Barnes and Noble's stock symbol is BKS, and it's been a wild ride. The stock symbol has been around since 1992, and it's had its fair share of ups and downs.

BKS has been listed on the New York Stock Exchange (NYSE) since 1992. This is a significant milestone for any company, and it's a testament to Barnes and Noble's commitment to growth and innovation.

In recent years, BKS has struggled to stay relevant in a digital age. Despite this, the company has managed to stay afloat, and its stock symbol remains a popular choice among investors.

Barnes and Noble's stock performance has been a mixed bag, with some years seeing significant gains and others experiencing losses.

Financial Performance

Barnes & Noble Education's revenue in 2024 was $1.57 billion, a 1.55% increase from the previous year. This growth is a positive sign for the company.

However, it's worth noting that the company still reported a loss of -$63.21 million in 2024.

To put these numbers into perspective, here's a comparison of Barnes & Noble Education's performance with the industry and market:

As you can see, Barnes & Noble Education underperformed the US Specialty Retail industry and the US Market over the past year.

On a similar theme: Us Cellular Ticker Symbol

Strong Q2 Results, Questions Remain

Barnes & Noble Education reported decent Q2/FY2025 results, driven by strong growth in First Day program contributions and ongoing cost savings initiatives.

Revenue growth was fueled by these efforts, but was slightly offset by a decline in ad revenue. In 2024, the company's revenue was $1.57 billion, an increase of 1.55% compared to the previous year's $1.54 billion.

Losses were also reduced, down to -$63.21 million in 2024, a 37.94% decrease from the previous year.

The company's shareholder returns have been a concern, with a 1-year return of -86.6% underperforming the US Specialty Retail industry's return of 18.7%. This is a notable drop, especially when compared to the industry average.

Here's a comparison of Barnes & Noble Education's return to the US Specialty Retail and US Market returns over the past 7 days and 1 year:

These numbers highlight the challenges Barnes & Noble Education faces in the current market, and it's clear that the company still has work to do to regain its footing.

Price History Performance

Barnes & Noble Education's stock price has been quite volatile over the past year. The current share price is $11.17.

The 52-week high was a staggering $135.00, showing just how far the stock has fallen. This is a significant decline from the 52-week low of $6.05.

The stock's beta is 2.14, indicating that it's been a relatively volatile investment. If you invested in the stock just one month ago, you'd be up 9.30%.

Over the past three months, the stock has increased by 22.48%. However, if you're looking at a one-year perspective, you'd be disappointed to see a decline of 86.56%.

This decline is even more pronounced when looking at the stock's performance over the past three and five years, with declines of 98.11% and 97.01%, respectively.

For another approach, see: History of Stock Price Symbol Svm

Company Information

Barnes & Noble Education, Inc. was founded in 1965.

The company operates bookstores for college and university campuses, and K-12 institutions primarily in the United States.

It has a significant workforce, with 3,195 employees.

Barnes & Noble Education, Inc. operates in two segments: Retail and Wholesale.

The company sells and rents new and used print textbooks, digital textbooks, and publisher hosted digital courseware through physical and virtual bookstores, as well as directly to students through Textbooks.com.

The company's CEO is Jonathan Shar.

Here's a brief overview of the company's operations:

Stock Overview

Barnes & Noble Education operates bookstores for college and university campuses, and K-12 institutions primarily in the United States.

Their current share price is $11.17, which is a significant drop from its 52-week high of $135.00.

The company's stock has been quite volatile, with a 1-month change of 9.30% and a 3-month change of 22.48%.

In comparison, the US market has seen a 6.4% average movement in the same period.

Here's a breakdown of the company's volatility compared to the industry and market:

The company's volatility has decreased over the past year, but it's still higher than 75% of US stocks.

Recent Events

Barnes Noble Education's recent events have been marked by significant changes in their earnings. Their Q2 2025 Earnings Report showed an Actual EPS of 1.870 USD.

The company's Annual General Meeting in 2024 resulted in a loss of 23.750 USD. They also reported a loss of 7.360 USD in their Q1 2025 Earnings Report.

Here are some key dates to remember:

Their Q4 2024 Earnings Release showed a loss of 10.240 USD, while their Q3 2024 Earnings Release resulted in a loss of 18.000 USD.

Calendar

Barnes Noble Education has some upcoming events on their calendar.

The company is expected to release their Q3 2025 Earnings Report on March 11, 2025, with an estimated earnings per share (EPS) of 0.120 USD.

Their Q4 2025 Earnings Report is scheduled for July 1, 2025, with an estimated EPS of -0.810 USD.

We can also see some of their past events in their past earnings reports.

Here's a list of their past earnings reports:

Adopts Short-Term Rights Plan

Barnes & Noble Education has adopted a short-term stockholder rights plan, also known as a poison pill. This plan was approved by the company's Board of Directors.

The plan is designed to protect the company's interests by preventing any individual or group from acquiring more than a certain percentage of the company's outstanding shares. This is intended to maintain the control and independence of the company.

Barnes & Noble Education is a leading solutions provider for the education industry, and the company's Board of Directors has taken this step to ensure the company's continued success.

