After filing for bankruptcy, you may think it's impossible to get a car loan. However, many lenders offer car loans to individuals who have gone through bankruptcy, often with more favorable terms than you might expect.

Typically, you can expect to wait at least 2 years after your bankruptcy discharge before being eligible for a car loan. This waiting period allows lenders to assess your creditworthiness and determine whether you're a reliable borrower.

Some lenders may offer car loans with higher interest rates or stricter terms due to your bankruptcy history. However, shopping around and comparing offers from multiple lenders can help you find a more affordable option.

Broaden your view: Car Loans during Bankruptcy Chapter 7

After Bankruptcy Car Loans

You can get a car loan after bankruptcy, but it may be more difficult and expensive than before. Your bankruptcy attorney may be able to provide a list of lenders and dealers that will work with you.

Expect higher interest rates, fees, and less favorable terms due to the bankruptcy. You may need to find a dealer who works with subprime lenders to get the car financed.

On a similar theme: Bankruptcy Payday Loan

It's essential to have the offer in writing, including the purchase price, monthly payment, and interest rate, to provide to the court. This document will help you keep track of the agreement and ensure you're not taken advantage of.

Once you're out of bankruptcy, you can start rebuilding your credit by making on-time payments. Your credit scores will still be low, but you can improve them over time with responsible financial behavior.

You can get approved for credit again after bankruptcy, but it's not a guarantee. Many dealerships have options for bad credit situations, including bankruptcy car loans.

A "buy here pay here" car lot will work with you on a case-by-case basis, without checking your credit score. They'll determine the vehicle that best fits your needs and financial situation.

You can get a post-bankruptcy auto loan from a "buy here pay here" car lot, and they won't waste your time. They'll help you find a vehicle that you qualify for.

If you're in a Chapter 13 bankruptcy, you can still get a used car loan, but it takes more work. You'll need to get an Authorization to Incur Debt from your bankruptcy trustee or attorney.

This document will lay out the maximum monthly payment you're allowed to take on and declares that the new loan and debt will not be part of the open Chapter 13 bankruptcy.

A unique perspective: Will Insurance Cover Solar Panels

Preparing for a Loan

To prepare for a loan after bankruptcy, you must show potential lenders you can handle a car payment on top of your debt repayment and other financial obligations or responsibilities. This means creating a new budget that takes into account the car payment and ensuring it fits within your budget.

You'll need to make sure your income is steady and verifiable, ideally through employment, but also through retirement, SSA-SSI, or child support. Most lenders want to see at least $1,500 of gross monthly income. You should also avoid getting a car loan if you're about to declare bankruptcy, as your credit score will likely be low and your debt-to-income ratio will be high.

Here are some key requirements to keep in mind when preparing for a loan after bankruptcy:

Best Dealers

To find the best dealers for a car loan after bankruptcy, look for those that work with Auto Credit Express. This process is one of the most hassle-free ways to get an auto loan after a bankruptcy.

If this caught your attention, see: Bankruptcy Friendly Car Loans

Auto Credit Express specializes in connecting people in bad credit situations, such as bankruptcy, to dealerships all around the country that have the lenders needed to get them financed. The process is simple and obligation free.

You can get back on the road and on the way to rebuilding your credit with the second chance you need.

Shop Within Budget

Shopping for a car can be overwhelming, especially when you're trying to rebuild your credit after a bankruptcy. To make the process less daunting, it's essential to shop within your budget.

You should review your monthly expenses to determine how much a car payment your budget will allow. As a rule of thumb, car-related expenses, including the cost of gas, maintenance and insurance, should not exceed 20 percent of your total monthly budget.

Set a target price for your purchase using information online through websites like Edmunds and Kelley Blue Book, which list new and used car prices and insurance cost estimates.

See what others are reading: Monthly Payment Furniture No Credit Check

A good starting point is to use an auto loan calculator to estimate your monthly payment and see if it will realistically fit into your budget.

Here's a rough estimate of how much you might expect to pay:

Keep in mind that these are rough estimates and your actual payment may vary depending on your credit score and other factors.

Remember, it's always better to err on the side of caution and aim for a lower payment that you can afford.

