Investing in a 2x leveraged semiconductor ETF can be a high-risk, high-reward strategy, but it's essential to understand the mechanics behind it.

The 2x leveraged semiconductor ETF is designed to deliver twice the daily return of the underlying semiconductor index, such as the PHLX Semiconductor Index. This means that if the index moves up 1%, the ETF will move up 2%, and if it moves down 1%, the ETF will move down 2%.

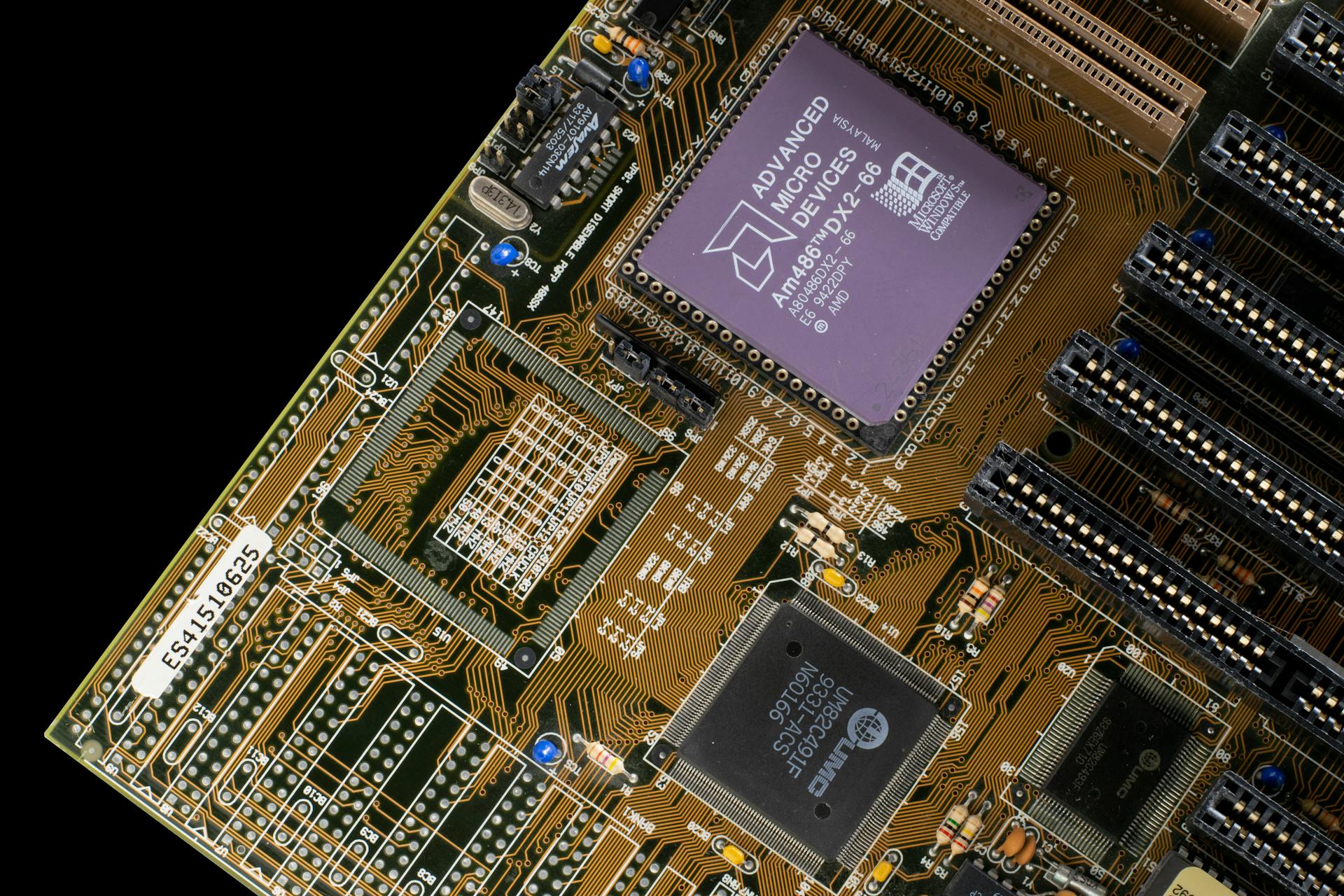

Semiconductors are a crucial component in many modern technologies, including smartphones, laptops, and servers, making them a vital part of the global economy.

The 2x leveraged semiconductor ETF can be a good option for investors looking to amplify their returns in the semiconductor sector.

Curious to learn more? Check out: Phlx Semiconductor Sector Index Etf

Investing in Leveraged Semiconductors

Investing in leveraged semiconductors can be a complex and nuanced topic, especially for beginners.

Trading is different than investing, and it's essential to understand the risks and rewards associated with leveraged ETFs like the 2x leveraged semiconductor ETF.

Before investing, take the time to educate yourself on the basics of trading and investing, including the concept of leverage and its implications.

Leveraged ETFs can be a powerful tool for investors looking to amplify their returns, but they also come with a higher level of risk.

Use our insights and educational resources to make sure you’re ready to trade in Direxion’s Leveraged and Inverse ETFs, including those focused on the semiconductor industry.

Investing in a 2x leveraged semiconductor ETF means you're essentially doubling down on the performance of the underlying semiconductor index, which can be both a blessing and a curse.