Additional reading: Stock Symbol B

Frequently Asked Questions

Is Barnes and Noble a publicly traded company?

Yes, Barnes & Noble became a publicly traded company in 1993. This move enabled the company to expand its operations and services, including launching its e-commerce website in 1997.

Can I buy Barnes and Noble stock?

Yes, you can buy Barnes & Noble stock through a broker. To learn more about purchasing BNED stock, visit our investment page.

Is BNED stock a good buy?

Barnes & Noble Education's stock has a Hold rating, which is lower than the average rating for its industry. Investors may want to consider the company's specific performance and outlook before making a decision.

What is Barnes and Nobles' stock symbol?

Barnes & Noble's stock is listed under the symbol BKS. You can find more information about BKS stock price, news, and historical data on TheStreet.

Sources

- https://stockanalysis.com/stocks/bned/

- https://investorplace.com/2024/05/what-is-going-on-with-barnes-noble-education-bned-stock-today/

- https://markets.businessinsider.com/stocks/barnesnoble_education_1-stock

- https://simplywall.st/stocks/us/retail/nyse-bned/barnes-noble-education

- https://finviz.com/quote.ashx

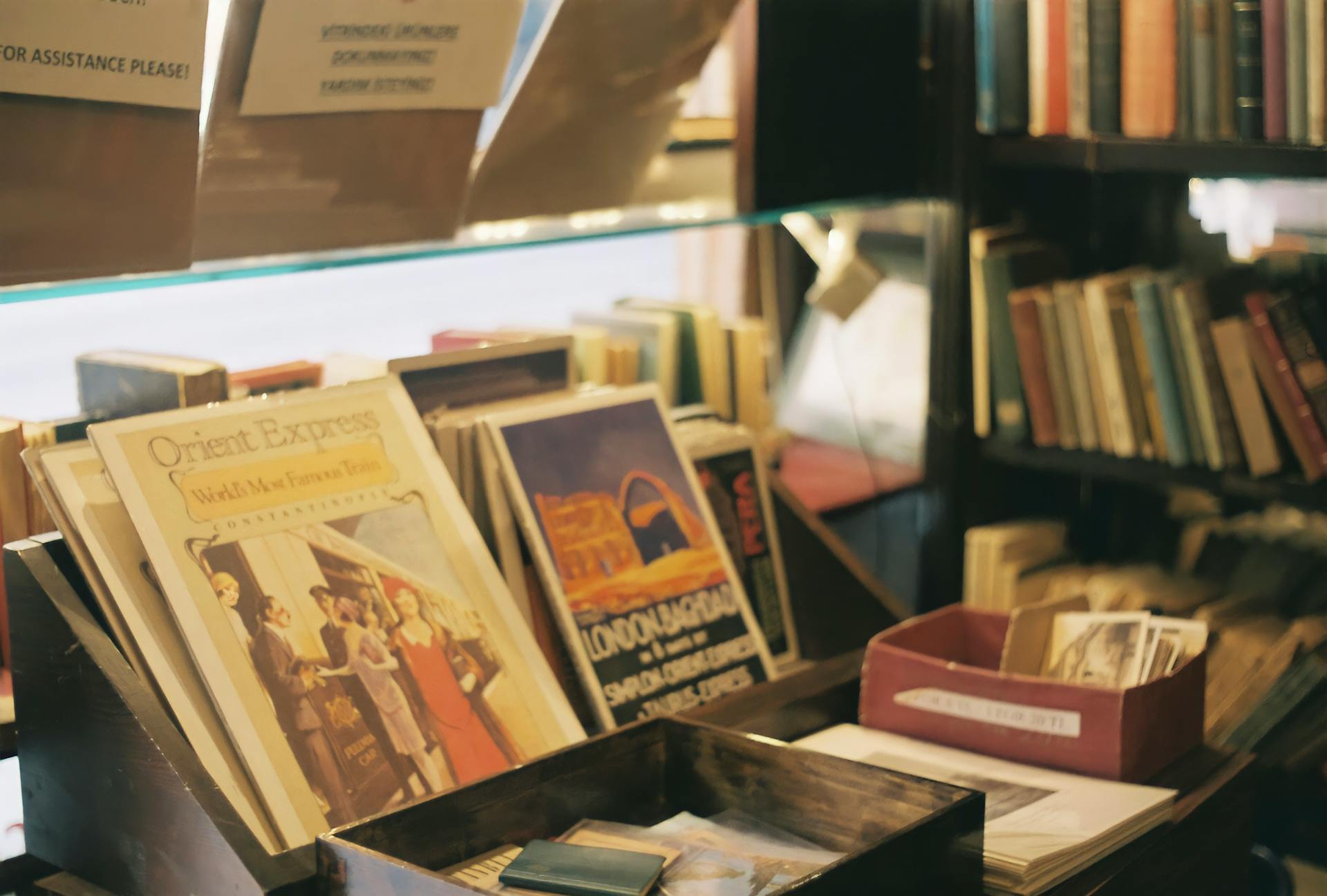

Featured Images: pexels.com