Understanding the Process

If you've filed for Chapter 13 bankruptcy, getting a car loan is still possible, but you'll need to be mindful of your budget and debt repayments. To do this, shop around to find a car that fits your budget and find a lender that will work with you.

Creating a reasonable budget and making timely debt payments is crucial to rebuilding your credit after Chapter 13 bankruptcy. This will help you establish a track record of consistent payments, which is essential for improving your credit score.

Explore further: Mortgage Loans after Chapter 7

It's worth noting that after you're discharged from bankruptcy, you won't need court permission to finance a car. However, rebuilding your credit will take time, and it's essential to be patient and consistent in your efforts.

Lenders for Bankruptcies

Few lenders and car dealers will work with those in active bankruptcy, but they do exist. Your bankruptcy attorney may be able to provide a list of lenders and dealers that will work with you, and you should check with your local credit union or bank.

You may need to find a dealer who works with subprime lenders to get the car financed. Expect higher interest rates, fees, and less favorable terms due to the bankruptcy.

It's essential to have the offer, including the purchase price, monthly payment, and interest rate, in writing to provide to the court. Keep the purchase price as low as possible and wait to exit bankruptcy and rehabilitate your credit before purchasing a more expensive vehicle.

Finding a lender that will work with Chapter 13 bankruptcies can be challenging, but it's not impossible. Some lenders may be willing to work with you, especially if you're able to find a dealer who works with subprime lenders.

Worth a look: How Does Owner Financing Work for the Seller

The Bottom Line

Getting a car loan after bankruptcy can be challenging, but it's not impossible. You can expect to pay higher interest rates, which can make your monthly payments more expensive.

The type of bankruptcy you filed, either Chapter 7 or Chapter 13, can impact how quickly you can get a car loan. Chapter 7 bankruptcy can remain on your credit report for up to 10 years, while Chapter 13 bankruptcy can stay on for up to 7 years.

Rebuilding your credit after bankruptcy is key to qualifying for better car loan rates. This can be done by making timely debt payments and setting up a track record of consistent payments. It's like they say, time really does heal all wounds, even wounds to your credit score.

To get a car loan after bankruptcy, you'll need to find a lender and create a budget that allows you to continue making debt repayments. Shopping around for a car that fits your budget is essential. The first step is to rebuild your credit, which can take time but is worth the effort.

Take a look at this: Can I Get a Heloc after Chapter 7 Discharge

Here's a summary of what you can expect:

Remember, getting a car loan after bankruptcy requires patience and responsible financial management. By rebuilding your credit and creating a budget that works for you, you can get back on track and qualify for better car loan rates.

Predatory Lenders

As you navigate the process of rebuilding your credit after bankruptcy, be aware of predatory lenders who prey on vulnerable individuals. Some lenders offer car loans with no credit check, but the fine print reveals exorbitant interest rates and fees.

It's essential to research lenders thoroughly before applying for a car loan after bankruptcy. Reading online reviews from customers and checking the Better Business Bureau (BBB) ratings can provide valuable insights into a lender's reputation.

Lenders with questionable reputations often target individuals in financial distress, making them an easy target for exploitation. You must be cautious and do your due diligence when seeking financial assistance.

Financial Considerations

You'll need to be patient and flexible when applying for a car loan after bankruptcy, as it can be a bit of a longer process. You can start applying for a car loan after you've filed for bankruptcy and had your 341 hearing, where the judge reviews your information.

Your credit score will likely still be low, but your debt-to-income ratio will improve greatly since your debt will be wiped away. This can put you in a position to obtain financing for a used car, although you won't get the same low interest rates as people with better credit.

Going through a bankruptcy can give you a financial fresh start, but it lowers your credit scores. You may think it's next to impossible to get approved for credit again, but that's typically not the case. You can get back on the road and on the way to rebuilding your credit with the second chance you need.

Related reading: Mortgage Loans for Low Income

You can get a post-bankruptcy auto loan, and the only question is which vehicle you qualify to drive away with. We won't waste your time, and we'll work with you on your down payment to make it more manageable.

