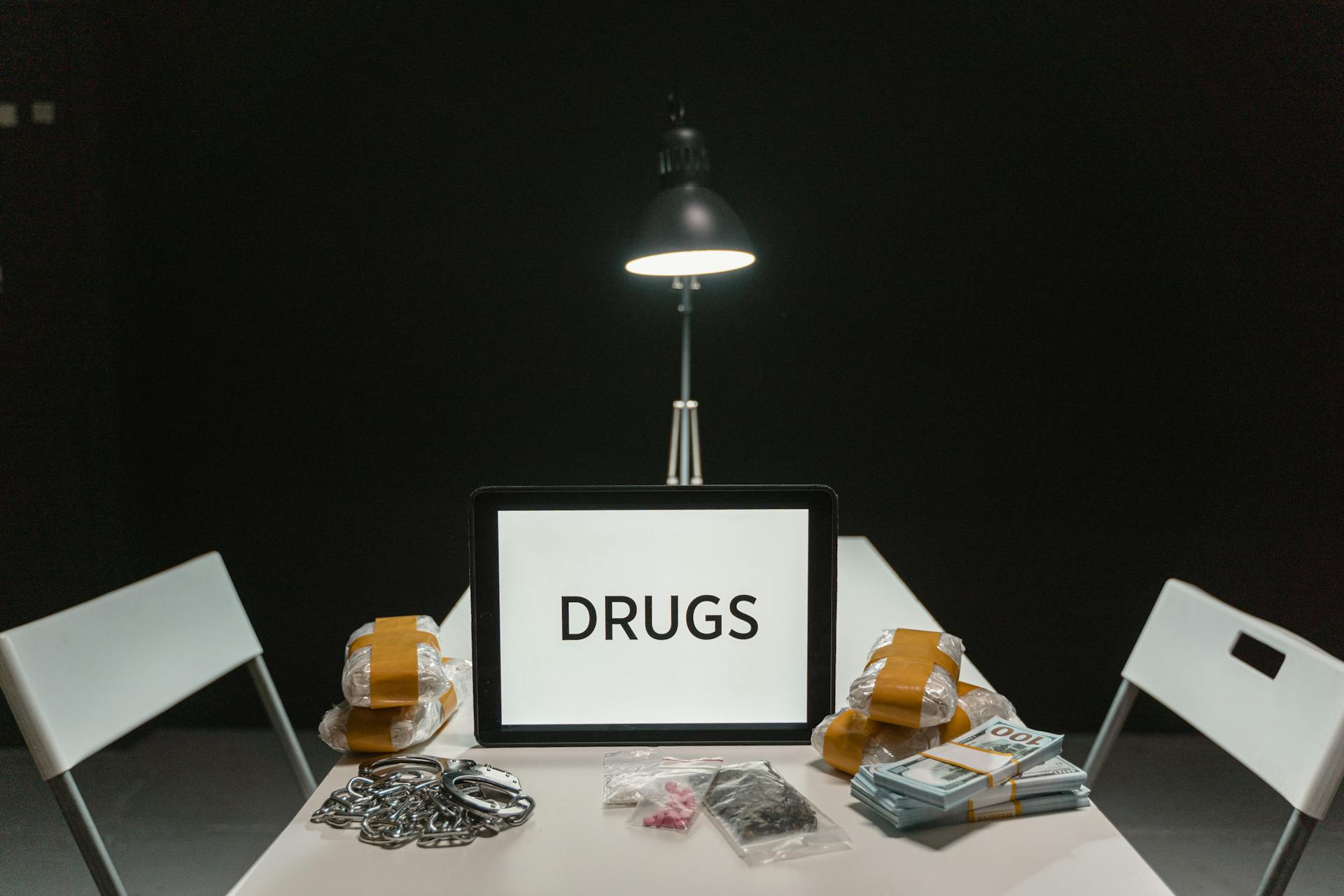

Black Market Exchange Rates

Black market exchange rates can vary significantly from official rates, as seen in the example of the Soviet Union, where black market transactions were common and even the elite used Foreign Exchange certificates that traded at a higher value than the official rate. In fact, these certificates traded as high as 6-10 times their nominal value.

