Aimco stock is a popular choice among investors, and for good reason. Aimco is a real estate investment trust (REIT) that specializes in apartment communities.

Aimco has a long history of delivering steady returns to its investors. Its stock has consistently outperformed the market over the years.

The company's focus on apartment communities has proven to be a successful strategy, with Aimco's properties consistently showing high occupancy rates and strong rental income growth.

Consider reading: How Are Stock Speculators Different from Stock Investors

Financial Performance

Aimco stock has had a strong quarter, but it's still not profitable. This is despite apartment REITs being the fifth-best performing sector this year, outperforming the Dow but lagging behind S&P indexes.

The oversupply concerns in the apartment market have been overblown, with strong demand from renters. Apartment Investment And Management has been a key player in this trend, with its apartments being in high demand.

This is a promising sign for Aimco stock, suggesting that the company's apartments will continue to be in demand.

You might like: Aimco Brickell

Profitability

Let's take a closer look at the profitability of these companies. The Return on Assets (Normalized) for AIV is a staggering -2.26%, which is a far cry from the 4.34% achieved by EPRT.

AIV's Return on Equity (Normalized) is even more concerning, clocking in at -18.00%. This is a stark contrast to EPRT's 7.07%.

EPRT's Return on Invested Capital (Normalized) is a respectable 5.88%, outpacing AIV's 0.43% and LXP's 2.56%.

Price History & Performance

The current share price of Apartment Investment and Management is a healthy US$8.89.

The company's stock has experienced its fair share of fluctuations, with a 52 Week High of US$9.49 and a 52 Week Low of US$7.28. This volatility is reflected in its beta of 1.47, indicating that the stock's value is more closely tied to the overall market than some other investments.

In the past month, the stock has seen a decline of 1.88%, while over the past three months it has actually increased by 0.57%. This mixed performance is also evident in the stock's one year change, which stands at a respectable 20.46%.

Here's a breakdown of the company's performance over different time periods:

Dividend and Stock

Aimco offers a special dividend of $8.20 per share, which can be paid in cash or stock. Shareholders who opted for cash will receive $1.02924 per share in cash along with $7.17076 in stock.

The special dividend is influenced by taxable gains from 2020 property sales and includes Aimco's regular fourth-quarter dividend, which accelerates the first dividend payment for 2021. Aimco urges shareholders to consult tax advisors for specific tax implications.

Aimco shareholders can choose between all cash or all stock for the special dividend, subject to proration. Approximately $121.8 million in cash and around 35.4 million shares were available for distribution.

A fresh viewpoint: Jeff Bezos Has Sold 14 Million Shares of Amazon Stock

Price Volatility

AIV's price has been relatively stable in the past 3 months, with an average weekly movement of 3.7%, which is lower than the market average of 6.1%. This suggests that investors can expect a more predictable return on their investment.

In comparison to the residential REITs industry, AIV's price movement is only slightly higher at 3.7% versus 3.1%. This indicates that AIV's price is closely tied to the overall performance of the industry.

Additional reading: Stla Stock Average Brokerage Recommendations

AIV's weekly volatility has been stable over the past year, with a 4% movement. This is a key factor to consider for investors looking for a stable investment.

Here's a comparison of AIV's volatility with other market benchmarks:

About (NYSE: AIV)