Obtaining financing before, during, or after a Chapter 7 bankruptcy depends on various factors. If you're about to declare bankruptcy, don't try to get a used car loan, as your credit score has probably already tanked, and your debt-to-income ratio is at its worst.

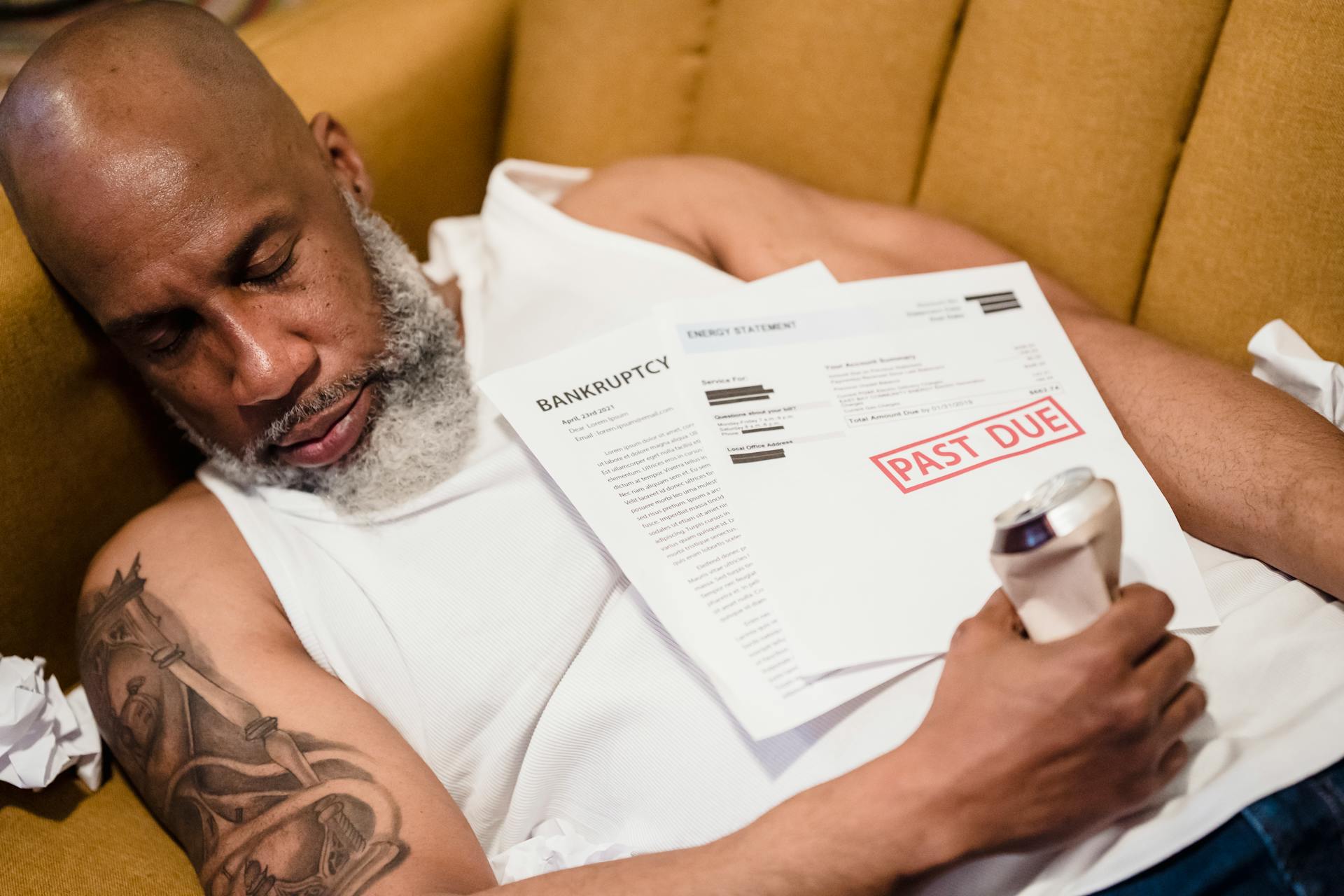

Featured Images: pexels.com