In a rapidly changing market, the potential for significant gains is also matched by the potential for significant losses, making it crucial to have a solid understanding of the underlying assets and the ETF itself.

Trading Strategies

Trading 2x Leveraged Semiconductor ETFs requires a solid understanding of how they function and behave in various market conditions. Direxion's ETFs are available for trading on most platforms, but it's essential to educate yourself before taking the plunge.

You can purchase these ETFs during trading hours, but be aware that your advisor or broker may charge commissions or transaction fees. It's always a good idea to consult a financial advisor or brokerage account representative if you have questions.

Trading is different from investing, so make sure you're ready to trade in Direxion's Leveraged and Inverse ETFs using their insights and educational resources.

Single Stock Exposure

Single Stock Exposure can be a double-edged sword.

Taiwan Semiconductor Manufacturing Co. Ltd. is the largest dedicated foundry in the semiconductor industry, producing 28 percent of the world semiconductor excluding memory output value in 2023.

The company is registered under the Securities Exchange Act of 1934, and information about it can be found on the Securities and Exchange Commission's website using file number 001-14700.

Investing in a single stock like Taiwan Semiconductor Manufacturing Co. Ltd. comes with a high level of volatility, which can affect the fund's performance.

Explore further: Single Stock Leveraged Etf List

The Direxion Daily TSM Bull 2X Shares (TSMX) seeks 200% daily leveraged investment results, which means it will have an increase in volatility relative to the underlying TSM performance.

Longer holding periods and higher volatility of TSM increase the impact of compounding on an investor's returns, making it crucial to carefully consider the risks involved.

How to Trade

You can buy and sell ETFs on exchanges, just like stocks, and trade them throughout the day whenever exchanges are open.

Direxion ETFs are available for trading on most trading platforms, but you can't purchase them directly from Direxion.

It's essential to educate yourself on how leveraged and inverse ETFs work and behave in different market conditions before trading them.

Consult a financial advisor or brokerage account representative if you have questions about ETFs, as they may charge commissions or transaction fees.

If you have specific questions about Direxion products, you can contact them directly at [email protected] or 866-476-7523.

Suggestion: Direxion Leveraged Etf

Specific ETFs

Let's take a closer look at some specific ETFs that offer 2x leverage in the semiconductor sector.

The ProShares UltraSemiconductors ETF (SMH) is one of the most popular options, with a 2.5x daily leverage.

This ETF tracks the PHLX Semiconductor Index, which includes major semiconductor companies like Intel and Texas Instruments.

The Direxion Daily Semiconductor Bull 3X Shares ETF (SOXX) is another option, with a 3x daily leverage.

It uses a combination of futures contracts and swaps to achieve its leverage.

The Global X Semiconductor ETF (SQNM) offers a more moderate approach, with a 2x daily leverage.

It tracks the Solactive Global Semiconductor Index, which includes companies like Taiwan Semiconductor and Micron Technology.

The Amplify Semiconductors ETF (XPH) is a physically replicating ETF, meaning it holds a basket of semiconductor stocks.

It has a 2x daily leverage and tracks the Solactive Semiconductors Index.

Related reading: Global X Asia Semiconductor Etf

Fund Details

The fund's objective is to track the daily performance of Taiwan Semiconductor Manufacturing Co Ltd (TSM) stock, with a goal of doubling its daily percentage change.

This means that if TSM's stock price goes up or down by a certain percentage in a day, the fund aims to match that change, but at a rate of 200%.

The fund's daily performance is not a guarantee, and there's no promise that it will meet its stated objective.

Pricing & Performance

The pricing and performance of a fund can be a bit overwhelming at first, but let's break it down. The NAV (Net Asset Value) and Market Price information as of 01/13/2025, shows us how the fund is performing.

The fund's NAV as of 01/13/2025 is $12.47 for the 1-month period, which is a slight increase from the previous month. The Market Price is also $12.48, a tiny difference from the NAV.

Here's a summary of the fund's performance over different time periods:

It's essential to note that the expense ratio for the fund is 0.99% (Gross) and 0.97% (Net), which is a relatively low cost. This means that the fund's management fees and other operating expenses are relatively low compared to other funds.

The fund's inception date is October 3, 2024, and it has been operating for a short period. It's crucial to keep in mind that short-term performance is not a reliable indicator of future performance, and an investment should not be made solely based on returns.

Fund Objective

The fund objective is to seek daily investment results that match 2 times (200%) the daily percentage change of the common stock of Taiwan Semiconductor Manufacturing Co Ltd (NYSE: TSM). This means the fund aims to double the daily return of TSM.

There's no guarantee the fund will achieve its stated objective, so it's essential to understand the risks involved. This is a reminder that past performance is not a guarantee of future results.

The fund should not be expected to provide 2 times the cumulative return of TSM for periods greater than a day, which means its performance may not be consistent over time.

Sources

- https://www.direxion.com/leveraged-and-inverse-etfs

- https://www.direxion.com/product/daily-tsm-bull-and-bear-leveraged-single-stock-etfs

- https://en.wikipedia.org/wiki/Direxion

- https://www.prnewswire.com/news-releases/direxion-launches-new-daily-2x-leveraged-tech-software-etf-swar-301446255.html

- https://graniteshares.com/institutional/us/en-us/etfs/tsmu/

Featured Images: pexels.com