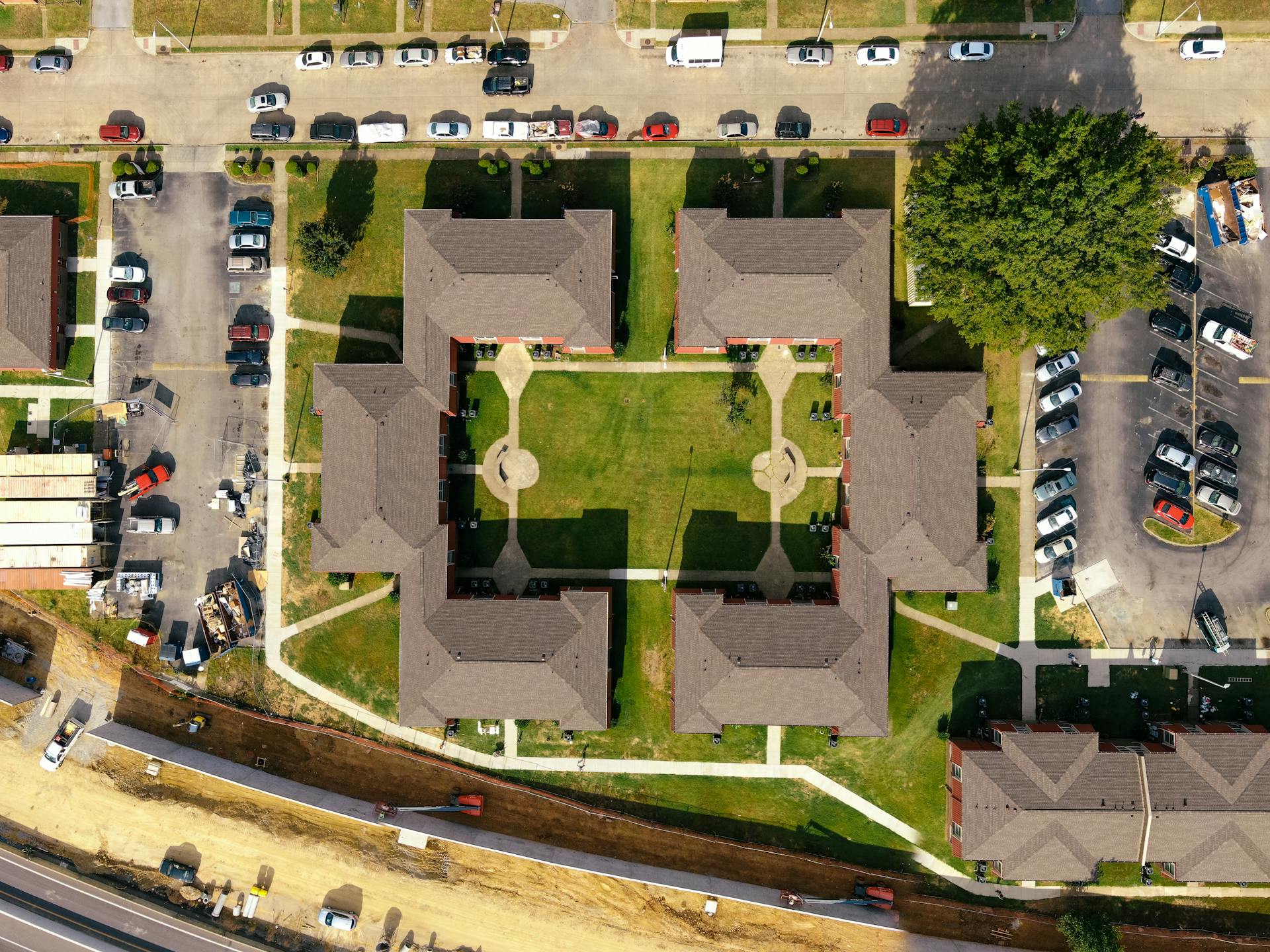

Aimco, a self-managed real estate investment trust, is one of the United States' leading apartment home providers, dedicated to delivering top-quality living experiences to its residents.

The company specializes in property development, redevelopment, and other value-creating investment strategies, with a focus on the multifamily market.

Aimco operates through three primary segments: Development and Redevelopment, Operating, and Other, with the majority of its revenue generated from the Operating segment.

Its investment strategy targets value-add, opportunistic projects, and alternative investments, enhancing outcomes through its highly skilled team.

Aimco frequently engages in strategic partnerships and transactions to optimize its portfolio and enhance shareholder value.

The company has announced significant transactions, including the sale of a 20% position in its Parkmerced mezzanine loan investment for $33.5 million, with an option for the purchaser to acquire the remaining 80% for $134 million plus interest.

Intriguing read: Petrolimex Joint Stock Insurance Company

Aimco has successfully refinanced high-cost debt and increased its liquidity to enhance financial stability, with a well-balanced debt portfolio that includes fixed-rate and interest rate-capped floating-rate debts.

As of June 30, 2023, Aimco's net leverage stood strong, with a net leverage that is a testament to the company's financial stability.

Aimco's recent financial performance has been robust, with stabilized operating properties reporting notable growth in net operating income, driven by high demand and favorable pricing strategies.

The company's CEO, Wes Powell, has emphasized the company's ongoing efforts to maintain a solid balance sheet, reduce capital allocations to alternative investments, and strategically unlock value through selective asset sales and reinvestments.

Aimco's mission is to create substantial value for its investors, employees, and the communities it serves, leveraging its human capital to achieve superior investment outcomes.

If this caught your attention, see: Timothy Sykes Net Worth

Announces Election Results for Special Dividend

Aimco announced the results of its special dividend election, offering stockholders a choice between cash and stock for a dividend totaling $8.20 per share. Stockholders had until November 20, 2020, to make their elections, with the record date set for November 4, 2020.

Approximately $121.8 million in cash and around 35.4 million shares were available for distribution. Holders of 118.3 million shares opting for cash will receive $1.02924 per share in cash along with $7.17076 in stock, while those electing all stock will receive the full $8.20 in shares.

The special dividend was influenced by taxable gains from 2020 property sales and includes Aimco's regular fourth-quarter dividend, which accelerates the first dividend payment for 2021.