Check this out: Which Is Traded in a Currency Exchange Market

In some countries, like Colombia, the government has even set up facilities to exchange dollars at black market rates, allowing cocaine traffickers to launder their earnings. This highlights the complex and often illicit nature of black market exchange rates.

In Nigeria, the black market exchange rate for dollars to naira can be found in various online sources, with rates varying between sources. For example, the current buying rate for dollars to naira in the black market is ₦1,600.00, while the selling rate is ₦1,605.00.

Here are some current black market exchange rates for your reference:

Note: These rates are subject to change and may not reflect the current rate. It's always best to check the latest rate from a reliable source.

Markets Beyond Backstreet Operations

In the Soviet Union, black market transactions were surprisingly widespread, with services like car repairs and plumbing being instantly arranged in exchange for payment in hard currency.

In urban areas, a significant portion of apartment repairs and car repairs involved the black market, with 45% and 40% respectively.

Even in rural areas, a whopping 80% of all services involved hard currency payments.

In 1967, the Soviet government officially recognized the black market by issuing Foreign Exchange certificates to the elite at the black market rate of 4.6 roubles per dollar.

These certificates were exchangeable for western luxuries in Moscow's GUM store, and a black market developed in the certificates themselves, trading as high as 6-10 times their nominal value.

In Colombia, the government allowed unlimited amounts of US dollars to be exchanged at prevailing black market rates through a facility known as the "sinister window".

Gold Is Important

Gold is a highly sought-after commodity in black market exchange rates, often used as a store of value and a hedge against inflation.

It's estimated that over 2,000 tons of gold are smuggled out of Africa every year, with a significant portion of it ending up in the black market.

Expand your knowledge: Gold for Bitcoins

In some countries, gold is used as a form of payment for bribes and other illicit activities, making it a crucial component in the black market economy.

The gold price can fluctuate significantly due to changes in global supply and demand, affecting the value of black market exchange rates.

The use of gold in black market exchange rates can be attributed to its high value and durability, making it an attractive option for those looking to exchange currency on the black market.

Dollar to Naira Exchange Rate

The dollar to naira exchange rate is a crucial aspect of the black market exchange rates. It can vary greatly from the official rate listed on the Central Bank of Nigeria (CBN) website.

In the black market, also known as the Aboki market rate, the dollar to naira exchange rate is significantly higher than the official rate. For example, the buying rate is around ₦1,600.00 and the selling rate is around ₦1,605.00.

The CBN rate, on the other hand, is usually lower than the black market rate. As of now, the official exchange rate is around 1700 Naira Per Dollar.

Here's a comparison of the current dollar to naira exchange rates:

It's worth noting that the dollar to naira exchange rate can fluctuate daily, so it's essential to stay informed and check for updates regularly.

Effects of Restrictions

The severity of currency restrictions can greatly impact the black market premium. In extreme cases, like China and the Soviet Union, the premium soared to over 100%, with Poland's reaching as high as 2400%.

Stringent currency restrictions can make it extremely difficult to obtain hard currency, which is reflected in the high premia. The risk of punishment, including death, for "crimes against the national currency" only adds to the challenges.

The stock of foreign assets is essentially fixed when controls are strict, leading to a steep rise in the premium whenever demand increases. This is a key determinant of the black market premium, making it crucial to understand the impact of FX controls.

If this caught your attention, see: Interest Rate Impact on Equity Market

Sources

- https://www.winton.com/news/shining-a-light-on-currency-black-markets

- https://ojs.ual.es/ojs/index.php/eea/article/view/9196

- https://www.njps.org.ng/dollar-to-naira-black-market/

- https://www.val9ja.com.ng/business/black-market-dollar-usd-to-naira-ngn-exchange-rate-today/

- https://ideas.repec.org/p/pra/mprapa/75280.html

Featured Images: pexels.com