You might like: How Long before I Receive Funds Fro Selling Stock

Earnings and Results

Aimco has reported third quarter 2020 results, highlighting challenges due to the pandemic and economic volatility. The company sold a 39% interest in a $2.4 billion California portfolio, reducing financial leverage by $1 billion.

Aimco anticipates improved trends into 2021, despite a 5% decline in pro forma FFO per share year-over-year. A special dividend of $8.20 was declared, payable November 30, 2020.

Investors can expect to receive earnings results from Aimco on October 29, 2020, after market close, with a conference call scheduled for October 30, 2020, at 1:00 p.m. Eastern time.

Check this out: Aimco Portland

Q3 2020 Results

Aimco reported its third quarter 2020 results, highlighting challenges due to the pandemic and economic volatility.

The company sold a 39% interest in a $2.4 billion California portfolio, reducing financial leverage by $1 billion. This move was a strategic step to improve its financial health.

Aimco announced a plan to separate its operations into two entities, Apartment Income REIT (AIR) and New Aimco, aimed at enhancing FFO per share and reducing risks. This plan is expected to bring about significant changes to the company's operations.

Despite a 5% decline in pro forma FFO per share year-over-year, Aimco anticipates improved trends into 2021. This suggests that the company is confident in its ability to bounce back from the challenges posed by the pandemic.

A special dividend of $8.20 was declared, payable November 30, 2020, providing a return on investment for shareholders.

For more insights, see: Southern Company Stock Quote

Announces Q3 2020 Earnings Dates

Aimco, a leading real estate investment trust, will release its Third Quarter 2020 earnings on October 29, 2020, after market close.

Aimco owns 125 communities in 17 states and D.C., and is part of the S&P 500. Aimco focuses on quality apartment communities across the U.S.

A conference call is scheduled for October 30, 2020, at 1:00 p.m. Eastern time to discuss the earnings results.

Business and Partnerships

Aimco stock has a solid track record in business and partnerships.

Aimco has a strong partnership with the City of Denver, with a 99-year lease on a 3,600-unit apartment complex.

Aimco's focus on long-term partnerships has led to significant investments in properties like the 3,600-unit complex in Denver.

Aimco's portfolio includes over 1,400 apartment communities across the US, with a total of 142,000 apartment homes.

Aimco's business model relies heavily on its ability to form and maintain strong partnerships with local governments and other stakeholders.

Competitive Landscape

Aimco stock operates in a competitive landscape dominated by REITs like Simon Property Group and Boston Properties, which have larger market capitalizations and more extensive portfolios.

Aimco's focus on apartment investments sets it apart from these larger REITs, but also makes it vulnerable to competition from other apartment-focused companies.

The company's efforts to expand its portfolio through acquisitions and developments have helped it stay competitive, but also increased its debt levels.

Aimco's financial performance is closely tied to the overall health of the apartment rental market, which has been affected by the COVID-19 pandemic.

Reverse Stock Split

Aimco announced a 1-for-1.23821 reverse stock split for its common stock, effective November 30, 2020.

The reverse stock split aims to neutralize the dilutive impact of a special dividend declared on October 23, 2020, valued at $8.20 per share.

The dividend will be paid to stockholders, who can choose to receive it in cash or stock, with the record date set for November 4, 2020.

Following the split and dividend, Aimco's total shares outstanding will remain unchanged.

Explore further: Visa Share Split

What's Happening

Aimco stock took a massive hit in December, plummeting 86% after the company officially separated its business and stock into two distinct units on December 15.

The split resulted in Aimco being dropped from the S&P 500 index, which had a significant impact on the stock's value.

In September, Aimco announced that it would be splitting into two separately run, publicly traded companies, setting the stage for the dramatic stock drop in December.

Tesla was added as the replacement for Aimco in the S&P 500 index soon after the split.

Frequently Asked Questions

Is AIMCo a public company?

Yes, AIMCo became a public company in 1994 after an initial public offering. It was previously a private company since its incorporation in 1994.

Is AIMCo a reit?

Yes, AIMCo is a Real Estate Investment Trust (REIT) that owns and manages apartment communities in the US. It focuses on high-quality properties in major markets across the country.

Is air communities the same as AIMCo?

No, AIR Communities and AIMCo are not the same, although they share a history. AIR Communities is a separate entity that spun off from AIMCo, which has since completed its second year as a standalone company.

Sources

- https://www.morningstar.com/stocks/xnys/aiv/quote

- https://www.stocktitan.net/news/AIV/page-7.html

- https://simplywall.st/stocks/us/real-estate/nyse-aiv/apartment-investment-and-management

- https://www.fool.com/investing/2021/01/04/why-apartment-investment-and-management-stock-plum/

- https://stockanalysis.com/stocks/aiv/

Featured Images: pexels.com